Three causes there gained't be considered a 2021 housing industry crash

Why DBS NAV Planner Will Be The Go-To Financial Tool Now That SGFinDex Allows Customers to Consolidate Their Financial Data

While some of us were focusing on digital bank license results made earlier in December, another major announcement may have gone unnoticed on 7 December 2021. It was when the launch of the Singapore Financial Data Exchange (SGFinDex) was announced.

What Exactly May be the SGFinDex?

SGFinDex is really a public digital infrastructure that allows individuals to access their financial information held across CPF, HDB, IRAS and seven participating banks in Singapore.

With SGFinDex, we can are now using our SingPass to retrieve consolidated personal financial information from CPF, HDB, IRAS and the 7 participating banks in Singapore. For example, we can get information for example our deposits, charge card balances, loans and investments from banking institutions there exists a banking relationship with. Likewise, we can also retrieve financial information from CPF, HDB and IRAS.

In the initial phase, seven banks is going to be participating in SGFinDex along with the government agencies. The participating banks are

- Citibank;

- DBS/POSB;

- HSBC;

- Maybank;

- OCBC;

- Standard Chartered; and

- UOB

This means that we are able to retrieve information from all of these participating banks using our SingPass via SGFinDex.

To be clear, these are personal financial information that 1) belongs to us and a pair of) we already have immediate access to. SGFinDex doesn't give us any new information that people don't already have. What it really does help us to do would be to easily access, via applications, the data held by these entities.

How SGFinDex Can Help Us With Financial Planning

If you ever attempted to do financial planning, among the challenges you will face has to consolidate all the financial information needed. This requires a tedious process of needing to retrieve data from accounts which are held with different banks and government departments.

Through SGFinDex, we no more have to manually extract information from different banking institutions and government agencies. Instead, we can retrieve the financial information needed from these entities using our SingPass.

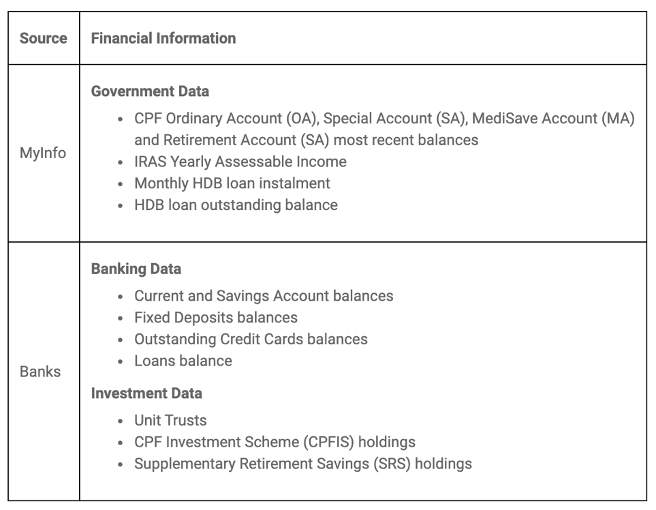

For the first SGFinDex phase, this is actually the information we can retrieve.

For those worried about their privacy, SGFinDex itself doesn't store any information. It only retrieves and transmits information to the financial planning platforms that we desire to share the data with. This must be authorised by us via SingPass. We are able to also decide to disconnect the access anytime we want.

To Use The Information On SGFinDex, We Still Need An economic Planning Platform Like DBS NAV Planner

While SGFinDex is great, alone, it's not an application and you may only can get on via a trusted financial planning platform, like the DBS NAV Planner. It is just whenever we have the right financial planning platform the information can be retrieved.

The great news for us can there be is really a perfectly ideal financial planning platform that people can already use in Singapore – the DBS NAV Planner. For individuals who have no idea, the DBS NAV Planner is a digital tool that helps us track, protect and grow our money, designed around an extensive financial planning framework.

For those of us who are a current DBS/POSB customer with online banking access, then we already have DBS NAV Planner, whether or not we realised or have tried on the extender before. We can access this through the “Plan” tab in DBS ibanking or the DBS digibank mobile app.

What is good about DBS NAV Planner is that if finances a banking relationship with DBS, it may utilise the data it already has from DBS to give us a great picture of our finances. This includes our spending and saving patterns every month, investments we have made and insurance protection policies we may have purchased through DBS.

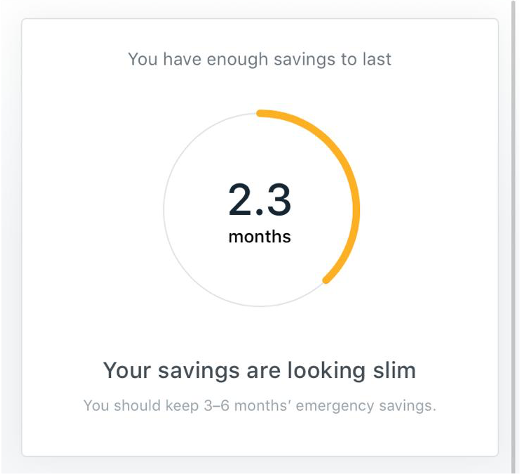

For example, like lots of people in Singapore, I personally use DBS in my day-to-day expenses. The DBS NAV Planner detects just how much I spend and save every month, and based on this, can also give me insights such as the emergency savings I actually have.

As you can see, at just 2.3 months, the quantity of emergency savings I have isn't looking too good.

But here's the problem. Like many other people, I have savings in other accounts beyond DBS. So while DBS NAV Planner is useful, it does not always produce an entire picture of my finances unless I connect it with information from other banks.

Prior to SGFinDex, basically wish to have an entire view of my finances using the DBS NAV Planner, I could still get it but that would require me to manually key in the extra information needed for example my savings in other non-DBS accounts. I will should also continually update the data to ensure that DBS NAV Planner can present in my experience information that's accurate.

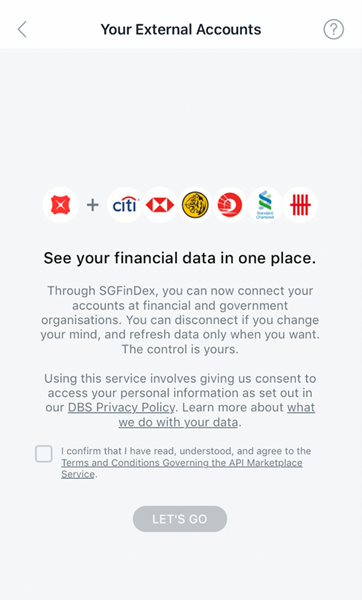

However, using the launch of SGFinDex, we are able to now choose to connect the DBS NAV Planner automatically to any from the other participating banks and government departments. It's interesting to notice that even if you are no existing DBS customer, you can still use the DBS NAV Planner by downloading the DBS digibank app.

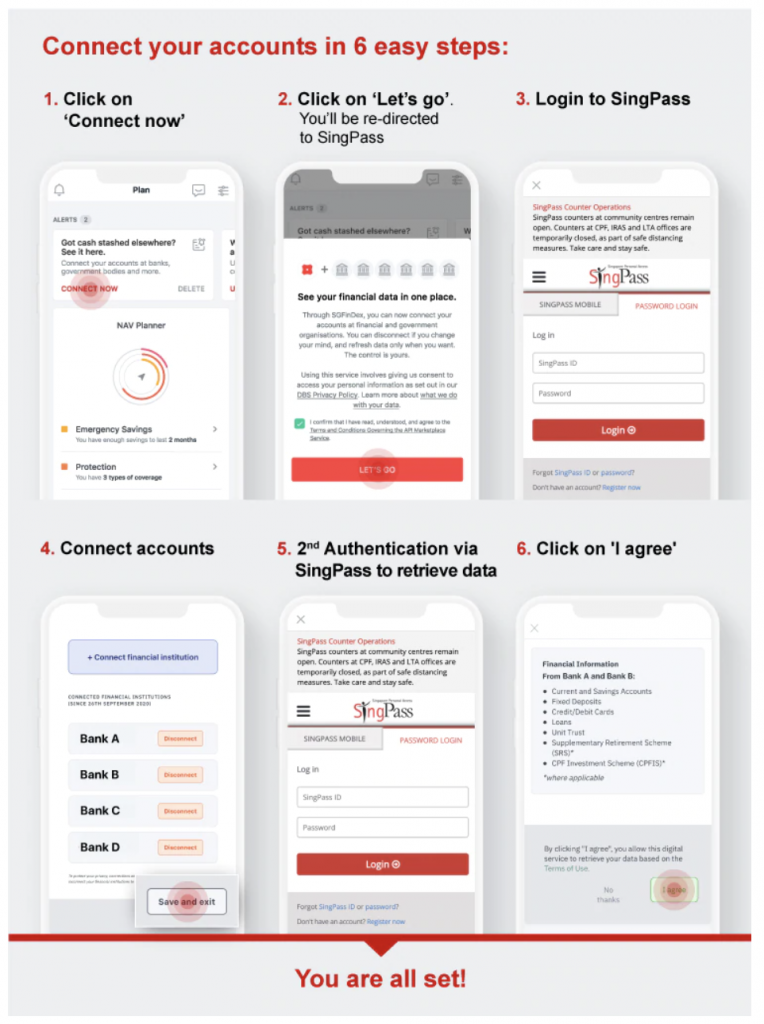

Based on our experience via mobile, you will need to login via your Singpass twice. The first login would be to access SGFinDex, which you can do so using your Singpass. If this sounds like the first time you are using SGFinDex, you will need to add the various banks that are looking to SGFinDex. The second login would be to provide permission for that DBS NAV Planner to access the data on SGFinDex.

You can refer to the steps below as explained by DBS.

Once we have done so, our DBS NAV Planner will utilise the additional information using their company financial institutions to provide us a more accurate assessment of our financial status.

For example, Now i have a much healthier level of emergency savings at 9.2 months once my savings from other bank accounts are taken into consideration.

Besides information using their company financial institutions, DBS NAV Planner can also include information from government agencies such as CPF, HDB and IRAS.

DBS NAV Planner Can Provide Us With Insights Beyond Just Financial Data

Merely having information is detrimental enough if it doesn't inspire us to take action to achieve positive outcomes. One advantage that DBS NAV Planner has is that after it features a holistic overview of our finances, it may give to us valuable insights that can lead to concrete actions to improve our current finances. For example, based on your current assets and liabilities and projected future expenditure and income, the DBS NAV Planner can help you project your future cashflow for the goals or retirement and help you plan 20, 30, or perhaps 40 years ahead.

Keep Track of Investments

Similarly, the DBS NAV Planner also offers an investment feature on its platform that may tell us the value of our portfolio. One of the features features a real-time investment tracker. For instance, once you tell DBS NAV Planner you own 1000 stocks of Apple (AAPL), the value of investments will reflect real-time market conditions.

Similarly, when we committed to other asset classes for example unit trusts (whether it's with DBS or any other banks), the marketplace value of these investments could be reflected automatically within our DBS NAV Planner, because of SGFinDex. There would not be a need for us to manually adjust our investment portfolio value each time we want an update.

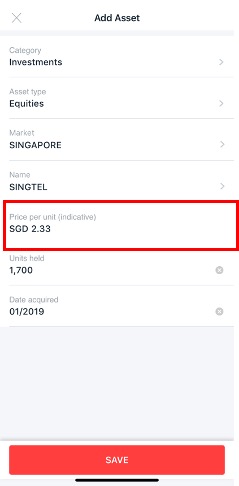

While SGFinDex does not let us link our CDP account (yet), we are able to still add equities and ETFs that people own to the DBS NAV Planner. Once added, the need for these equities and ETFs will automatically be updated by DBS NAV Planner.

For example, as somebody who owns some Singtel shares, I can add the assets to my DBS NAV Planner.

The indicative price SGD 2.33 that you see above is automatically provided by the DBS NAV Planner based on the current Singtel share price.

Once added, it will likely be entering neglect the portfolio along with other investments you will probably have. DBS NAV Planner can show the market value of your investments.

I also provide some Nikko AM Singapore STI ETF shares that were bought through DBS making this automatically included in my investment portfolio for that DBS NAV Planner.

Insurance Coverage Gap

The DBS NAV Planner includes a protection feature that helps us understand if we have any insurance coverage gap. These include critical illness mortgage insurance, health insurance and life insurance coverage. After we provide DBS NAV Planner with info on our existing insurance plans, it may suggest to all of us what are the protection gaps we might have.

One challenge that we still need accommodate (for the time being) is that we have to manually update insurance plans and certain investment that we may have made beyond DBS. It is because currently, SGFinDex doesn't let us connect insurance plus some investment information (like our CDP holdings) in the initial launch phase. However, this might alternation in the future.

With DBS NAV Planner being able to encompass management of your capital, protection, investments and retirement planning, it's, within our opinion, probably the most comprehensive financial planning tool available to all free of charge in Singapore.

Despite that, DBS NAV Planner continues to be relatively beginner friendly. Even though you don't wish to deep dive and geek out about your financial health, it's still relatively accessible to people just beginning their financial journey.

Indeed, DBS NAV Planner isn't just about helping us consolidate information – an excel sheet can perform that if necessary. Instead, the additional value with DBS NAV Planner is it can offer us with useful insights that we have to allow us to make smarter financial decisions.

According to DBS, the DBS NAV Planner has helped a lot more than 1.8 million users to do budgeting and monitor their investment performance, and obtain personalised financial insights and suggestions. 400,000 of them have even turned their finances around through using DBS NAV Planner. And with SGFinDex, the question isn't so much about if the DBS NAV Planner might help more people in Singapore, but rather, whether you'll be keen to accept initial step to begin your financial planning journey now that you have the various tools inside your hand to get going easily.