Three causes there gained't be considered a 2021 housing industry crash

The World of Margin Financing: How It Works & How It May Help Your Investment

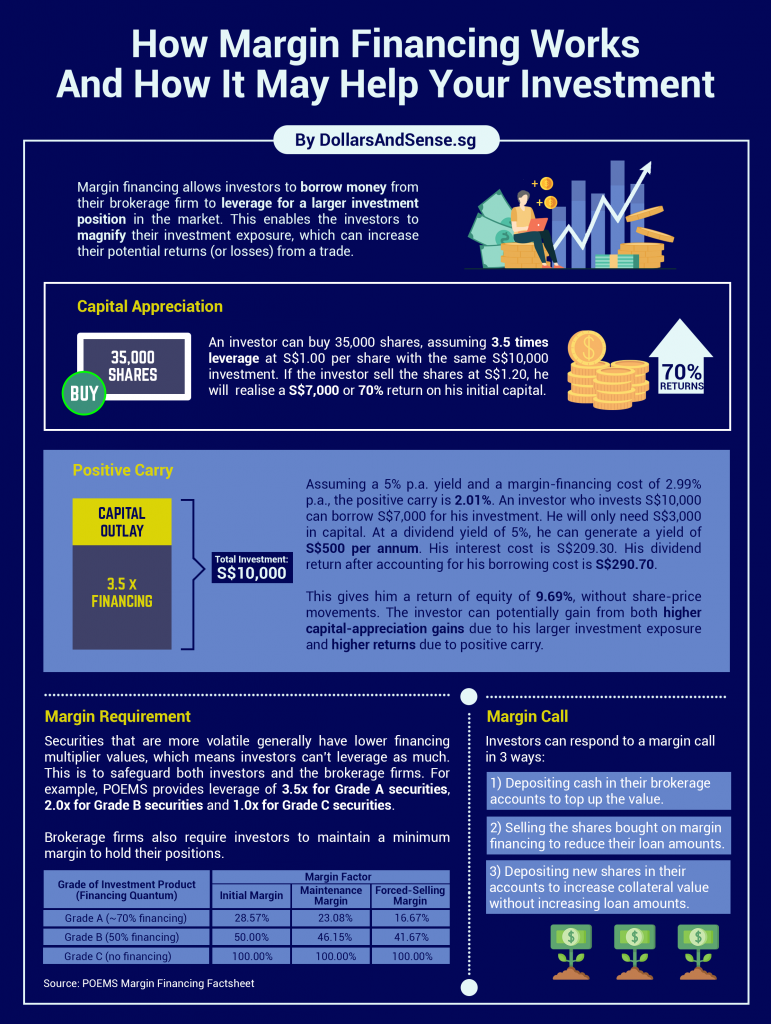

Margin financing allows investors to borrow money from their brokerage firm to leverage for a bigger investment position in the market. This permits the investors to magnify their investment exposure, which could increase their potential returns (or losses) from the trade.

Without margin financing, an investor who wants to invest in Company A, which is trading at S$1.00 per share, can buy 10,000 shares with S$10,000 in cash. If the price of the shares rises to S$1.20, the investor realises a tidy return of S$2,000 or 20% of his capital if he sells his shares. A trading platform that provides you with margin financing will help you increase your return.

Why Use Margin Financing?

By leveraging margin financing, the investor can buy 35,000 shares – assuming 3.Five times leverage – at S$1.00 per tell the same S$10,000 investment. If he sells his shares at S$1.20, he realises a S$7,000 or 70% return on his initial capital.

Besides capital appreciation within the above example, margin financing may be used to create positive carry. This describes a situation whereby the investor makes a higher return from his REIT dividends than the interest he pays for his borrowed funds.

Based on 3Q2021 performances, the distribution yield of numerous S-REITs right now is about 5-10%. If we assume a 5% p.a. yield along with a margin-financing cost of 2.99% p.a., the positive carry is 2.01%. The gains from this trade can potentially be magnified by margin financing.

For example, a trader who invests S$10,000 can borrow S$7,000 for his investment. He will only need S$3,000 in capital. At a dividend yield of 5%, he can generate a yield of S$500 per annum (5% of $10,000). His interest cost is S$209.30 (2.99% of $7,000). His dividend return after accounting for his borrowing cost is S$290.70.

This gives him a return of equity of 9.69% (S$290.70/S$3,000), without share-price movements. The investor can potentially gain from both: 1) higher capital-appreciation gains because of his larger investment exposure; and 2) higher returns due to positive carry.

This is, obviously, a simplistic example.

In reality, margin financing is generally more complicated. It increases the risks – and thus potential returns – for an investor. The use of leverage is always a double-edged sword. If prices move against you, your losses will be magnified by your greater investment exposure as well. This is why prudent and active risk management is important when investing through margin financing.

Margin Requirement

Many stock brokerage accounts, like the Margin (M) account by Phillip Securities (POEMS) provide margin-financing options. These are suitable for investors who trade and monitor markets more actively. They can utilise margin financing to buy more shares and potentially earn higher returns without forking out more money upfront.

Brokerage firms typically have a financing multiplier value that determines just how much funding for each security they are willing to provide investors. The more stable or safer a burglar, the higher the financing multiplier value tends to be. Securities that are more volatile have lower financing multiplier values, meaning investors can't leverage just as much. This is to safeguard both investors and the brokerage firms.

For example, POEMS provides leverage of three.5x for Grade A securities, 2.0x for Grade B securities and 1.0x for Grade C securities.

It's a little technical, so we have provided a table to illustrate how the financing multiplier works.

| Investment Type | Financing Multiplier Value | Your Potential Market Exposure With Capital Of S$10,000 | How Much Funds You are able to Borrow |

| Grade A | 3.5 | S$35,000 | S$25,000 |

| Grade B | 2.0 | S$20,000 | S$10,000 |

| Grade C | 1.0 | S$10,000 | S$0 |

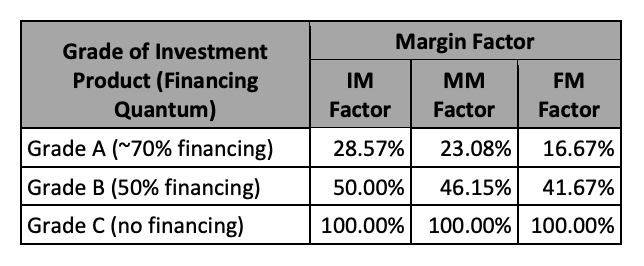

Brokerage firms require investors to keep a minimum margin to hold their positions. For each type of investment, the Initial Margin (IM) to spread out a position, the Maintenance Margin (MM) to hold the position and the Forced-Selling Margin (FM) or minimum margin requirement before forced-selling of the investment kicks in, will be different.

So, if you are investing in Grade A securities, your capital of S$10,000 will allow you to buy up to S$35,000 price of Grade A securities. Which means that your IM is 28.57% (S$10,000/S$35,000).

To keep your position, your MM is 23.08%. If this margin hits the FM of 16.67% because of a drop in the price of your securities, your brokerage will make a margin call on your securities.

Depending around the product, the IM, MM and FM may differ.

Margin Call

Here's how it works.

If you had deposited S$10,000 cash to buy S$35,000 worth of Grade A securities and their investment value falls to S$30,000:

Your cash balance = S$10,000 – S$35,000 = – S$25,000

Your equity balance = – S$25,000 + S$30,000 (current worth of Grade A securities) = S$5,000

Your margin call = S$30,000 X 23.08% (MM) = S$6,924 – S$5,000 (equity balance) = S$1,924.

Investors can respond to a margin call in three ways, by:

1) Depositing cash in their brokerage accounts to top-up the value. This will increase the total collateral value in their accounts

2) Selling the shares bought on margin financing to reduce their loan amounts, or

3) Depositing new shares in their accounts to increase collateral value without increasing loans.

While investors may buy Grade A securities with as many as 3.5x the cash they deposit, they may choose to be more conservative in their gearing.

Ensuring that clients own equities at a comfortable level is vital as neither your brokerage nor you would want to run the risk of having the total value of your investments fall below your borrowing sum.

To learn more, check out the POEMS Margin (M) Account factsheet.

Cost Of Margin Financing

Margin financing comes at a cost.

Investors are ultimately borrowing funds to create their investments. The cost of the funds varies, depending on the broker and currencies you borrow in. This means you would want to ensure that the returns you like from your trades outweigh the price of your borrowing.

Some brokerage firms like Phillip Securities (POEMS) allow you to borrow in foreign currencies like the US$, HK$ and EUR. This means you can utilise margin financing for overseas share purchases too.

For the Margin (M) account by Phillip Securities (POEMS), you may enjoy up to 70% financing for 2,000 stocks across 11 international markets. Financing is available in nine currencies and clients can maintain credit balances in 10 currencies.

To look into the financing cost of each currency, make reference to our Margin (M) account infosheet or speak to your POEMS dealer.

At the moment, you'll enjoy margin financing at 2.99% p.a. for SG$, 3.50% p.a. for US$ and 3.60% p.a. HK$ when you open a new Margin (M) account with POEMS. This promotion is just applicable to POEMS customers who have not opened a margin account before.

You will discover more on the promotion here. If you are keen, you can sign up for a merchant account here today.

Read also: POEMS Cash Plus Account: Complete Help guide to Understanding This Low Cost Trading Account

While margin financing enables you to leverage and multiply your potential rewards, the risks are also correspondingly higher. Check out our infographic below for any quick summary of how margin financing works and just how it may help your investment.