Three causes there gained't be considered a 2021 housing industry crash

Going for a Personal Loan For Short-Term Cashflow Requirements? Here's what You Need To Consider First

When you need cash, going for a personal loan may be a tempting proposition because it can help you meet urgent, short-term cash requirements. However, as many financially savvy people would know, credit could be both a boon along with a bane for individuals who wield it.

When used correctly, an unsecured loan can be a lifesaver. Similar to how the Singapore government helps SMEs survive the current COVID-19 outbreak by providing use of cheaper borrowing through the Enterprise Financing Scheme, a personal loan might help individuals tide through their current difficulties by giving cashflow during a period as it's needed probably the most.

However, if you do not use a personal bank loan prudently and responsibly, the repayments you need to make (with interest) might potentially provide you with more problems compared to current ones you are trying to resolve.

When Is The Right Time To utilize a Personal Loan?

A valid reason to take up an unsecured loan will be to lower your interest costs using their company high-interest debts you might have.

For example, if you have outstanding payments due on multiple credit cards, you'd be best taking a personal bank loan to pay off these debts first, because most credit cards in Singapore charge mortgage loan of approximately 25% per annum (p.a.).

In contrast, an unsecured loan such as the Standard Chartered CashOne Personal bank loan has an effective interest rate from about 7.63% p.a., which is cheaper when compared to interest rates charged on outstanding credit card balances, that could easily be 25% p.a. or even more.

Besides using a personal bank loan to lessen debt, you may even have unplanned emergency expenses you need to purchase. These could include medical treatments, funeral expenses or even a pay advance if you are in between jobs and want to continue paying for daily necessities.

Reasons Not To Have a Personal Loan

You shouldn't have a personal loan to cover a 'want' that you didn't conserve for. For example, if you want to purchase a car or hold a luxurious wedding, you ought to be saving towards it, instead of taking a personal loan to invest on this stuff that you simply didn't adequately arrange for.

Other people might reason privately it's okay to be borrowing if they are while using borrowed funds to take a position. However, by having an effective interest rate of 7% to 8% p.a., the eye charges you pay on your personal loan could easily exceed the returns you get in the markets if you aren't experienced with investing. Moreover, the markets tend to reward long-term investors while unsecured loans are a supply of short-term funding.

Personal loans should be thought about like a last measure choice to be utilized only when we've exhausted other cheaper (and legal) ways of borrowing, and urgently need cash to cover immediate needs. It's certainly a better option than accumulating charge card debts, that will incur high-interest costs or borrowing from illegal lenders, which isn't only costly, but may cause you all types of unnecessary problems.

Key Terms You need to know When Going for a Personal Loan

Before going for a personal bank loan, it is important first to know how it operates. Here are some details to look out for.

Advertised Rates of interest VS Effective Interest Rates: As designed in an earlier article, the advertised rates of interest (also referred to as the applied rate) for a personal bank loan is rarely the effective interest rate (EIR) that you simply pay. The advertised interest rate may be the interest that you simply pay in line with the amount you borrow. The EIR takes into account other costs, for example processing fees as well as your repayment schedule.

Loan Duration: How long you anticipate to need the money for should be the loan duration that you should be taking – with no more than that. For example, if you need the loan for just one year, that needs to be the borrowed funds duration you select. The more your loan tenure, the higher your interest costs. Not pay higher interest costs than you have to by selecting a suitable loan duration.

Early Repayment & Annual Fee: There are often charges if you choose to repay the loan early. Before taking a loan, check what these repayment charges are. For instance, the conventional Chartered CashOne Personal bank loan charges an earlier redemption fee of $150 or 3% of the outstanding principal, whichever is higher. Personal loans may also charge a yearly fee, which adds to the amount you need to repay.

Understanding The loan Repayment Schedule

When going for a personal loan, you need to remember that every dollar you borrow needs to be repaid, with interest, later on. After getting immediate cashflow relief, you may then need to invest in the payment schedule. Otherwise, you will incur additional additional fees for missed or incomplete payments.

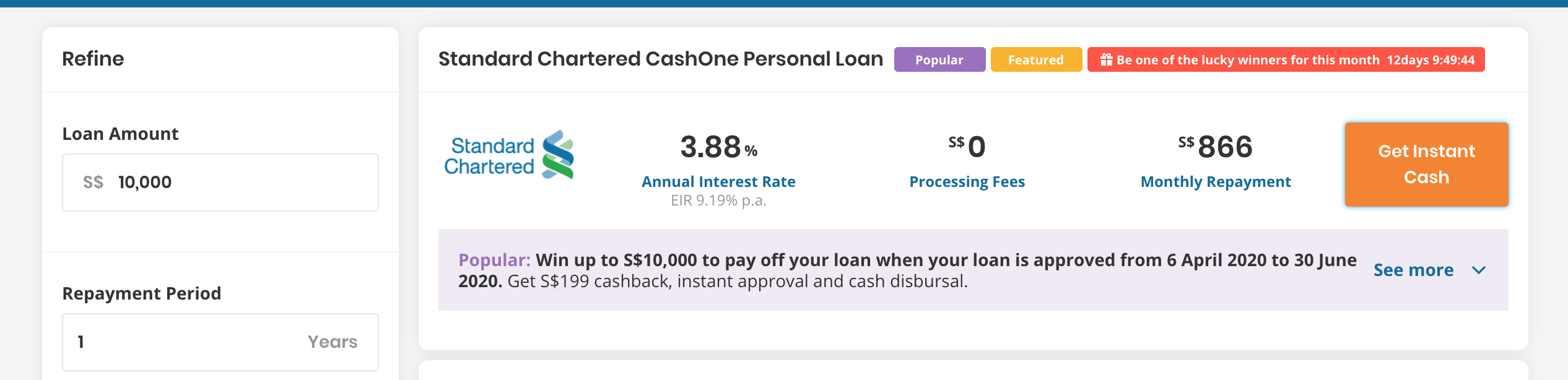

For example, if you borrow $10,000 using the Standard Chartered CashOne Personal bank loan for one-year (at 3.88% (EIR 9.19%) p.a.), you will have to make a monthly repayment of approximately $866 for the following 12 months, or about $10,392 in total.

Source: SingSaver Personal Instalment Loan

While the number you repay is more than what you borrow because of interest, this can be seen as a small fee to pay for if it can help you lower your interest costs in other areas, or supply you with a cash lifeline throughout a period when you need the money most.

Apply For the Standard Chartered CashOne Personal bank loan Through SingSaver & Stand An opportunity to Win Up To $10,000

From now till 30 June 2021, stand a chance to win up to $10,000, or perhaps an amount equal to your total loan repayment, if you obtain a Standard Chartered CashOne Personal bank loan through SingSaver.

For example, if you borrow $5,000 and your total loan repayment is $5,582 (with different 3-year, 3.88% p.a.), then you'll win $5,582. There will be three winners in total, one for every month in April, May & June. Do refer to the terms & conditions for detailed information of this SingSaver exclusive promotion and the way to be eligible for a it.

To reiterate, you should only take an unsecured loan like a last resort option for essential needs you need to continue spending money on, and not since you need some extra cash for discretionary purchases in order to invest. You should definitely not apply for a loan so that you stand a chance to win this promotion – this isn't the lottery.

If cashflow is tight, you should consider lowering your expenses, dip into your savings first or consider government schemes that you may qualify for. All of these won't incur interest costs or late payment penalties.

With all that taken into consideration, an unsecured loan can still be a good choice to determine that you have urgent short-term cashflow requirements as long as you can commit to the monthly repayments needed in the months to follow.

Sponsored Message: