Three causes there gained't be considered a 2021 housing industry crash

Interactive Brokers (IBKR) Opens Singapore Office: Here's What It Means For Investors In Singapore

On 7 July 2021, Interactive Brokers (IBKR), a worldwide brokerage firm, announced the opening of their Singapore office, citing a rapidly growing client base in our financial hub.

Listed around the NASDAQ in the US, Interactive Brokers is really a pioneer of global electronic trading with over 40 years of track record, and is best known for its industry-low commission rates, innovative brokerage services and global presence providing access to over 135 markets.

This is nice news for Singapore investors.

Why Interactive Brokers Expanded Into Singapore?

Interactive Brokers reported that its client base continues to rapidly rise in Singapore. By opening an office here, investors in Singapore can finally leverage on its platform to invest in Singapore stocks. Previously, investors in Singapore could just use its platform to buy then sell stocks that are not listed in Singapore.

Its Singapore office can provide a more dedicated on the ground support and service active traders and also the wealth management community here. A nearby office typically also provides a method for brokerages to engage clients more closely with events and value-added services, which can be in store for clients of Interactive Brokers.

The Singapore office, its ninth globally and fourth in Asia, also points to an increasing interest in the Asia and Asia Pacific markets. Interactive Brokers also highlighted that Asia accounted for 37% of its client accounts, that is a substantial increase from 27% in 2021.

Finally, Interactive Brokers pointed out that it is committing to the Singapore financial hub at a point where “other brokers have exited Singapore or decreased their resolve for the country”. This is perhaps hinting in the exit of Charles Schwab in 2021 and DBS Vickers transferring its offline retail securities brokerage business to UOB Kay Hian.

Should I Use Interactive Brokers To Buy And Sell Stocks?

On the Interactive Brokers' website, it states three premiere factors behind people to invest via Interactive Brokers.

#1 Low Cost

Known for charging very competitive brokerage commissions and financing rates, Interactive Brokers claims to offer the lowest commissions and states that if an exchange provides a rebate, Interactive Brokers will spread some or all of the savings directly back to clients.

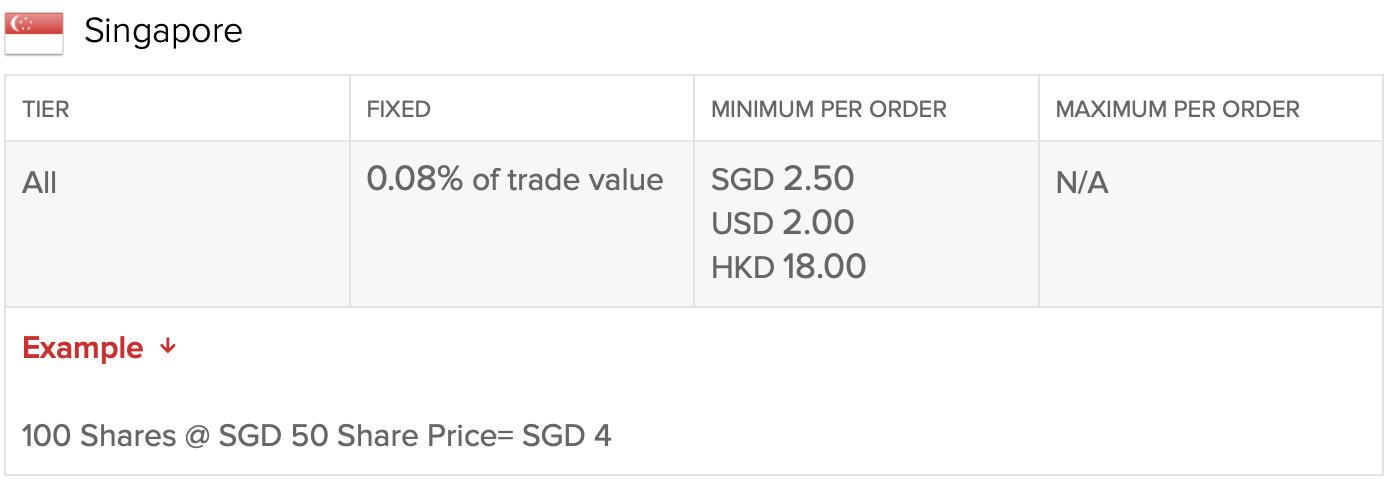

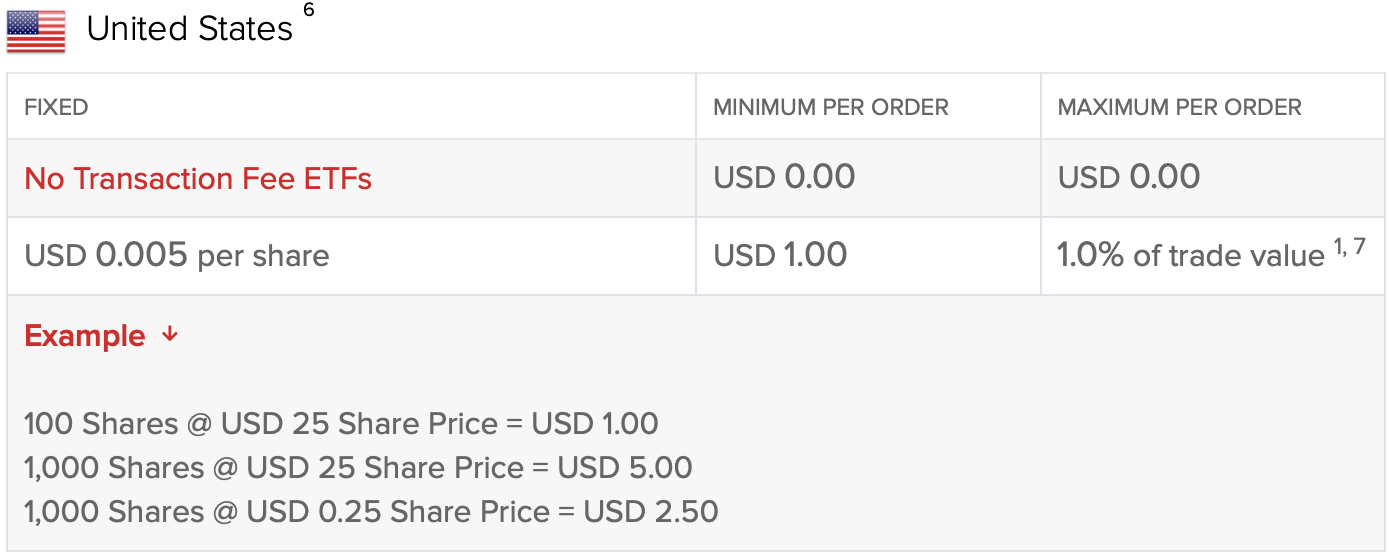

For stocks and other securities indexed by Singapore, there is a fixed brokerage commission of 0.08% of the trade value. There also doesn't appear to be a minimum brokerage fee which a number of other brokerages currently charge.

For ETFs listed in the US, it charges no transaction fees, and merely US$0.005 per share.

Its transaction fees for other regions are also very competitive, and you can review the entire list here.

In addition, additionally, it charges competitive margin financing rates of interest and allow us to earn an additional income on our shares held with Interactive Brokers by lending them to traders who want to short the market.

#2 Global Access

Via a single Interactive Brokers integrated account, investors can access stocks, options, futures, currencies, bonds and money in more than 135 markets, across 33 countries as well as in 24 currencies.

This means investors can fund our accounts in multiple currencies and trade assets in multiple currencies, without incurring foreign currency costs.

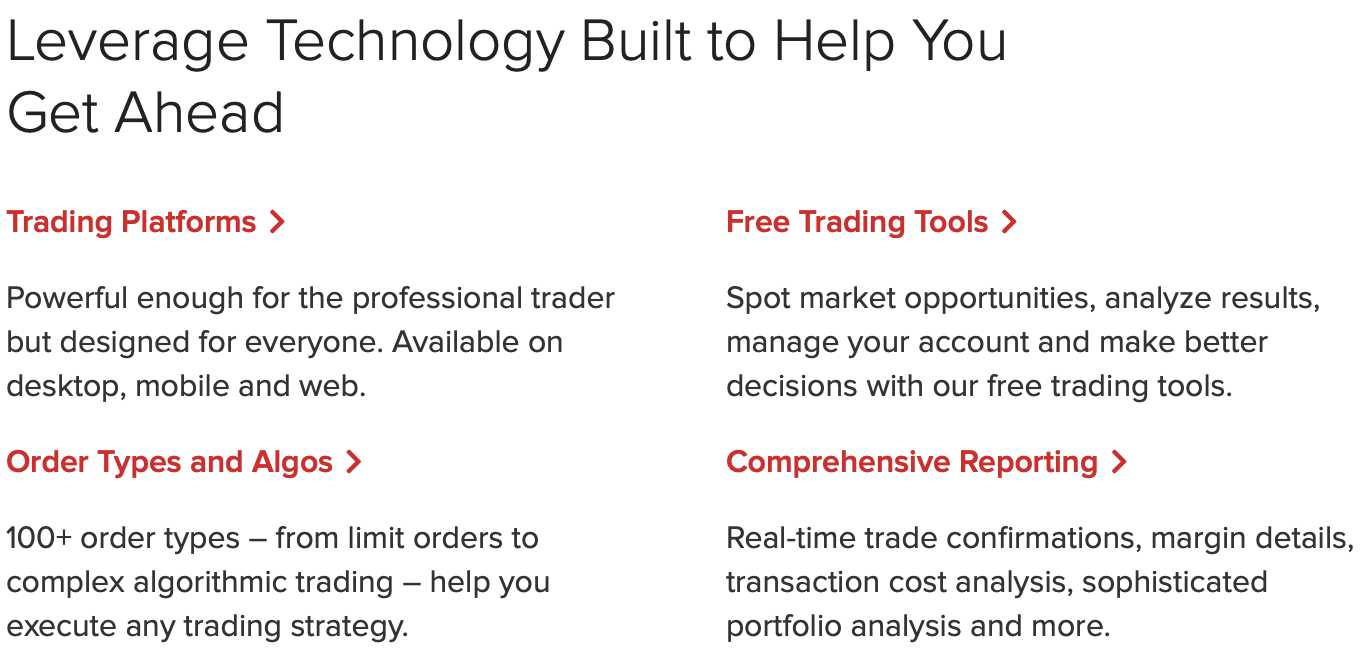

#3 Innovative Solutions With Its “Premier Technology”

Interactive Brokers offer technological solutions that suits new investors as well as sophisticated traders and wealth managers. We are able to visit the Interactive Brokers website to find out more about these technology.

Opening An Interactive Broker Account

The process was fairly quick and straightforward. We can apply for an Interactive Brokers account within 10 minutes and can be completed entirely online, while not having to print anything or send in any hard copy documents – very convenient.

I won't go into details, save for the proven fact that we should have our MyInfo details updated and use it to apply for our account, and now we need to have our mobile phone, to get an authentication code, around when we start the application process.

When we did this (and performed other functions like try to fund our account), i was routed to the Australian website, because it had a .au at the end, after inputting my initial information. Found that slightly strange, however i figured they're still new there may be bugs to be fixed.

At no more the application process, there was a notification that it will take a few days before the account application is approved. So, we cannot start trading immediately.

How To Fund My Interactive Brokers Account In Singapore?

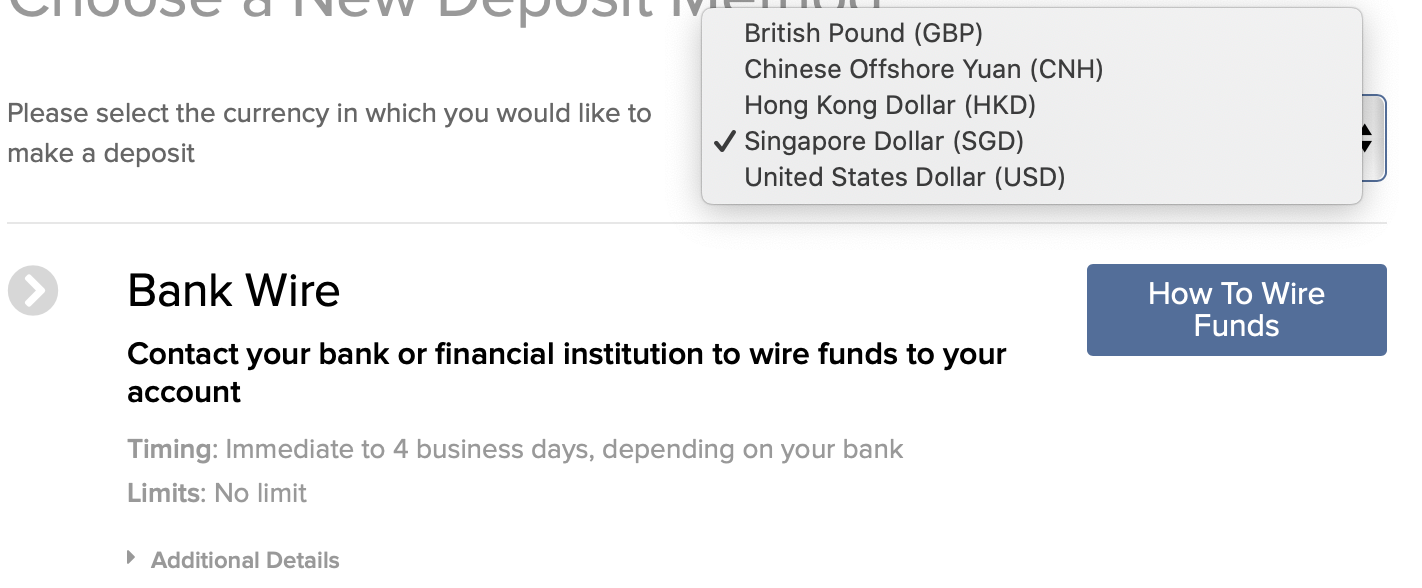

There are a couple of ways to go about funding our Interactive Brokers account: 1) using a bank wire, which can take up to four business days, and 2) by transferring securities we already own from another firm.

Choosing to wire in money simply means we will receive the account information and need to log into our accounts to make the transfer to the account details supplied by Interactive Brokers.

We can also decide to transfer multiple currencies, namely British Pounds, Chinese Yuan, Hong Kong Dollars, US Dollars and Singapore Dollars, into our accounts.

It does look like Interactive Brokers only offer a custodian account, meaning we will store our investments with Interactive Brokers instead of in our CDP Account after buying stocks.

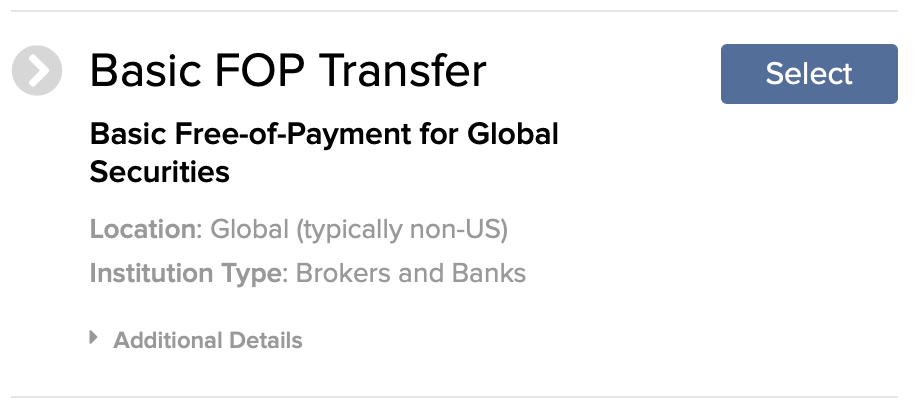

We can pick the Basic FOP Transfer option, which allows us to transfer our securities held in another custodian account in Singapore, or with another brokerage internationally, to Interactive Brokers, free-of-charge.

Buying And Selling Stocks On Interactive Brokers

As mentioned earlier, one of many advantages of using Interactive Brokers is its industry-low trading commissions, which is 0.08% of the transaction cost for Singapore stocks, and may even be free if we invest in US-listed ETFs and US$0.005 for US-listed stocks.

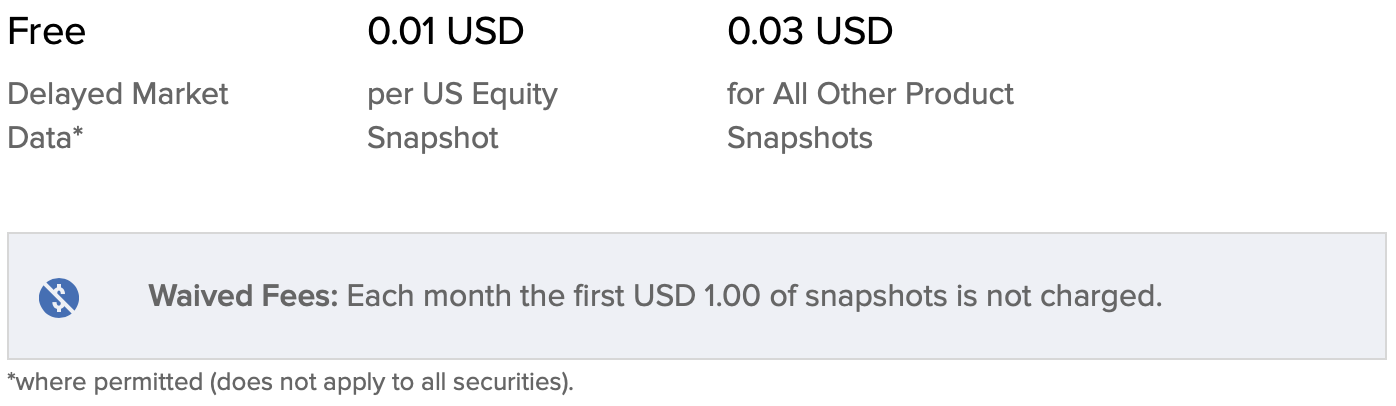

However, we discovered that we may not have live market data when investing with Interactive Brokers. To receive it, there may be some charges involved. For example, live SGX prices are costed at a hefty $13.00 a month while live prices of stocks on the NYSE are more affordable at $1.50 per month.

While this may benefit traders and wealth managers, it may not be sensible for retail investors to incur such fees.

From what we should understand, most local brokerages offer live prices for SGX-listed stocks free of charge, while prices for foreign listed stocks are usually delayed.

If we do not want to pay a monthly fee, there is also the option of trading via the delayed prices or deciding to receive a “snapshot” of prices whenever we wish to trade. The good thing is that costs are relatively low and fees for the first $1.00 of snapshots we request are waived.

If we are trading the Singapore market, this gives us a runway of approximately 23 trades each month. Around the US markets, this is near to triple that. For many retail investors, it might be sufficient and more worthwhile to use this method to invest.

Using Your Interactive Brokers Account

While awaiting our Interactive Brokers account application to complete, we can explore some features offered by Interactive Brokers on its Traders' Academy, including its IBKR Trading Tools, Investment Products, Investment Analysis, and other. In total, there are 49 courses we can explore.

In addition to this, there are also webinars, videos, traders' insights, blogs, an investing lab and other features we can leverage on to improve our investing knowledge.