Three causes there gained't be considered a 2021 housing industry crash

Here's Why iFAST Corporation (AIY.SI) Shares Plunged 31%

It failed to get the Digital Banking License, but that’s half the story told. Here’s what you exactly have to know about iFAST’s other side of the story.

First, the bad news.

Last week, the Monetary Authority of Singapore (MAS) awarded the entire Digital Banking licenses to Internet companies SEA Ltd and Grab-Singtel partnership.

And gave Digital Wholesale Banking licenses to China's Ant Group and another group led by Greenland Financial.

But iFAST Corporation Ltd (AIY.SI) and its Chinese partners, Yilion Group and Hande Group failed to get their Digital Wholesale Banking license.

The Digital Wholesale Banking license allows iFAST to function like a bank, lending money to SME companies.

People think having one of these license is a huge game-changer for iFAST.

That's why the marketplace panicked and iFAST shares plunged 31% from their peak earlier this week.

But that's half the storyline told.

So here's the good news for long-term investors looking to build their wealth, this is what people are not paying attention to.

iFAST's Strong Growth Originates from its 'Network Effect'

Thanks to its “network effect”, iFAST will only get bigger.

With or without the license.

I'll explain.

iFAST's business design is very simple.

Each time you buy a unit trust from its online platform, the organization charges you a small transaction fee, a yearly platform fee to “safekeep” the lending options for you.

Unit trusts are funds professionally managed by a good investment company. It's also commonly known as a mutual fund.

The company also takes a cut from the investment companies selling their unit trusts on its platform, which is called distribution fees.

The best part from the business is that as more people and investment companies use iFAST's platform to buy and sell financial products, the bigger it gets.

And the greater money iFAST makes.

This creates a very strong “network effect”.

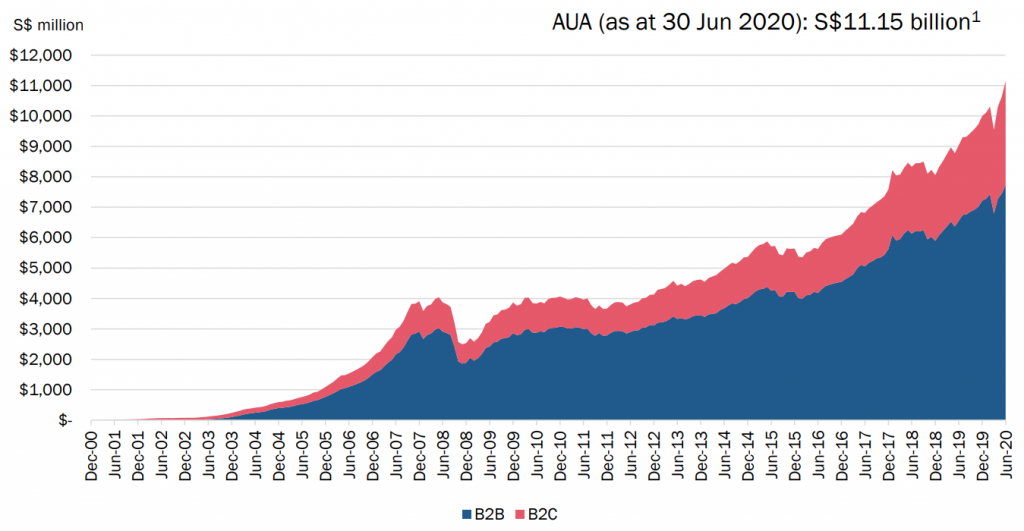

In fact, iFAST's assets under administration (AUA) grew massively and hit SGD12.6 billion in Sep 2021.

AUA is the total amount of assets iFAST holds for investors after they'd order products through iFAST's platform.

And this amount alone is larger than many other investment companies in Singapore.

You see, iFAST is really a SGD780 million online financial supermarket.

It sells one of the most popular investment products in Singapore – unit trusts, through its online platform, fundsupermart.com.

iFAST is already one of the fastest growing businesses. The company started only during the dotcom of 2000. And also over the past 20 years, its net sales hit a record of SGD65 million. Most of it is recurring.

What's better still is it's net sales in the last nine months achieved SGD61.5 million.

Net sales are the fees that iFAST earns, after paying commissions to its third-party financial advisors.

You see, what iFAST has that competitors like Aviva Navigator and Phillip Securities online platforms sometimes lack is that this.

In my opinion, iFAST's platform makes it convenient for everyday investors to pick from its huge library of 9,000 products, including unit trusts, bonds, stocks and ETFs.

Once one enters iFAST's website, all the information is immediately packed right in front your eyes.

You can say it's such as the Amazon for everyday investors.

And because iFAST doesn't possess a physical store, it saves a lot of its earnings on rent.

And its excess cash can be used to invest in technology systems and labor – two of the most important things a financial company needs to grow.

That's why iFAST is a capital-efficient business.

Since its listing in 2021, iFAST's average return on shareholders' equity (ROE) is around 14.6%.

ROE measures how much a business makes back for every dollar invested.

With or With no Digital Banking License, iFAST's Growth is Inevitable

iFAST is really a heavy digital adopter.

That's why people think it's important for iFAST to get the digital banking license.

iFAST can then offer almost what all banks can perform – from selling financial products, insurance, to moneylending, except without the hassle of opening physical branches.

Yet without the license, the company continues to pull in additional people onto its platform.

In fact, during the pandemic crisis, it still received net new money of SGD2.3 billion, that's triple the amount over the same period last year.

Now, iFAST shares sold-off earlier this week. But that is after their share price soared over 370% since March this year.

That dwarfed Straits Times Index (STI) tiny returns of 2.3% over the same period.

What's better still, is iFAST has been growing their dividends. Its dividends grew from 2.79 cents per be part of 2021 to 3.15 cents per share last year.

Even during its 9M2021 financial results, through the pandemic crisis, dividends paid is 2.30 cents per share, greater than the previous year.

Even if iFAST fails to obtain the license, it isn't a deal-breaker for them.

Its gains from its online supermarket aren't over.

That's because Singapore is poised to be the next biggest financial hub in Asia, after Hong Kong.

With MAS's move to develop and grow the nation's reliable financial system, this is likely to attract even more money from the region.

That should be a huge tailwind for iFAST's growing business.

As far and i'm concerned, no other players could match iFAST's convenient online financial supermarket.

And everyday investors will probably turn to iFAST for their investing needs.

Sometimes, investing could be simple.

Always here for you,

Willie Keng, CFA