Three causes there gained't be considered a 2021 housing industry crash

Grab Expands Financial Services Beyond GrabPay: Listed here are 4 Things You Need To Know About New Investment, Loans And Payment Products

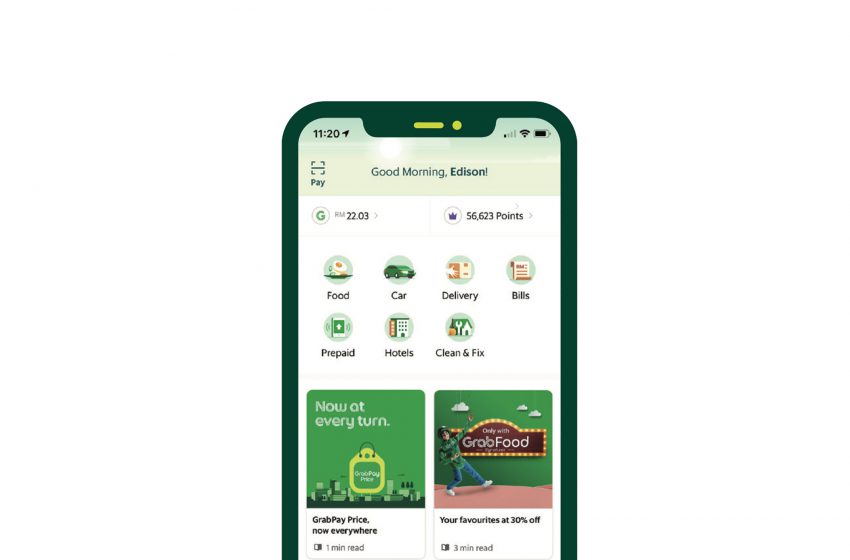

Besides using Grab for food (GrabFood), groceries (GrabMart) and transport, Grab also really wants to be part of your wallet (GrabPay) and financial life. As part of Grab's continued effort to grow their product offerings and repair to customers, they are expanding into micro-investing, consumer lending and flexible payment solutions.

Here are 4 what exactly you need to know about their new services: AutoInvest, Consumer Third-Party Loans and purchase Now, Pay Later.

#1 Micro-Invest With AutoInvest

Micro-investing is investing in tiny amounts. Grab's AutoInvest is a bite-sized method of investing. Every time you spend or make a transaction (i.e. using Grab, GrabFood, GrabMart, GrabPay), additionally you top-up a small amount that goes into AutoInvest. Every time you spend, you are also investing. As the process is automated, you're building an investing habit with little additional effort.

With AutoInvest, there is no transaction fees for making the investment and the minimum investment sum per transaction is often as low as $1.00. The funds are invested into actively managed portfolios by having an estimated return of 1.8% p.a. and expense ratio of 0.45% p.a. Currently, the investment partners for AutoInvest are Fullerton Fund Management and UOB Asset Management.

#2 AutoInvest Isn't a Substitute For Regular Investing

However, as AutoInvest is tied to transactions, you cannot make lump-sum investments. Which means that if you have substantial savings that you want to invest at a similar yield, you should think about a cash management account instead.

Additionally, the funds invested by AutoInvest are restricted. If you wish to make investments that yield higher returns or select your investments with the same digital convenience, you can look at using either an online brokerage or a robo advisor.

Note: Funds invested in AutoInvest can only be cashed out to your GrabPay account. As of now, you cannot spend the funds to your bank account.

#3 Take Loans With Third-Party Institutions Through Grab

As area of the Grab eco-system, Grab is also introducing Consumer Third-Party Loans. This distribution service aims to provide easy access to loans from third parties (e.g. banks) inside the Grab platform. Grab will not offer loans directly but will act as a platform to enable users to search for licensed loans from bank partners for his or her everyday borrowing needs. User may then access and securely apply for the loans directly within the app.

Full details of this service will be released later after Grab finalises their list of bank partners. While this service makes it much simpler for people to take loans to satisfy their cashflow needs, do remember that the potential pitfalls of going for a loan still applies.

#4 Buy Now, Pay Later

Aptly named, Buy Now, Pay Later allows users to create an immediate purchase but defer the payment to some later time at 0% interest. There are two options: one for monthly instalments (PayLater instalments) and one for deferral of payment towards the following month (PayLater Postpaid).

Grab will be rolling out this selection first to a select group of users in October 2021, who will have to complete a GrabPay Know-Your-Customer process before they could use the service. Grab plans to onboard more than 100 merchants, including beauty, fashion and furniture retailers in Singapore and Malaysia, by the end of the year.

While these features sound exciting, especially in the context of the Grab app, they're still in the process of rolling out. For those who have an urgent need for services such as personal loans and instalment payment plans, you will find pre-existing similar solutions in the market, albeit with no ultra-convenience of using Grab.