Three causes there gained't be considered a 2021 housing industry crash

Step-By-Step Guide To Opening An Account With Tiger Brokers Singapore

For Singapore investors who don't already know, Tiger Brokers – a NASDAQ-listed broker, has recently launched its access into the Singapore Exchange (SGX). What this means is that investors are now able to buy and sell stocks listed on the SGX. This is in addition to being able to trade U.S., H.K. and China stocks, that have been previously readily available on the platform.

Within the brokerage industry, Tiger Brokers is sort of unique because it prides itself on as being a mobile brokerage firm. It has a dedicated and comprehensive app, Tiger Trade – which is a one-stop mobile application that allows investors to access global markets and manage their investment portfolio using just their mobile phone.

Of course, the platform is also on your desktop/laptop as well. Tiger Trade can be downloaded as an app on your phone, or installed as a software on your desktop/laptop, depending on your choice.

Tiger Brokers prides itself on being a low-cost platform, so naturally, investors would be curious about its brokerage commission fees to invest in various global stock exchanges.

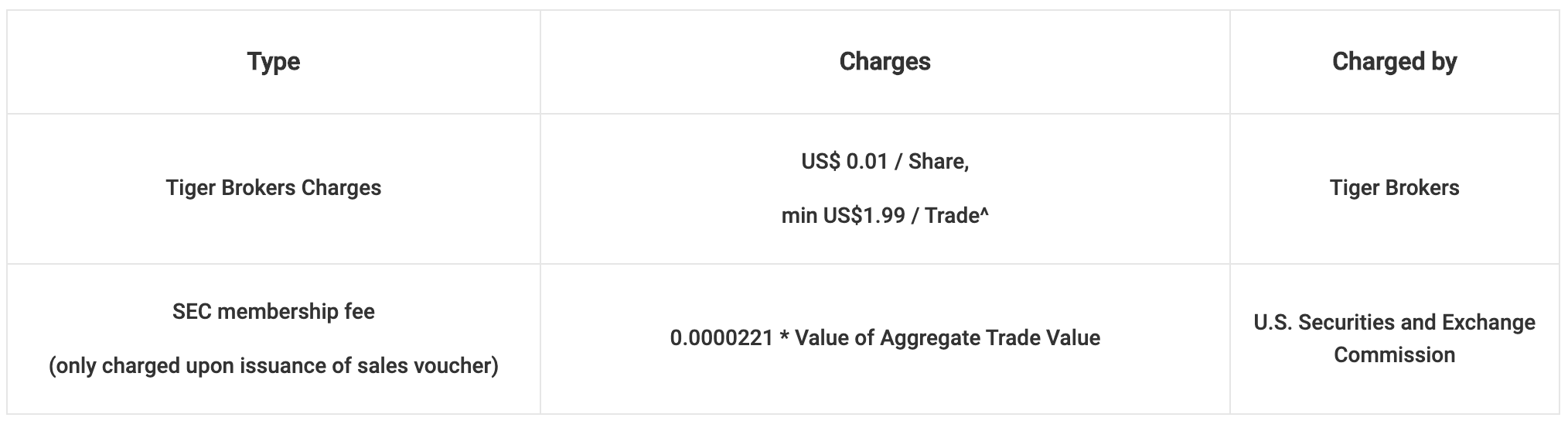

U.S. Stocks

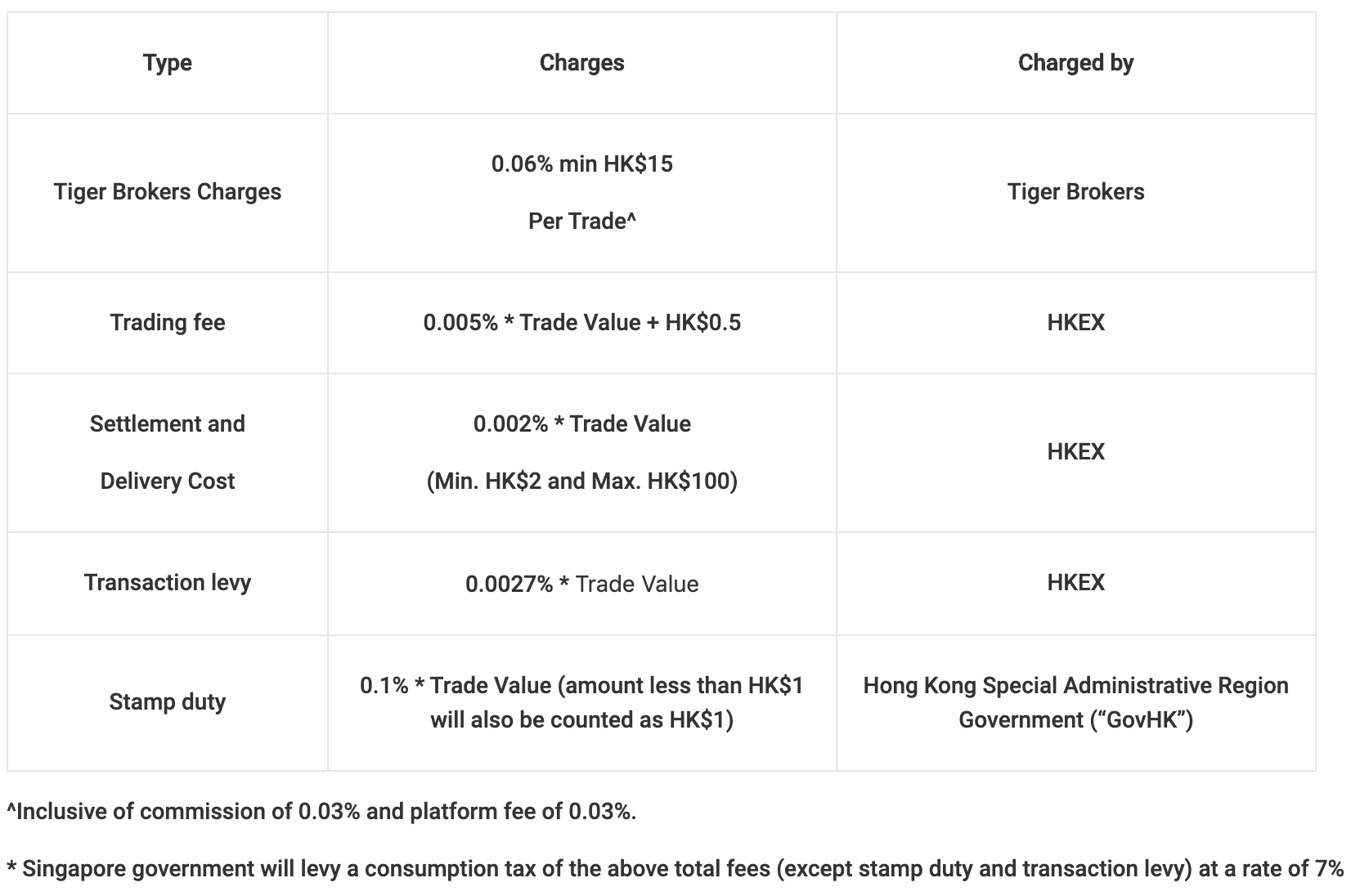

H.K. Stocks

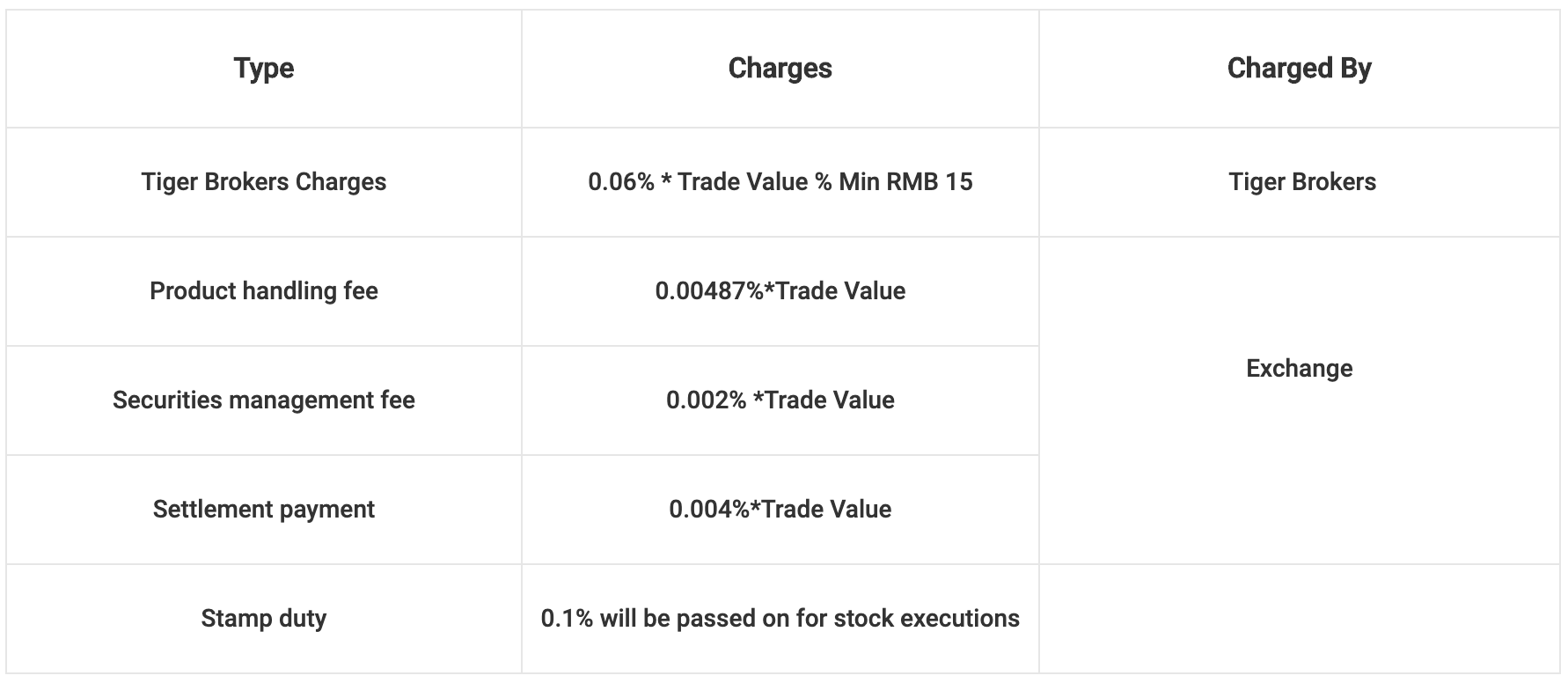

China Stocks

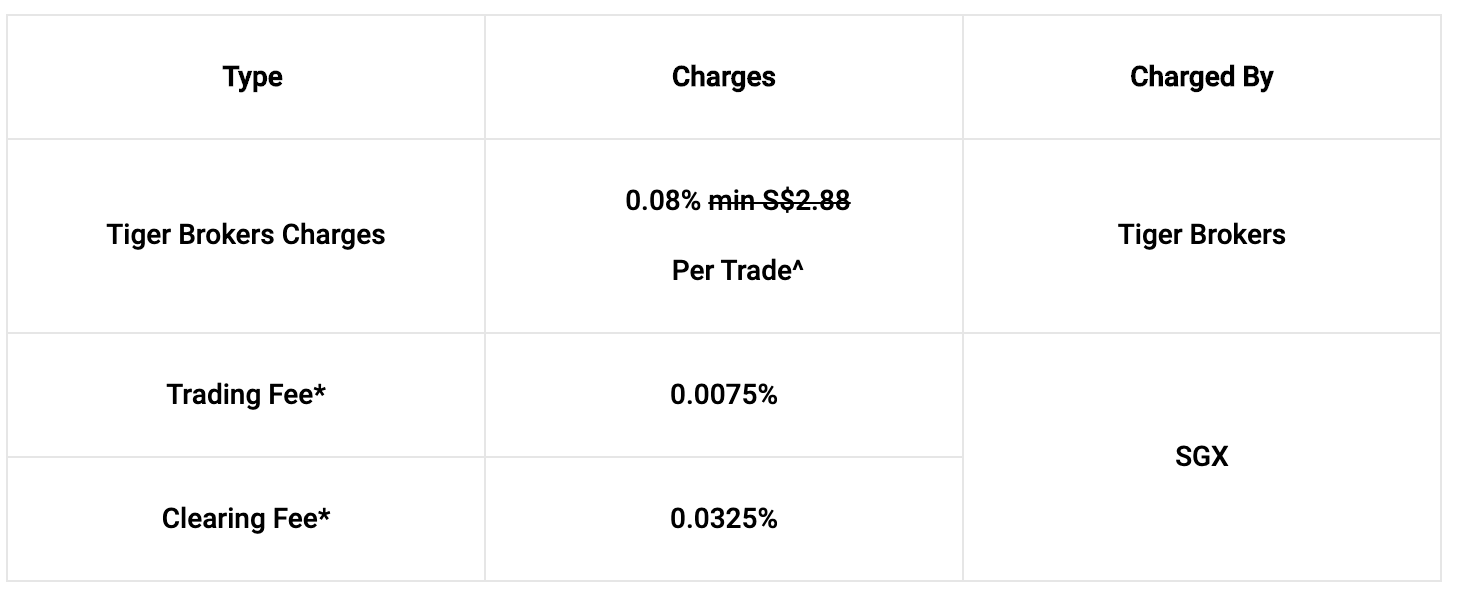

Singapore Stocks

While there are several local brokerage firms offering 0.08% commission fee, most, if not completely, have a minimum fee of approximately $8 to $10. Given that Tiger Brokers currently does not have a minimum fee, a stock acquisition of $1,000 will only cost you $0.80. Yes, we know – it's ridiculously low. From now until 31 December 2021, Tiger Brokers is providing Singapore stocks at 0.08% per trade with no minimum charges!*

* Terms and conditions apply

If you are excited (like us!) about the pricing and keen to spread out a Tiger Brokers account today, we've got you covered in our step-by-step guide here.

Download around the App Store

Get it on Google Play

Download around the Mac

Get it for Windows

PS: All screenshots here are taken from our MacBook. But the steps are similar even if you open your bank account via mobile phone.

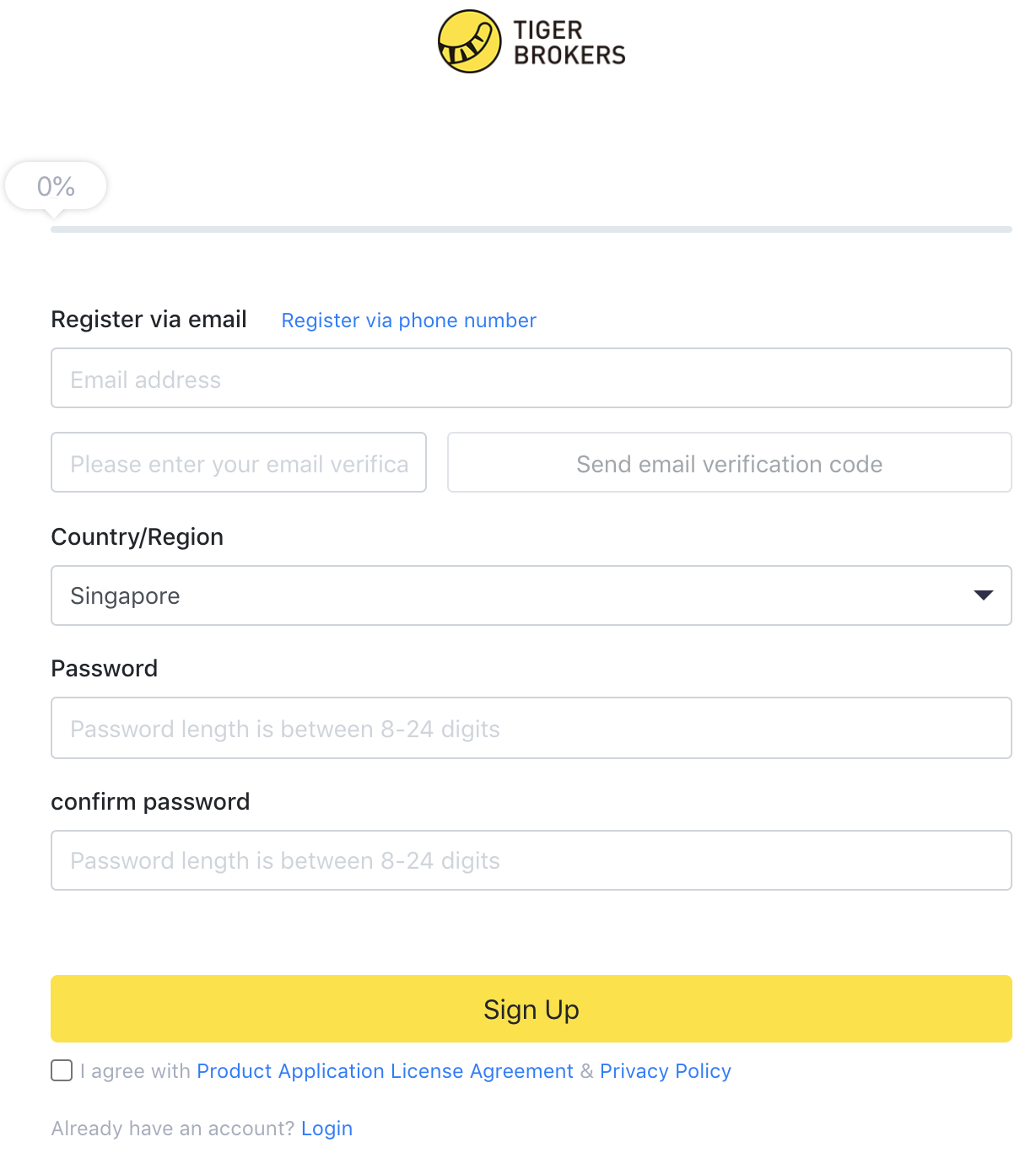

Step 1: Subscribe to an account

Sign up for an account here if you are using a laptop/desktop. Otherwise, the process can be done on your mobile phone. You will be necessary to confirm your nationality.

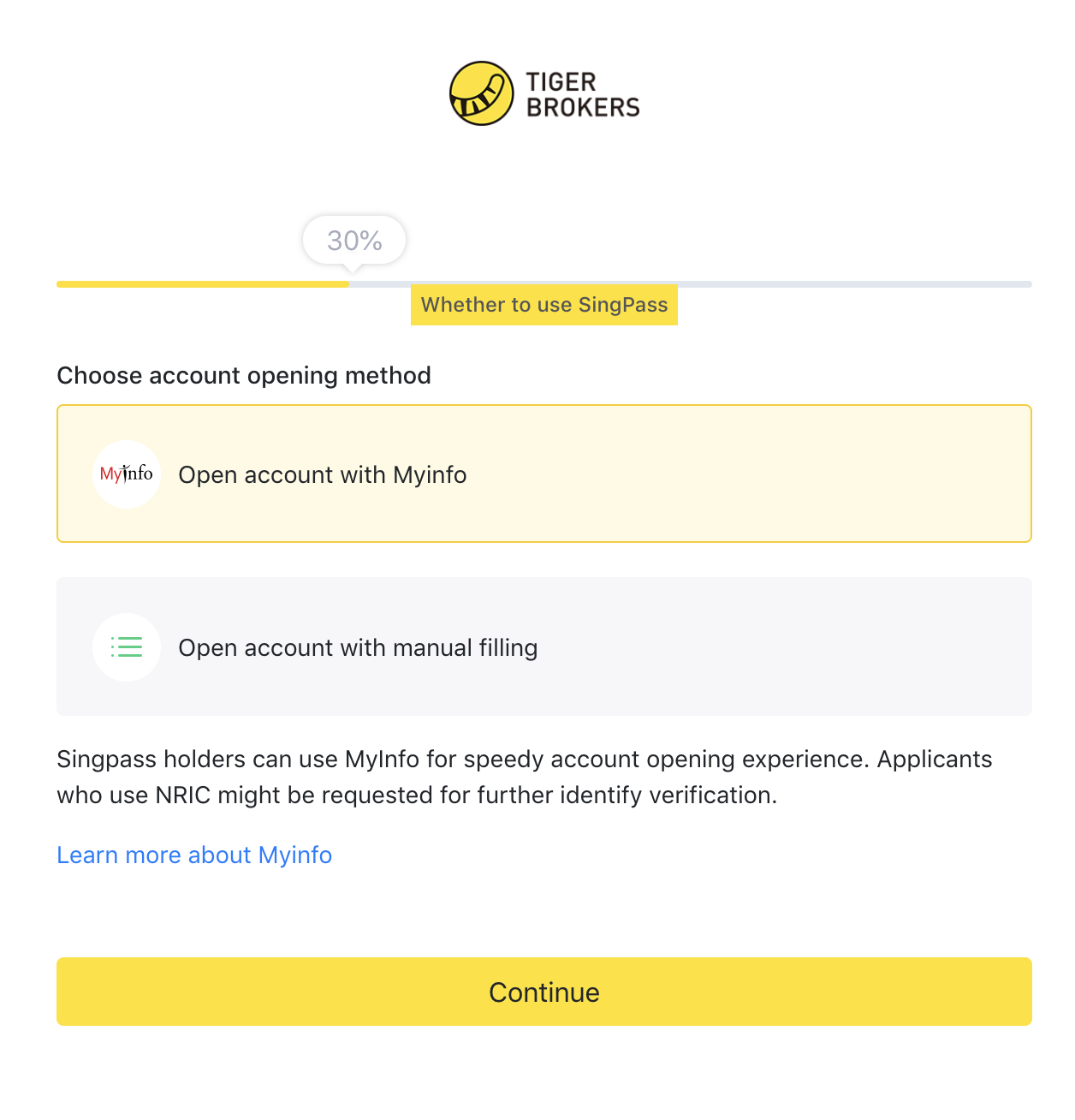

Step 2: Open account via Myinfo

If you're Singaporean, you will have the option of fast-tracking your sign up via MyInfo. We recommend for you to do in order it's much more convenient. Obviously, we chose this method.

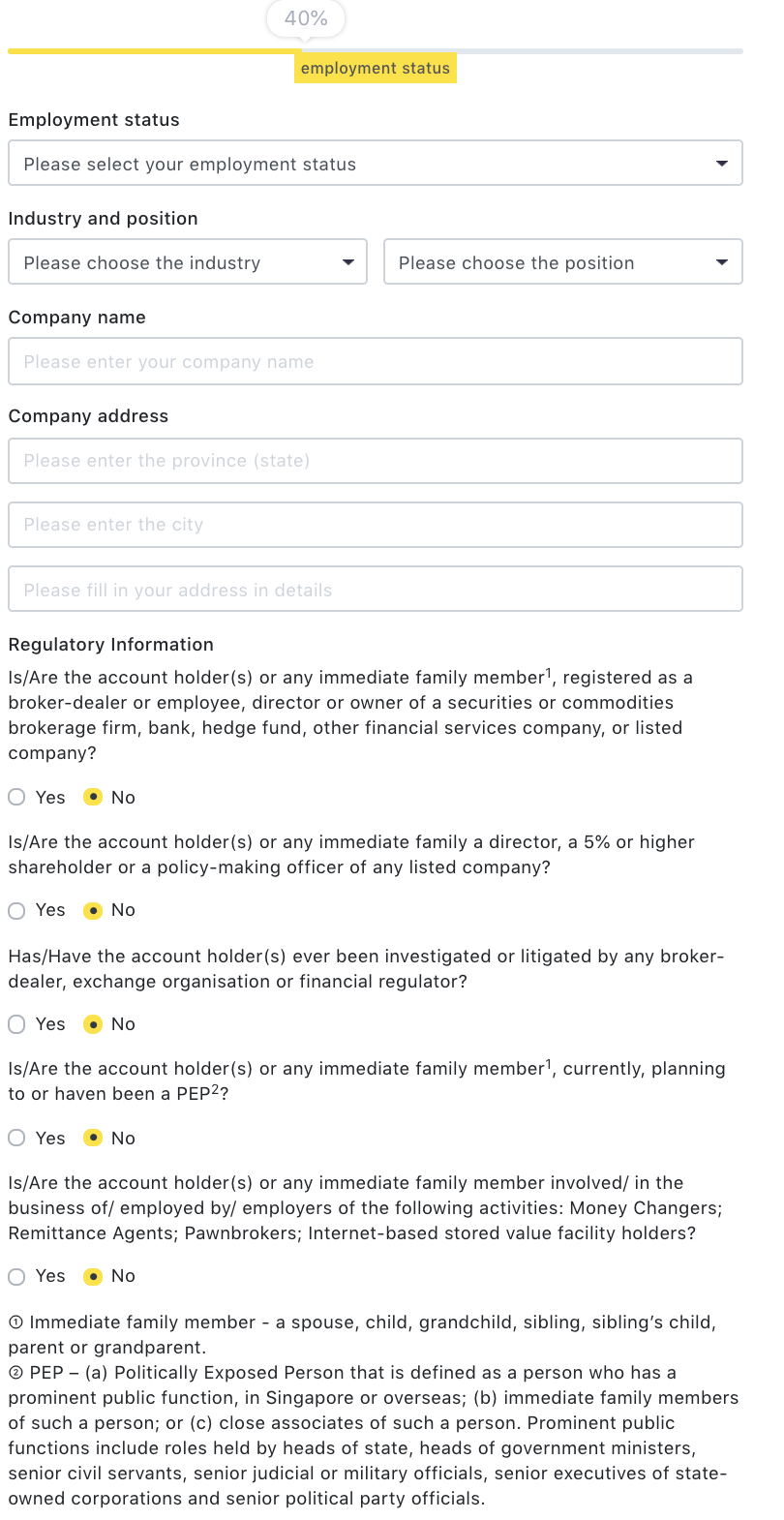

Step 3: Verify your employment details

MyInfo will automatically pull out the basic information that are requested (e.g. your address, birth date, etc). You will still need to complete your employment status for that registration.

Step 4: Fill in your years of investing experience

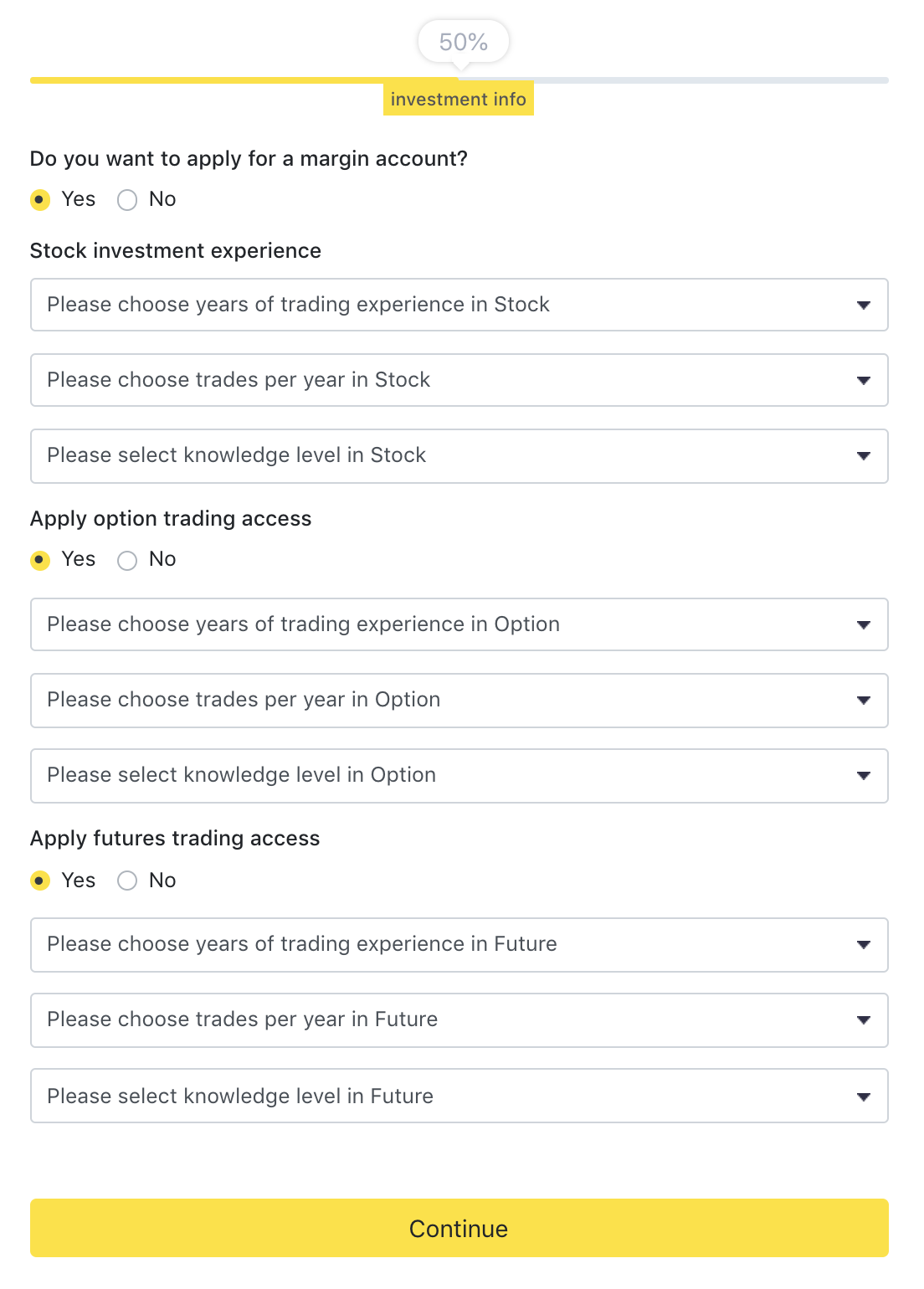

Besides opening a stock trading account, you are able to choose for additional account or access that you would like, depends on your trading needs. This includes margin account, option trading access and future trading access. There is no need to have prior experience in stock investing before opening an account. However, it does provide the platform with a few background knowledge on your prior experience.

Step 5: Declare your source of income and your assets

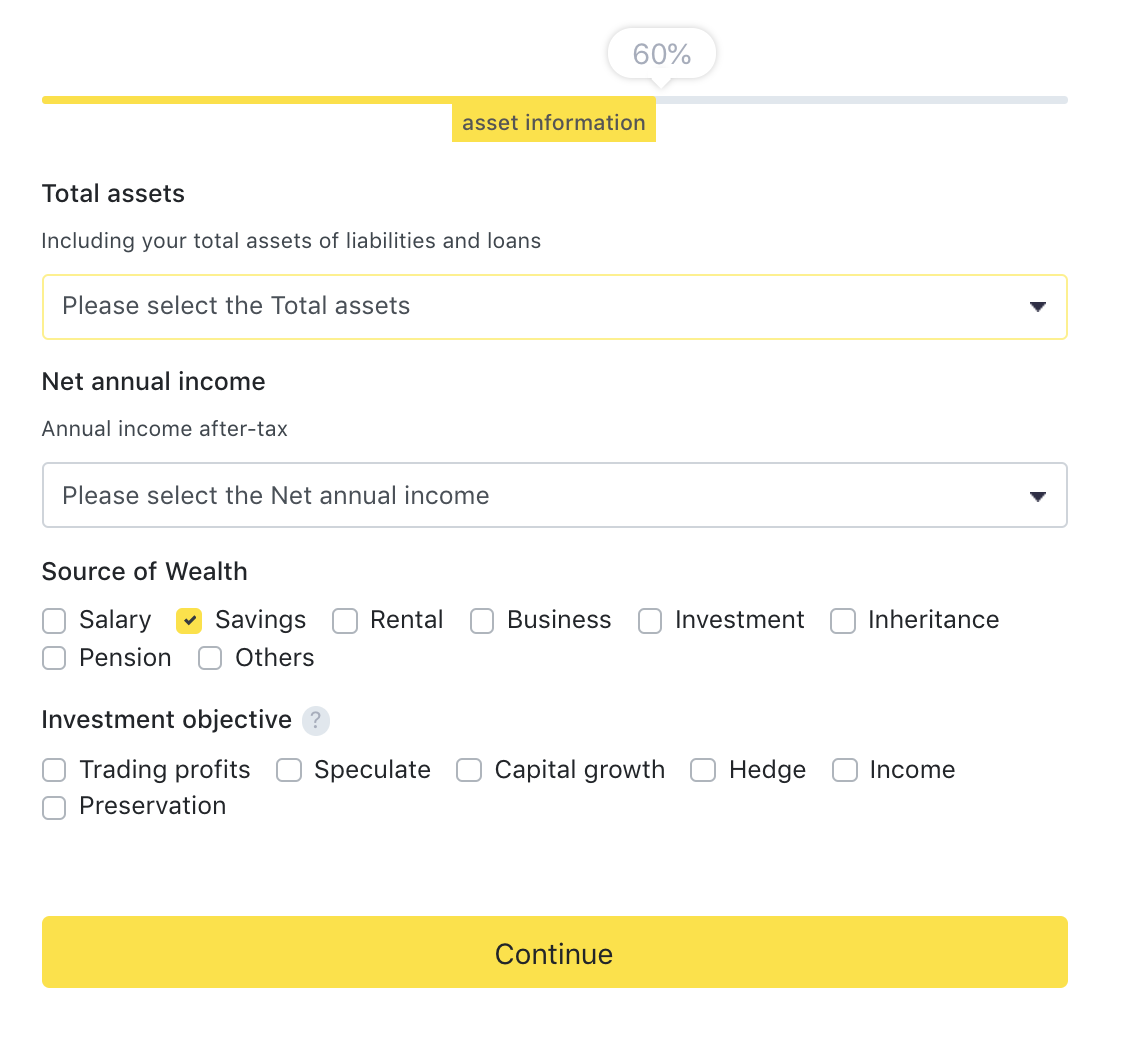

You will need to provide information on your assets, annual income and source of funds. These are standard questions.

Step 6: Declare your relevant qualification and experience

There is a customer account review step where Tiger Brokers will have to find out if you understand the risk of Specified Investment Product (SIPs). It is not a prerequisite to have these qualifications, but if you want use of SIPs, you will need to meet one of the four criteria below.

After this, you need to agree to some final compliance matters as well as your registration is completed.

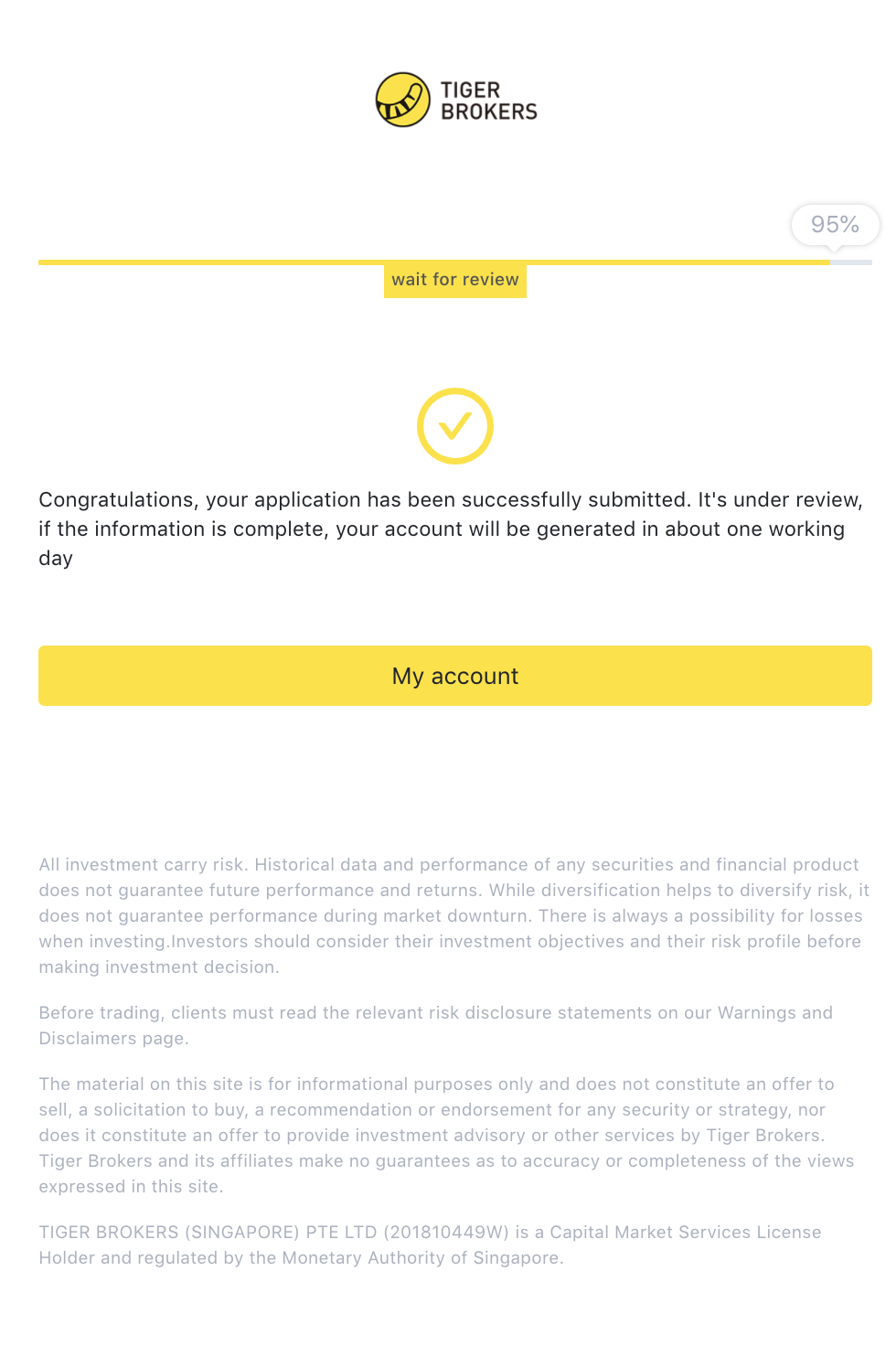

Within minutes of submitting our application, we receive the confirmation that our trading account was successfully opened. In conclusion, opening the trading account took us less than 10 minutes.

Based on our experience, this is way faster than other brokerage platforms that we have used before. The lack of any paperwork if you use MyInfo for your registration is also a huge convenience when you have a Singpass account.

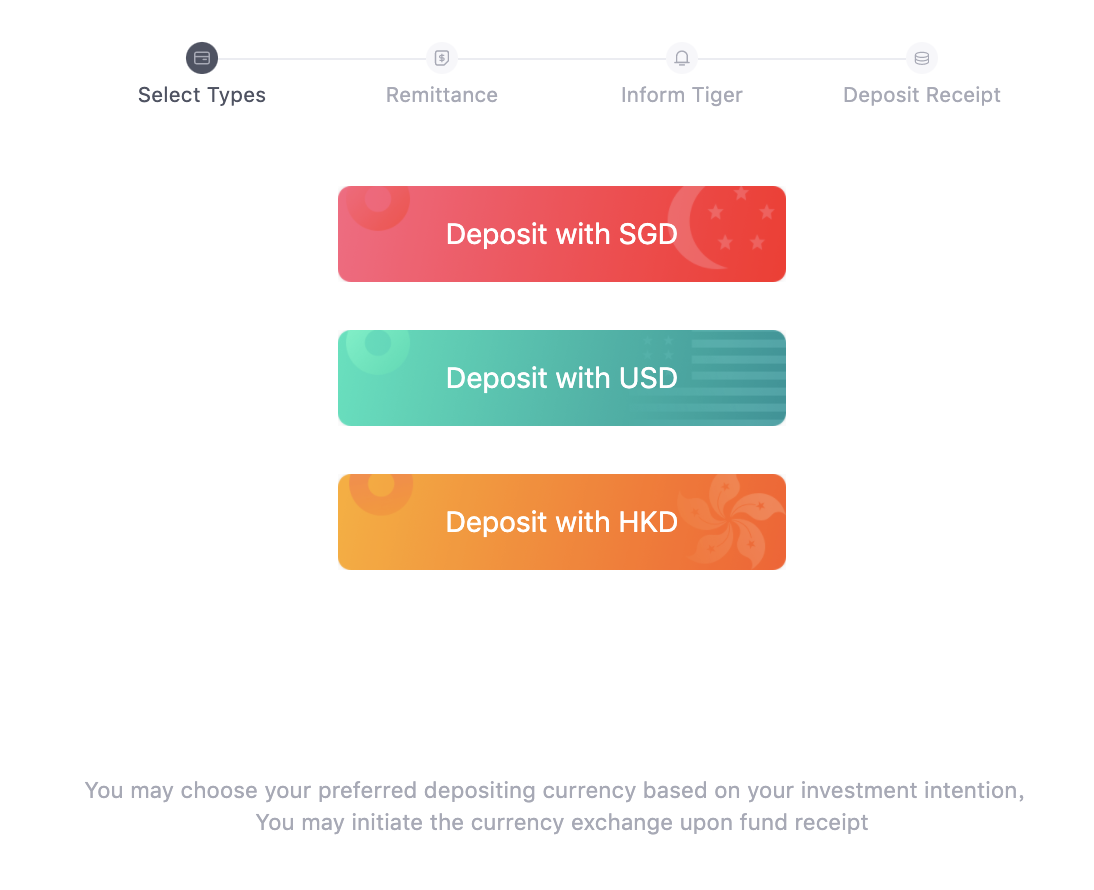

You can then start funding your trading account, because you will need to pre-fund the account, prior to being able to trade. You can choose to deposit in 3 currencies – SGD, USD or HKD.

Do be aware that you have to deposit your investment monies from the savings account under your name. Tiger Brokers doesn't accept third party deposits (i.e. you transfer money from a savings account under your spouse name). We did so through a PayNow transfer.

Once that is done, your funds will require about 1-4 business days. For us, the funds were in within a day. Once the funds are in, you can start your investment journey!

As you would expect from the FinTech brokerage firm, Tiger Brokers allows you to do everything you need to, from opening a merchant account to making trades, entirely online. As well as if you are always on the go, its mobile trading platform is created specifically to make investing and trading on your fingertips as easily as possible, much like reading an article on DollarsAndSense.

Tiger Brokers is made for self-directed investors and traders. Besides investing straight into stocks, you can apply for margin trading and option trading too. All these instruments come with higher risk and investors need to be aware of the trades that they are making.

For those seeking to open a Tiger Brokers account, you will be happy to know that in conjunction with Singapore's 55th birthday celebration, Tiger Brokers will be managing a special promotion from 9 August to 31 August 2021 for individuals who open a trading account.

Besides enjoying 5 commission-free trades, you can also enjoy a sure-win lucky dip and referral bonus as high as $100. You can also enjoy stock vouchers worth as much as $100 when you deposit funds to your Tiger Broker Account. You can find out more details about this promotion here.