Three causes there gained't be considered a 2021 housing industry crash

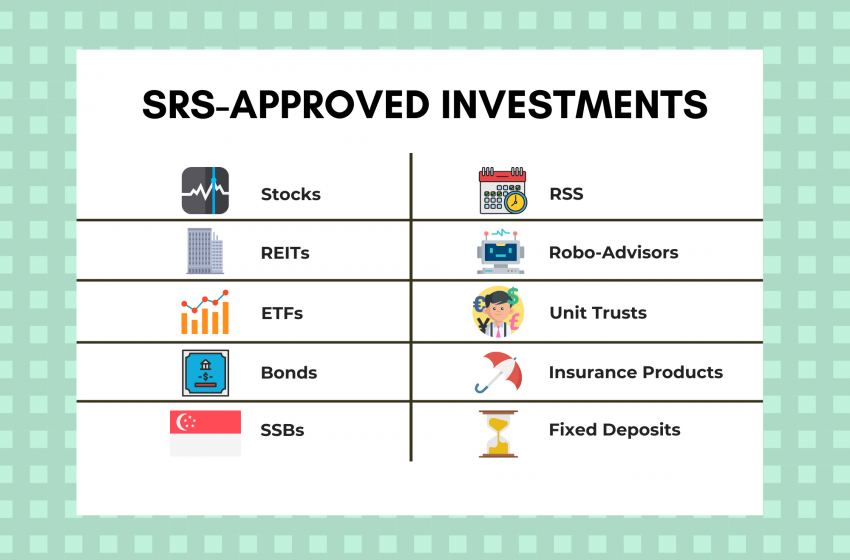

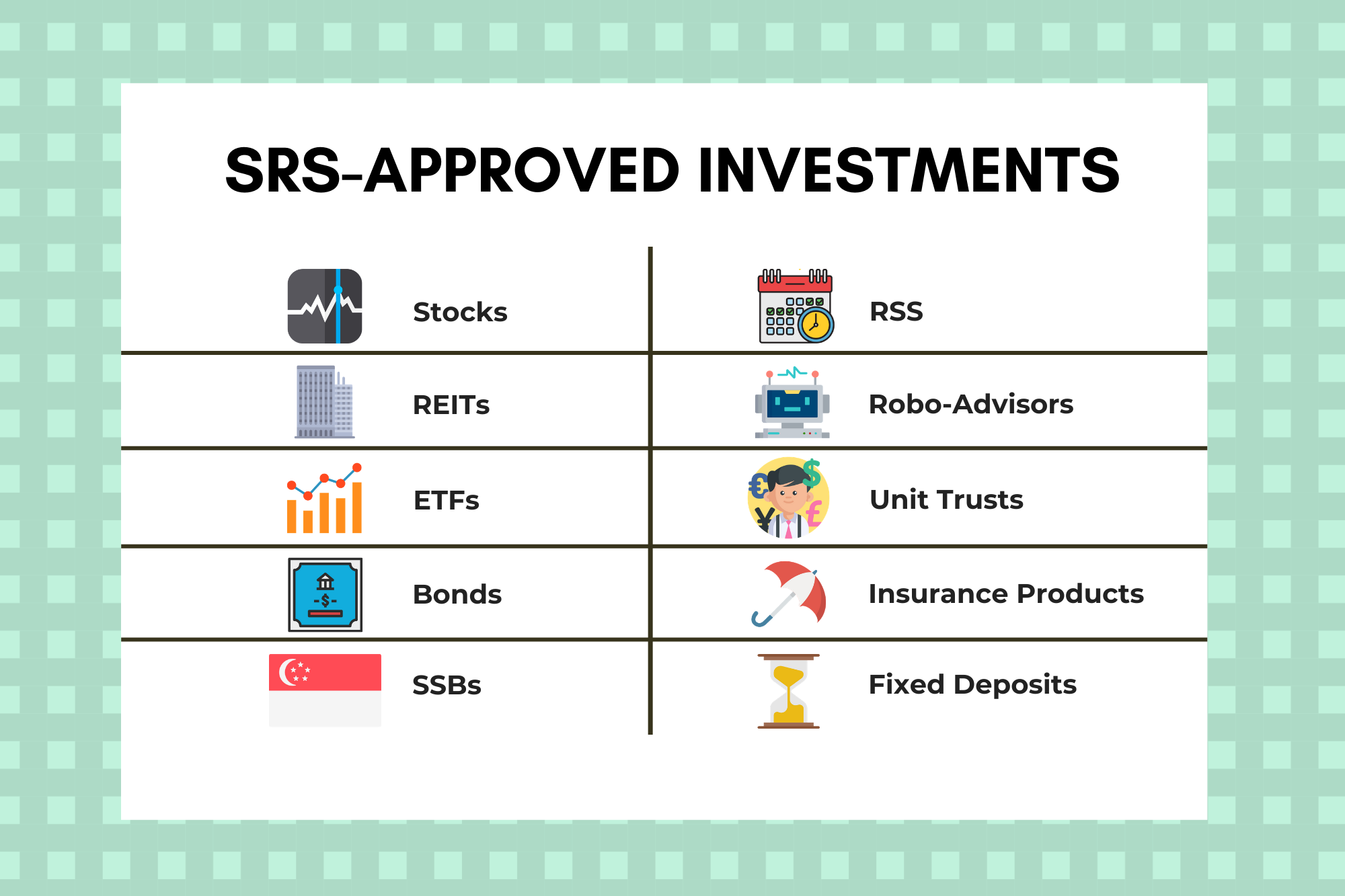

10 Investments You Can Make With Your Supplementary Retirement Scheme (SRS) Account

Started in 2001, the Supplementary Retirement Scheme (SRS) is a voluntary initiative that forms a part of Singapore's multi-pronged strategy to help citizens, permanent residents (PRs) and foreigners begin to build up their retirement nest egg.

As an incentive to contribute to our SRS accounts will get a dollar-for-dollar tax relief up to $15,300 for citizens and PRs and $35,700 for foreigners. Note that we have a personal income tax relief cap of $80,000 each year.

To start contributing to our SRS account, we have to first open an SRS account with either DBS, OCBC or UOB, what are three SRS operators in Singapore. We're not tied down to these operators after opening our SRS accounts and can choose to invest in all available SRS investments with other financial institutions.

Finally, we can only start withdrawing once we hit the statutory retirement of 62. As announced by the government, Singapore’s statutory retirement is set to increase to 65 by about 2030. For this reason it makes sense to open an SRS account now to “lock in” the current statutory retirement age for withdrawals.

Subsequently, upon our first withdrawal, we will have a 10-year window to withdraw the entire amount of our SRS funds. We have to understand that the SRS is a tax deferral system, meaning we will be taxed on our SRS withdrawals. 50% of our SRS withdrawals will be taxable. For example, if we withdraw $40,000 from our SRS account during the year, we will only be taxed on $20,000. We have to note that there will be a 5% penalty as well as 100% taxation on withdrawals for those who take out funds before the statutory retirement age of 62.

Importance Of Investing Your SRS Contributions

Funds that we contribute into our SRS account earns an interest rate of 0.05% per annum (p.a.). This means that if we want to meaningfully grow our retirement nest egg, we need to invest our SRS funds to earn better returns.

This is very different from voluntarily contributing to our CPF Special Account (SA), where funds earn basics interest rate of 4.0% p.a.

Thus, even though we can invest a portion in our CPF balances, we may not need to. Conversely, even though we can allow our funds to sit in our SRS accounts, we have to invest to see a meaningful return.

In reality, 29% of all SRS contributions, or $3.1 billion, remain sitting idle in cash or Singapore Dollar fixed deposit as at December 2021. Knowing that, here are 10 investments we are able to all make with our SRS accounts right now to grow our retirement portfolio.

# 1 Stocks

We can purchase stocks listed on the Singapore Exchange (SGX) with our SRS funds. We don't have to invest through the banks administering our SRS accounts – we can continue using our brokers in most instances.

This is especially handy for investors who're already funnelling a chunk of our savings into locally-listed stocks. This way, we are just going to continue making investments, while saving on our taxes in return.

# 2 REITs

Similar to investing in stocks, we can invest in real estate investment trusts (REITs) that are listed in Singapore. Again, since REITs are purchased and sold like stocks, we can continue to use our existing brokerage firms to create such investments.

REITs tend to shell out higher distributions, and we have to note that these distributions will be channelled back into our SRS accounts instead of come to us in liquid cash.

# 3 ETFs

Short for Exchange Traded Funds, ETFs typically replicate the composition of a broad index tracking regional or country indexes, stocks inside a particular sector, REITs, bonds, commodities and other financial instruments.

In Singapore, there are two ETFs tracking the country's Straits Times Index (STI) – the SPDR STI ETF and the Nikko AM Singapore STI ETF. There are also bond ETFs, the ABF Singapore Bond Fund comprise bonds issued by the Singapore government and Singapore government-linked entities, as the Nikko AM SGD Investment Grade Corporate Bond ETF comprise corporate bonds issued by investment-grade issuers. There are many other ETFs also on the SGX, with three REIT ETFs, the SPDR Gold Shares and many more.

# 4 Bonds

Several bonds are also listed on the SGX, and we can invest our SRS funds in these bonds. These include Temasek’s T2023 S$ bonds and Temasek-linked Astrea IV private equity finance bonds, as well as retail bonds which have been listed on SGX.

# 5 Singapore Savings Bonds

From December 2021, the Monetary Authority of Singapore (MAS) announced they would allow investors to buy Singapore Savings Bonds using our SRS funds, in addition to double the amount of SSBs that an individual can hold to $200,000 from $100,000 previously.

# 6 Regular Shares Savings (RSS)

A regular shares savings (RSS) plan allows us to start investing in stocks, bonds, ETFs and REITs on the SGX from as little as $100 a month. It's an ideal way for investors with limited knowledge and interest in monitoring their portfolio to start their investment journey.

In Singapore, there are four brokerages currently offering RSS plans – OCBC Blue Chip Investment Plan; POSB/DBS Invest-Saver; Phillip Share Builders Plan; and FSMOne ETF Regular Savings Plan. Each one has its own specifications of which types of shares we can invest in and brokerage charges we must pay.

# 7 Robo-Advisors

As more investment tools become open to us, we can also start incorporating them into our portfolio. Majority of robo-advisory firms aim to utilise complex algorithms to offer retail investors access to professional portfolio management services. We can also tap on robos to fit our SRS top-ups into less risky cash management accounts – which enables us to earn a better interest than just letting it sit idle.

The following robo-advisors allow us to invest our SRS funds together:

- MoneyOwl

- StashAway

- Endowus

Launched in 2021, MoneyOwl is a joint venture between NTUC Enterprise and Providend. It offers bionic investment advice – which means it incorporates advice from both humans and robots to deliver low-cost investment solution to its clients. Currently, MoneyOwl offers 5 investment profiles – Equity, Growth, Balanced, Moderate and Conversative – which are created through different combinations of 3 globally diversified Dimensional equity and bond funds, according to their ability, willingness and need to consider risks.

Founded in 2021, StashAway uses an Economic Regine-based Asset Allocation, its proprietary investment strategy to manage portfolios. It also charges an aggressive rate and advocates investing within the long-term.

Enjoy 50% Management Fees For 6 Months With StashAway

For those people who are interested to try the StashAway platform for yourself, StashAway is giving 50% off in management fees for 6 months, for up to $50,000 in portfolio value.

That makes it perfect for giving StashAway a try and see if it is the robo-advisor for you. You are able to sign-up for free today to enjoy this exclusive promotion.

Endowus is really a fee-based digital financial advisor, offering best-in-class global unit trust investments by Dimensional Fund Advisory, PIMCO, First State Investments, Eastspring Investments, Vanguard, Shroders yet others at the lowest costs. Endowus rebates trailer fees to the clients, thus branding themselves as independent advisor that only gets paid by their customers.

Invest Better With Endowus

If you’re interested to begin investing with Endowus, you’ll gladly know that DollarsAndSense readers can have their first $10,000 managed for free for 6 months, which means savings of $20 in fees. Sign-up by using this link to claim this special offer. Terms & Conditions apply.

# 8 Unit Trusts/Mutual Funds

We can also invest in unit trust and mutual funds with this SRS funds. Remember, this extends to unit trusts outside of the three SRS administrators – meaning we are not limited to investing in unit trusts which are sold by them.

Platforms such as FSMOne and Aviva's Navigator, dollarDEX allows you to invest in diverse unit trusts investments with your SRS funds. These platforms also enable us to find the regions, sectors and even fund managers we are comfortable investing our funds in.

# 9 Insurance Products/Annuities

We may also put our SRS funds towards insurance products and annuities. About this point, we have to note that there are restrictions on Life Insurance items that we can buy. Typically, we are able to invest in only single-premium products, including recurrent single premium products. We also aren't allowed to purchase critical illness, health and long-term care products with our SRS funds.

We have to check with our agents and/or insurers to invest with our SRS funds. MoneyOwl is an example of one such platform we are able to use to purchase retirement income plans with this SRS funds.

# 10 Fixed Deposits

If we are extremely risk-averse and unsure of how to handle our funds, we can invest in fixed deposits rather than allow it to sit idly in cash. By doing this, we're pretty much exposed to the same extremely low level of risk but getting a significantly improved interest rate return on our SRS funds.

The SRS Is A Powerful Tool To Save On Taxes And Encourage Us To construct Our Retirement Nest Egg

The Supplementary Retirement Scheme provides for us the dual benefit of saving on taxes today as well as encouraging us to invest for our retirement.

Many people may procrastinate retirement planning today as we don't see an immediate benefit. The SRS helps resolve some of this issue by giving us a tangible benefit, of coughing up lower taxes in the following year of assessment immediately.

We may also be more in-tuned to investing our SRS funds to develop it for our retirement. The ten investments listed above are not a complete list, however, they provide a good start to get us on our method to making investments with our SRS funds.