Three causes there gained't be considered a 2021 housing industry crash

Should You Invest In Bitcoin?

There's a macro story for owning Bitcoin – record low yields, or even negative yields, with global debt at record levels poised to reach $277 trillion by the end of the year, or a debt-to-GDP ratio of 365%.

This puts governments and corporations in danger to service the debt during economic downturns in future, which would most likely be refinanced by issuing much more bonds/debt – fueling the belief that debt is basically unlimited and governments can issue unlimited money in their own will.

This macro backdrop, alongside growing institutional adoption of Bitcoin – some publicly listed companies like Microstrategy even publicly announcing that it has added US$1B worth of Bitcoin onto their balance sheet in 2021 – are earning the case of owning Bitcoin even more attractive.

Bitcoin As A Digital Alternative To Gold

J.P. Morgan published a report saying that some investors that previously invested in gold ETFs such as family offices, might be looking at Bitcoin as an alternative to gold.

This trend, if shown to be prevalent and sustainable, might see Bitcoin's possibility to rise in price even further, approximately 10x from current levels to match total private sector purchase of Gold via ETFs or gold bars.

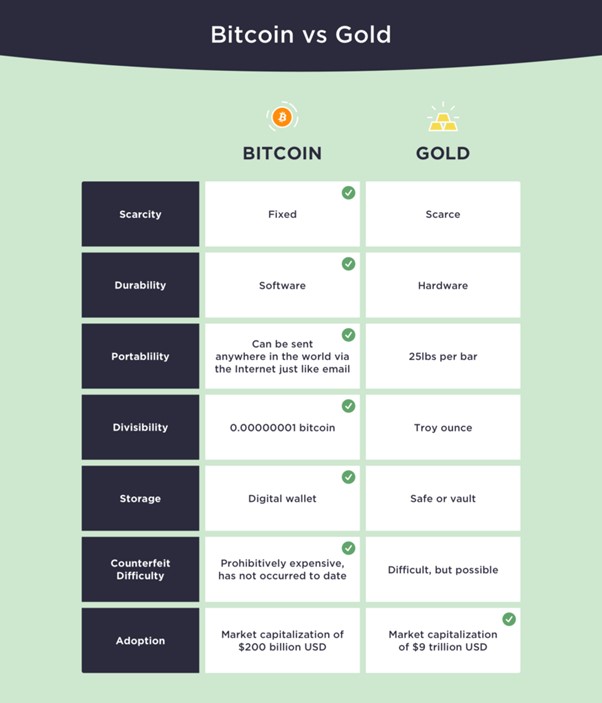

Bitcoin's alternative as digital gold are available in its characteristics: finite supply – 21 million Bitcoins will exist ever – and its supposed store of value in an era of loose central bank policies.

But Bitcoin's properties will make it more useful compared to physical gold.

Unlike gold, Bitcoin exists in digital form and can be easily transferred around digitally with the blockchain. Physical gold is hard to transport around and requires trucks to move it.

This means that it's way simpler to expand the utility of Bitcoin, for instance, as collateral for borrowing stablecoins, or global peer-to-peer transfer without a central clearing party with low fees.

The supply of gold, while finite, is actually unknown. It can be found in many places, above ground, in the ocean floor, as well as on asteroids maybe. Technological advancements over the course of the lifetime of humans can expand its supply beyond Earth.

Bitcoin vs Gold.

How Does Bitcoin Actually Get Produced?

To understand Bitcoin, it's important to first understand how it's generated.

Bitcoin was originally introduced in 2008 when Satoshi Nakamoto published a whitepaper titled Bitcoin: A Peer-to-Peer Electronic Cash System and released it as open-source software in 2009.

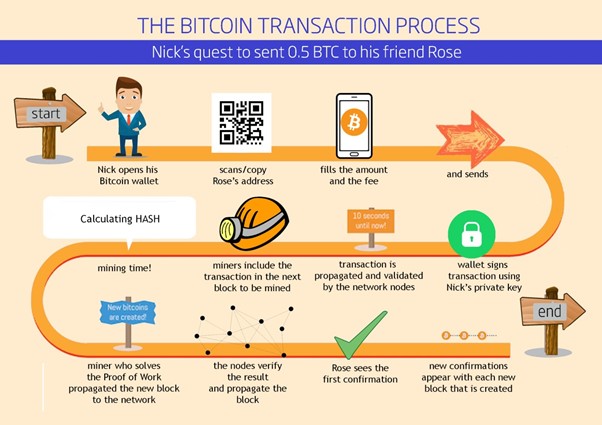

Bitcoin is mined (using computing devices or computing resources) as a reward when miners around the world verify a block around the Bitcoin blockchain, i.e. to monitor and audit Bitcoin transactions and securing its ledger.

When transactions around the Bitcoin network occur, these miners assistance to verify that transactions aren't fraudulent, e.g. the Bitcoin exists, and there isn't double spending (sending one copy and keeping the initial copy of the digital token).

When users broadcast transactions to the blockchain, it's not immediately valid. It has to be first added to a candidate block where miners will then work to append all the unconfirmed transactions in the block to the blockchain.

Bitcoin Mining Through Proof Of Work

To append the candidate block to the blockchain, the user creating the block needs to use computing power to hash the block data until a strategy to a cryptographic puzzle – a certain target hash with specific requirements – is located.

Hashing means passing the block data via a hashing function with a certain variable (a nonce) to produce a hashed block data.

It's a process of trial and error and consumes a lot of computing resources, and once the miner successfully finds the circumstances to produce the valid hash, it gets rewarded with Bitcoin, and also the block gets confirmed and appended to the blockchain.

Not everyone who solves the puzzle gets the reward, you need to be the first miner to reach the closest answer to be eligible.

Furthermore, the Bitcoin rewards for successful mining are reduced by half every four years. When Bitcoin was first mined in 2009, block rewards were 50 Bitcoins per successful block mined. On May 11, 2021, the reward is now 6.25 Bitcoins per block.

What Is Bitcoin's Value?

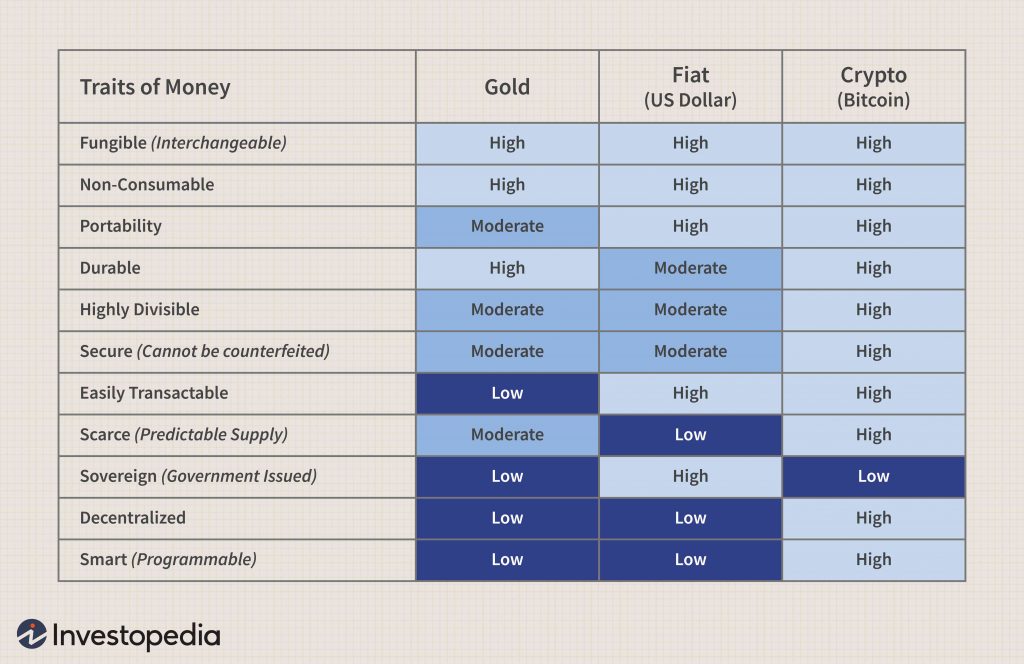

Bitcoin has intrinsic value because it requires resources and it is computationally expensive to produce. But whether it can be considered money is a different matter altogether.

Comparing the characteristics of Bitcoin against Gold and Fiat currencies.

For example, Bitcoin might be valuable in countries of depreciating fiat currencies (e.g. Turkish Lira) where government-backed tender does not retain value over time.

Where governments can technically issue paper money at their own will and the utilization of fractional reserve banking assists you to increase the velocity of money flows, Bitcoin's verifiable supply around the blockchain also makes it valuable for those who trust it more than their very own government.

Bitcoin's value has also criticised by a few as being manipulated using another cryptocurrency called Tether (USDT), to enhance demand for bitcoin, leading to the price surge. It's also been called a Tulip bubble fueled by speculation.

As long as investors think that Bitcoin has the potential to rise further when supply drops, it'll always increase in value.

Where Can I Buy Bitcoin?

Since Bitcoin is made by mining, the 'free' way to obtain Bitcoin is thru mining it on your computer or through specialised mining rigs.

You may also buy them on crypto exchanges. Popular ones include Binance, Gemini, Huobi, Coinbase, Coinhako and Crypto.com which have all fiat gateways for converting USD/SGD into cryptocurrencies. Note the fees and spreads on a number of them (~1%) which can eat into your returns.

If you don't like to use an exchange, you can purchase them over-the-counter without KYC. This means you need to find a trusted counterparty to trade.

Concluding Thoughts On Bitcoin

Bitcoin introduced a new asset class that many years ago, was dismissed even by top bankers as a fraud fueled by the greater fool theory.

Maturing technology (e.g. wallets, decentralized apps, platforms), regulatory clarity and institutional adoption will also be giving Bitcoin mainstream credibility it has sought for years.

As we move from the early adoption phase towards the mainstream adoption phase, we can expect to see changes like individuals deciding to adopt Bitcoin as cashback rather than miles for their cards, digital exchanges and custody for digital assets, interoperability with central bank digital currencies and more.