Three causes there gained't be considered a 2021 housing industry crash

Syfe Equity100: Why This Is The Right Stock Investment Portfolio For Investors Prepared to Take On Higher Risk

For those of you who don't know about Syfe, they're one of the younger robo-advisory platforms in Singapore. Launched in July 2021, Syfe has done exceptionally well over the past year since we first wrote about them. They have also launched multiple products for Singapore investors looking to invest via robo-advisory platforms.

While the COVID-19 global pandemic has thrown the global economy into disarray, one interesting observation is it has also propelled many people to start investing. After one of the worst stock market crash in recent times, when major indices such as the S&P 500 fell by 30% within a 30-day period from 24 February to 23 March 2021, markets have made a stunning recovery with a few stock market indices trading greater than their pre-COVID-19 levels. Naturally, this has caused some retail investors to wish they had invested more throughout the initial drop.

In an interview earlier this year that we did with Dhruv Arora, Founder and CEO of Syfe, he shared that “the last three months [March 2021 to May 2021] has been [Syfe's] strongest since its inception when it comes to new clients coming onboard and the assets [the company] managed”.

Even those who may have invested during this time period may lament that they wished they had taken on more risk. Traditionally, robo-advisory platforms hold a portfolio mix of equities, fixed income, cash and sometimes even gold, as with Syfe Global ARI portfolios. The asset diversification implies that the portfolio is better protected during market downturns (e.g. from 24 February 2021 to 23 March 2021), but may not increase in value as quickly during a market rally (e.g. from 24 March 2021 till 31 August 2021) as compared to a pure equity portfolio.

It's for this reason that Syfe has launched a new portfolio – Equity100. This fully-managed portfolio puts 100% of the investment monies into equities (i.e. stocks). Based on Syfe, this means getting access to a well-diversified global portfolio of over 1500 stocks in the world's leading companies.

What Does Syfe Equity100 Purchase?

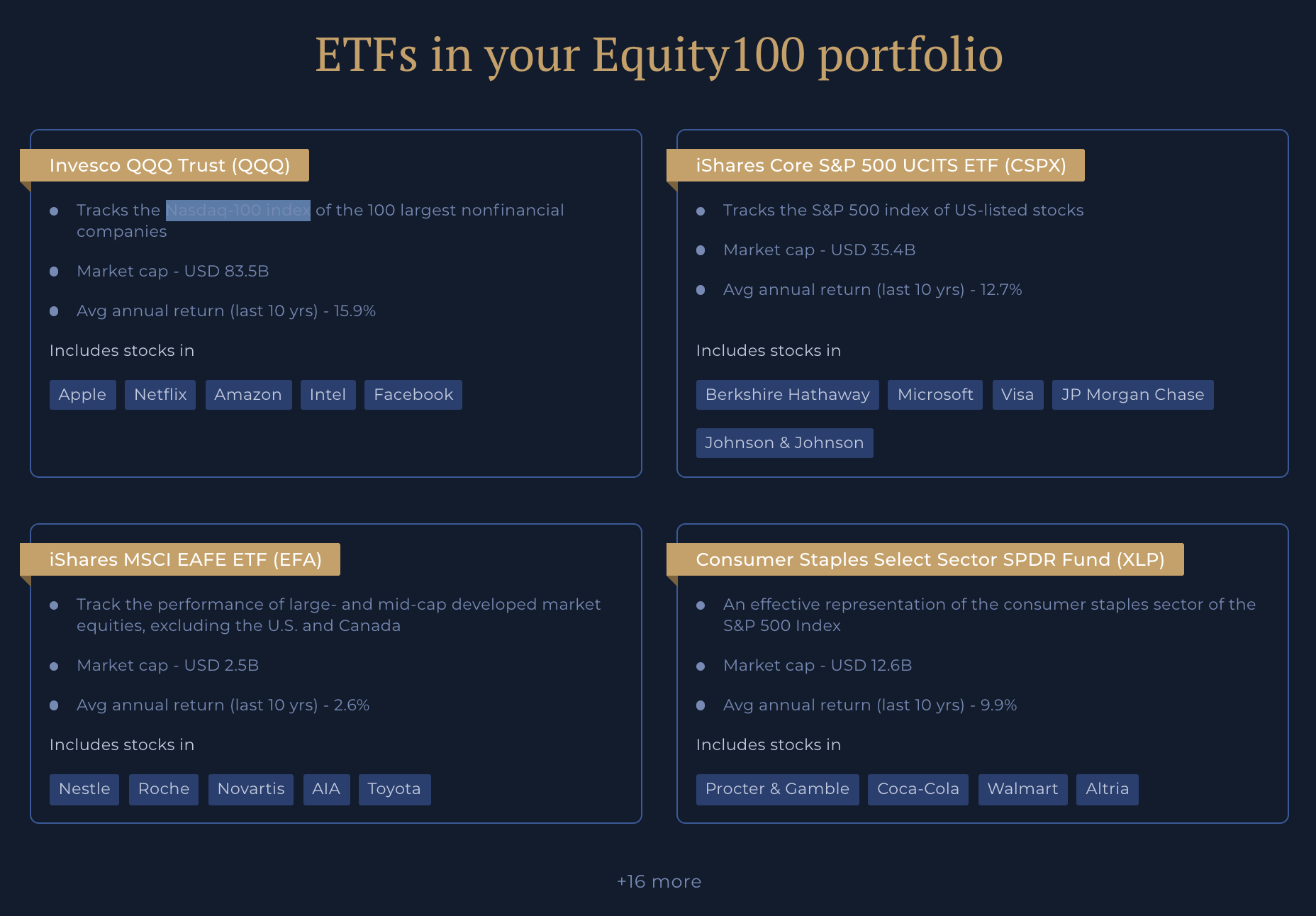

Naturally, Syfe doesn't invest in 1500 + stocks directly. Instead, it gains use of these stocks via the Exchange Traded Funds (ETFs) that it invests in.

These include the Invesco QQQ Trust, which tracks the NASDAQ 100 index, and also the iShares Core S&P 500 UCITS ETF, which tracks the S&P 500.

If you're wondering why Syfe has chosen the S&P 500 UCITS ETF, that is domiciled in Ireland, it is mainly for tax efficiency. A US-domiciled ETF tracking the same S&P 500 index could be subject to a higher dividend withholding tax rate when compared with its UCITs counterpart.

At the risk of simplifying the portfolio, here are the four main things you need to know about the Equity100 Portfolio.

Firstly, you are getting a global portfolio, not a U.S. or perhaps a Singapore-based portfolio.

Secondly, with exposure to more than 1,500 stocks, you are getting a well-diversified equity portfolio. Most of Equty100's component