Three causes there gained't be considered a 2021 housing industry crash

4 Sectors In 2021 To pay attention to As We Prepare For A Post-COVID-19 World

2021 has not unfolded the way many of us expected it to. At the start of the year, if someone had said that most people will be working from home, unable to travel overseas which bars and attractions would be mandatorily closed for a temporary period, you most likely would not have believed it. Unfortunately, that's exactly what has happened in the first 1 / 2 of the year.

Neither could any of us have anticipated the stock exchange crash around March 2021. From 19 February 2021 to 23 March 2021, the S&P 500, including the largest and most liquid stocks in the united states, declined 34%, from 3,386.15 to two,237.40.

The only thing more surprising was the unexpected recover, with the S&P 500 recovering hitting 3,235.66, as of 23 July 2021, that was higher than it closed at the end of 2021 (3,230.78). This hits home a timely reminder that predicting short-term stock exchange movement can be a futile endeavour.

That said, you need to recognise that the post-COVID-19 world coming will be different from what we have grown to be accustomed to in the pre-COVID-19 world we left out. Like it or not, COVID-19 will have a long-lasting impact on some companies and even entire industries. Simultaneously, it will also create many new opportunities.

As investors, there are several trends that we can concentrate on as the global economy shifts towards how life and commerce are going to be after COVID-19.

#1 Medical & Healthcare

The COVID-19 pandemic has reminded us again concerning the importance of medical and healthcare companies. As my colleague Dinesh noticed in a recent article, healthcare companies in Singapore have performed exceptionally well in 2021, using the iEdge SG All Healthcare Index climbing about 66% since the start of the year (From 2 Jan to 23 Jul 2021).

Whether these businesses are treating patients, involved in developing a vaccine or supplying personal protection equipment, many of them have been at the center of attention recently as the world scramble to handle the COVID-19 outbreak.

Many governments around the world also had to dig deep into their pockets to tackle the current problem, and we can expect this to continue in the foreseeable future. Even after the world has overcome COVID-19, medical and healthcare matters will probably remain a national priority for a lot of countries, and the world continues to take added precautions to contain any future potential outbreak of viruses.

Money that accustomed to go towards travelling may be redirected towards medical and healthcare companies instead. The right companies in the sector can take advantage of this potential for strong growth in the years to come.

#2 Technology

Even as brick and mortar companies struggled badly previously few months due to lockdowns around the world, technology companies, have largely been left unaffected or even seen business boom because of the way they operate.

For example, the NYSE FANG + Index, which comprises the top 10 technology companies in the world such as Facebook, Apple, Amazon, Netflix and Google, is currently trading at 4,601.48 (as of 23 Jul 2021). This is significantly higher than the 3,024.08 (2 Jan 2021) at the beginning of the year.

In the past, technology companies have usually been considered risky investments, since they are seen as stocks in high growth sectors that would be the first to be affected during an economic slowdown. However, as observed in the COVID-19 pandemic, technology information mill the ones that continue operating normally and are seeing some growth during difficult periods. For instance, many of us are using Facebook, Google and Netflix in the past few months to stay connected with our family, friends and colleagues and for our entertainment needs.

There are many technology companies rapidly building market share during this period and seeing their value and resilience recognised by investors. Zoom, a relevant video conferencing company, has seen their share price climbed 365% from US$68.72 (2 Jan 2021) to US$251.50 (23 Jul 2021), in only six months as people around the world started widely adopting the utilization of video conferencing and telecommuting tools.

In the near future, technology companies will likely continue dominating our economy, including disrupting traditional sectors. For example, Tesla has recently overtaken Toyota to become probably the most valuable car company in the world and we should expect to see more technology companies taking sizeable share of the market in major sectors across the globe.

#3 Consumer Staples

Traditionally considered as defensive stocks, companies that produce or distribute consumer staples have benefitted from COVID-19 as people rushed to stock up necessities out of uncertainty. For instance, on the back of strong share price increase in 2021, local supermarket chain Sheng Siong has become worth about S$2.43 billion (based on its share price of S$1.62 by 23 Jul 2021).

It's worth noting that many such companies have remained resilient in 2021 despite the challenges they had to face, such as coping with safe distancing measures. Many also have embraced new ways of doing things, such as delivery services to reach more customers.

While consumer staples stocks might not always produce a high return when compared with technology companies, many may pay out a higher dividend yield, which would appeal to investors seeking regular income.

Even as consumer staples continue to be an essential cog in our economy, we should keep an eye out on how the sector performs within the next couple of years, particularly for the companies that may embrace technology and merge their traditional offerings along with a digital solution.

#4 Gold

Gold has typically been considered as a safe haven for parking money whenever fear, inflation or volatility heightens within the financial markets. The COVID-19 pandemic has supported this theory.

At the start of 2021, gold was trading at US$1.527 per oz (2 Jan 2021). At its lowest point this year, it was trading at US$1.474.25 per oz (19 Mar 2021), and price is now at US$1.868.66 per oz (23 Jul 2021). The resilience in gold price is a reminder that this valuable metal can continue to be an important component in our investment portfolio, providing us with necessary protection against volatility and inflation during both good and bad times.

Given the current low-interest rate environment due to quantitative easing measures, gold will probably remain an attractive option like a good store of value.

Ensure You Have A Diversified Portfolio

Even if you are bullish on certain sectors, it's still difficult to know which information mill going to do well within the sector. Nobody can predict the future, and even companies in the right industry can still perform badly when the entire industry grows. For instance, in the mobile handset industry, big companies for example Nokia, Sony Ericssion and BlackBerry, which dominated within the 1990s and 2000s were omitted in the smartphone industry boom in 2010s.

It's important to know what you are investing in, but also to ensure that you have a diversified portfolio. Never invest your eggs into one basket, regardless of how confident you are of your investments.

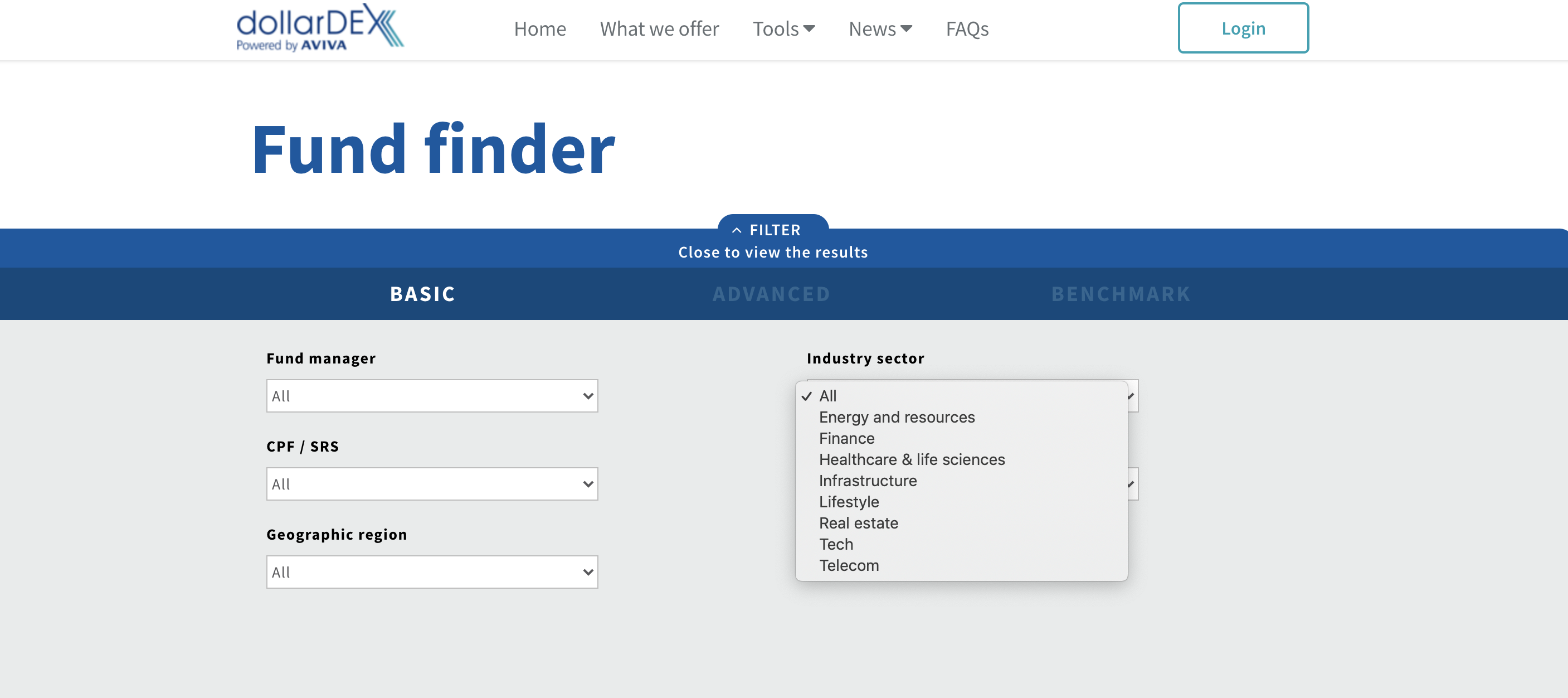

To help investors obtain access to a diversified portfolio of companies within a sector that they want to invest in, dollarDEX, an online investment platform by Aviva, allows investors to invest in mutual funds and unit trusts across a variety of industries and geographic regions. This allows you to choose the kind of investments you intend to make, while having professional fund managers assist you to select a broad base of companies that fit within your investment criteria.

Fund Finder, dollarDEX

Fund Finder, dollarDEX

Besides allowing you to invest in the mutual funds of your choice, dollarDEX also has a retirement calculator that permits you to calculate how much you need to invest today, to accumulate the funds that you need in retire comfortably later on.

Retirement Calculator, dollarDEX

Retirement Calculator, dollarDEX

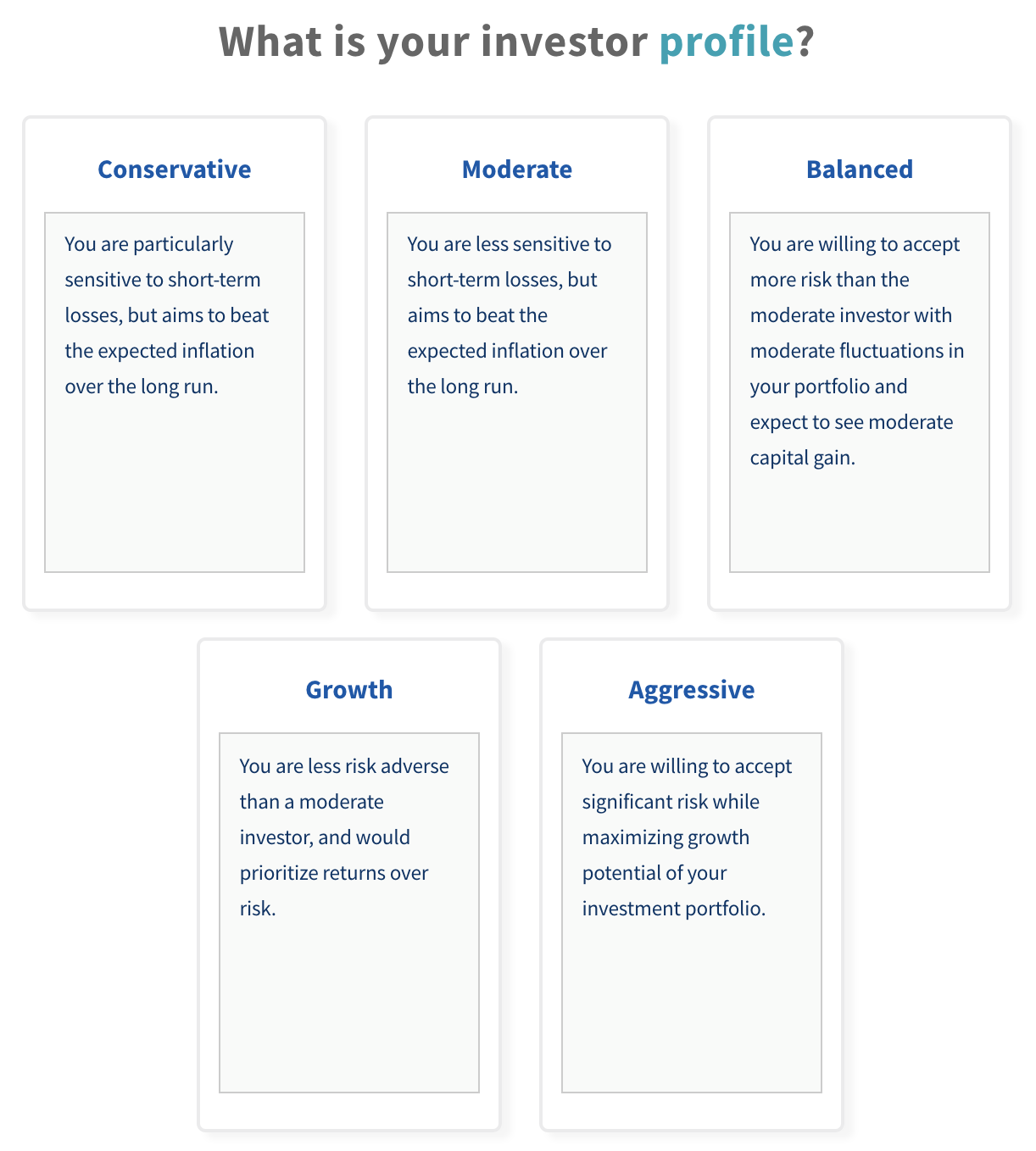

If you are interested in investing in mutual funds but they are unsure of how to get started, dollarDEX also offers a Recommended portfolio service where you can get a recommended portfolio based on your investor profile.

Investor profile, dollarDEX

Investor profile, dollarDEX

Investing through dollarDEX includes no sales charges, switching fees or platform fees. If you invest, your money is invested fully. The only real fee you pay is the usual annual management fee charged through the fund manager. As explained by dollarDEX, how it makes money to maintain its platform is by sharing the annual management fee from the fund manager.

If you are keen to begin investing in some mutual funds today, you are able to open a dollarDEX account today online. If you want to learn more about how it's like purchasing mutual funds first, browse the articles on the dollarDEX website .