Three causes there gained't be considered a 2021 housing industry crash

How The UOBAM Invest Robo-Advisor Is Different, And Why You Should Consider Investing In It (Even If You Are Using Other Platforms)

If you are a regular reader of DollarsAndSense, you would have read some of the articles we have written about robo-advisors. You may have even started investing with one or more of these robo-advisory platforms in Singapore.

Besides providing low-barrier use of globally diversified investments, robo-advisors also help their customers determine the right risk level to consider based on their risk tolerance. Risk-averse clients can maintain a higher proportion of their portfolio in fixed-income assets for example bonds, while those prepared to take on higher risk can hold a higher proportion of equities, which is commonly more volatile in the short-term but can deliver higher returns within the long-run.

Since many robo-advisors in Singapore offer similar benefits (e.g. low starting amount, hands-off investing approach, portfolio allocation, and rebalancing support), some investors might think of the different platforms as homogeneous, and just choose the platform that looks cheaper.

However, robo-advisory platforms can operate quite differently in one another even though they serve the same primary purpose – to help you invest in a hands-off manner.

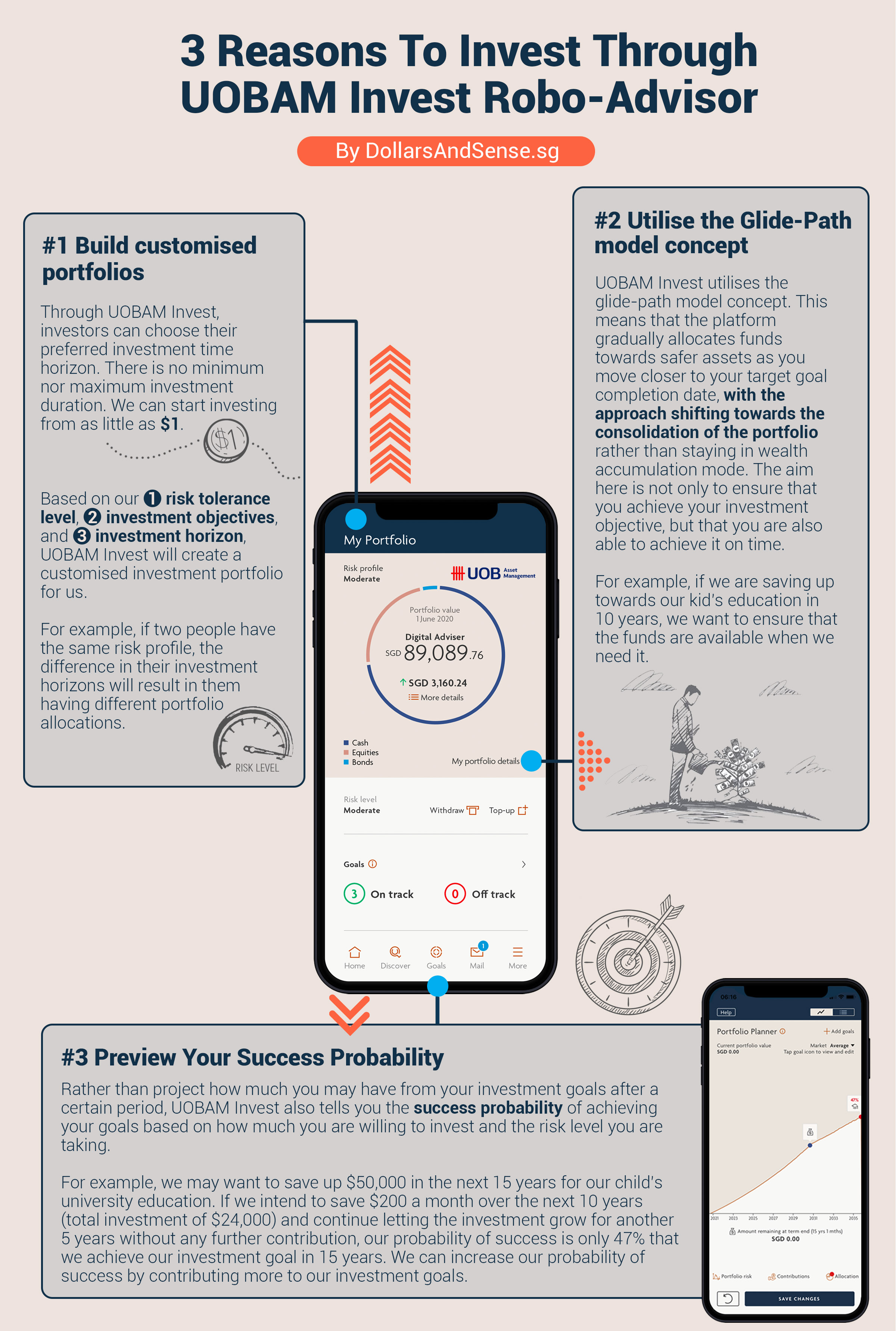

UOBAM Invest – A robo-advisor that can help you build customised portfolios

One from the newest robo-advisors in Singapore is UOBAM Invest by UOB Asset Management. With 3 decades of investment expertise and to be the investment arm of UOB, UOB Asset Management is a that most Singaporeans should be familiar with, even when they have never invested through them.

Like most other robo-advisors in Singapore, UOBAM Invest provides investors a hands-off approach to investing in an appropriate investment portfolio according to their risk tolerance level.

Investors can also start investing from as little as $1, and can invest a lump-sum and/or regular monthly contributions. Investors also support the flexibility to change their goals, stop investing, or perhaps withdraw their investments, at any time in time. Although, this may not be well suited for their investment outcome.

However, unlike other robo-advisors in Singapore, UOBAM Invest provides a few additional features that can be helpful for retail investors, even if they already started investing on their own or through another robo-advisory platform.

#1 UOBAM Invest Can Customise A Portfolio According to Your Investment Horizon & Goals

Due to the way they build portfolios, many robo-advisory platforms in Singapore are the most suitable for investors with long-term investment horizons. They might only advocate for clients to invest if they can hold their investment for a horizon of at least ten years or even more to ride out the volatility from the stock market.

With UOBAM Invest, investors can pick their investment time horizon. There isn't any minimum nor maximum investment duration.

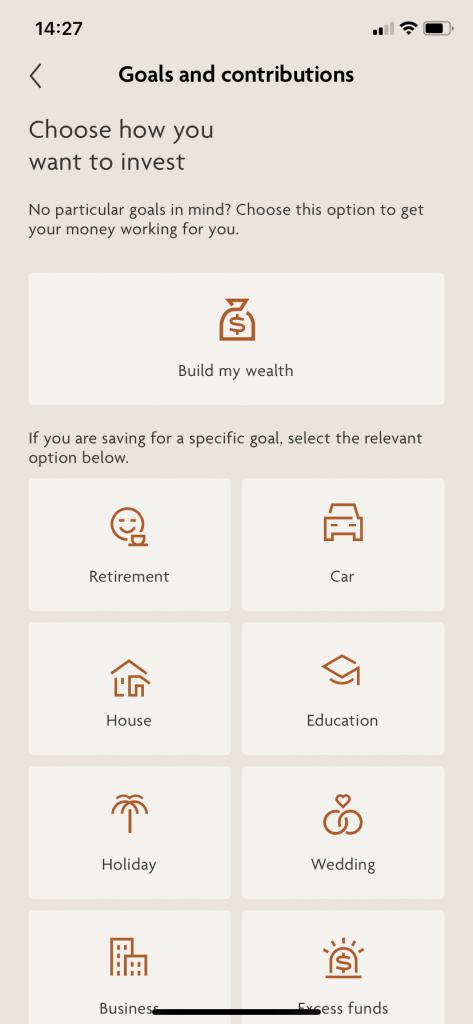

You can choose specific investment objectives or build wealth if you have no particular goals in your mind yet.

Based on your 1) risk tolerance level, 2) investment objectives, and 3) investment horizon, UOBAM Invest will personalise a portfolio for you personally.

Most robos out there do create customised portfolios for investors too. However, the key differentiation is that UOBAM Invest takes customisation to some personal level. The portfolios it creates are neither standard nor pre-built based on risk levels. So for instance, if two people have the same risk profile, the main difference in their investment horizons will result in different portfolio allocations.

UOBAM Invest also enables you to fine-tune your investment preferences. If a moderate or conservative risk investor wants to reach their investment goals earlier, they can increase the risk levels of their portfolios. UOBAM Invest will alert you if you take on more risk for the portfolio beyond your risk category.

In our view, the ability to customise your investment objectives and investment horizon is one of the key unique selling propositions that differentiates UOBAM Invest using their company robo-advisory platforms.

#2 Using The Glide-Path Model

Instead of having a set asset allocation based on your risk tolerance level, or asset allocation that could change based on the discretion of the investment team, UOBAM Invest also utilises the glide-path model concept. What this means is that the platform gradually allocates funds towards safer assets as you move closer to your target goal completion date, with the approach shifting towards the consolidation from the portfolio rather than staying in wealth accumulation mode.

The aim here is not only to ensure that you achieve your investment objective, but that you are also able to achieve it on time. For example, if you're saving up towards your kid's education in Ten years, you want to ensure that the funds are available when you need it.

#3 UOBAM Invest Gives You Your Success Probability

Rather than project just how much you may have from your investment goals following a certain period, UOBAM Invest also tells you the success probability of achieving your purpose based on how much you are prepared to invest and the risk level you are taking.

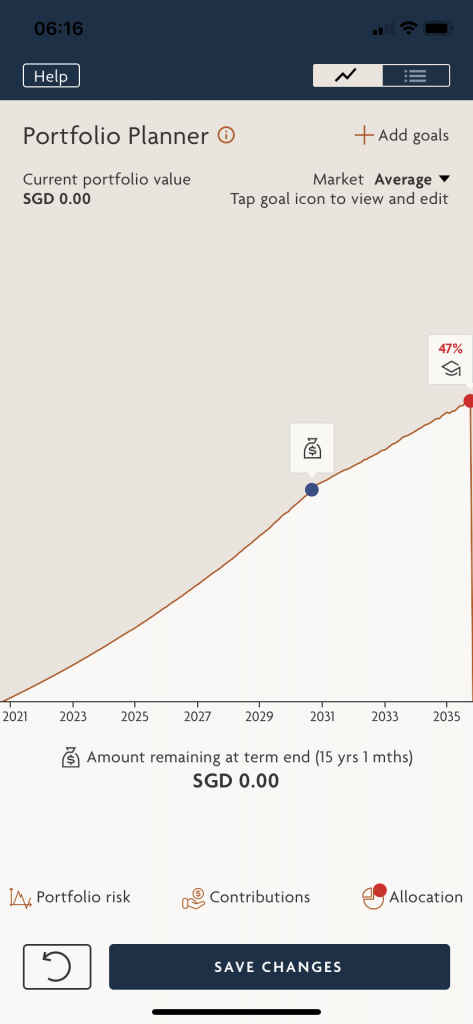

For example, we may want to conserve $50,000 in the next 15 years for the child’s university education. So, we set an objective to achieve a full payment of $50,000 on Oct 2035.

As we have in all probability other financial goals, we can only allocate a regular contribution of $200 per month towards this financial goal for Ten years. This means we intend to make monthly contributions of $200 from Oct 2021 to Oct 2030 (total contribution of $24,000) and allow the money continue growing for the next 5 years without any further contributions. Based on this input, UOBAM Invest calculates that there is only a probability of 47% that we achieve our investment goal of $50,000 by Oct 2035.

With the relatively low probability rate and never wanting to fall short for our child's university education, we may want to consider contributing more towards this goal to improve our odds of success.

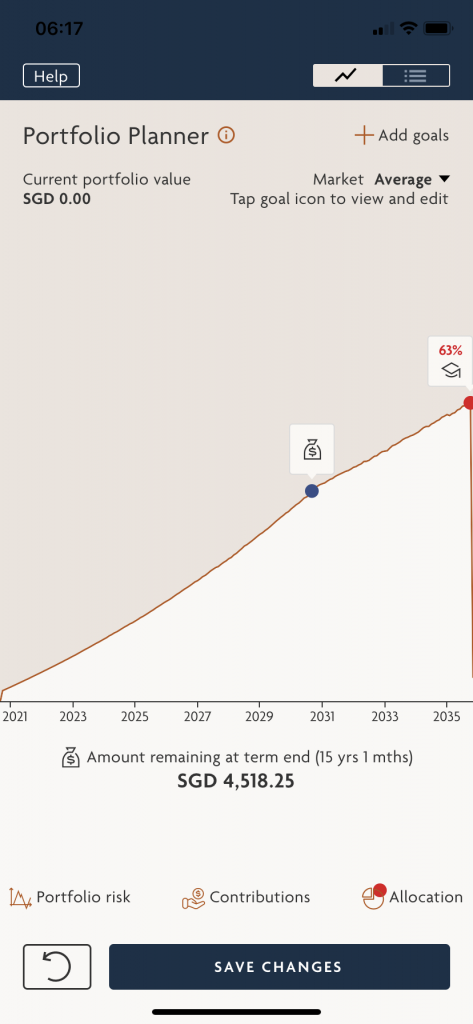

We can enjoy around with the inputs to derive a possibility of success we are comfortable with. For example, we added an initial contribution of $2,000 towards our goal, on top of the monthly contribution of $200 for 10 years. With this, our probability of success increases to 63%, making sense since we are now contributing a greater amount to achieve the same goal.

We are also estimated to have about $4,518.25 following the $50,000 withdrawal on Oct 2035.

You may add multiple goals and UOBAM Invest will automatically calculate for you personally your success probability and change the allocation of the portfolio if required.

Start Investing With UOBAM Invest

If you have not already started investing, UOBAM Invest offers an ideal starting point to work towards your financial goals. Whether it's for your upcoming wedding, deposit of a home in a few years or to build up a retirement pot in 30 years, UOBAM Invest can help create a good investment portfolio for both your short-term and long-term investment goals.

The success probability they show you helps, as it would tell you whether your goals are realistic depending on how much you are setting aside. For instance, if you want to save up $100,000 in 5 years to buy a car, but they are only willing to invest $200 per month, then it's likely that you won't achieve your objective.

Another thing we love to about UOBAM Invest is that even if we already started investing, it may still be useful for us, designed for setting shorter-term investment goals that we have. For example, even self-directed investors may also have other financial goals that we wish to invest towards while we pick bonds and stocks on our own with a separate pot of money. UOBAM Invest can help us with this particular.

Like other robo-advisors, UOBAM Invest doesn't allow us to choose specifically what we wish to invest in. We set our risk tolerance level and goals and UOBAM Invest creates an investment portfolio that can help us achieve our investment objectives. Rebalancing of our portfolio will be also be done automatically by UOBAM Invest.

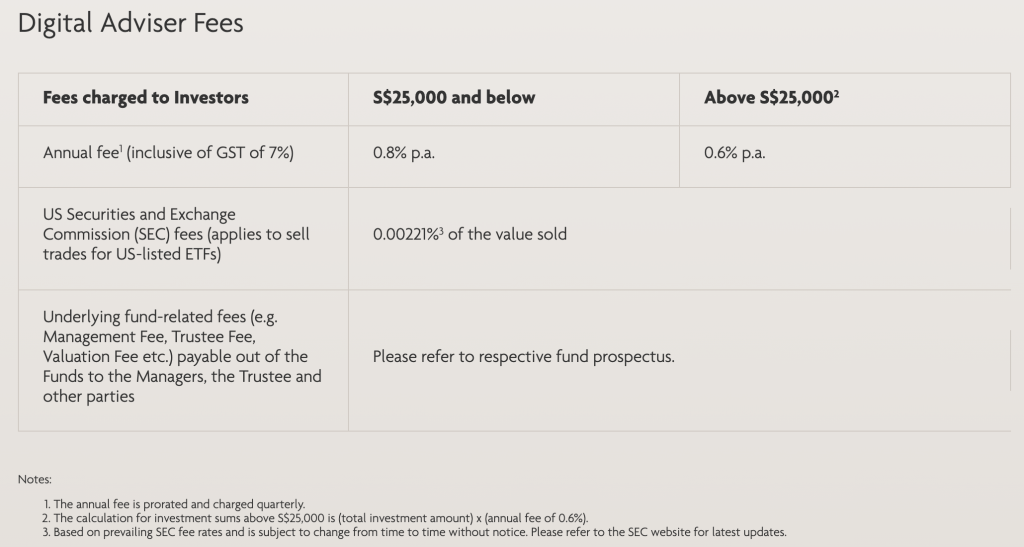

Fees for UOBAM Invest is 0.8% p.a. in case your account balance is below $25,000 and below and 0.6% p.a. in case your account balance is above $25,000. For example, if your portfolio is $30,000, you pay 0.6% p.a. ($180 each year) on the entire sum rather than charging a higher rate on the first $25,000. Fees are including the 7% GST but excluding SEC fees, which is charged when an investor's portfolio transacts on US-listed ETFs and underlying fund-level fees.

As another standalone mobile app, monitoring neglect the progress and setting new goals can be done from the palm of your hands.

You could possibly get started on UOBAM Invest without having to be a current customer of UOB. Based on our experience, you can register an account, set neglect the goals, and fund your bank account in just 10 minutes or less – something that is easily done on your daily commute or during a coffee break.

If you want to browse the UOBAM Invest app on your own, you are able to download it on the App Store or Google Play today.

You can also find out more about UOBAM Invest in this infographic on their own Invest Hub or our summarised version here: