Three causes there gained't be considered a 2021 housing industry crash

![[2021 Edition] Seniors' Guide To Healthcare Schemes, Grants And Subsidies In Singapore](https://creditoverview.net/wp-content/uploads/2021/07/20210722113721-36-850x560.jpg)

[2021 Edition] Seniors' Guide To Healthcare Schemes, Grants And Subsidies In Singapore

Similar to many other developed nations, Singapore has been and continues to face a maturing population. Put simply, our country's human population is getting older, and we have more older folks being supported by fewer number of younger people.

While natural replacement rate of a country is usually 2.1 babies per woman, the fertility rate in our country currently stands at just 1.14.

This means moving forward, healthcare schemes, grants, and subsidies will end up even more important, as Singaporeans combat the challenges brought about by our ageing population.

The government has already put in place numerous schemes to support our seniors during their golden years. These schemes are administered by various government departments including the Ministry of Health, the Central Provident Fund Board (CPF Board) and HDB.

One of the greatest challenges facing health and social care workers in Singapore is getting the right information to the right people. Even though there are plenty of schemes, subsidies and grants available to the elderly in Singapore, many eligible seniors might not be utilising them because they are not really aware that they exist.

You can perform your part by understanding the various schemes, grants and subsidies that you could tap on to support yourself, or perhaps your aged loved ones, during their golden years.

Find Out More:

- Community Health Assist Scheme (CHAS)

- Pioneer Generation Package (PGP)

- Merdeka Generation Package (MGP)

Medisave Top-ups For Elderly(Substituted with PGP & MGP)- Flexi-Medisave Scheme

- MediShield Life Premiums Subsidies

- Medifund Silver

- Intermediate And Long-Term Care (ILTC) subsidies

- Enhancement For Active Seniors (EASE)

- Foreign Domestic Worker (FDW) Levy Concession

- CareShield Life

- ElderShield

- Interim Disability Assistance Programme For that Elderly (IDAPE)

- Seniors' Mobility And Enabling Fund (SMF)

The various schemes, grants and subsidies can be grouped according to three groups. They're 1) Healthcare Subsidies, 2) MediShield Life and three) Day-To-Day Senior Care Support.

Healthcare Subsidies

Community Health Assist Scheme (CHAS)

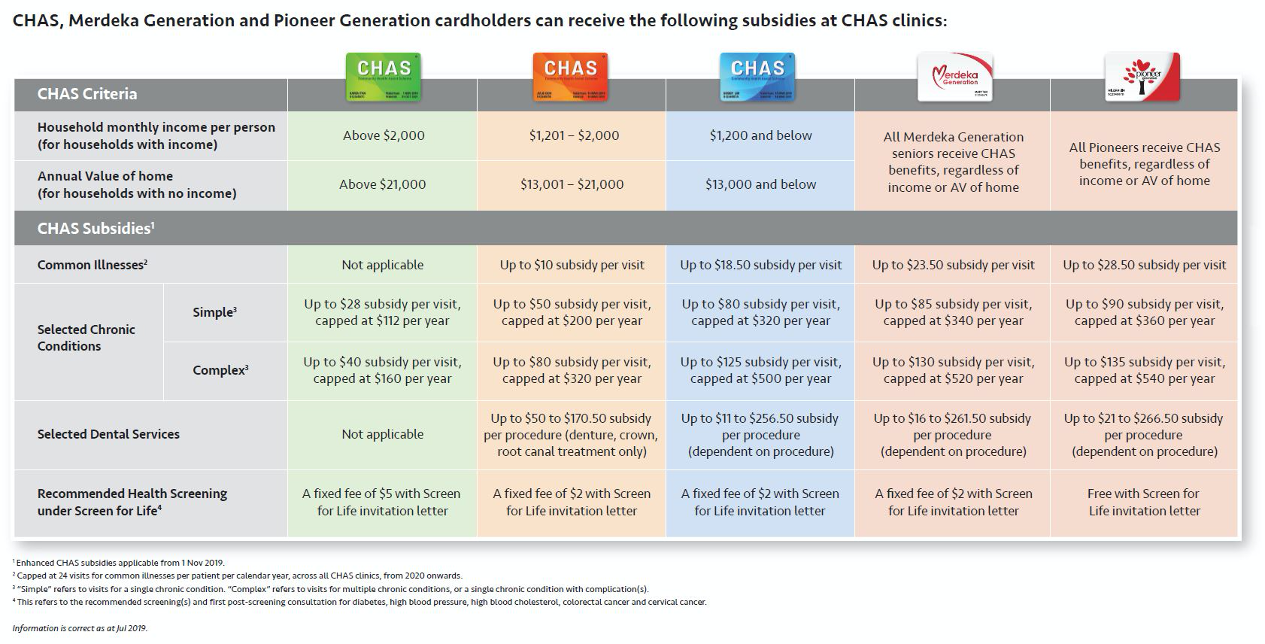

Community Health Assist Scheme, also known as CHAS, enables Singapore Citizens from lower-to-middle-income households, as well as all Pioneers (aged 65 and above in 2021), to get subsidies for medical and dental hygiene at participating General Practitioners (GP) and dental clinics near their home.

CHAS is a tiered subsidy scheme. This means lower-income families will love higher subsidies. The subsidy tier depends upon the average household monthly income per capita. If your household has no income, the subsidy tier will be tied to the annual worth of your home, as assessed by the Inland Revenue Authority of Singapore.

However, seniors who entitled to the Pioneer Generation Package will enjoy enhanced CHAS benefits, regardless of their household income.

Here is the eligibility criteria for CHAS and also the various subsidies that you receive.

To apply, you can go to the CHAS website, or visit any public hospital, polyclinic, Community Centre (CC) or Community Development Council (CDC).

You will discover more about CHAS on its website.

Pioneer Generation Package (PGP)

Introduced in the Singapore Budget 2021, the Pioneer Generation Package (PGP) is really a $8 billion healthcare fund for that Pioneer Generation, which consists of Singaporeans born in 1949, and who've obtained Singapore citizenship by 31 December 1986.

In total, about 450,000 citizens qualify for the PGP which consists of 1) outpatient care subsidies, 2) MediShield Life premium subsidies 3) Medisave top-ups, and 4) disability income assistance and 5) participation incentive for joining CareShield Life.

– Special subsidies at CHAS GP and dental clinics.

– Additional 50% off subsidised services and medication at polyclinics and specialist outpatient care in public places hospitals.

– Special premiums subsidies for MediShield Life premiums.

– Annual Medisave top-ups ranging from $200 to $800 annually for life. Again, the top-ups are tiered which means the older you are, the more subsidies you get.

– $100 each month for individuals who qualify for the pioneer generation disability assistance scheme.

– Total of $4,000 participation incentive to join CareShield Life by 31 December 2023. This will be spread over ten years and used to offset their annual CareShield Life premiums.

Qualification for that PGP is based purely on age and citizenship status.

You will discover more about the PGP here.

Merdeka Generation Package

The Merdeka Generation Package is perfect for Singaporeans born from 1 January 1950 to 31 December 1959, and who became a Singapore Citizen on or before 31 December 1996. The package can also be given to seniors who do not get the Pioneer Generation Package, but were born on or before 31 December 1949, and have become a Singapore Citizen on or before 31 December 1996

Intended to honour the generation who steered the nation during the nation's growing years, the Merdeka Generation Package consists of 1) a one-off $100 PAssion Silver Card top-up, 2) MediSave top-ups, 3) Outpatient Care Subsidies, 4) participation incentive for joining CareShield Life and 5) Additional MediShield Life Premium Subsidies

– One-off $100 PAssion Silver Card top-up which may be used for public transport, ActiveSG gym and pool entries, at Ezlink-accepted merchants and Active Aging Programmes.

– $200 Medisave Top-Ups every year, from 2021 to 2023.

– Additional 25% off remaining bill for subsidised services and medications at polyclinics and public specialist outpatient clinics (SOCs). A referral from polyclinic or CHAS clinic is required for subsidized rates at public SOCs.

– Subsidised rates at CHAS clinics and $2 fixed fee for Recommended Health Screening

through Screen for Life.

– Total of $4,000 participation incentive to become listed on CareShield Life.

– Additional 5% subsidy for your annual premiums for MediShield Life, increasing to 10% after the age of 75.

Medisave Top-ups For Elderly

Update: This has been replaced by the PGP and MGP.

Singaporean seniors who do not fall under the Pioneer Generation will get Medisave top-ups of $100 to $200 annually until 2021. Medisave may be used to pay for your personal or immediate family's hospitalisation, day surgery and specific outpatient expenses in any hospital in Singapore.

If you're already receiving GST Voucher – Cash or GST Voucher – Medisave, you don't have to sign up. Otherwise, you can apply through any Community Centre, Social Service Office (SSO), CPF Service Centre, or the GST Voucher website.

Flexi-Medisave Scheme

Introduced in 2021, built allows seniors, aged 65 and above, to make use of an additional $200 of their Medisave a year, for outpatient treatments at CHAS-registered public-sector specialist outpatient clinics (SOCs), GPs and polyclinics.

Do note that the $200 of Flexi-Medisave can be used over and above other outpatient Medisave limits, such as the $400 annual limit for the Chronic Disease Management Programme, and the $300 limit for outpatient scans.

You can see up more about the use of the Flexi-Medisave in this release from the Ministry of Health.

MediShield Life

MediShield Life Premium Subsidies

MediShield Every day life is a basic health insurance plan that pays for large hospital bills and specific outpatient treatments, and is extended to Singaporeans and PRs for life. The government subsidises all senior citizens' MediShield Life Premiums by up to 50 per cent for lower- and middle-income households.

For seniors who're unable to afford MediShield Life premiums even after the subsidies, additional support is going to be provided. No application is needed for this, as the subsidies will be distributed based on existing information in the Government databases.

To check or update your household information used to calculate your Premium Subsidies, you can check the Household Check e-Service.

Medifund Silver

Targeted towards the needy elderly, Medifund Silver helps seniors who require financial support after exhausting their finances on their own medical bills. Medifund assistance can be sought through consultation with medical social workers from Medifund-approved institutions.

To be clear, Medifund Silver is really a subset of Medifund, which is for that general population. It does not overlap the role of Medifund.

Day-to-Day Senior Care Support

While CHAS, the PGP and the various MediShield and Medisave subsidies and top-ups are well-discussed, many of the areas provided under the senior care support are less known.

Intermediate And Long Term Care (ILTC) Subsidies

ILTC subsidies extend not just to seniors, but also to people who require further care and treatment after being discharged in the hospital as well as people who are frail and wish day-to-day assistance.

Support areas include the following.

Home-Based Services: Home Medical Care; Home Nursing Care; Palliative Home Care; Meals-On-Wheel; Escort/Transport Services; Home Personal Care

Centre-Based Services: Community Rehabilitation Services; Dementia Day Care Services; Social Day Care Services

Residential ILTC Services: Community Hospitals; Chronic Sick Hospitals; Nursing Homes

Inpatient Hospice Care: Sheltered Home For Ex-Mentally ill; Respite Care

Getting such health insurance and social care can be very expensive in the long run, and subsidies of up to 80% for home care and 75% for residential services (e.g. nursing homes), are in place to help offset these bills.

To qualify for these subsidies, the main eligibility criteria are that 1) the person must be a Singapore citizens or Permanent Residents, 2) satisfy the admission criteria of the ILTC services required and three) are receiving care from MOH-funded service providers.

Once again, the subsidies are tiered according to monthly household income per person, and vary according to the type of care required.

If you need more information on the subsidies available, check out the MOH website.

Enhancement For Active Seniors (EASE)

Offered by HDB, built allows HDB owners who are 65 or over, or have a family member in the household who is 65 and above, to make their flats elder-friendly by installing useful items. These items include grab bars, slip-resistant bathroom floors and ramps.

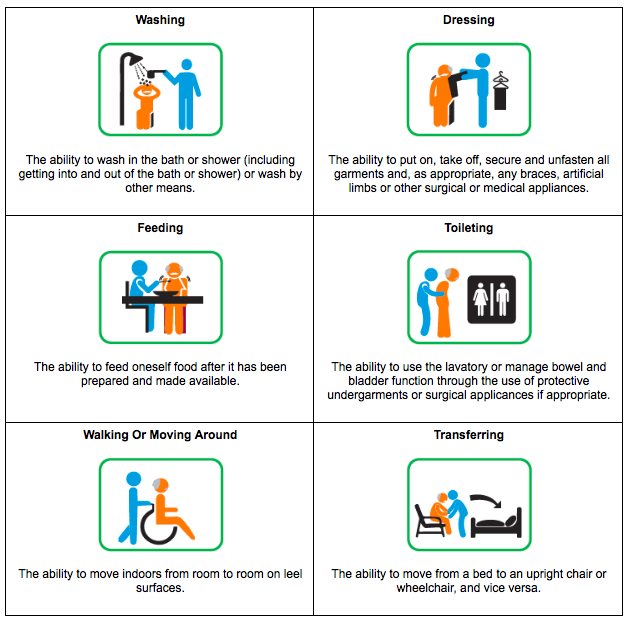

Those who're aged between 60 and 64 many requires assistance for one or even more of the Activities of Daily Living (ADL) are also eligible. These activities include washing/ bathing, dressing, feeding, toileting, mobility, and transferring.

You can use for EASE via HDB e-Services, through your phone with [email protected], or visit the HDB Branch that administers your estate. So, don't miss out on such subsidies if you are already intending to install any of these items.

Foreign Domestic Worker (FDW) Levy Concession

Seniors who wish to hire a FDW, or for people who wish to hire a FDW to care for a family member sticking with them, may be eligible for a lower levy rate of $60 per month. The qualifying age for the aged person is 67. This really is only applicable for Singaporean seniors. When the senior is a Permanent Resident and you or your spouse is Singaporean, you may also apply for the levy concession.

No application is needed if you are the employer, as the concession will automatically affect all seniors aged 67 and above.

Alternatively, people with disabilities (PWD), certified by Singapore-registered doctor to want help with at least 1 activity of everyday living (ADL), such as showering, feeding, dressing or toileting are also eligible for the concession.

Application is required if you're hiring a FDW for your family member, or PWD.

If you hire the FDW to take care of a family member who needs permanent help with 3 or more ADLs, you may also qualify for the Home Caregiving Grant, a monthly grant of $200. For more information, please refer to AIC.

CareShield Life

The launch of CareShield Life continues to be delayed to end-2021 instead of mid-2021 as announced earlier due to delays caused by COVID-19 measures.

CareShield Life will switch the existing ElderShield and provides better coverage for those who require long term care in Singapore. It features 1) lifetime cash payouts, 2) increasing payouts over time, 3) subsidies that make it affordable and 4) premiums which are payable by MediSave.

Singapore Citizens or Permanent Residents born in 1980 or after are automatically covered under CareShield Life or is going to be enrolled when they reach the chronilogical age of 30.

Singapore Citizens or Permanent Residents born in 1979 or earlier can choose to join CareShield Life from end-2021, if they're not severely disabled. You'll be automatically enrolled if you are born between 1970 and 1979, are insured under the ElderShield 400 scheme, and are not severely disabled.

ElderShield

Update: ElderShield will be replaced by CareShield Life for new cohorts born in 1980 and after, while those born in 1979 or earlier can enrol in CareShield Life.

ElderShield is a national insurance scheme that aims to supply basic insurance coverage to Singaporeans who are in need of long-term care support during their old age.

Unlike Medishield Life, which is compulsory for those, ElderShield is an opt-out scheme. That means all Singaporeans and Permanent Residents (PRs) can choose to opt-out of the insurance scheme if they wish to.

Under ElderShield 400, policyholders will get a payout of $400 per month for a maximum of 72 months (6 years) if they are assessed to have “severe disability”.

The criteria for severe disability are whenever a person cannot perform three out of six Activities of Daily Living (ADLs).

Interim Disability Assistance Programme for the Elderly (IDAPE)

Since ElderShield was only introduced in 2002, there may have been some citizens who may not have been eligible to join it – because they already exceeded the maximum entry age and have pre-existing disabilities.

For these seniors, IDAPE will provide a cash payout as high as $250 a month for up to 6 years, whenever they meet the necessary criteria. The factors to be met are similar to those of ElderShield.

Coverage for IDAPE and ElderShield do not overlap. You are either eligible for one or the other, not both.

Seniors' Mobility and Enabling Fund (SMF)

The Seniors’ Mobility and Enabling Fund (SMF) provides holistic support for seniors

to help them remain mobile and live independently. The fund provides financial support for cost items that fall within one of three categories.

Assistive Devices: This describes items that help an elderly person move around, such as walking sticks, wheelchairs and pushchairs. It also includes things that an elderly person may require at home, such as commodes, pressure relief cushions and hospital beds as well as spectacles and hearing aids.

Transport: For seniors attending any day services at the Ministry of Health-funded Eldercare Centres, Dialysis Centres or Day Hospices can get subsidies for their transport costs.

Home Healthcare Items: Frail seniors who are able to stay in nursing homes but decide to stay at home and be supported by home healthcare services in their community can get subsidies for the cost of catheters, milk supplements, thickeners, adult diapers, nasal tubing and wound dressings.

There will vary criteria in order to qualify for the various subsidies. You will get more information here.

The plethora of assistance programmes support Singapore's seniors in enjoying dignified lives without putting burden of financial strain on families. However, as stated before, these schemes, grants and subsidies are just useful if the people who be eligible for a them actually know about it. You can do your part by keeping yourself well-informed, and to let your family members and friends who qualify for them know about it.

Have we missed out some other programmes? Drop us a message at [email protected] if there are any more grants, initiatives and schemes that you know about.