Three causes there gained't be considered a 2021 housing industry crash

How Much Would Singapore Investors Make If They Invested $1,000 In Every REIT ETF Since Their Listing?

While residential properties have remained resilient in 2021 with resale prices rising for both HDB and condominiums, Real Estate Investment Trusts (REITs) have taken a pummelling this year. With a crash of near to 35% at the lowest point in mid-March 2021, REITs have recovered most of its losses and looks set to end the year at a slight negative loss.

REITs have been a long-time favourite of Singapore investors because of their steady dividend payouts and property-focused investments. Rather than cherry-picking individual REITs, Singapore investors can invest in REIT ETFs which offer diversification and the ease of passive investing.

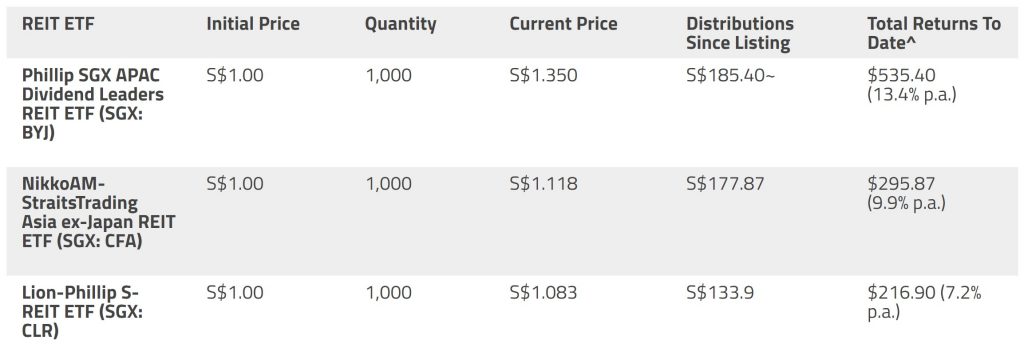

If you've wondered about the returns of REIT ETFs in Singapore and whether or not they are worth investing in, here's just how much Singapore investors would have made for those who have invested $1,000 in every REIT ETF on the SGX during their Initial Offer Periods (IOPs).

Note: This is a theoretical computation and excludes the possible fees incurred if you have actually invested in these IPOs. Your actual returns is going to be lower due to costs such as transactions fees and management fees.

The Three REIT ETFs In Singapore

As of 2021, you will find 3 REIT ETFs listed on the SGX with a Singapore focus.

The first is Phillip SGX APAC Dividend Leaders REIT ETF by Phillip Capital Management, indexed by October 2021. The fund tracks the iEdge APAC ex-Japan Dividend Leaders REIT Index and focuses on REITs across the Asia-Pacific region, including Singapore.

Next, the NikkoAM-StraitsTrading Asia ex-Japan REIT ETF was launched by Nikko Asset Management and Straits Trading Company in March 2021. The fund tracks the FTSE EPRA/NAREIT Asia ex-Japan REITs Index and SGX-listed REITs make up 70% of the fund.

Finally, the Lion-Phillip S-REIT ETF premiered by Lion Global Investors and Phillip Capital Management in October 2021. The fund tracks the Morningstar(R) Singapore REIT Yield Focus Index and consists of only Singapore REITs.

Each of these REIT ETFs launched in a par value of S$1 per share when listed on the SGX.

REIT ETFs Have Returned 7% To 13% Since Their Listing

~ Phillip SGX APAC Dividend Leaders REIT ETF distributes its dividends in US$, the S$ figures are computed based on the forex rate at the close from the ex-dividend month.

~ Phillip SGX APAC Dividend Leaders REIT ETF distributes its dividends in US$, the S$ figures are computed based on the forex rate at the close from the ex-dividend month.

^ Total Returns include the capital gains if you sold the shares and also the distributions accumulated since the shares were purchased at listing. Per annum return is computed by total returns divided by number of years since listing (i.e. Four years for SGX:BYJ and 3 years for SGX:CFA and SGX:CLR)

Phillip SGX APAC Dividend Leaders REIT ETF (SGX: BYJ)

The Phillip SGX APAC Dividend Leaders REIT ETF returned typically 13.4% over the past 4 years. While the share price is available in both Singapore dollars and US dollars on the SGX, the dividends are announced in $ $ $ $, thus the returns could be affected by foreign currency changes. Currently, its holdings are based in Australia (56.6%), Singapore (29.2%), Hong Kong (13%) and Thailand (1.2%). Its top 3 holdings are Link Investment Trust, Scentre Group and Mirvac Group.

| Year Of Distribution | No. Of Shares | Distributions in US$ | Converted to S$ |

| 2021 | 1,000 | 40.20 | 55.36 |

| 2021 | 1,000 | 14.50 | 19.76 |

| 2021 | 1,000 | 52.10 | 70.35 |

| 2021 | 1,000 | 29.00 | 39.93 |

| Total | 135.80 | 185.40 |

Since its listing, it's distributed US$135.80 or approximately S$185.40 in dividends which formed about a third of the total returns up to now. As it can be seen from the table, the distributions happen to be fluctuating yearly, even though the average returns would be the highest of the 3 REIT ETFs (mainly driven by the increase in share price).

NikkoAM-StraitsTrading Asia ex-Japan REIT ETF (SGX: CFA)

The NikkoAM-STC Asia REIT ETF returned typically 9.9% since its inception in 2021. Its holdings are concentrated in Singapore (75.6%), followed by Hong Kong (15.2%), Malaysia (4.3%), India (2.8%), China (1.1%) and Thailand (1.1%). Its top three holdings are Ascendas Real Estate Investment Trust, CapitaLand Integrated Commercial Trust and Capitaland REIT.

| Year Of Distribution | No. Of Shares | Distributions in S$ |

| 2021 | 1,000 | 23.76 |

| 2021 | 1,000 | 46.91 |

| 2021 | 1,000 | 49.40 |

| 2021 | 1,000 | 57.80 |

| Total | 177.87 |

Since its listing, the REIT ETF has distributed $177.87 for a theoretical lot of 1,000 shares or about 60% of the total returns to date. The distributions are also slowly increasing over the years striking its highest distribution in 2021 throughout the COVID-19 recession.

Lion-Phillip S-REIT ETF (SGX: CLR)

Lion-Philip S-REIT ETF has returned a typical 7.2% since its inception in 2021. Because this is 100% S-REIT focused ETF, significant majority of its holdings are in Singapore (even though there is no country analysis provided). Its top three holdings are Mapletree Industrial Trust, Mapletree Logistics Trust and Ascendas Real Estate Investment Trust.

| Year Of Distribution | No. Of Shares | Distributions in S$ |

| 2021 | 1,000 | 34.80 |

| 2021 | 1,000 | 49.20 |

| 2021 | 1,000 | 49.90 |

| Total | 1,000 | 133.90 |

Listed on Oct 2021, Lion-Phillip S-REIT ETF only started distributions in 2021 and it has distributed $133.90 since its inception or about 60% of their total return to date. Similar to NikkoAM-STC Asia REIT ETF, the distributions happen to be increasing over the years and the COVID-19 recession has not negatively affected the 2021 distributions.

If you've invested in any of the 3 REIT ETFs since their listing, you would have been well-pleased to know that your investment is paying dividends and weathering the current recession well. Based on the above analysis, there's no wonder that REITs are favoured by Singaporean Investors.

That said, you will find differences between the 3 REIT ETFs. Both NikkoAM-STC Asia REIT ETF and Lion-Phillip S-REIT ETF possess a strong Singapore focus and majority of their returns were driven by their distribution payout. If you have traded these two REIT ETFs and overlooked the distributions, your returns would be much poorer. Conversely, Phillip SGX APAC Dividend Leaders REIT ETF derived much more of its return from an increase in share price and its distributions have been varied widely over the years.