Three causes there gained't be considered a 2021 housing industry crash

Living To 100 Or Beyond? 5 Important Financial Areas To Review To Build A Multi-Stage Life

With one of the highest life expectancy at birth of 84.8 years, it should come as no surprise that the quantity of centenarians in Singapore has also increased significantly over the past 10 years, from 700 in June 2010 to 1,500 in June 2021.

Thanks to advancements in medical technology and healthier living, people in Singapore can expect to live even longer resides in the future. This brings us to an essential question: if we are going to live longer lives when compared to generation before us, so what can we do with the additional years? Do we use the extra years to volunteer for a cause that we believe in, pursue an interest that we have, or extend the number of years that we would continue employed by?

And with our additional years on the planet, we need to be prepared to build for ourselves a multi-stage life that goes beyond just the traditional three stages – school, work and retirement.

This can include further education and retraining as we find ways to stay relevant in our workforce. Options to take a sabbatical before pursuing our next career could also transform the traditional three stages of life that we're used to into a longer, multi-stage life that will look like school, work, sabbatical, school, work, retirement.

In theory, this sounds feasible and even logical. In reality, a 2021 research paper commissioned by Prudential demonstrated that more than half of Singaporeans surveyed weren't ready to live till 100. So what can we do to prepare ourselves financially for any multi-stage life that could stretch beyond 100 years?

#1 Save & Invest A Larger Portion Of Our Income

As we embrace a multi-stage life that could include multiple periods of non-work, we need to take proactive steps to make sure that we have enough not just for our retirement, but also when we are not working such as during our sabbatical or when pursuing further education. This means diligently saving a larger proportion of our income during our working years.

Besides saving, we also need to invest our savings. This can allow us to grow our retirement nest egg and to ensure that inflation doesn't erode the spending power of our savings.

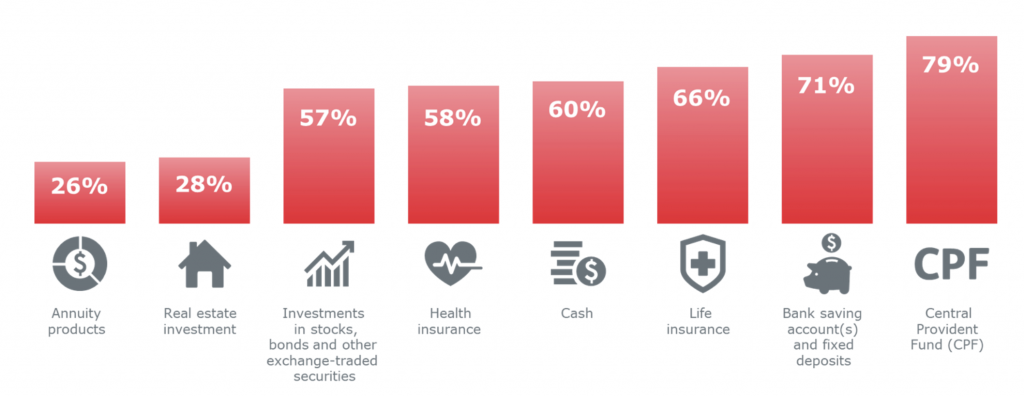

According to Prudential's Saving For 100 research, the top three most popular tools that Singaporeans are using are their CPF (79%) , bank savings accounts and glued deposits (71%) and 66% (life insurance). That can bring us to our next point.

#2 Utilising CPF LIFE & Retirement Insurance Plans To Obtain Higher Monthly Payouts

As Singaporeans and PRs, we have to make mandatory contributions to our CPF accounts each month when we work.

Perhaps as a sign that even the Singapore government realizes that people need to plan to live beyond 100, CPF LIFE was introduced in 2009 to replace the Retirement Sum Scheme (RSS). The critical distinction between CPF LIFE and the RSS is the fact that CPF LIFE provides a lifelong monthly payout provided we live while the RSS provides monthly payouts that is expected to last till 95.

For people who wish to have a higher lifelong guaranteed income, we are able to consider topping up our CPF Retirement Account to the Enhanced Retirement Sum, which is $271,500 as of 2021. This will give us a regular monthly lifelong payout of between $2,030 – $2,180 from 65.

However, with respect to the standard of living that you are used to, CPF LIFE might not be enough to provide you with all the income that you'll require. According to the most recent Household Expenditure Survey 2021/18, the monthly expenses for a non-working person aged 65 and above who is living in a condominium or private apartment is $2,680 per month. In this instance, the individual would need to have extra cash to supplement his monthly CPF LIFE payouts.

A retirement insurance plan is one tool that we can use to provide us with supplementary income for the retirement. As compared to CPF LIFE, retirement insurance plans are more flexible and can cater to the specific needs of individuals.

For example, those who wish to opt for early retirement may use a retirement insurance plan such as the PRUGolden Retirement Premier, which allows us to start payouts from as early as 55. We can choose how long we want the payout period to become. So, if we want to retire at 55 but need a steady stream of income to sustain us till our CPF LIFE payouts commence at 65, we can choose a payout period of 10 years, starting from 55.

For those of us who require greater flexibility, we can consider the PRUActive Retirement plan. This plan allows us to customise when our payout period start, from age 50 up to age 110. So whether you need to have an early retirement or intend to work till your old age, the PRUActive Retirement is suitable in supporting the decisions you want to make for your multi-stage life.

#3 The rest of the Lease On The Home That We Buy

Some Singaporean home buyers are attracted to older HDB flats and rightly so. Older flats tend to be 1) located in central locations for example Kallang and Ang Mo Kio 2) are more spacious and 3) may be cheaper when compared with newer flats in the same area.

However, when buying a resale flat, one factor to be mindful of is the remaining lease around the flat. For example, buying a 40-year old flat means using a remaining lease of just 59 years from the time we purchase it. For any 30-year-old buyer, this means that the lease will run out when the person is 89.

Now that many of us need to be prudent about planning to live beyond 90 or perhaps 100, we should carefully consider the rest of the lease on the home we purchase once we would ideally not want to live the lease on the house.

#4 Consider Insurance Policies That Provide You With Coverage For Life

There are a couple of main types of insurance plans – Whole Life Insurance Plans and Term Life Insurance Plans.

As their names suggest, a whole life insurance plan provides us with insurance policy for life, or up till age 100. A term life insurance plan usually gives us insurance coverage for a specific term, usually up till age 70 or 75. However, some term life plans such as PRUActive Term may permit you to buy coverage till age 100.

As we live longer, we might prefer to have insurance coverage to cover us during our old age, or even for the duration of our entire life. For instance, we may wish to have a whole life critical illness plan that gives us with a lump sum payout as diagnosed with any critical illnesses during our lifetime. This is when a whole life insurance plan will become important.

#5 Embrace Learning In Our Multi-Stage Life

When it comes to learning, the traditional mindset that people used to have was that people learn in class before joining the workforce to work. In 2021, such a perspective is not applicable. Rather, to keep ourselves relevant within our later years, we should regularly upskill ourselves.

SkillsFuture is the umbrella movement to support Singaporeans in their journey of lifelong learning and professional development. Among other things, the SkillsFuture framework provides an integrated eco-system of high-quality, relevant, and industry-recognised educational and training programmes, no matter your age or stage of career. Subsidies will also be provided via a variety of credits, grants, as well as scholarships available.

Beyond just utilising their SkillsFuture credits, many working professionals are also embracing lifelong learning.

An example is Darren Ho. One of the founders of local men's title AUGUSTMAN. Darren took some time off in 2021 to reassess his life and after spending a few months picking up new knowledge in e-commerce while travelling through The european union and Asia, Darren returned to Singapore to work for a global content and e-commerce platform. Due to the COVID-19 pandemic, Darren has switched to a new industry – advertising while concurrently pursuing further studies. You can read up more about Darren's experience here.

As more of us begin on our multi-stage lives, we may find that similar to Darren, our careers and even our children's careers won't conform to traditional societal norms that people were brought thinking. Career switches, further studies, constant upskilling as well as taking a sabbatical during the peak in our careers may become increasing common in the future. We may also find ourselves working beyond the retirement age – not because we must, but because we want to and therefore are able to.

We captured all these considerations within an infographic:

With all these in mind, it is wise to think about having a holistic long-term plan to allow us to prepare for this longer, multi-stage life. With the additional life span, living a fulfilling long life is possible when we are financially prepared and hang realistic goals to realise our dreams we have always desire.

Do you have a “game” plan in mind now to prepare you to live to 100 or beyond? If you need guidance on what to do financially, get in touch with a Prudential Financial Consultant who are able to give you advice on the steps to get ready to live beyond 100.

You are suggested to read the product summary and seek advice from a qualified Prudential Financial Consultant for a financial analysis before purchasing a policy suitable to meet your requirements.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that's payable to you may be zero or less than the total premiums paid.

Premiums for some supplementary benefits are not guaranteed and could be adjusted based on future claims experience.

The information on this website is for reference only and is not a contract of insurance. Please refer to the exact terms and conditions, specific details and exclusions applicable to these insurance products in the policy documents that can be obtained from your Prudential Financial Consultant.

The information contained on this website is intended to be valid in Singapore only and shall 't be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore.

These coverage is protected under the Policy Owners' Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for the policies is automatic with no further action is required of your stuff. For more information on the types of benefits that are covered under the scheme along with the limits of coverage, where applicable, please speak to your insurer or visit the GIA/LIA or SDIC websites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg).

Information is correct as at 23 December 2021

This advertisement has not been reviewed by the Monetary Authority of Singapore.