Three causes there gained't be considered a 2021 housing industry crash

Should You Make Lump Sum Top-Ups Or Regular Contributions For The CPF Retirement Sum Topping-Up Scheme

By now, you're probably familiar with the advantages of making voluntary CPF top-ups – such as tax reliefs, government matching, or to earn guaranteed, risk-free interest to attain 1M65.

So if you've decided you want to make CPF top-ups on your own or your loved ones, the only thing left to reply to is how you want to do it: inside a lump sum, or making regular contributions monthly.

How Interest In your CPF Monies Calculated – And Credited To You

Any discussion on CPF contributions frequency must take place in the context of how CPF interest is calculated and credited.

The good news is that interest on our CPF monies is computed monthly. Top-ups and contributions will begin to earn us pro-rated interest in the next month onwards, while withdrawals and deductions stop earning us interest in the month they are made.

In layman's terms, you can think of the amount of interest you will earn in a given month as being in line with the lowest level of balances you've – since any new top-ups would only begin to earn interest the following month, and anything you withdraw would not earn interest for you.

All the interest owed to us for any given year will be credited to our respective CPF accounts by 1 January the following year, which means our CPF monies compound annually.

Scenario #1: What goes on When You Make Monthly CPF Top-Ups

As we are able to see from the previous section, any top-ups we make will begin to earn pro-rated interest for the year when the following month. Any top-ups to our CPF made in January would earn 11 months of great interest, and delaying that top-up till the end of the year would mean i will be missing out that interest.

Here's an easy illustration of the interest we'll earn if we make $100 in top-ups a month to our CPF Retirement Account:

| Month | Amount Of Interest Earned On $100 (Months To Earn Interest / 12 x 4% x $100) |

| January | $3.67 |

| February | $3.33 |

| March | $3.00 |

| April | $2.67 |

| May | $2.33 |

| June | $2.00 |

| July | $1.67 |

| August | $1.33 |

| September | $1.00 |

| October | $0.67 |

| November | $0.33 |

| December | $0.00 |

| Total | $22.00 |

As you can see, you would be better off by $22, compared to someone who contributed the exact same amount inside a lump sum at the end of the year.

Of course, one might say that contributing a lump sum in January would be even better, which is true – if you had the money lying around. The main point would be that the sooner you make top-ups, the sooner they are able to begin generating good, risk-free returns for you personally.

The same logic applies to making CPF transfers out of your CPF Ordinary Account to your Special Account/Retirement Account.

Scenario #2: The reason why you May Want To Wait And Make Lump sum payment Top-Ups At The End Of The Year

We've learnt that creating top-ups (and transfers) as soon as you could make mathematical sense, but flexibility may be one reason why someone would wait till the end of year to make CPF top-ups.

The extra money buffer might be useful for many, plus some would also like the benefit of knowing their income for that year and the total deductions they're eligible for to help them decide how much they wish to top-up to their CPF for tax relief benefits.

In those cases, there can be some sense in waiting before committing to making the CPF top-ups, which we all know is irreversible.

Scenario #3: Making A Lump Sum Top-Up At The Beginning Of The Year

Those who appreciate the sooner you make your CPF top-up, the sooner your funds can begin generating returns for you personally, might wish to consider the third option should they have the cash on hand: To make CPF top-ups at the beginning of the year.

While this approach would provide the greatest returns of the 3 scenarios, but would be also the least flexible, since CPF top-ups are one-way, and also you would lose the ability to wait up until the end of the year to evaluate how much you want to commit to your CPF (for tax relief or spare cash reasons).

Automating Your Regular CPF Cash Top-Ups – Monthly/Annually

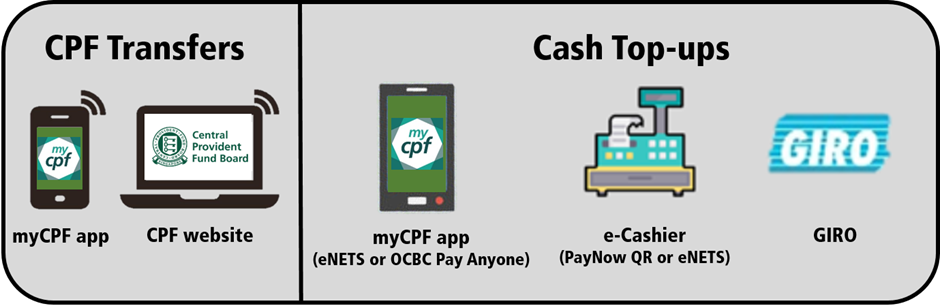

As you know cash top-ups can be made using three ways:

– myCPF app on Android or iOS (using eNETS or OCBC Pay Anyone)

– CPF e-Cashier service using eNETS or PayNow QR)

– GIRO (monthly or yearly instruction)

For those who want to make regular monthly contributions, you should use GIRO to automate this process, by completing and mailing in the Top Up Retirement Sum Using GIRO form to CPF Board, Robinson Road, P.O. Box 3060, Singapore 905060.

Upon approval, GIRO deduction will begin on the 15th of every subsequent month. If the 15th falls on a non-working day (Saturday, Sunday or Public Holiday), deduction will be made on the next morning.

You will need to ensure you maintain sufficient funds inside your bank account for the deductions to go through successfully, since banks may charge an admin fee for unsuccessful deductions.

If you intend to amend your GIRO instructions (such as changing the amount or frequency), you can complete and mail in the Top Up Retirement Sum Using GIRO form. For those who want to terminate the GIRO arrangement, you are able to submit a request via the CPF website.