Three causes there gained't be considered a 2021 housing industry crash

What Is P2P Lending And just how Can You Invest In P2P Loans In Singapore

P2P lending has been heating up over the years, not just in Singapore, but in other countries such as China as well. Over the past decade, China has become the world's largest P2P lending industry, with total loans of about $200 billion.

What Is P2P Lending?

Peer-to-Peer (P2P) lending is the lending of money to individuals or businesses through online platforms. Lenders can make use of their money to finance others' loans to acquire interest on the money lent out.

This allows an individual or company to obtain a loan using their company individuals rather than borrowing traditionally from a bank.

There are two different parties in P2P lending – the borrower and the lender (or investor).

The borrower is definitely an individual or business that's looking to borrow money. In Singapore, these are usually businesses

The lender/investor is an investor that is prepared to lend their money in return for higher returns. The borrowed funds amounts of these lenders could be pooled to provide the total loan amount to the borrower. To be eligible to be a lender/investor, you have to:

1) be 18 years old and above

2) a Singaporean citizen, Permanent Resident (PR) or perhaps a foreigner residing in Singapore with a valid employment pass, dependent's pass or student pass

3) have a bank account with a local bank or foreign qualifying full bank in Singapore

Risk VS Returns

P2P investing offers higher returns for the investment, making it a viable option for investors looking for the best investment vehicle that provides greater returns. P2P lending is also a way for some investors to diversify their investments. It adds another dimension to traditional investments for example stocks, bonds, funds, commodities and more.

With higher returns comes greater risk. There is a chance of the borrower defaulting and being unable to return the promised returns or even your capital. In 2021, there have been high profile P2P lending incidents in China. In these lending failures, the borrower is unable to pay off the loan taken.

In 2021, default rates in Singapore for P2P loans seem to be climbing as well, perpetuated by the COVID-19 pandemic. Most recently, CoAssets, which was previously one of the biggest P2P lending platforms in Singapore, has found itself in difficulty as reported by TechInAsia. This also means that its investors would potentially be losing countless their investment monies.

Due to the high risk of P2P lending, it's important to invest using a platform that's regulated by the Monetary Authority of Singapore (MAS). Do note however that simply being regulated by the MAS is no guaranteed that 1) your investment funds are definitely safe and 2) that the platform will not fail. It's like investing in stocks. Even within the best P2P platforms, there's always a probability of default.

How Can Singapore Investors Make P2P Investments?

P2P lending platforms facilitate P2P lending by connecting and matching the borrowers towards the lenders. There are a few platforms in Singapore where you can become a borrower or a lender.

Due to the high risk of P2P lending, it's important to invest using a platform that's regulated by the Monetary Authority of Singapore (MAS).

You will first need to register as a member for just about any of these platforms before you can see the available campaigns and select which to invest your money in. The woking platform should allow you to view applications and monitor your investments.

P2P Lending Platforms In Singapore

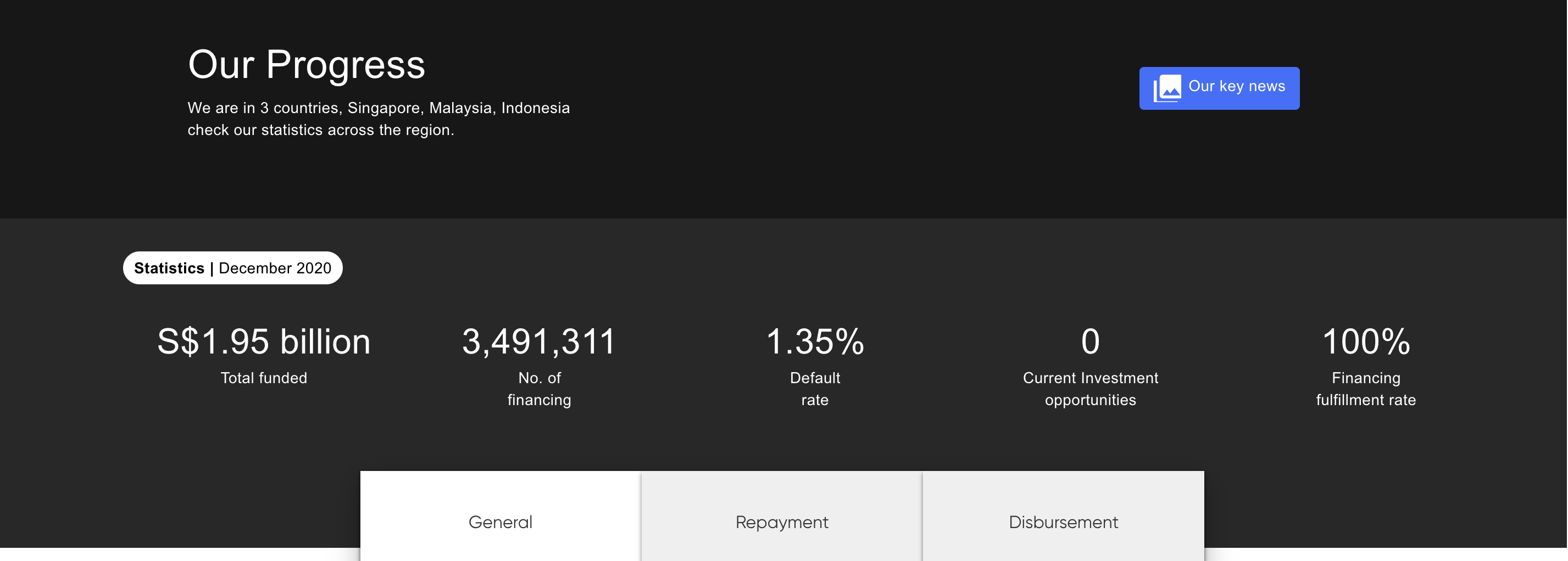

#1 Funding Societies

Founded in 2021, Funding Societies is the first P2P lending platform using government-registered escrow account for security of funds. By December 2021, Funding Societies has funded a lot more than S$1.95 billion in loans. Loan default rates for that company is currently at 1.35%.

For businesses: Funding Societies offers 3 types of products: 1) FS Bolt 2) Business Term Loan and 3) Invoice Financing. FS Bolt offers lighting fast approval within A couple of hours for loans up to $100,000. For a Business Term Loan, businesses could possibly get up to $3,000,000 for secured loans and $1,500,000 for short term loans. Businesses can receive up to 80% of invoice value under invoice financing.

Investing with Funding Societies: The minimum investment amount is $20, the lowest among all the P2P players in Singapore. In 2021, Funding Societies has a 9.82% weighted average return. Loan tenure aren't any more than 12 months so it's only short-term deals the company offers.

The company currently offers 6 various kinds of investments for investors:

- Guaranteed Property-backed Investment

- Guaranteed Returns Investment

- Property-backed Secured Investment

- Invoice Financing Investment

- Revolving Credit Investment

- Business Term Investment

If you are new to Funding Societies and would like to start investing with them, you can sign up using the DollarsAndSense Promo code <DNS20> to get $20 cashback.

Find out more about this promotion and register today here.

#2 MoolahSense

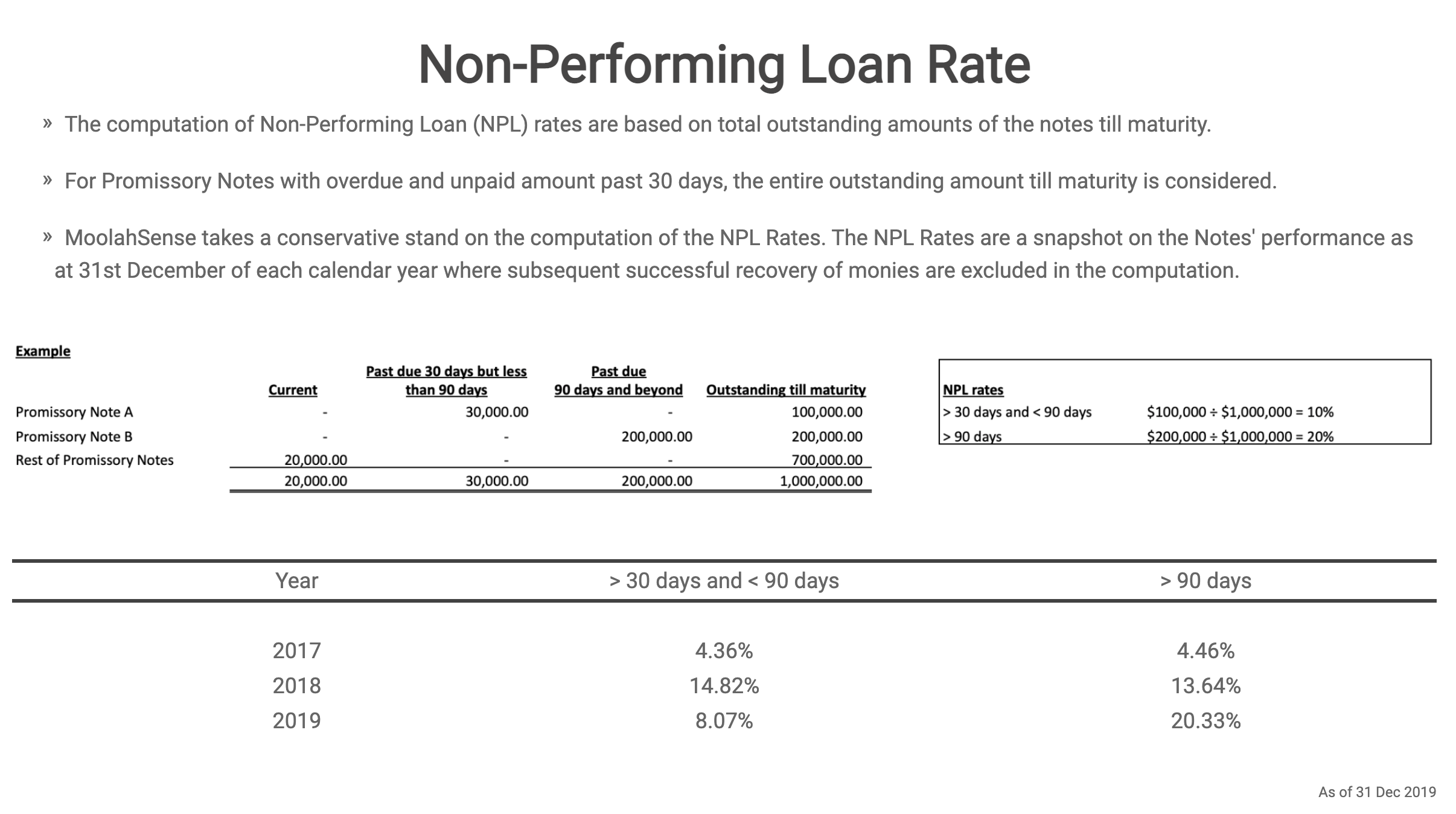

Founded in 2021, MoolahSense was the first digital lending platform to receive the full Capital Markets Services license from MAS. MoolahSense provides investors and businesses with two allocation mechanisms, through either an auction or through a first come first serve basis.

For businesses: For business loans with MoolahSense, businesses can access funds from $50,000 to $5 million under Small Offers Exemption, and above $5 million under Private Placement Exemption. For invoice financing, businesses can access funds from $15,000 and above. Businesses can get their loan as fast as 5 working days.

Investing with MoolahSense: MoolahSense also allows investors to begin investing in campaigns with less than $100 for returns up to 24% p.a. This low barrier gives investors more capital capability to invest in multiple different campaigns to diversify their investments. MoolahSense charges a trader Servicing Fee of 1% of repayments. All investors' monies are in a separate account under OCBC.

As of 31 December 2021, non-performing loans on MoolahSense is high at 20.33% (a lot more than 90 days)

#3 Capital Match

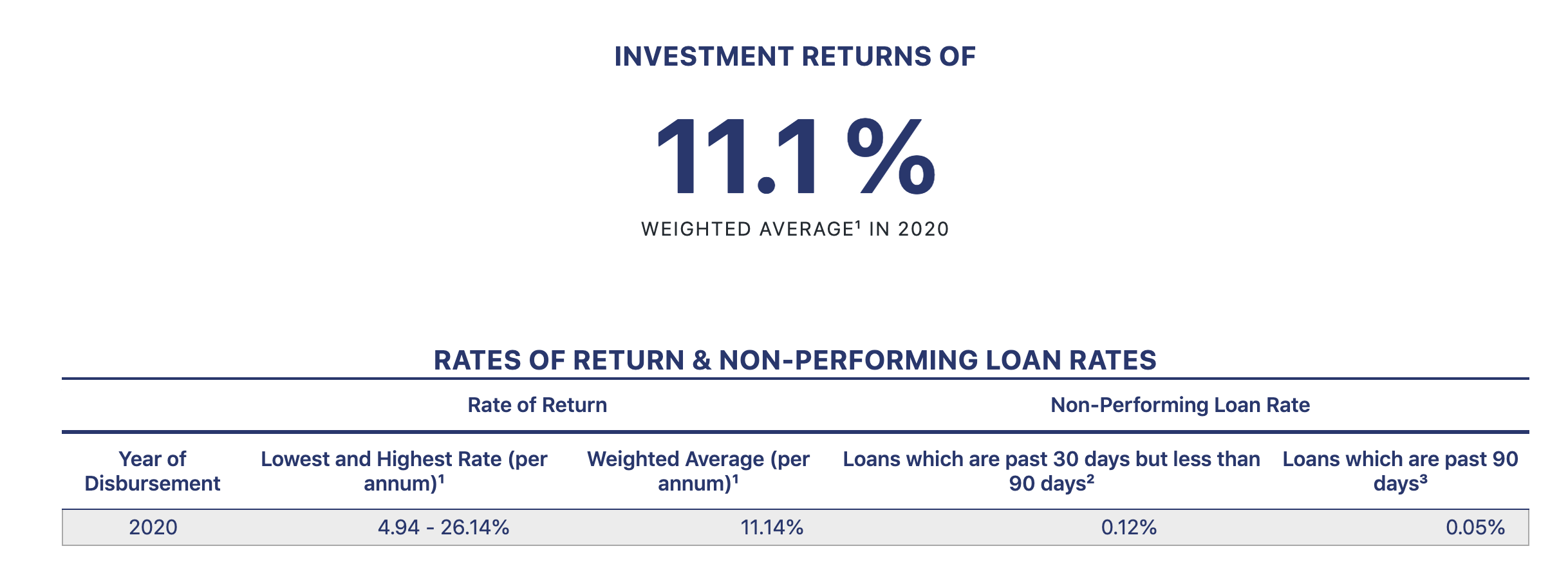

Capital Match was established in 2021, to supply P2P lending and invoice financing platform for SMEs in Southeast Asia. To date, Capital Match has funded a lot more than $201million in loans. Do observe that Capital Match is not regulated by MAS.

According to Capital Match, investment returns are in a weighted average of 11.1% in 2021. Non-performing loans are at 0.05% (past 90 days).

For businesses: Get business and SME loans and invoice financing facilities of $5,000 to $200,000 for tenures from 3 to 12 months. Including interest rates and fees, the total annual cost is 15%-20% of the loan amount.

Investing with Capital Match: Having a wide range of local businesses to choose from, Capital Match allows investors to take a position with a minimum investment of loan $1,000 in each loan. By supporting growing businesses in Singapore, returns range from 15%-25% p.a. Capital Match charges 20% commission on the interest payments.

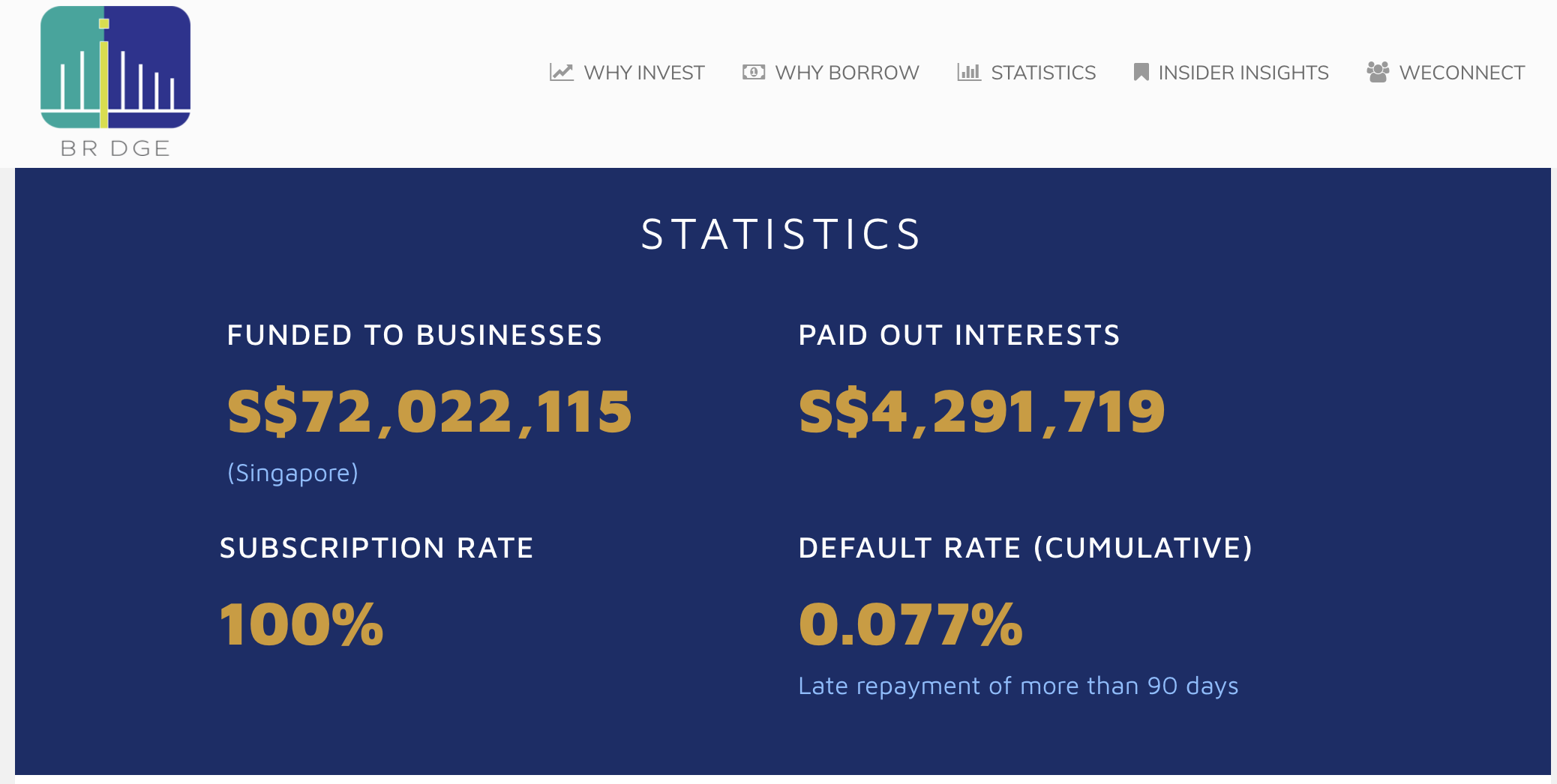

#4 BRDGE (previously known as SeedIn)

Previously referred to as SeedIn, BRDGE has provided S$72 million in funding for Singapore companies. The present default rate (late repayment in excess of 90 days) is at 0.077%

For businesses: Businesses borrowing from BRDGE can get funds as fast as 7 business days. BRDGE provides businesses with funds as much as $2 million over 3 to 12 months of tenure. You might also need your own client advisor to speak to when you borrow from BRDGE.

Investing with BRDGE: Investors can begin investing on BRDGE with just $1000. with BRDGE can earn 5% to 17% returns p.a. in the end fees. Since 2021, BRDGE has successfully achieved 100% repayment to investors. BRDGE charges a merchant account Management Fee for platform services and loan monitoring in addition to a 15% fee on every loan repayment made by the borrower.

#5 Validus Capital

Founded in 2021, Validus may be the largest P2P lending platform in Singapore, with more than $250 million financed to SMEs by July 2021. Validus is backed by Temasek Holding’s Vertex Ventures and also licensed by the MAS. In July 2021, Validus announced that they will be applying for a digital banking licence in Singapore.

For businesses: With Validus, SMEs can access up to $500,000 with no collateral required. Validus has a fast approval process, allowing businesses to obtain funded within 48 hours. Financing options include invoice financing, capital loan and purchase order financing. Validus provides personalized, low-interest rates from 1% monthly.

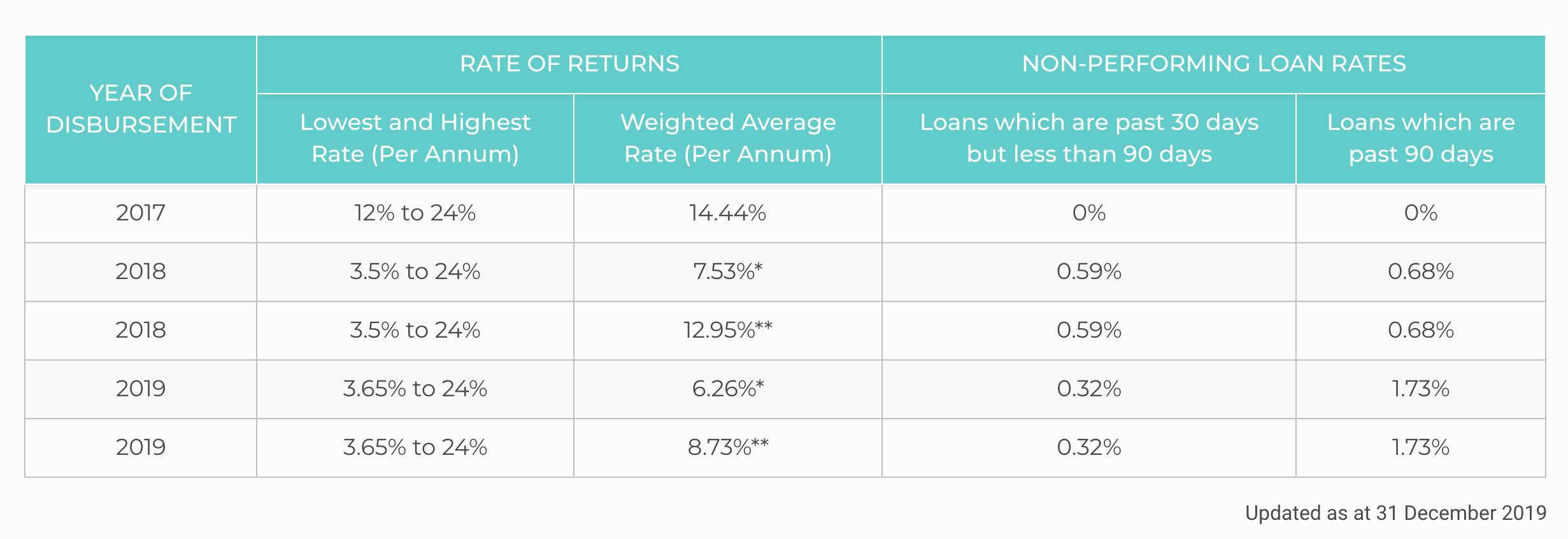

Investing with Validus: The Validus financing companies are currently open to Accredited Investors only, with a minimum investment of $1,000 in each facility. Validus also requires a minimum total portfolio size $50,000. Validus charges a flat 20% fee on all returns. This fee is payable every month to Validus and will be deducted prior to the amount disbursed to you. Validus uses a separate independent escrow account to carry investors' monies. In 2021, investors on Validus generated 4% to 24% net rate of return p.a.

#6 Minterest

Minterest has raised over $152 million. In 2021, non-performing loans which are past 90 days was 1.73%.

For businesses: Borrowers will get cash in as fast as 10 business days. Financing options include corporate loans and invoice financing. Minterest includes a minimum loan amount of $50,000 and lower amounts may be considered on the case-by-case basis. Borrowers can expect to pay for interest rates between 8% to 18% p.a. In terms of fees, Minterest charges a processing fee calculated in line with the loan amount, which is payable upfront when the loan is disbursed.

Investing with Minterest: Minterest requires a minimum investment size of $500. This allows investors to diversify investments across multiple loans. Investors can earn as much as 18% p.a. on investments. Minterest also charges a minimal service fee of 15% on interest, factoring fee along with other fees earned by investors. Minterest doesn't have access to investors’ uninvested funds as funds are held by Vistra Trust.