Three causes there gained't be considered a 2021 housing industry crash

Retirement Planning In Singapore: Just how much Do I Need To Save And Invest To Retire At 55?

Retirement planning in Singapore can be quite formidable to think about. Being one of the world's most expensive countries to live in, it's important for Singaporeans to begin planning for their retirement early.

The official retirement in Singapore is 62. However, CPF LIFE payout only commences from age 65 onwards. What this means is if you wish to retire earlier, say at 55, you will need to find other causes of income to cover your bills.

But how much exactly would you have to save and invest to retire at 55?

Monthly Expenses Needed

Before you are able to determine whether you have enough to retire at 55, you first need to have a comprehensive understanding of what's your average monthly expenses. Logic dictates that the lesser you spend each month, the easier it will be for you to retire.

When you are looking at how much money you need, some people simply base it on what's the median income in Singapore. However, this may not be the most accurate way to estimate just how much you need.

The best way is obviously to calculate how much you normally spend each month. For this article, what will do is to rely on data from Singstats to guide us on how much we need.

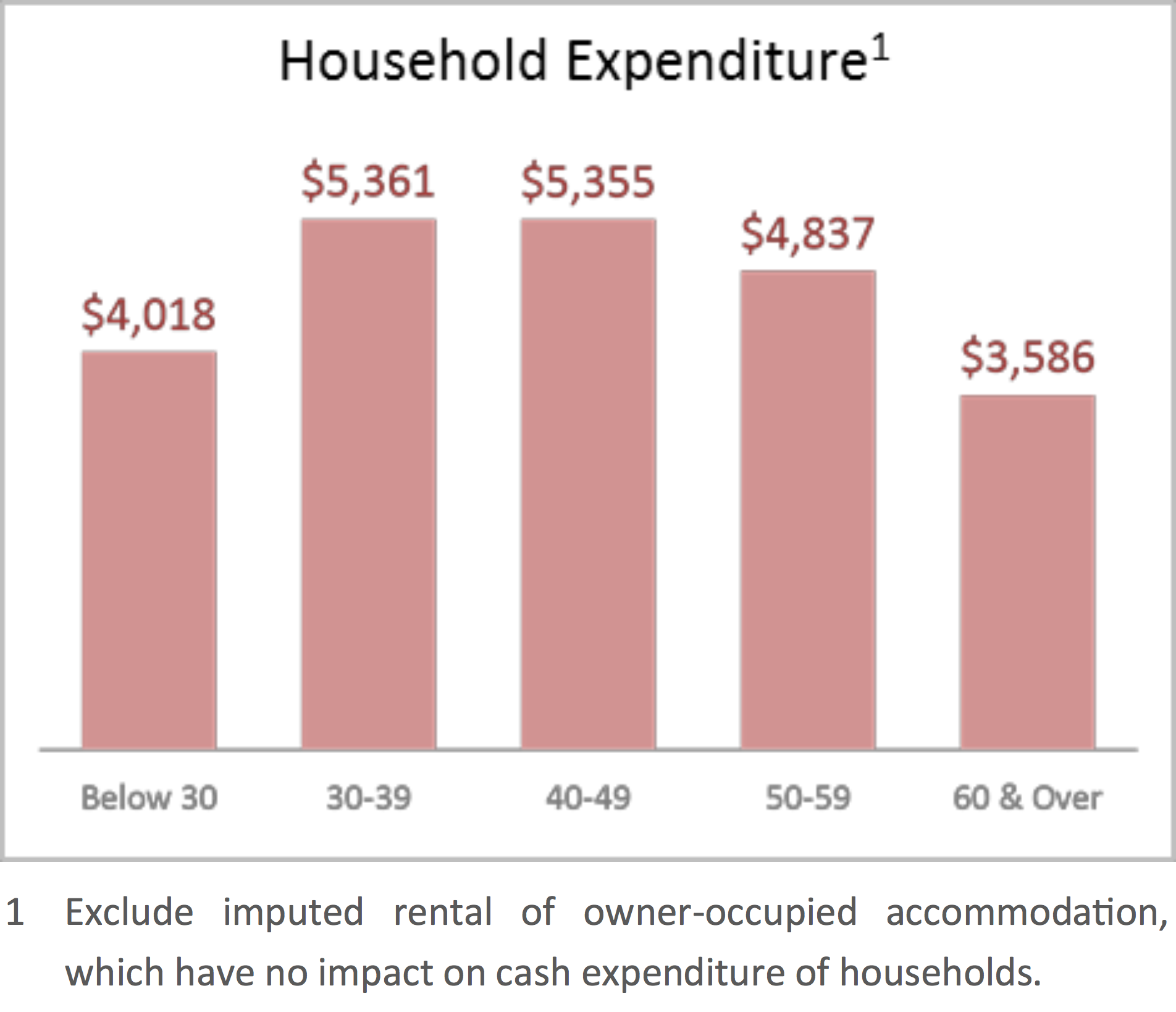

According to Singstats, a household which is led by somebody that is between the age of 50 to 59, spend typically $4,837 per month. These households tend to have an average of 2.1 working person. Do note this really is based on a 2021 report so the amount might be higher today.

If we divide the average expenditure of $4,837 by two, it means an individual needs to have an income of about $2,419 per month, in order to retire at age 55.

For both couples to retire, they will need on average $4,837 per month. However, for the purpose of this article, we will only take into consideration the amount needed for one person to retire.

Funding Your Retirement

For a start, consider CPF.

If you set aside the Enhanced Retirement Sum (ERS) of $279,000 (by 2021) by age 55, you will start receiving a monthly payout of about $2,155 at age 65. Utilizing CPF is probably the most cost-effective way for retirement planning in Singapore.

However, this can lead to two further questions.

Using Our Savings Only

Firstly, $2,155 continues to be about $264 short of our target of $2,419. Secondly, CPF LIFE payout only starts from age 65, meaning we cannot retire at 55.

To solve the initial question, what it means is that we need an extra $264 per month or about $3,168 per year. Assuming life expectancy till age 85, we'll need about $63,360 in savings to cover the shortfall in the amount we get from CPF LIFE from age 65 to 85.

To solve the 2nd question, for an individual to retire at age 55, the person will need an average of $2,419 per month, or about $29,028 each year, over a period of about 10 years.

An good way to calculate this is to assume that the individual funds his/her early retirement solely through savings. In this case, the person would need about $290,280 as a whole to fund an early retirement from age 55 to 65, prior to the CPF LIFE payout commences at age 65.

Here's a simple table as one example of the amount needed, in order to receive a payout of $2,419 from age 55 to 85.

| Age 55 to 65 | Savings Needed | $290,028 |

| Age 65 To 85 | Additional Savings Required

CPF LIFE For Enhanced Retirement Sum |

$63,360

$279,000 |

| Total Amount Needed At 55 | $632,388 | |

In total, the individual will need about $632,388 at 55 in cash and CPF to retire and to receive $2,419 per month.

Listen: The DollarsAndSense Podcast Episode #1: What Is Retirement, Anyway?

Earning Interest On Our Savings

However, we ought to not simply leave the amount we have saved into an account that pays us zero interest. Since we only need to draw down this amount monthly, we should leave the unused amount into a merchant account that pays us interest.

One obvious account that we can leave our savings untouched will be our CPF Ordinary Account (CPF-OA), which pays an annual interest of 2.5%. Of course, this isn't the only account that you can use and you can also consider other high-interest savings accounts.

With a yearly interest of 2.5% per annum, we will need about $261,000, and not $290,280, in order to get a payout of $2,419 from age 55 to 65. This is because our savings are also earning interest each year even as we slowly draw recorded on the principal.

In order to make up for the shortfall of $264 from age 65 to 85, we will need about $40,000 at age 55, at an interest rate of 2.5% per annum. This assumes that the money grows from age 55 to 65, having a monthly withdrawal of $264 from age 65 onwards for 20 years.

Lastly, we will also need $279,000 in our Retirement Account at age 55.

| Age 55 to 65 | Savings Needed (assuming 2.5% interest) | $261,000 |

| Age 65 To 85 | Additional Savings Required

CPF LIFE For Enhanced Retirement Sum |

$40,000

$279,000 |

| Total Amount Needed At Age 55 | $580,000 | |

Funding Our Retirement Through Investments

Another method to fund our retirement is going to be through investments.

In order to enjoy a passive income of $2,419 per month, or $29,028 per year, we will need a portfolio size about $580,560, based on a dividend/interest income of about 5% per annum.

The good thing about this method of calculation is the fact that we can receive lifelong dividend/interest income, without having to draw down on our principal investment.

If we were to draw down on our principal investment each year, and still continue to earn 5% per year, we will need a portfolio size of $450,615. This will provide us with a passive income of $2,419 a month till age 85. Under this method, we will need a smaller portfolio since we are drawing down on our principal each year, but this also means that we will have nothing at age 85.

There are a couple of big assumptions that we are making here which we need to point out.

Firstly, we are assuming our portfolio size remains constant throughout the duration. Secondly, we are also assuming that the dividend/interest income of 5% remains constant through the duration.

While these assumptions are necessary for ease of calculation in this article, they hardly ever apply in the real world, where markets constantly progress and down, and where dividend/interest changes constantly. So you need a margin of error.

How You Fund Your Retirement Matters

To conclude, how we intend to fund our retirement is just as important as how much we need, and when we hope to retire. If you are relying purely on savings alone, without earning ongoing interest in your savings, then you would need a bigger sum of money in order to retire.

Through the Enhanced Retirement Sum, CPF LIFE is able to give us about $2,155 per month. In practice, this is probably the most cost-effective way for Singaporeans to get started on retirement planning. However, the payout only starts from age 65 onwards.

In order to retire at 55, Singaporeans should have a mixture of both CPF and investments. This gives them the best of both worlds as they can earn a higher return from their investments, while concurrently obtaining the good risk-free interest provided by CPF.

Retirement Planning In Singapore: 3 Lesser-Known Information about CPF LIFE