Three causes there gained't be considered a 2021 housing industry crash

5 Financial Gaps That Singaporeans Are Discovering Because Of COVID-19

The year 2021 has been an exceptionally difficult year for most of us due to COVID-19. With governments all over the world still trying to control the outbreak, the global economy is now at a standstill.

Not surprisingly, the virus has impacted most businesses in Singapore, and many Singapore personnel are now finding themselves within an uncomfortable financial situation. Earlier this week, OCBC released some insights it learnt based on a Financial Impact Survey for COVID-19 completed with 1,000 Singapore and PR working adults between the ages of 21 and 65, across different age groups and income levels to represent the Singapore population.

The survey was conducted in mid-May, about 1.5 months into the circuit breaker.

One thing that stood out is the fact that nearly half (47%) of these surveyed have experienced a dip in their income, such as through wage cuts, having to take no-pay leave or a reduction in commission earnings. A similar proportion (46%) will also be concerned about losing their jobs despite extensive government support.

Here are 5 financial gaps that Singapore workers are discovering because of COVID-19.

#1 Insufficient Emergency Savings

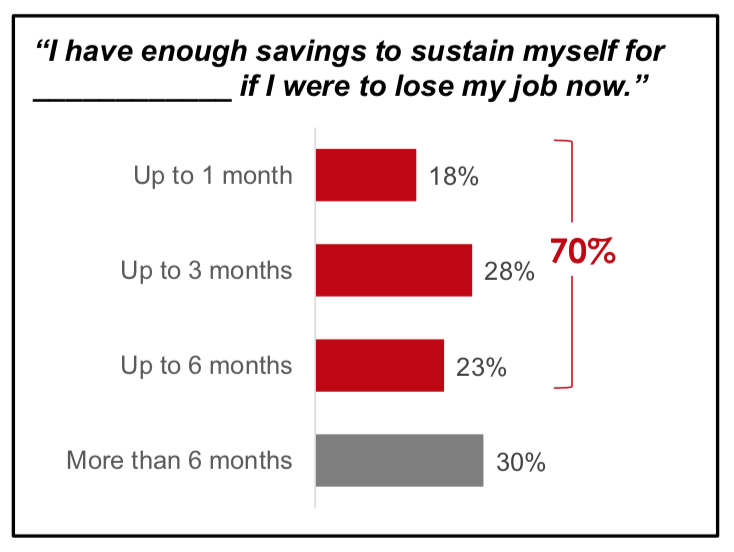

The first financial goal that anyone entering the significant world should work at has at least 6 to 9 months of average monthly expenses in emergency savings. Through an emergency fund is an important prerequisite before investing or perhaps getting insurance plans you need to pay in cash.

Unfortunately, the OCBC survey revealed that only 30% can sustain themselves for more than Six months if they would lose their job now. 18% admitted that they have enough savings to cover only up to 30 days of expenses. This doesn't bode well for his or her financial security.

Source: OCBC

The idea here is simple. If the unexpected event happens (e.g. loss of job, unexpected bill), you can then tap in your savings, rather than be instructed to sell your investments, surrender your insurance plans or borrow to pay for your short-term expenses.

#2 Wherewithal to Save More

One of the lessons that lots of us are learning during this pandemic is the need for savings. However, while it's not hard to admit that saving is important, putting this information into practice will be a lot harder.

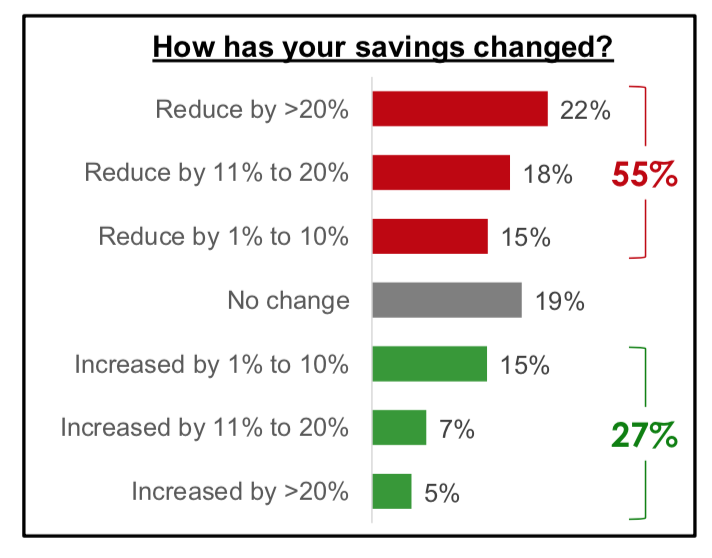

In the survey, 55% of respondents said they'd reduced their savings in the last months. We suspect this is because many respondents might have suffered a reduction in their income, making it difficult to spend less during this time period if their expenses remain the same.

Source: OCBC

Like how individuals the past accustomed to stock up food when preparing for the long winters, we need to focus on saving more during periods where we've excess funds, to ensure that this can compensate us throughout the period when we do not have enough.

#3 Insurance Worries

Insurance is among those things that most people don't consider – until it's past too far. However, if you already agree that you might lack sufficient insurance policy, even without the need for an economic adviser suggesting so, then most likely you are likely to be correct.

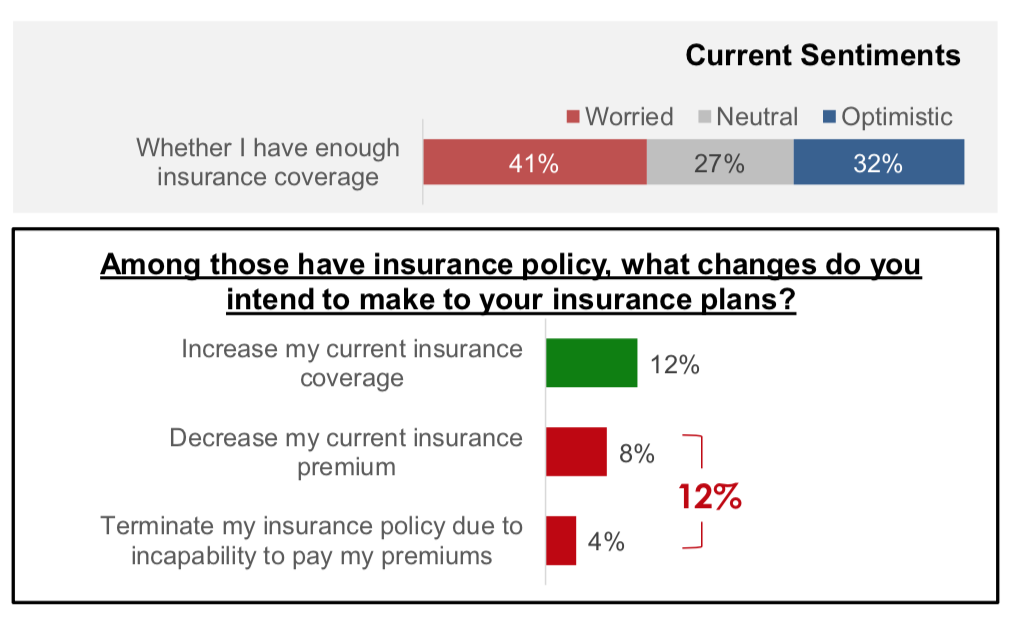

According to OCBC, 41% of respondents are involved about having enough insurance policy, with 47% of Singaporeans aged between 40 and 54 being the most concerned.

Source: OCBC

It's hard to say if the worry for lack of insurance coverage is associated with the present pandemic which has caused a lot of us to inquire about ourselves what would happen when we fell sick. But suffice to say, if you're worried about gaps inside your insurance policy, it's worth using a review together with your financial adviser, which can be done safely using a video call.

#4 Investing Lesser

Investing during a recession might seem counter-intuitive, given the uncertainty all around the financial markets. Still, you need to remember that investing during market downturns could be the best way to build long-term wealth.

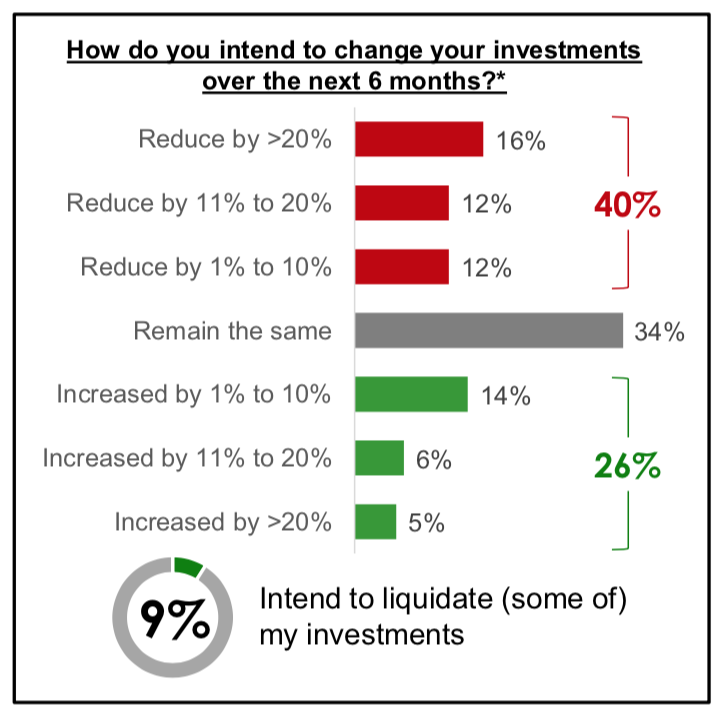

Unfortunately, but perhaps not surprisingly, the type of who have invested, 40% have asserted they plan to reduce their investments. 9% even admitted that they would be liquidating a few of their investments during this period.

While pausing our investments during this time period may be a simple means to fix increase our income, it's important to remember that doing so could also impact our long-term investment goals, including our retirement plans.

#5 Pausing Our Retirement Plan

Retirement might not be the very first thing most people consider when they are working, but it's a part of our finance plans that people cannot afford to disregard. Like it or not, there will come each day when we are unable to work, even when you want to. Our retirement planning doesn't stop simply because of a recession.

Unfortunately, for a lot of Singapore workers, it's difficult to continue investing for the future throughout the current climate. 27% of those with financial plans said they have stopped setting aside or perhaps reduced their funds for retirement. A third (32%) of the sandwiched generation – those between the ages of 40 and 54 and lots of of whom must take care of both young kids and aging parents – said they've cut down on such funds.

Short-Term Decisions Might have Long-lasting Impact

It goes without saying that for most of us, getting through this difficult COVID-19 period may be the immediate priority in our minds.

At the same time, it's easy to make 'bad' financial decisions throughout a crisis, when emotions can quickly dominate rational financial decisions. If these 'bad' financial decisions only affect us within the short-term, that's not an enormous concern.

However, the problem is that a number of these 'bad' financial decisions could affect us in the long term and affect our long-term financial health. Similarly, good financial decisions made during the crisis can also significantly help in assisting us develop our financial well-being. So even as we make an effort to overcome this difficult period, let's continue to make sound financial decisions for ourselves and our families.