Three causes there gained't be considered a 2021 housing industry crash

5 Useful DBS Features That Even Their very own Customers May not Learn about

As Singapore's largest bank, a large part of individuals Singapore possess a banking relationship with DBS where they might tap on DBS' many services, such as charge cards, high-interest savings account, multi-currency account, or perhaps robo-advisor.

However, using the speed of innovation within DBS as a leading “digital bank”, there can be new offerings and services that even long-time DBS customers as if you and I might not know about – and could be thinking about if perhaps we knew about the subject.

Here are 5 unique offerings from DBS we picked out – read on to determine what percentage of them you're currently utilizing and just how many of them you didn't even know about.

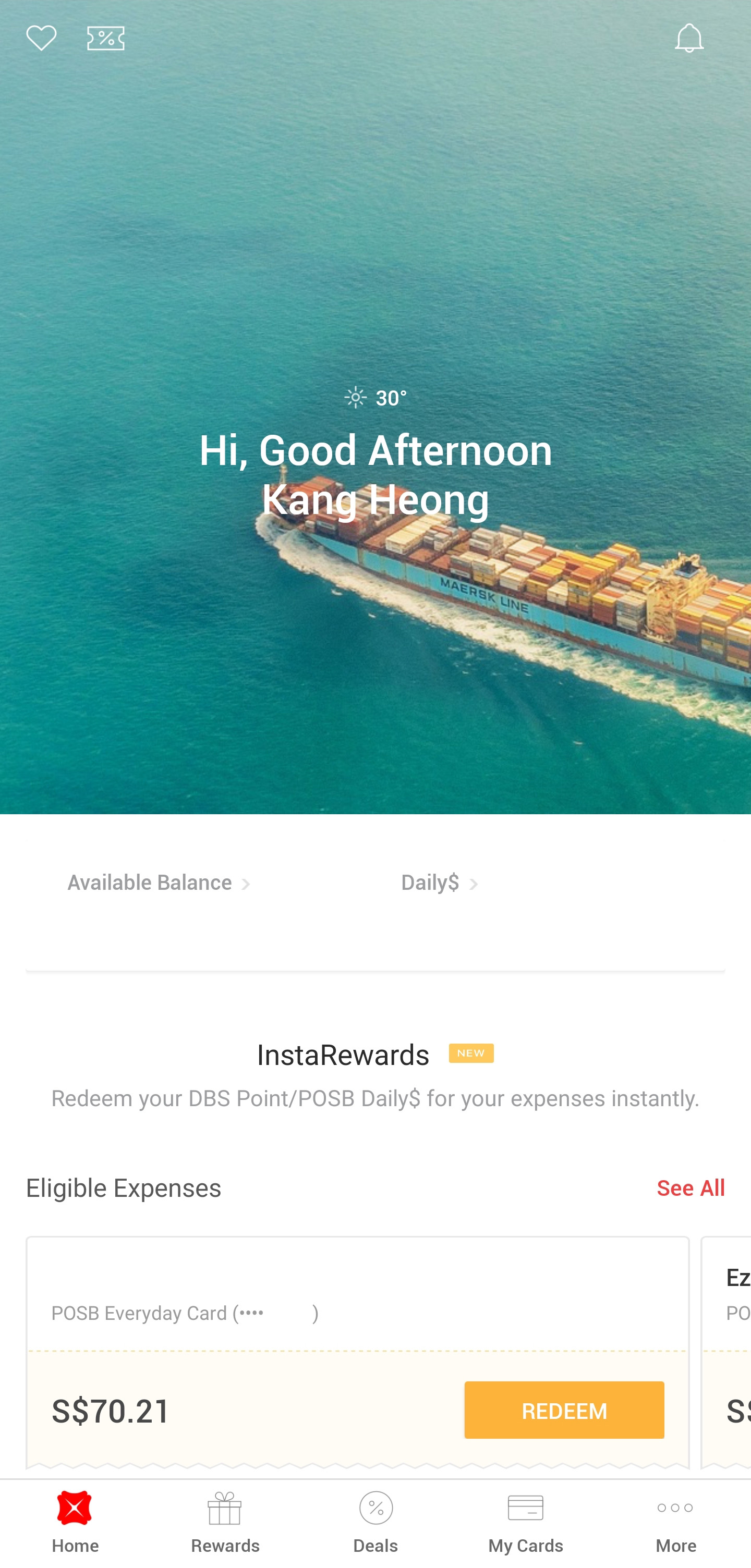

#1 DBS Lifestyle App

The DBS Lifestyle app brings to DBS customers a wealth of exclusive promotions and deals from DBS as well as their merchant partners. Included in this are familiar names like Kate Spade, Lazada, Taobao, Innisfree, LANEIGE, Birkenstock, Challenger, Golden Village, G2000, Your body Shop, and Browhaus.

Given the sheer number of deals available, deals are automatically prioritised based on the categories you're most interested in.

Aside in the promotions, DBS Lifestyle also provides you with powerful methods to track and utilise credit card rewards that you might not even realise that you're entitled for.

For example, paying for different DBS cards enable you to get DBS Reward Points, which can be used to redeem shopping and dining vouchers, movie tickets, air miles and much more. You should use the DBS Lifestyle app to see the rewards available for redemption, and instantly redeem them.

If you are a POSB Everyday Card user, your spending earns you Daily$, that are loyalty dollars that can be used to offset your purchases at that moment at a lot more than 200 participating merchant outlets, including Sheng Siong, SPC, , Watsons, and Pets Lover Centre.

Through the InstaRewards feature inside the DBS Lifestyle app, you can view your Daily$ balance and retroactively counterbalance the price of eligible purchases made at participating outlets.

Besides giving you more insights and more options to spend your rewards, DBS Lifestyle provides you with the chance to be a part of personalised promotions too.

You can watch this video from DBS to determine the best way to enjoy deals, rewards and treats while using DBS Lifestyle app:

#2 Bank & Earn

Ever wondered if your investments or insurance policies are being counted towards unlocking a brand new category for that DBS Multiplier Account?

With the most recent Bank & Earn Summary on digibank mobile, you can access a consolidated look at all of your eligible transactions easily and conveniently without needing to do any guesswork or take out your calculator to crunch numbers.

The Bank & Earn Summary allows you to see your total interest earned till date, the product categories you've unlocked as well as your current eligible transactions. This helps you to see how much interest exactly you're entitled to, and plan in advance for potential methods for you to maximise your dollar and enjoy additional interest or cashback for the month.

To access Bank & Earn on mobile, log in for your digibank mobile, tap in your Multiplier Account details in the dashboard, accompanied by Bank & Earn.

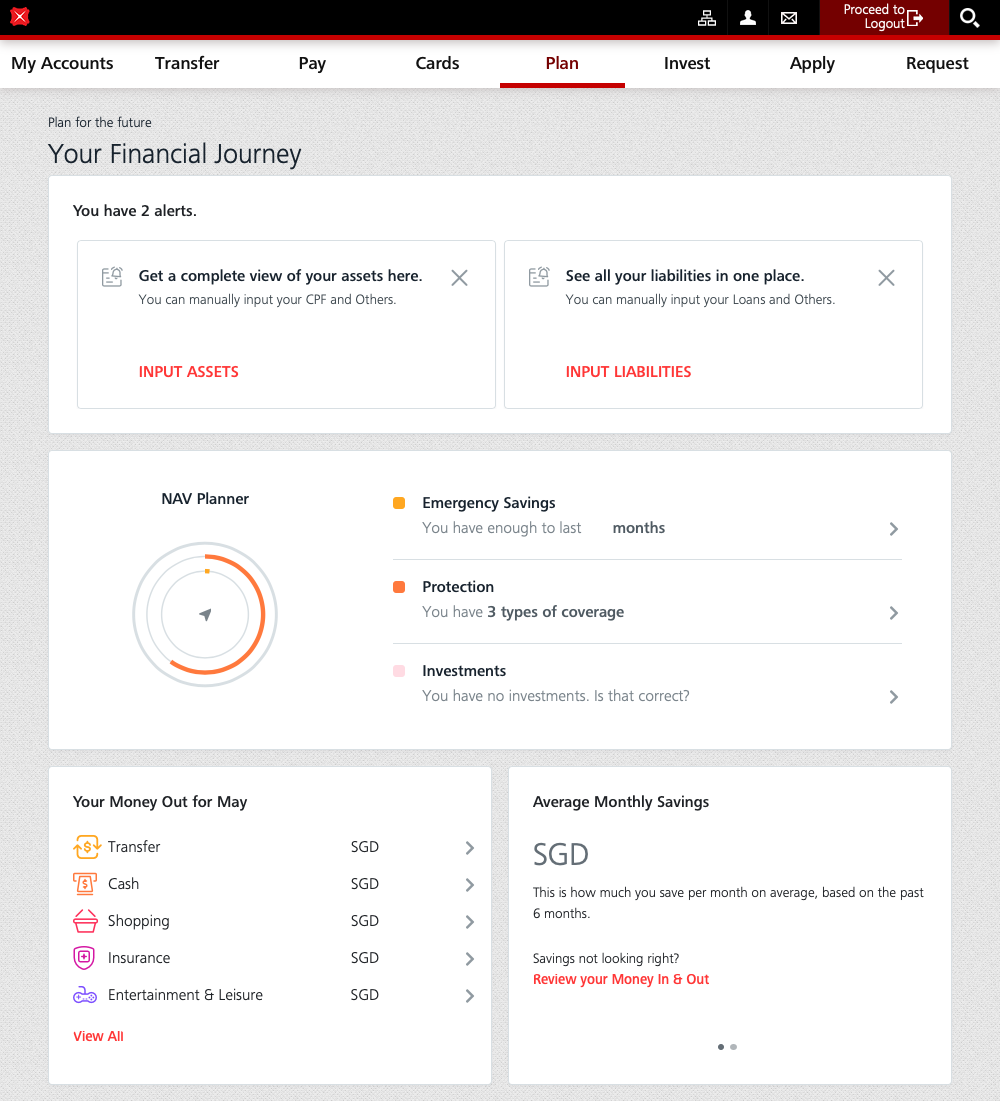

#3 DBS NAV Planner

You will probably already be using online banking to make fund transfers, pay your bills, making your annual fee waiver requests for your cards. However, are you aware that inside the DBS and POSB internet banking website is a full-featured personal finance analysis tool and planning service?

The newly-revamped that has been enhanced DBS NAV Planner gives you insights on your spending and saving habits, collated automatically from across all of your DBS and POSB accounts and cards, in addition to any loans, investments and insurance plans you have with DBS, POSB and their partners.

In accessory for the data and charts that you can access instantly, DBS NAV Planner also provides you with suggestions how you can improve your financial health, for example starting to invest, getting insurance policy, and building up your emergency savings.

To check out NAV Planner, log in to your DBS/POSB online banking and select the Plan tab, followed by NAV Planner.

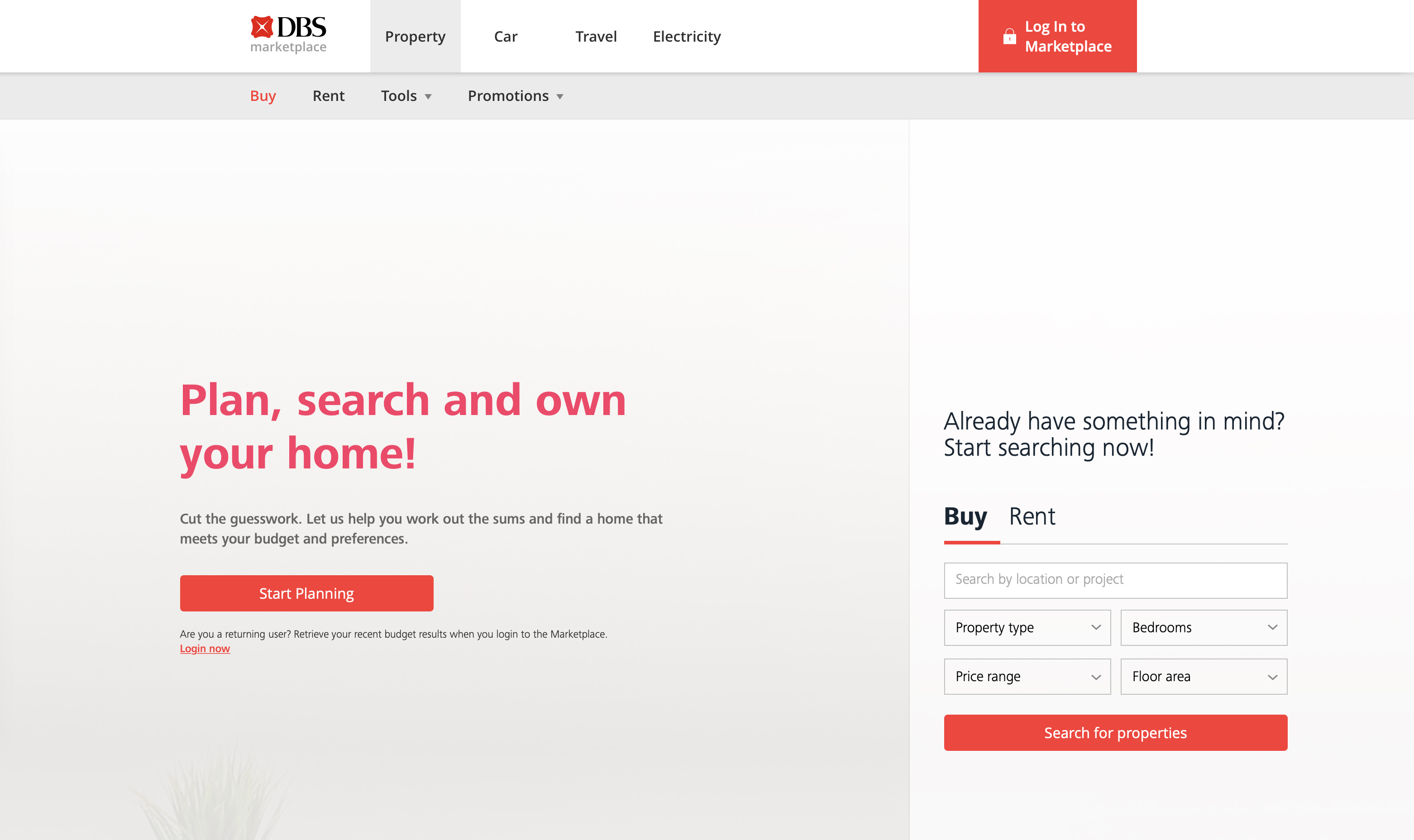

#4 DBS Marketplaces

DBS continues to introduce services and services which will benefit their clients. Towards this end, they've introduced marketplaces for customers to simply and reliably compare offerings when creating important purchase decisions, for example buying a property, getting (or getting rid of) a car, switching for an Open Electricity Market retailer, or making departure date.

In accessory for listings for property for rental and sale, the home Marketplace includes budgeting tools that remember your calculations, so you can retrieve exactly the same information in future sessions and filter properties based on various criteria.

To help homebuyers have better peace-of-mind when financing one of the greatest purchases in their lives, you can even apply for an In-Principle Approval (IPA) on DBS Property Marketplace to guarantee the loan amount so you don't accidentally sign an option-to-purchase for a property that is outside your financial means.

When you found your dream home to buy, you can aquire a home loan directly from DBS, right from inside the platform.

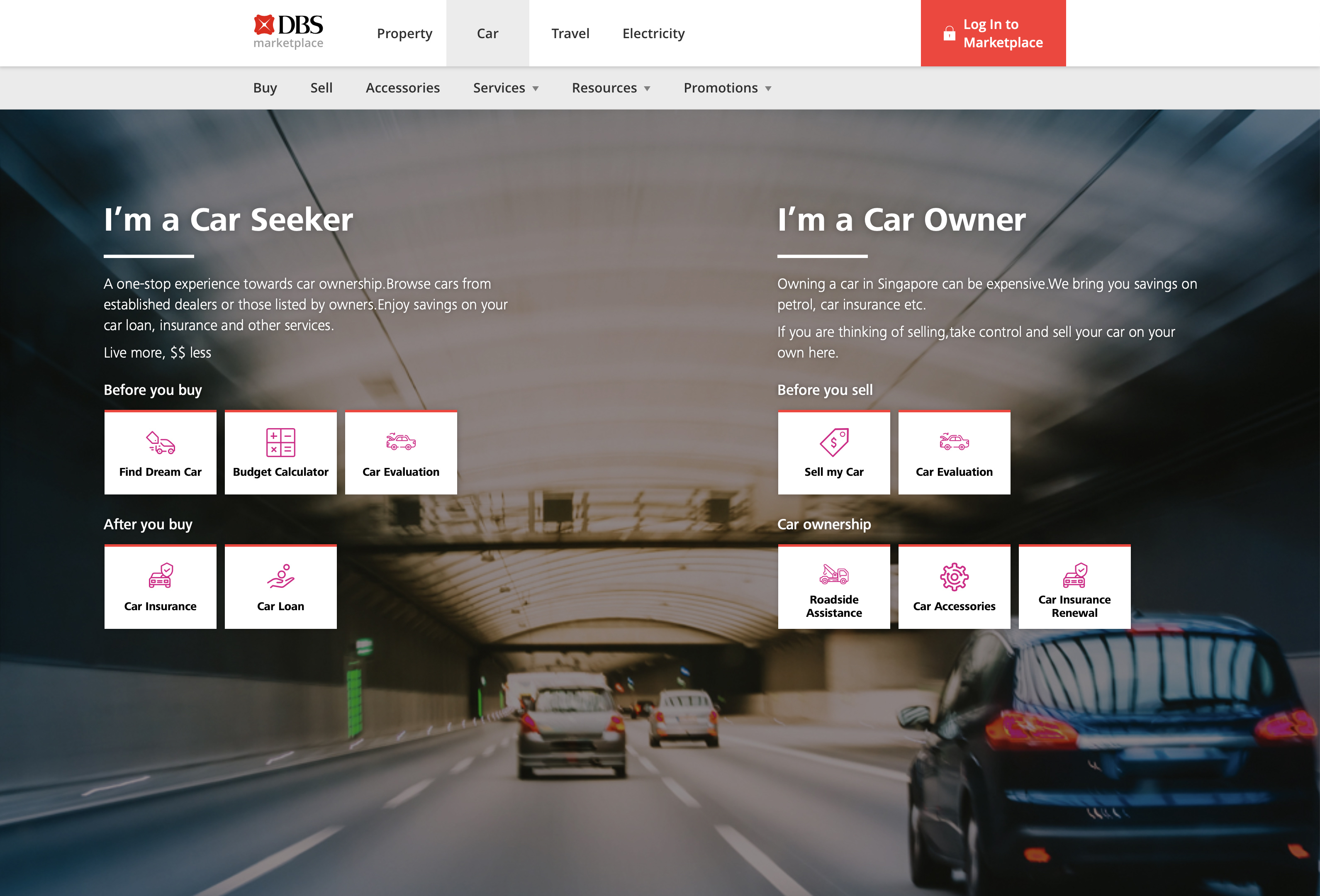

For the vehicle Marketplace, DBS has partnered with SGCarMart and Carro for listings to allow sellers to link up with potential buyers directly. They've also incorporated used car offerings from reputable dealerships like Inchcape and gratifaction Premium.

Along using the comprehensive number of listings, DBS Car Marketplace also has budgeting tools, as well as exclusive discounts for DBS customers, for example auto insurance, car loans, roadside assistance, workshop repairs or maintenance, and even car evaluation services.

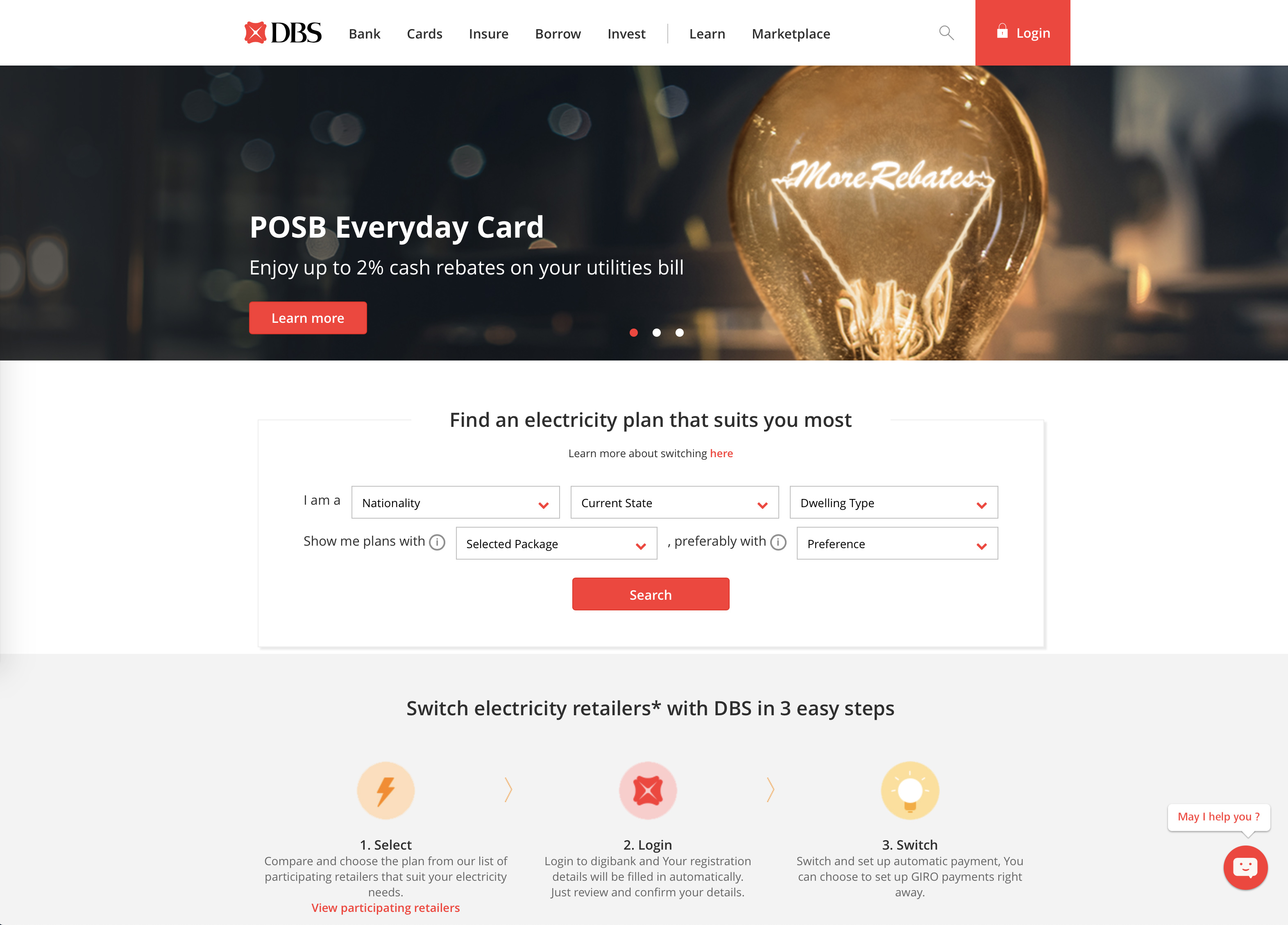

As we all know, it might be confusing to choose between multiple Open Electricity Market (OEM) retailers, each with their own set of standard and non-standard plans. DBS's Electricity Marketplace allows you to easily compare plans from 8 leading OEM retailers, namely Best Electricity, Geneco, Keppel Electric, iSwitch, Pacific Light, Sunseap, Tuas Power and Union Power by filtering according to various criteria.

An average household can save as much as S$400 annually by switching away from SP Group, and DBS customers can now do so seamlessly and instantly within digibank's Electricity Marketplace.

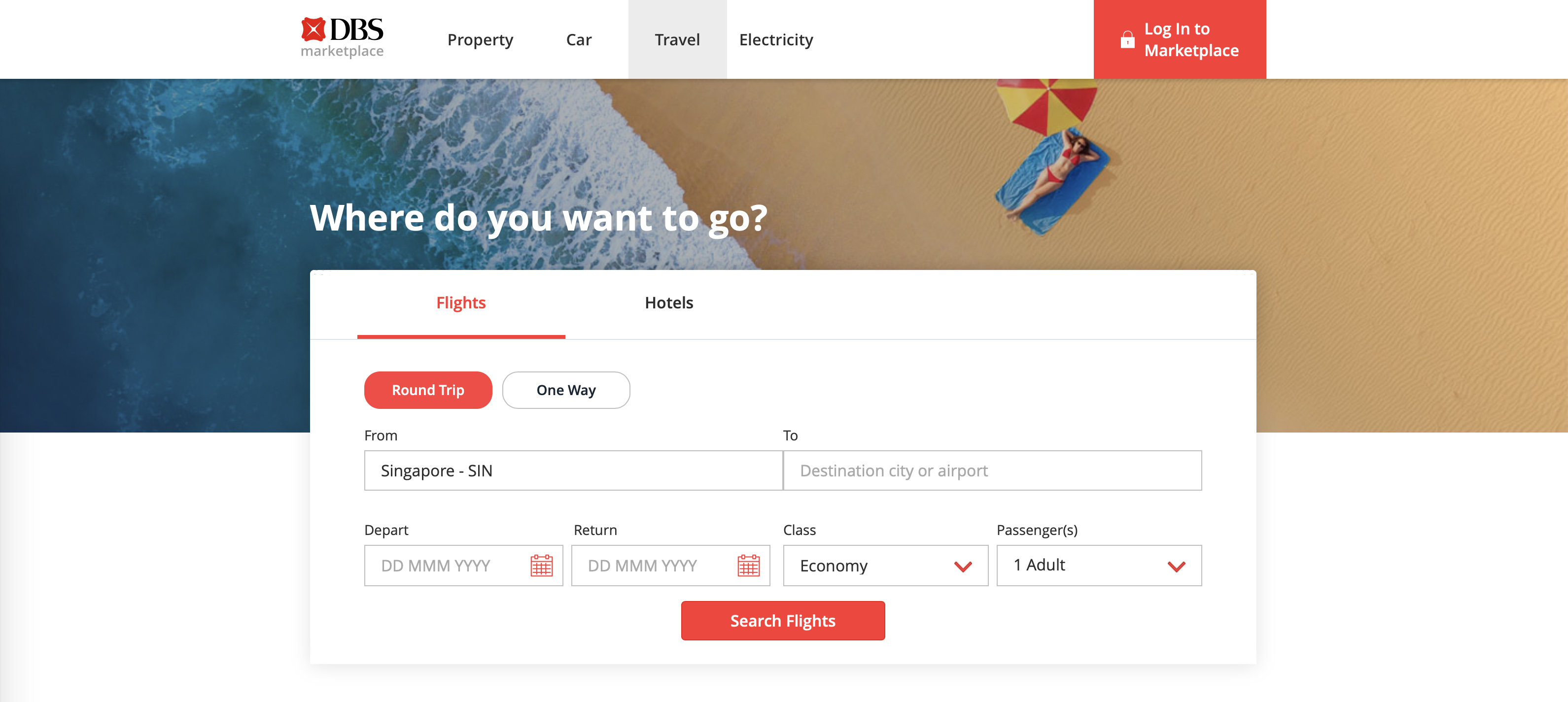

Powered by Expedia, the DBS Travel Marketplace makes booking flights and hotels a breeze. Plus, you can use your DBS Rewards points or Daily$ to offset your travel purchases, and enjoy complimentary travel insurance coverage with every booking. DBS Rewards points utilized in this way possess a 2 times multiplier effect, so you get to unlock double the amount value.

To further stretch your hard earned money, there's also hotels with DBS Special Price, which are available specially for DBS customers, which means you should sign in when browsing industry to find the best deals.

#5 DBS Digibot And Live Agent Chat

In yesteryear, any queries or banking related services will have to be handled by a trip to the bank and assisted by bank tellers. With DBS's internet banking, we no longer need to make a physical trip down to the financial institution or ATM for many common banking functions.

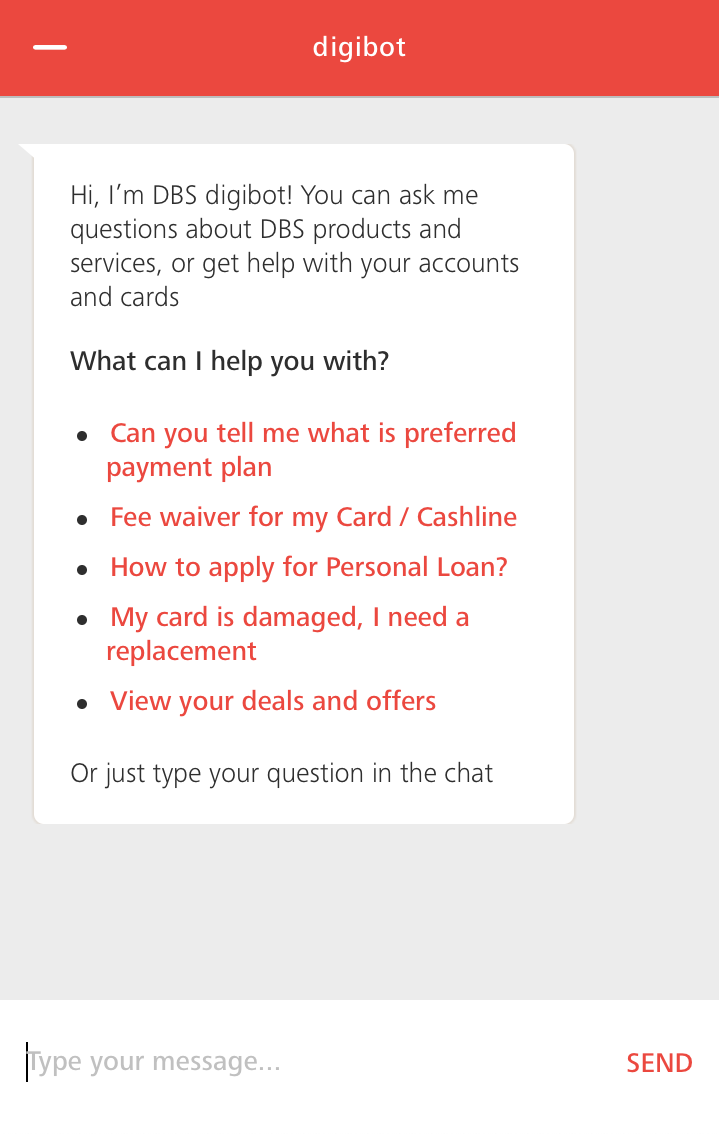

However, there are times when we prefer not to have to navigate the extensive internet banking interface and interact with DBS in a natural way. Enter DBS digiBot and Live Agent chat.

To use digiBot, you can simply visit the DBS/POSB website or open the DBS digiBank app and start chatting.

With the same ease in which we contact our friends, we can are in possession of our questions answered as well as certain banking requests executed by digiBot, our very own va. This includes finding out your bank account balance, viewing your transaction history, locate the closest ATM or bank branch, or perhaps transfer money between accounts.

If you prefer a persons touch, you may also choose to chat with an amiable human staff from DBS by selecting the Live Agent Chat.

How Many Of These Cool DBS Services Perhaps you have Tried?

As a current DBS customer, you can test all of the apps and services we've mentioned in this article, especially if you think they're interesting for you. Considering that a number of these were recently launched, we can keep looking forward to ever better offerings from DBS in the months and years to come.

It sure is definitely an exciting time for you to come alive!