Three causes there gained't be considered a 2021 housing industry crash

Citi Cash return VS Citi Cash Back Plus Card: Differences Between These Cards & Which You Should Choose?

DollarsAndSense works with affiliate partners and that we may receive revenue from sign-ups through affiliate links in the following paragraphs. It goes towards keeping the site sustainable.

When it comes to cash back cards, the Citi Cash Back card is one of the best card you will get in Singapore. The credit card promises cardholders with a cashback of up to 8.0% on dining, groceries and petrol having a minimum total spend of $888 every month.

Optimising the money back you get around the Citi Cash return card requires users to know how it works and also to focus on the way they utilize it.

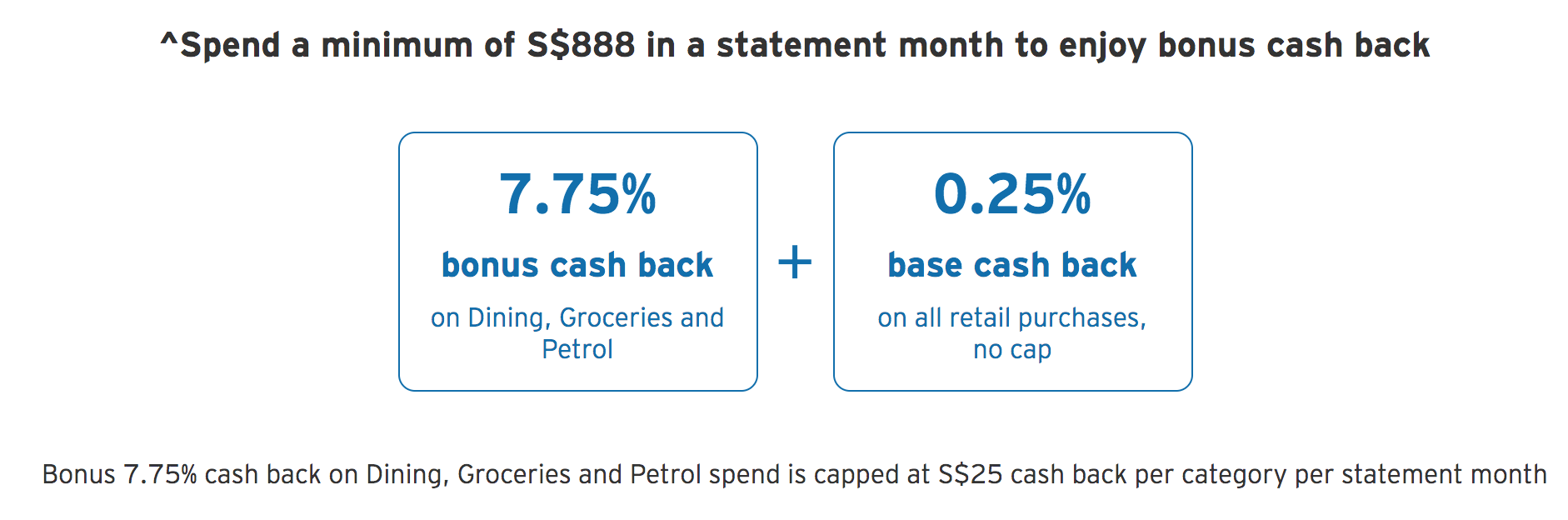

Restricted Categories: To begin with, the power cashback (7.75%), which is why is this card attractive, is fixed to dining, groceries and petrol spend. If you are using the credit card for other kinds of spend (e.g. shopping, booking your holiday), you only get the base cash back of 0.25%.

Minimum Spend: At the same time, you need to spend no less than $888 each month to entitled to the bonus cash back. If you don't spend the minimum required, you only receive a base cash return of 0.25%.

Cap On Bonus Cash return: Though the 7.75% cash return is exceptionally attractive, there is a monthly cap of $25 for every category. For example, even if you spend $1,000 a month on dining, you will simply receive $25 cash return for that category, and not $77.50.

When It seems sensible To make use of The Citi Cash return Card

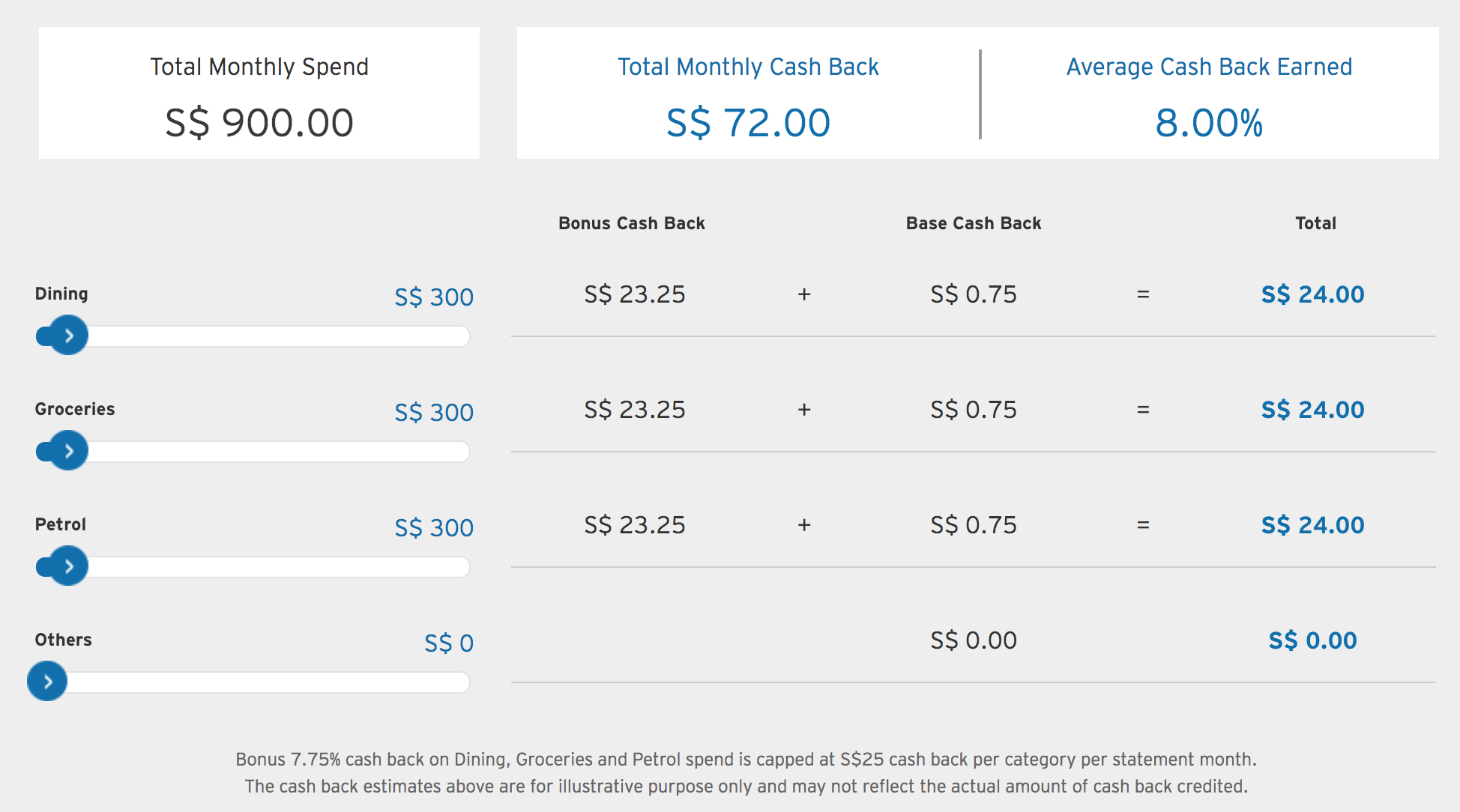

The perfect example of methods to use the Citi Cash return card is if you want to charge an average amount of spend each month to the three categories that give the bonus cash back.

For example, should you spend about $300 per month on groceries, $300 on dining and $300 on petrol, you will spend $900 each month. This provides you a base cash return of $2.25. (0.25%). Additionally you entitled to the bonus 7.75% cash return since you have spent more than $888 for the month. This allows you to earn a cash return of $23.25 (7.75% of $300) for every category.

In total, you will receive a cash back of $72, which gives you an effective cash return rate of 8%.

Limitations From the Citi Cash return Card

While the scenario above shows a knowledgeable method to be using the Citi Cash Back card, the credit card isn't without its weaknesses. Listed here are three examples where you will not optimise the money back on the card.

# 1 You cannot spend more than $888 every month: A credit card shouldn't be forcing you to definitely spend more than you naturally have to. If you are only able to spend $700 each month, the credit card is only going to give you a cash back of 0.25% ($1.75) which isn't great.

# 2 You have a tendency to spend much more every month on the three categories: If you've got a big family and have a tendency to spend more about dining, groceries and petrol, charging all of your spending for your Citi Cash Back Card only doesn't allow you to optimise for your cash return.

For example, if you spend $1,000 a month on dining, $1,000 a month on groceries and $500 a month on petrol, you will simply get a cash return of $81.25 every month. Case slightly greater than our previous example where despite spending only $300 in each of the categories, we've got back $72 in cash return.

# 3 You don't spend much in the bonus categories: If you're someone who tend to spend on shopping, holiday trips or service products only, then you can't earn the bonus cash back for the Citi Cash Back Card.

So, spending $2,000 every month on just shopping and other service-related products (e.g. telco bill, subscription services) won't permit you to earn a cash return.

Introducing The Citi Cash return Plus Card

To complement the Citi Cash Back card, the bank also provides the Citi Cash Back+ Card.

Some simple features with this card.

– 1.6% cash back on your spend, no matter categories.

– No minimum spend required. No cap how much cash back you can earn every month either.

For example, should you spend $5,000 per month on the Citi Cash Back+ Card, you'll receive $80 cash back for that month. For those who only spend $700 a month, you earn $11.20 in cash return, as compared to just $1.75 for those who have used your Citi Cash return card.

For those who do not spend much on dining, groceries or petrol, the Citi Cash Back+ card will be a better option, than the Citi Cash return card, since it allows you to earn higher base cash return of just one.6%, as compared to 0.25%.

Citi Cash Back With Citi Cash Back+: Benefit from the Best Of Both World

Rather than pick one card within the other, you are able to, obviously, benefit from the best which both cards can offer you.

For example, you are able to decide to clock in about $320 in invest each of the category (dining, groceries, petrol) while using Citi Cash Back card while keeping every other spend, or spend beyond $320 in dining, groceries and petrol towards the Citi Cash Back+ Card.

Here's a good example.

| Citi Cash Back Card | Citi Cash return + Card | Total | |

| Dining – $800 per month | $320

Cash back earned: $25.60 |

$480

Cash return earned: $7.68 |

$33.28 |

| Groceries – $800 per month | $320

Cash back earned: $25.60 |

$480

Cash return earned: $7.68 |

$33.28 |

| Petrol – $320 per month | $320

Cash back earned: $25.60 |

N.A | $25.60 |

| Others – $500 | N.A. | $500

Cash return earned: $8 |

$8 |

| Total | $960

Cash return earned: $76.80 |

$1,460

Cash return earned: $23.36 |

$2,420

Cash return earned: $100.16 |

If you need to make an application for either cards or both these cards, you are able to apply through SingSaver, where you enjoy exclusive welcome offers for example cash, free vouchers and rebates. Deals are updated continuously so that you can apply here for the Citi Cash return card and the Citi Cash Back+ Card to check out what's the offer today.