Three causes there gained't be considered a 2021 housing industry crash

![4 Stocks This Week (Best 52-Week SGX Stock) [24 July 2021] Medtecs Intl; UG Healthcare; AnAn Intl; Zhongxin Fruit](https://creditoverview.net/wp-content/uploads/2021/07/20210722113842-51-850x560.jpg)

4 Stocks This Week (Best 52-Week SGX Stock) [24 July 2021] Medtecs Intl; UG Healthcare; AnAn Intl; Zhongxin Fruit

The last 52-weeks period, or past year, has seen heightened volatility in the stock markets. While COVID-19 is most fresh in our minds, uncertainties persisted by means of the ongoing US-China trade war, Brexit as well as record-high stock market valuations and possible a late cycle downturn coming.

In our 4 Stocks Now column this week, we check out four stocks that have performed the best in the last 52-week period, not just in spite of the uncertainties but also by taking benefit of it in certain instances.

Medtecs International (SGX: 546)

Medtecs International has surfaced on our column within the recent weeks – when we covered the popular healthcare consumables sector in mid-June.

Medtecs International, a built-in healthcare product manufacturer and services provider, has definitely been among the beneficiaries of the recent spike in demand for its personal protective equipment products and integrated hospital services.

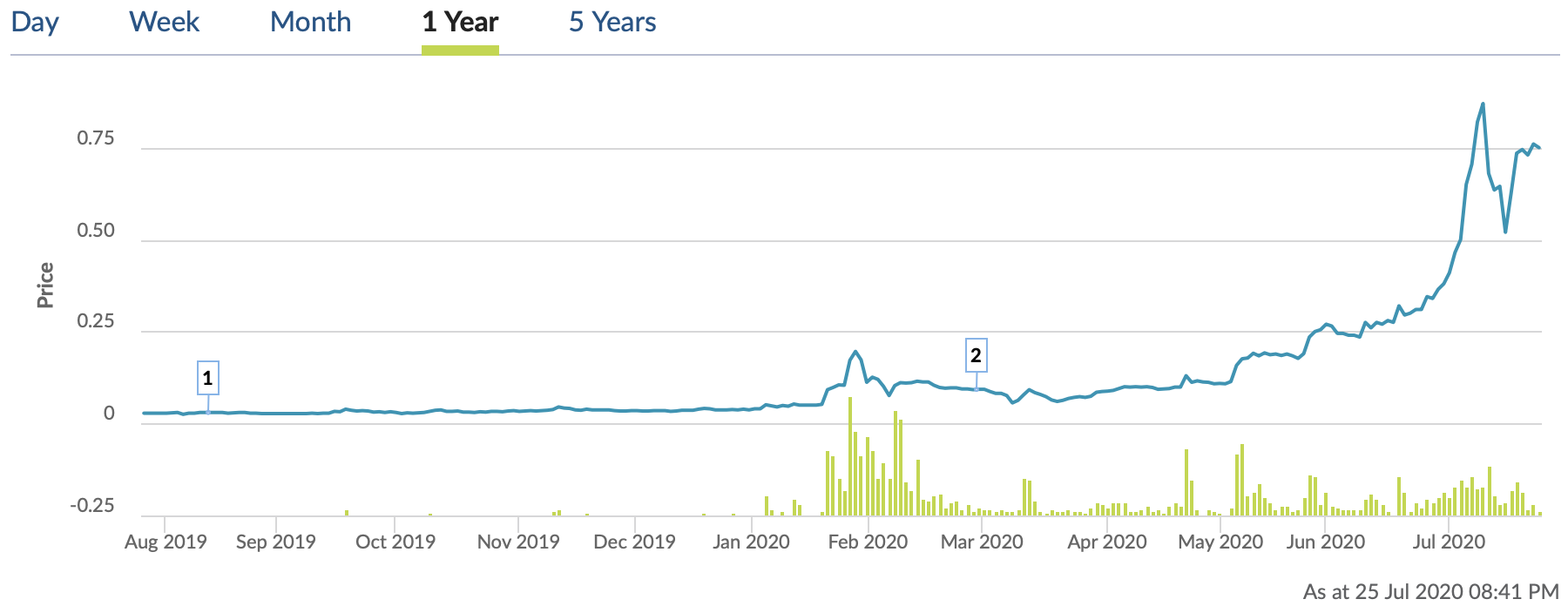

According towards the SGX Stock Screener, Medtecs has been the best performing stock on the Singapore Exchange (SGX) in the past 52-weeks period – increasing a cool 2,578% to $0.75 today, when compared with $0.028 around the end of July 2021.

In this era, its market capitalisation has soared to $412 million today, from approximately $15 million.

As we are able to see in the chart above, its stock price was relatively stable in the first half and only started rocketing since mid-February. This is not surprising as the COVID-19 pandemic had been contained to mostly China and other Asian countries till around that point.

UG Healthcare (SGX: 41A)

UG Healthcare, one of the largest rubber gloves manufacturer in Malaysia, is another beneficiary of the COVID-19 pandemic that was covered in the same Healthcare Consumables article we wrote as Medtecs International.

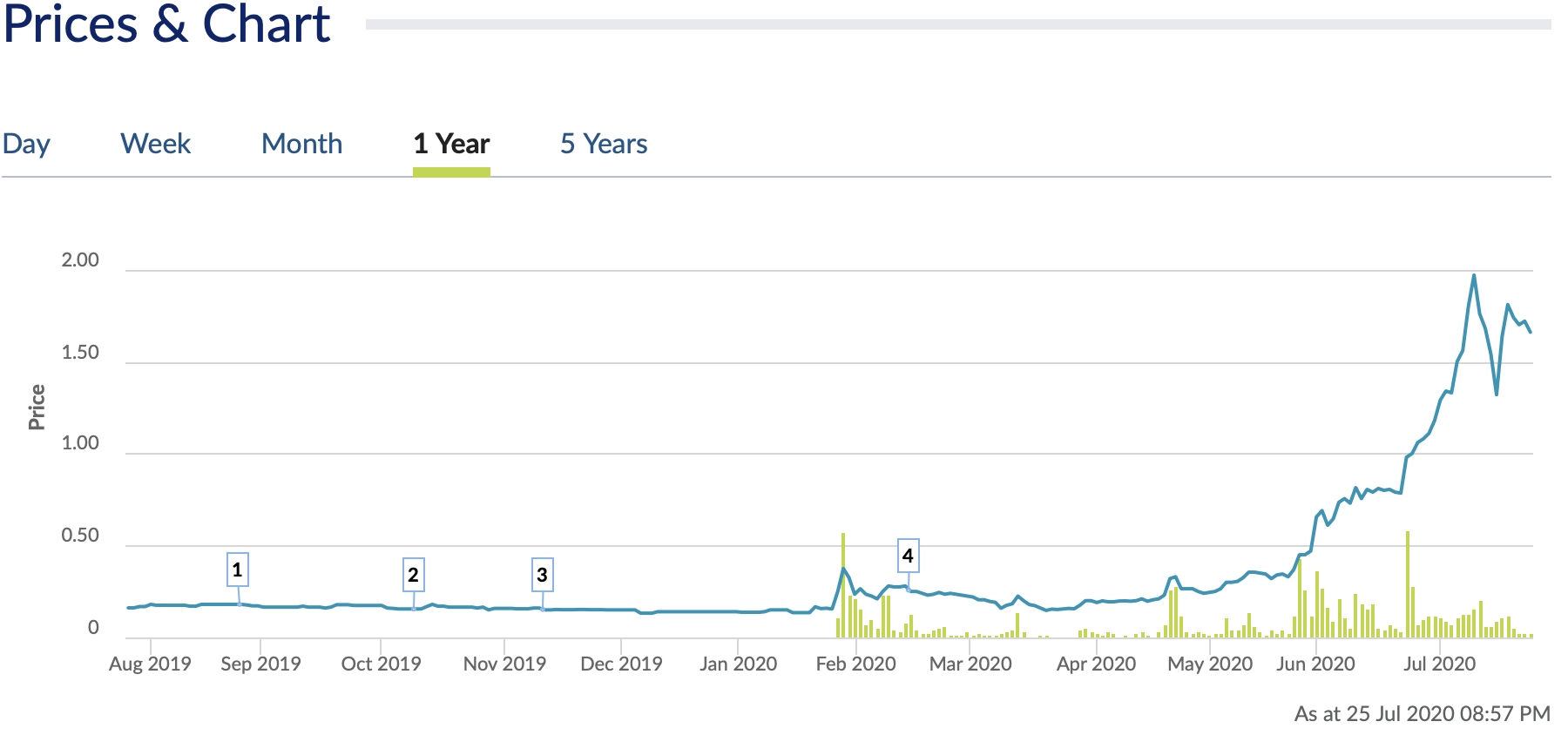

Thus, it's perhaps unsurprising then that has been the second-best performing stock on the SGX in the past 52-weeks period, according to the SGX Stock Screener. In the past 52-weeks period, UG Healthcare has climbed over 931% to $1.66 today, from about $0.161 last July.

Correspondingly, its market capitalisation has risen to almost $326 million, from about $32 million.

Following Medtecs International's stock price trajectory, UG Healthcare's share price was also very stable within the first half of the 52-weeks period, and only took off in late January 2021.

AnAn International (SGX: Y35)

AnAn International is an investment holding company within the energy business. While energy prices has additionally come under pressure in the recent years, as well as due to waning demand around the COVID-19 pandemic, AnAn International seems to have bucked the trend.

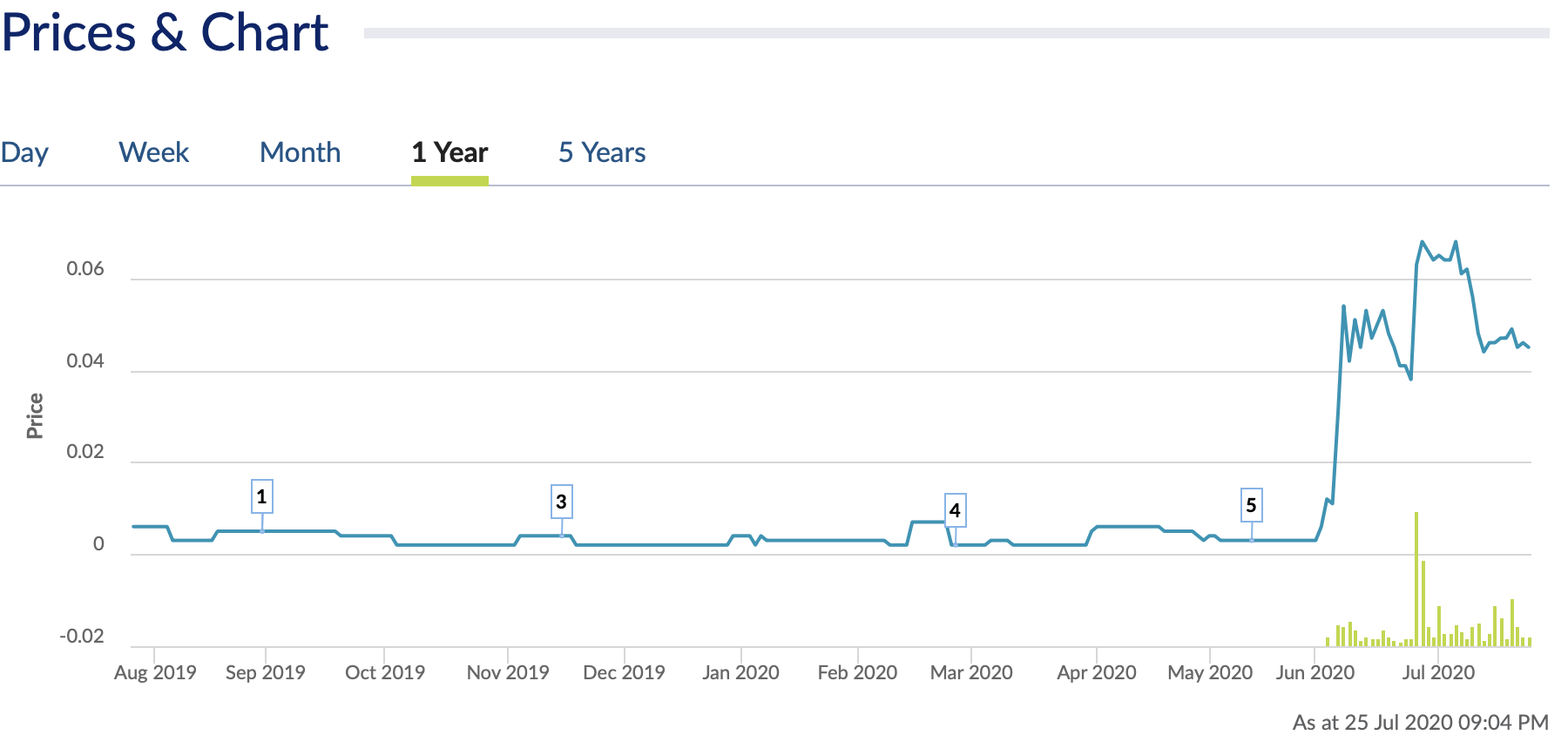

In the past 52-weeks period, AnAn International's share price has risen 650% to $0.045, from about $0.006 in July 2021. Hence, its market capitalisation has similarly grown to $190 million today, from near to $25 million in July 2021.

Looking at its share price, AnAn International has only started spiking recently – in June 2021. This resulted in an SGX query in relation to unusual volume movements in its shares. AnAn International responded that it was not aware of any reasons that hasn't already been announced publicly that may explain the sudden increase in share prices, as well as confirmed that it's in compliance with listing rules.

Zhongxin Fruit and Juice (SGX: 5EG)

According to Zhongxin Fruit and Juice, it's a subsidiary of the world's leading producer of fruit and vegetable juice concentrates, SDIC Zhonglu Fruit Juice Co. The Group's primary clients are in producing concentrated apple juice, mainly for packet juice drinks, sodas, cider, yogurt and candies, for the US, European Union, South Africa, Japan, Canada and Australian markets.

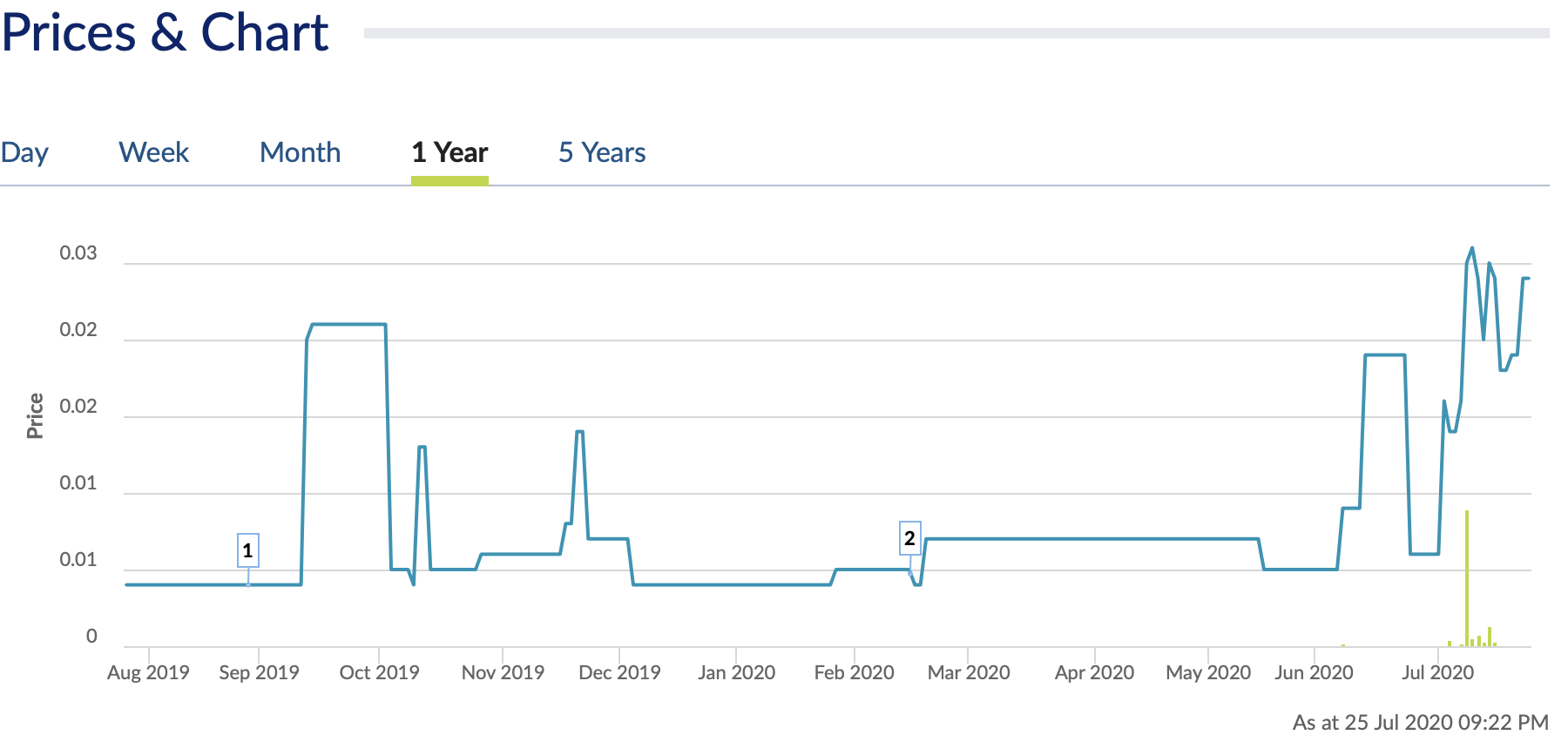

In yesteryear 52-weeks period, Zhongxin Fruit and Juice has witnessed large volatility in its share price, spiking 500% to $0.24 today, from $0.004 in July 2021. This has translated into an improved market capitalisation of $25 million today, from approximately $4 million in July 2021.

As can be seen in the chart below, its stock price hasn't just risen steadily either and has spiked up and down in the past 52-weeks period.