Three causes there gained't be considered a 2021 housing industry crash

Why CPF Needs To Review Interest Rates For Our Ordinary, Special, MediSave And Retirement Account

From time to time, we may read in the newspapers that the CPF accounts interest rates will be maintained. For example, the Straits Times recently carried the piece “Minimum interest rates for CPF accounts monies to stay unchanged”, and the Business Times also published “Some CPF accounts to obtain minimum 4% interest rate extended”.

For the layperson reading this, we may be confused – what makes them telling us that the minimum interest rates that we are entitled to are being extended?

What These Articles Are Actually Trying To Tell Us

While some of the headlines could be clearer, these articles are not wrong and in fact delivering an important message.

According to the CPF Act, the CPF Board must declare an interest rate which “is not less than 2.5% per annum”. This represents the legislated floor rate we receive on our Ordinary Account (OA). And the declarations are done through the local media.

What About The Higher Interest Rates We Receive On Our Special, MediSave And Retirement Accounts?

By definition, the minimum 4.0% per year earned on our Special Account, MediSave Account and Retirement Account savings is not mandated in the CPF Act.

This is the same for the additional 1% we receive on the first $60,000 of our combined CPF balances (with up to $20,000 from Ordinary Account) as well as the extra additional 1% interest we receive around the first $30,000 after our Retirement Account is opened at age 55.

While the minimums for Special Account, MediSave Account and Retirement Account is not in the CPF Act, the CPF Act does suggest that the CPF Board “may declare different rates of interest for different part of the amount standing to the credit of a member within the Fund”.

Nevertheless, we don't expect the minimum interest rates for these CPF accounts to be suddenly removed either because the government has committed to them.

These Would be the Minimum Interest Rates – But We Can Also Receive More Than The Minimum

For a lot of us, it may also feel like the interest rates we get today are the default rates.

However, the CPF interest rates we receive on our CPF savings aren't fixed. They are calculated based on a formula. Here's how much the individual CPF accounts pay us:

| CPF Accounts | Interest Rate Formula | Floor Interest Rate | Review Frequency |

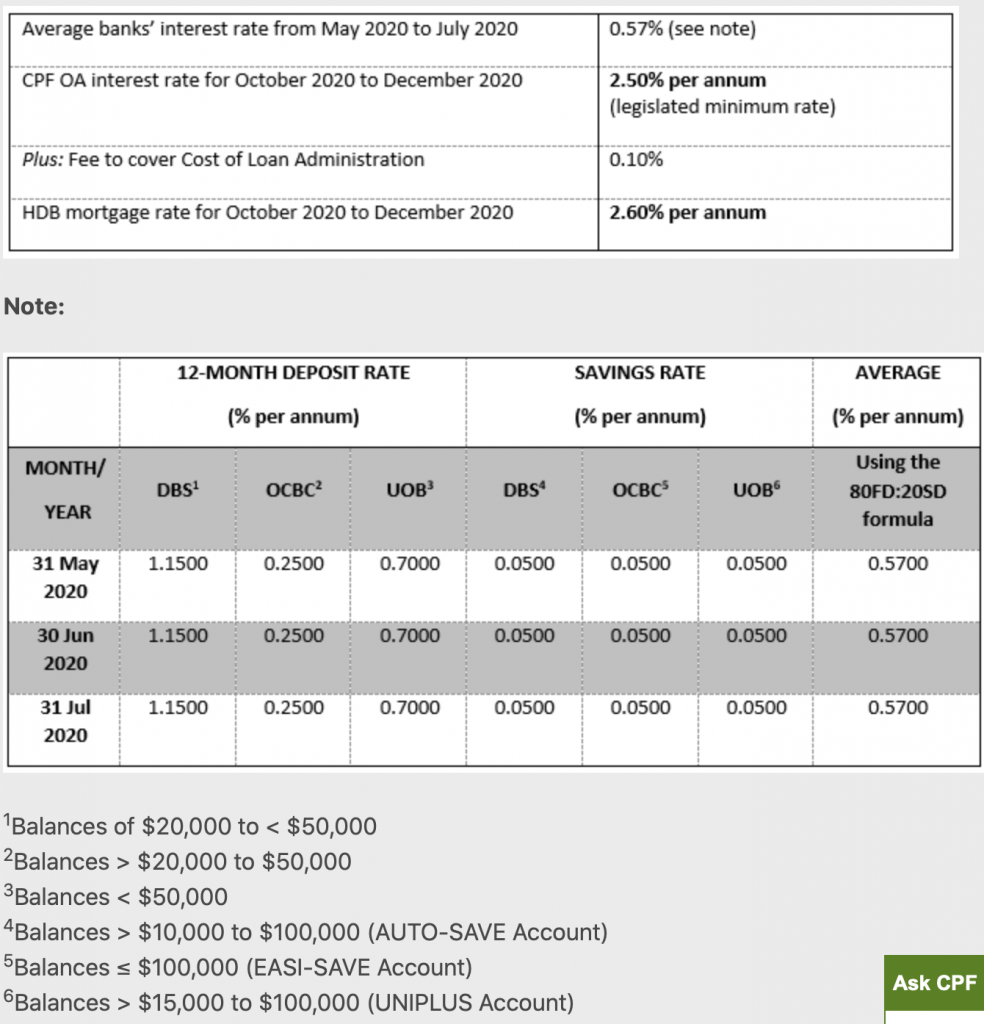

| Ordinary Account (OA) | 80% : 20% fixed deposit to savings rate of preceding 3-month average of major local banks' interest rates | 2.5% per annum | Quarterly |

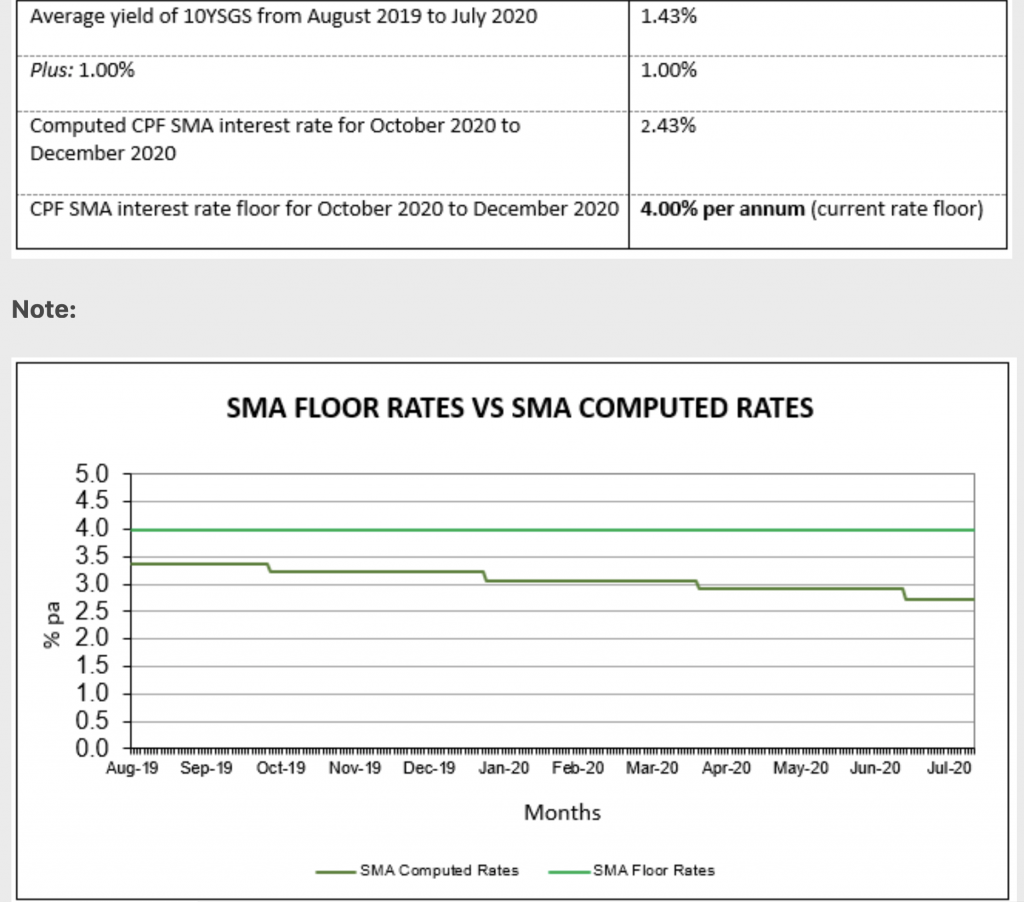

| Special Account (SA) | 12-month average yield of 10-year Singapore Government Securities plus 1% | 4.0% per annum | Quarterly |

| MediSave Account (MA) | 12-month average yield of 10-year Singapore Government Securities plus 1% | 4.0% per annum | Quarterly |

| Retirement Account (RA) | 12-month average yield of 10-year Singapore Government Securities plus 1% | 4.0% per annum | Annually |

The only reason we may think they are the default rates is the fact that interest rates have been so low for so very long that the formula constantly derives a lesser return than the floor rates.

For example, the newest calculation for the Special Account and MediSave Account in October to December 2021 would yield mortgage loan of 2.43% (even lower than the standard Account floor rate) – but we will continue to receive the Special Account and MediSave Account floor rate of four.0%.

Similarly, the Ordinary Account computation would have resulted in an interest return of 0.57% per annum. But we continue to get the legislated minimum of 2.5% per year. [Fictional scenario: The only downside to the ground rate is that our HDB Housing Loan would have been 0.1% more than the floor rate – offering us a beautiful 0.67%. But we obviously shouldn't view it that way.]

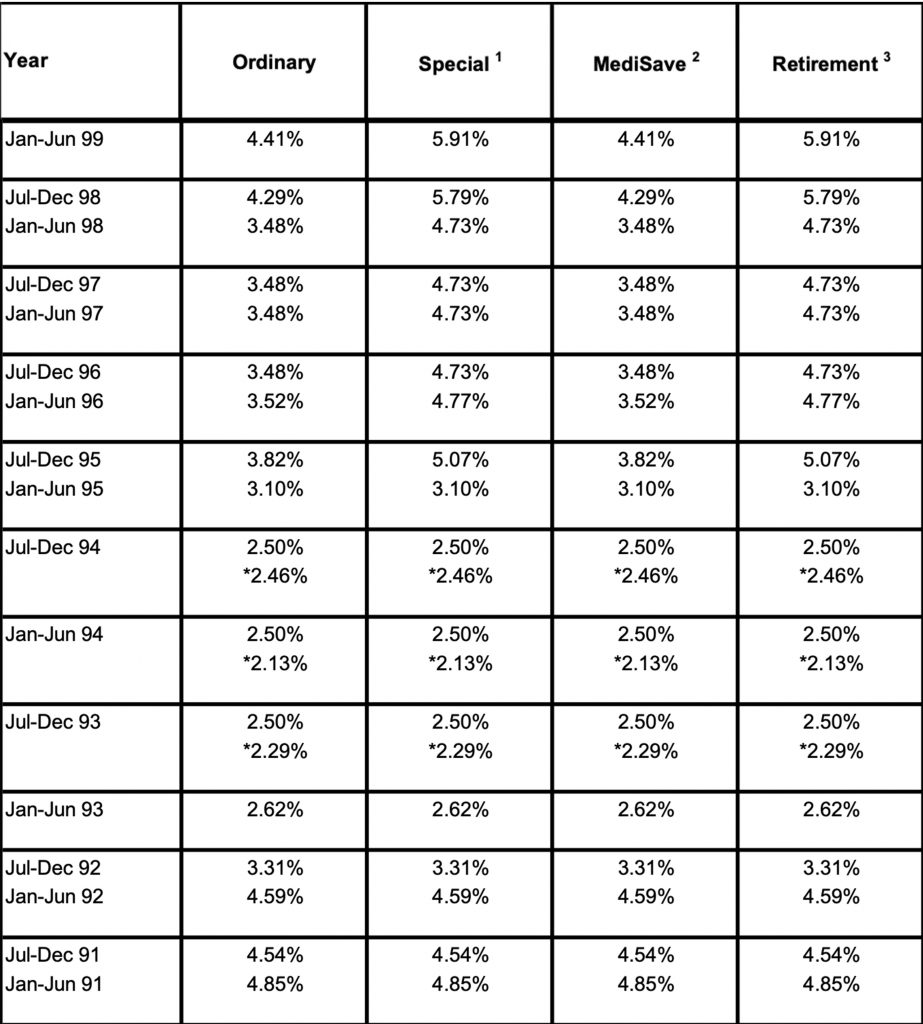

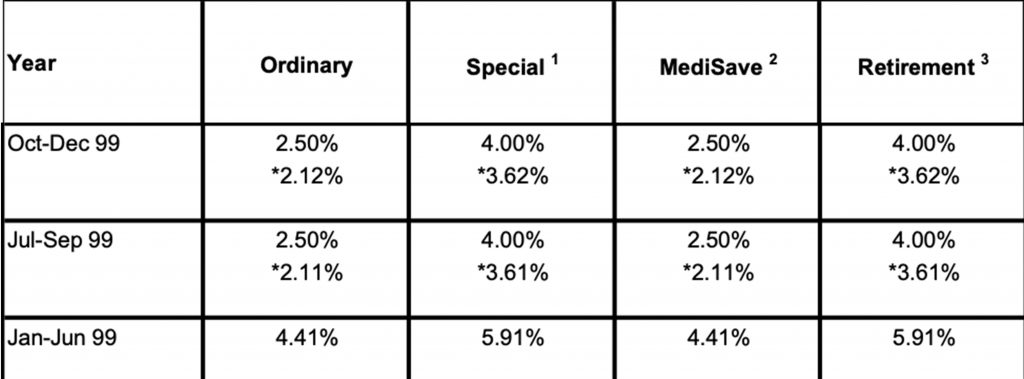

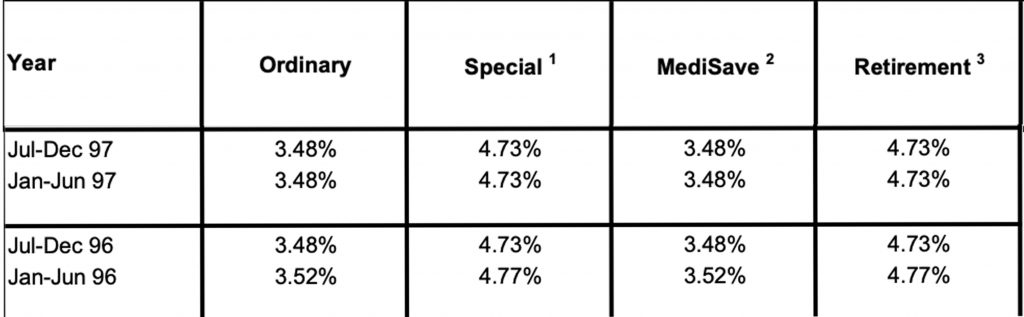

While it has been this way for a long time, it wasn't always the case. As you can tell from the table below, before 1999, we have received more than 4% on our Ordinary Account balances and also over 5% on our Special Account balances.

Going further back, we have received up to 6.5% interest on our Ordinary Account balances in 1986.

Why Are These Reviews Done And Announced?

For the standard Account, the legislated floor rate is 2.5%, and the CPF Board has a responsibility to declare the speed. However, the frequency of these declarations isn't found in the CPF Act.

For the Special Account, MediSave Account and Retirement Account, commonly referred to as SMRA, there is no legislated floor rate above the 2.5% level. Since 1 January 2008, the government pegged the interest rates on these accounts to instruments concentrating on the same risks – the 12-month average yield from the 10-year Singapore Government Securities plus 1%. Simultaneously, the government also committed to providing a floor rate of 4.0% on the SMRA accounts. It has been ongoing, and the comments are meant to inform us that the floor rate continues. In CPF's latest announcement, the ground rate will be extended to 31 December 2021.

Looking back, we are able to understand why the reviews and announcements might be important:

From 1 October 2001 to 2008, the government had committed to the SMRA paying out 1.5% above the Ordinary Account. It was then changed to the current formula but with a similar 4.0% interest floor rate.

From 1 July 1998 to at least one October 2001, the MediSave Account was not part of the government commitment to pay a floor rate of 4.0%. The government had only dedicated to paying an additional 1.5%, on top of the Ordinary Account interest, on our Special Account and Retirement Account. At the time, the only thing protecting our MediSave Account interest returns was the legislated minimum of 2.5% to be paid on our CPF savings.

Before that, between 1 July 1995 to at least one July 1998, the government commitment ended up being to pay the Special Account and Retirement Account 1.25% above the Ordinary Account interest.

As you can see, the government commitments to different accounts can change, and the announcements serve as timely updates around the CPF floor rates as well as the extension of the floor rates on our Special Account, MediSave Account, and Retirement Account.

The announcements for that interest rates reviews are delivered four times a year (quarterly), about two weeks before the new rates work.