Three causes there gained't be considered a 2021 housing industry crash

REITs ETFs VS Unit Trusts VS Syfe REIT+: Which REITs Investing Method Should Beginners Choose?

For beginner investors with dreams of owning property, investing in REITs is a way of investing in property without the actual hassle and paperwork of being a landlord. Additionally, the dwelling of REITs enables investors to build a steady stream of dividend income as REITs in Singapore are required to pay out 90% of their taxable income to enjoy tax transparency treatment.

An evergreen favourite of Singaporean investors due to the steady dividend income, Real Estate Investment Trusts (REITs) have taken a beating in 2021. While the prices of REITs have not recovered to the pre-pandemic heights, the dividend distributions have softened the blow to investors.

If you have an interest to begin investing in REITs because of the dividend income and property investment, listed here are 3 methods of REITs investing available in Singapore that are suitable for a beginner investor:

- Real Estate Investment Trusts (REITs) Eft's (ETFs)

- Real Estate Unit Trusts

- SYFE REIT+

#1 Investment Trusts (REITs) Exchange Traded Funds (ETFs)

REITs ETFs allow investors to purchase public-listed REITs according to an index. In Singapore, there are 3 REITs ETFs listed on the Singapore Exchange (SGX). The Phillip SGX APAC Dividend Leaders REIT ETF tracks the iEdge APAC ex-Japan Dividend Leaders REIT Index and concentrates on REITs across the Asia-Pacific region, including Singapore. The NikkoAM-StraitsTrading Asia ex-Japan REIT ETF tracks the FTSE EPRA/NAREIT Asia ex-Japan REITs Index and SGX-listed REITs constitute 70% of the fund. The Lion-Phillip S-REIT ETF tracks the Morningstar(R) Singapore REIT Yield Focus Index and consists of only Singapore REITs.

The key advantage of investing via REITs ETFs is it merges the advantages of an index fund using the property investment focus of REITs.

REITs ETFs offer diversification so that an investor only needs to hold just one ETF to participate in the returns of multiple REITs. Not only do you lower the transactional fees incurred to amass the same basket of REITs, but you also bypass the large capital requirements to buy into all these REITs. You can start buying a REITs ETF with just $100 a month using a regular savings plan offered by many brokerages and be invested into multiple REITs.

Additionally, the REIT ETFs are publicly listed which makes them relatively liquid and easy to buy and sell, unlike unit trusts. They also have lower management fees when compared with unit trusts as they are passively managed by tracking their benchmarked index.

#2 Real Estate Unit Trusts

If the 3 REITs ETF on the SGX are not quite what you are looking for or if you want to have greater overseas property exposure, you may want to consider looking at real estate unit trusts. These are mutual funds which are actively managed by fund managers plus they cover a broad spectrum of real estate investment that may be lacking in REITs ETFs. As they are actively managed, the fund manager can discretionarily allocate the actual funds without adhering to a catalog and present more interesting options to investors.

For example, if you wish to expand beyond Asia-Pacific, you can look at a unit trust such as Fidelity Global Property A-USD, that has more than 50% exposure to the US. Likewise, in order to invest in only Grade A commercial offices in a specific region, you are able to probably find a specific unit trust that does that.

As the money is actively managed, they tend to have high management fees which will eat into your overall returns. Additionally, as unit trusts aren't publicly listed, they tend to become more illiquid than ETFs, and therefore it is more difficult to buy and sell them. You will also have to go through your financial institution or relationship manager to gain access to these funds. Some platforms that list unit trusts include FSMOne. POEMs, in addition to DBS, OCBC and UOB.

#3 Syfe REIT+

Finally, we have the robo-advisory services that concentrate on REIT investments. Our focus is on Syfe REIT+ as it is currently the only REITs-focused robo-advisory product that invests in individual REITs.

Syfe REIT+ is interesting because it balances the potential volatility of REITs investing with risk management. It allocates part of the funds to Singapore government bonds based on their in-house algorithm to reduce your risk exposure. This could reduce the likelihood and harshness of your REITs portfolio crashing during periods of market volatility for example during March 2021.

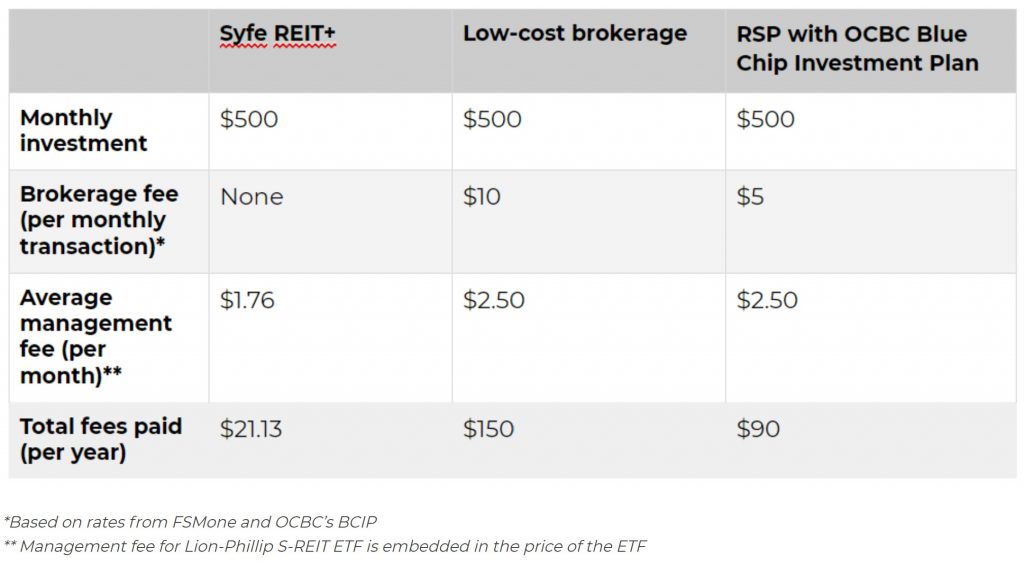

Syfe REIT+ tracks the SGX iEdge S-REIT Leaders index and may automatically reinvests your dividends. However, unlike purchasing a REITs ETF, you actually own units of the baby REITs. Additionally, your total cost of acquiring these units is likely to be lower than buying them individually or through a REIT ETFs due to the absence of brokerage fees.

REITs ETFs are probably the most familiar method for beginners as it is the same as buying a stock around the SGX and easily executable via an online stock brokerage. Whereas unit trusts are probably more suited to an investor who has specific investment goals that aren't covered by REITs ETFs, such as if you would like more overseas exposure beyond what's offered by the 3 Singapore-listed REITs ETF. Syfe REIT+ with its risk management component is possibly more suitable for an investor who's more risk-averse and may be appealing to those who want to reinvest their dividends automatically.

Once you've gained confidence in investing, you may also want to consider investing in individual REITs. However, as a beginning step, investing in property via one of the abovementioned 3 methods is a good choice depending on your preferences.