Three causes there gained't be considered a 2021 housing industry crash

How Endowus Fund Smart Help Investors Create Unit Trusts Portfolio

Since their introduction in Singapore, robo-advisory platforms have been widely accepted by Singapore investors, both new and experienced. According to our latest count, a minimum of 11 financial institutions and financial technology (FinTech) firms offer robo-advisory investment services for investors in Singapore.

One from the main advantages robo-advisory platforms offer is allowing investors to enjoy a convenient, hands-off approach towards long-term investing. Investors don't need to choose which investments to make, because this is made on their behalf by the robo-advisory platforms.

They also do not have to worry about actively managing their investments as robo-advisory platforms are made to help investors optimise their long-term returns by selecting an optimal portfolio and managing it with respect to them.

Investors only need to choose 1) the risk tolerance level suitable for them, and 2) the amount they wish to invest, either via a regular savings plan and/or by looking into making a lump sum investment.

This hands-off approach towards investing is especially useful for new investors who're unsure of what they should purchase but would like to start investing. For a lot of investors, this also works since they may not have the investment knowledge or inclination to determine what to invest in.

The Limitations With Robo-Advisory Platforms

One main drawback for many robo-advisory platforms is an inability for investors to customise their own portfolios. Some experienced investors may prefer to have some control over their portfolios, rather than allowing the robo-advisory platforms to invest on their behalf. Others may want greater or lesser contact with certain sectors.

For example, it is a well-known fact that most robo-advisory platforms have extensive exposure to U.S. indices such as the S&P 500 and the NASDAQ. Both S&P 500 and the NASDAQ are heavily exposed to technology companies. For example, the five biggest stocks on the S&P 500 (Apple, Microsoft, Amazon, Facebook, Alphabet) are technology stocks and they account for about 28.7% of the index.

If you're new to investing, having exposure to these companies makes sense as they are a few of the world's biggest, fastest-growing and most profitable companies. However, if you are a self-directed investor who already owns individual stocks or ETFs that invests during these companies, your investments via a robo-advisory platform simply improve your exposure to these companies – which may be something don't want.

Alternatively, you may be working in one of these simple technology companies and may prefer to not have a large component of your investment portfolio sharing exactly the same exposure as your job.

Investing In Individual Stocks, ETFs & Bonds Instead?

An alternative option to the problems mentioned above is to simply invest by yourself. When you invest on your own, you've full control over what you purchase, how much to invest in each stock, ETF or bond, so when you wish to sell them. You don't need to let a robo-advisory platform decide this for you personally.

The challenge for many self-directed investors is certainly not they are unsure about what to invest in (otherwise, they wouldn't be self-directed to begin with) but rather, having to manage their investment portfolio consistently over 10, 20 or even 30 years and more.

Setting your investment objectives and making the initial investment isn't difficult. Handling the portfolio and having to rebalance it consistently, especially during volatile periods, may be the harder task. This is what self-directed investors have to be ready for if they want full control over what they invest in. You do not want to be caught out overseas on a journey when the market suddenly crashes like what happened in 2021.

As a self-directed investor, you will also incur brokerage fees when you constantly buy and sell stocks to rebalance your portfolio, or you only want to invest a small monthly sum each month.

How Endowus Fund Smart Helps Investors To construct Their Own Investment Portfolio

To provide investors with increased choice and control over their investment portfolio and also at the same time, provide robo-advisory services for example allowing investors to have a hands-off approach towards managing their portfolio, Endowus has introduced a new advisory service feature – Endowus Fund Smart – to assist investors create their own best-in-class unit investment portfolio, guided and advised through the Endowus platform.

Instead of the main advised portfolio that many Endowus investors are currently familiar with, investors can pick a combination of up to 8 funds from a carefully curated list of 55 funds. Endowus has done the heavy lifting of identifying these 55 funds as the best-in-class. This includes the likes of Shariah-Compliant Funds (Templeton Shariah Global Equity Fund), Asian Growth Fund (Schroder Asian Growth Fund) and bond funds (PIMCO GIS Income Fund). Some of the funds that you see on offer will also look familiar (e.g. Lion Global SGD Money Market Fund) as these are the same funds that are also being used by other robo-advisory platforms. You can refer to the full list of funds here.

Advice In your Customised Portfolio Based On Your Risk Tolerance

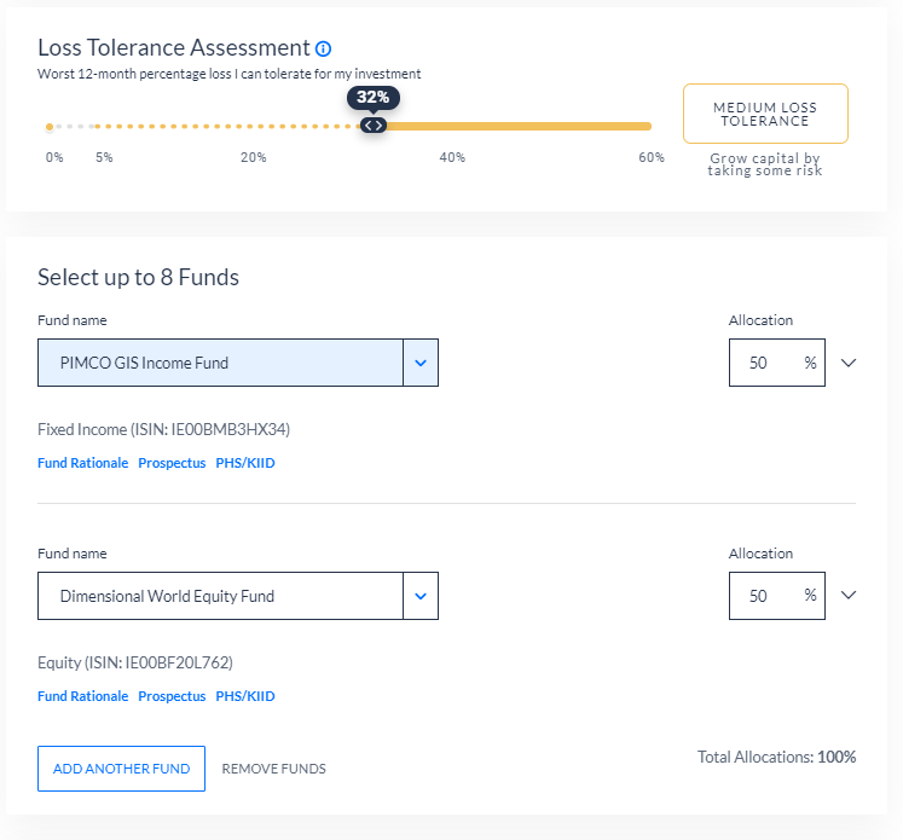

Similar to its core advised portfolio, Endowus will have to understand a client's risk profile first. Clients will need to share their financial goals, annual income and risk tolerance level. After that investors are allowed to choose the funds that they wish to own, and the percentage allocation into each fund.

Once you have selected the funds you need to invest in, Endowus will provide you with the historical performance of the funds. It will also give you a unique portfolio simulation of how your investment portfolio may perform in varying market conditions because of the weightage that you have allocated to each fund that you have selected.

This is exceptionally useful because as investors, we can't expect certainty of outcome. Rather, what we need to be aware of are the likely projections given varying market conditions.

Unlike the Endowus advised portfolio, the Endowus Fund Smart will require you to select 1) the funds that you would like to invest in (from 1 to 8 funds out of a list of 55 funds) and a pair of) the allocation that you wish to set for each fund. You decide this, not Endowus.

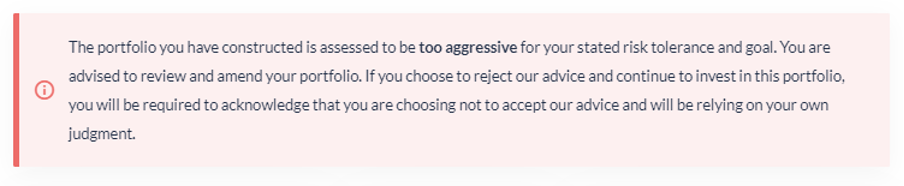

That said, if the investment portfolio that you have created is not aligned with your risk tolerance level, Endowus will state you of this to ensure that you are fully aware of the risk that you are taking.

While Endowus can tell you if the risk that you are taking may be higher than your ideal risk tolerance level, clients will always have the final say on the investment that they wish to make.

What Endowus can help you with is ensuring that neglect the portfolio will continue to be balanced consistent with your desired asset allocation. For instance, if you choose to invest in 4 funds with an equal weightage of 25% for each fund, and one of the funds dipped to 10% while the remaining funds now hold 30% from the portfolio allocation each, Endowus will rebalance the portfolio such that the weightage for the 4 funds reverts to 25% each.

In short, as an investor, you get full control and choice over the funds that you want to purchase, while Endowus helps you to manage it over the long-term.

To be clear, Endowus Fund Smart isn't necessarily a better product compared to the main advised portfolio that many Endowus investors are likely already using. If you are a new investor, or even an experienced investor who agrees with the way Endowus approach investing, then your advised portfolio will likely be more suitable for you.

However, if you are a self-directed investor who wants to choose the funds you want to purchase, but still, wants access to Endowus robo-advisory services, the Endowus Fund Smart is worth looking at.

Endowus will also be launching a series of recommended portfolios called Endowus Model portfolio, which include a more defensive 100% fixed income portfolio to weather volatility in markets and preserve your capital.

Besides the truth that investors can choose up to 8 funds that they wish to invest in to build their customised portfolio, Endowus Fund Smart investors will continue to enjoy the benefits that all Endowus investors get.

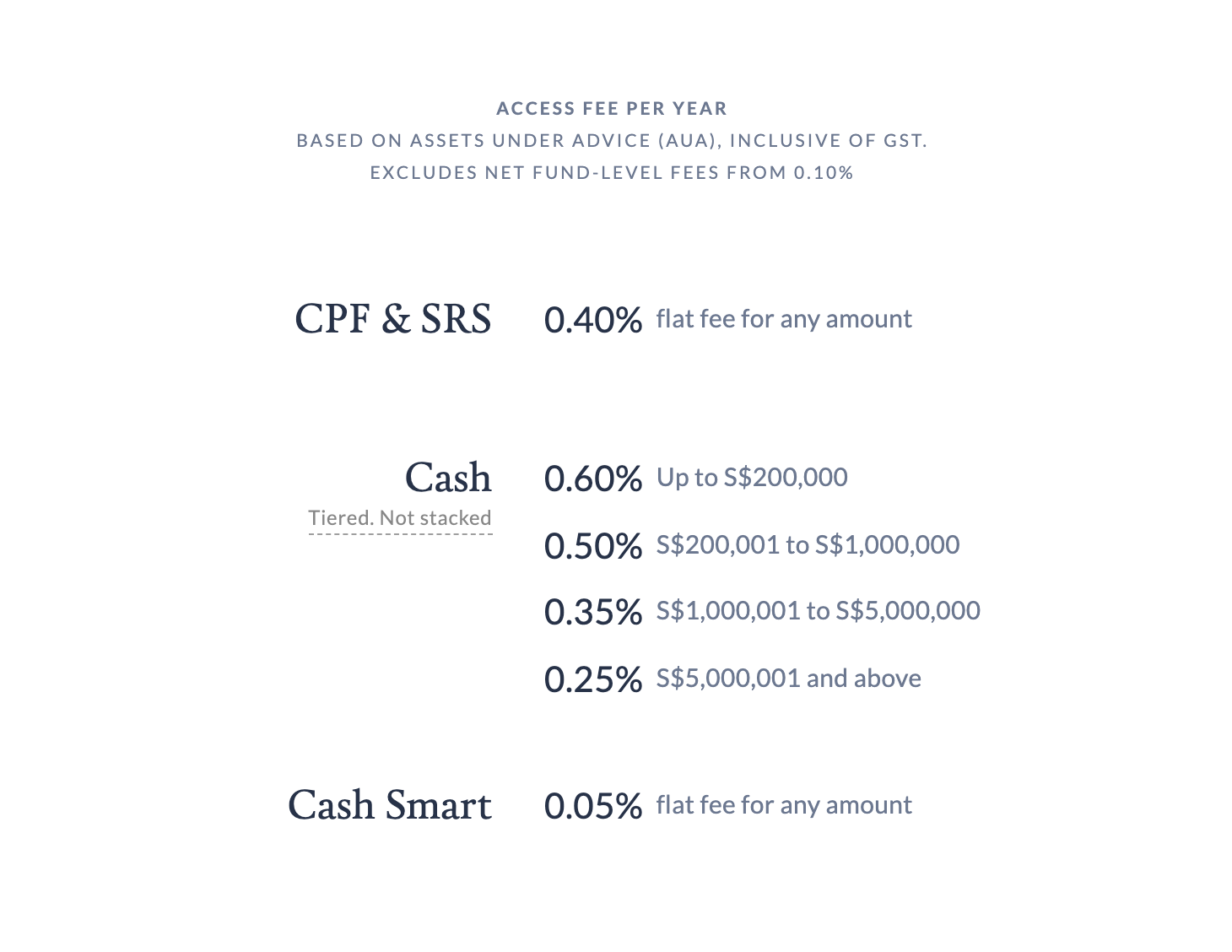

For a start, any trailer fee that is payable by the mutual fund is automatically passed back to investors. This means that investors end up paying a lower fee investing through Endowus as compared to using other platforms to invest in the same funds.

For the Endowus Fund Smart, the platform fee is similar to its Endowus Advised Portfolios. This all-in-one access fee includes regular rebalancing of the portfolio as well as brokerage fees for transactions. Similar to its advised portfolio, investors could make regular monthly investments into a portfolio as high as 8 funds from as little as $100 per month, with the initial minimum investment of $1,000. Investors can use a combination of cash, CPF or SRS funds to invest.

For self-direct investors who want to decide where you can park their money, Endowus Fund Smart enables them to choose the right allocation of funds to purchase but at the same time, without having to worry constantly about the asset allocation mix since rebalancing will be done automatically by Endowus.

This makes it a viable strategy for long-term investing as your funds is going to be managed in accordance with your preference, without resorting to you to be hands-on all the time.

Even if like us, you're already an existing Endowus investor using their core advised portfolio, you can still choose to own a separate investment portfolio that includes unit trusts that have been selected based on your personal preference. This gives you two portfolios. One which is fully managed on your behalf by the Endowus investment team, an additional portfolio where the investment decisions are decided by you.

If you are new to Endowus and would like to start investing through them today, DollarsAndSense has a special partnership with Endowus where readers can enjoy $10,000 managed free for six months (equivalent to $20). Sign up for it here today and enjoy your discount.