Three causes there gained't be considered a 2021 housing industry crash

Rise Credit Loans Review: Great Small Loan Lender

Honesty is the greatest policy. Why is Rise a great small loan company may be the company's willingness to admit that its rates aren't the least expensive which its loans can also be wrong for everybody. Rise also offers transparent terms and some unique benefits which make its credit loans a viable alternative to pay day loans.

The Basics

There are some criteria to satisfy prior to applying for a Rise credit loan. Applicants have to be a minimum of 18 years of age, have a regular source of income, an energetic bank account, current email address and live in a state that Rise services. How much money you are able to borrow depends upon a state of residence, but ranges from $500 to $5,000.

The application process includes three steps: apply online, choose your terms and receive cash directly inside your account when the next day. Results appear within a minute approximately. In some instances, applicants might need to fax proof of income or any other information to complete the application process.

As of 2021, Rise credit loans are just obtainable in 15 states, including:

- Alabama

- California

- Delaware

- Georgia

- Idaho

- Illinois

- Missouri

- New Mexico

- North Dakota

- Ohio

- South Carolina

- South Dakota

- Texas

- Utah

- Wisconsin

The Costs

The apr (APR) that Rise charges depends on a number of factors, especially your state of residence and credit rating. In general, APRs vary from 36% to 365%, with origination fees and additional fees that vary among states. Some states also add origination fees. Additional fees vary depending on the state, but normally amount to 5% from the missed installment amount.

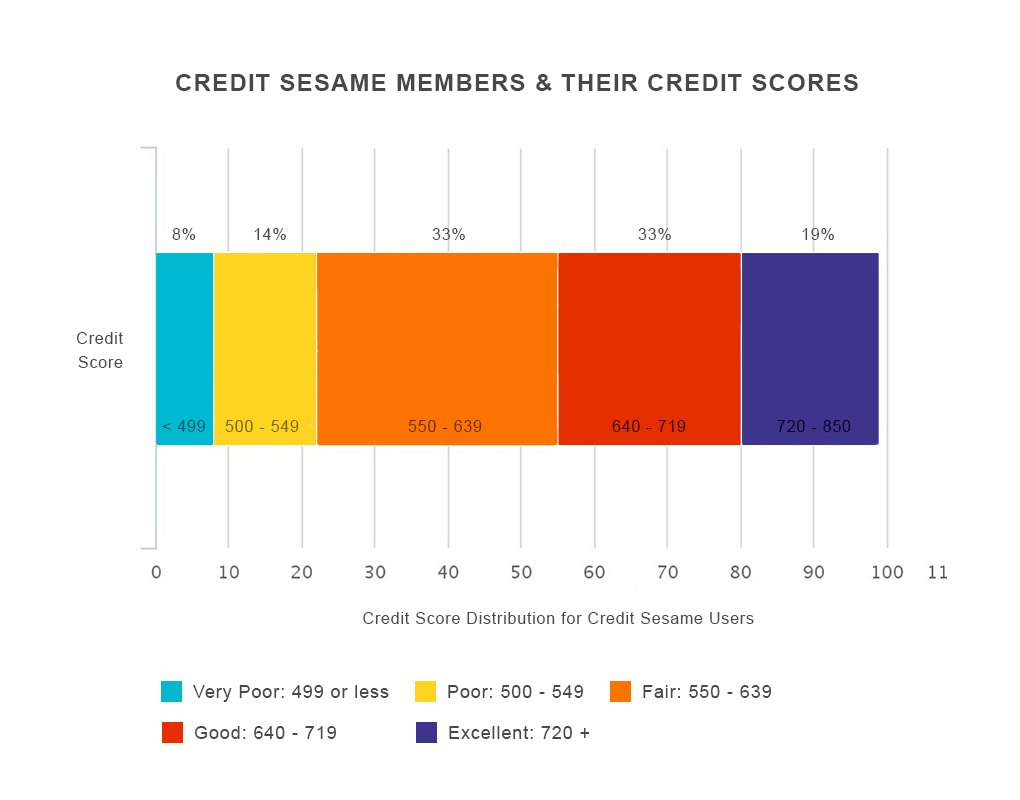

Your credit rating is an important element in snagging the best APR. This chart shows the average Credit Sesame member’s credit rating. See how you compare.

Benefits

Unlike many payday loans and loans for poor credit, Rise offers terms that extend up to 26 months, which supplies more flexibility in the bi-weekly payment schedule. Additionally, Rise rewards its good customers with lower rates on future loans so long as 24 months when they make their scheduled payments on time. Rise offers flexible payment scheduling along with a five-day, risk-free guarantee that lets you change your mind and return the funds without any fees.

Rise Credit Loan Comparison

Because Rise credit loans can transport a hefty APR, consumers must do all the necessary research to research all of their available options. Other online unsecured loans offer fast, simple online applications with direct deposit of funds with no sky-high interest rates related to some Rise loans.

LightStream

What helps make the LightStream personal loan unique may be the lender's tailored method of assigning APRs to loans based on the use of the funds. For example, LightStream considers automotive loans to be less risky than debt consolidation loans. The lender offers fixed interest rates as little as 2.99% for financing a brand new automobile, while the fixed rate for a debt consolidation loan ran up to 14.49%, that is still relatively competitive when compared to rates charged in many personal loans for bad credit. Applicants generally need a good credit rating and a well-established credit rating to qualify.

Avant

Applicants with lower credit ratings often use Avant. Avant's minimum credit rating of 580 is well below a lot of its competitors, and its maximum rate of interest of 35.99% caps off where Rise loans begin, making Avant a strong contender for consumers who've less-than-perfect credit and want money quickly try not to wish to cope with high APRs. Applications are approved or denied within 24 hours, even though it may take up to a week to receive the funds.

Discover

With its relatively low APRs of 6.99% to 24.99%, the Discover personal bank loan is considered the most effective loans to consolidate credit card debt. Applicants need an annual salary of $25,000 or more and a credit score of at least 660. Unlike Rise loans, that are ideal for people in a financial pinch who've poor credit, Discover personal loans are geared more toward individuals with good credit who wish to pay off high-interest debts, go on vacation or fund other major purchases.

Prosper

The Prosper personal loan works differently than other loans since the lender uses a peer-to-peer model, which relies on investors to finance the loans. To apply, you fill out a quick online application and the lender performs a soft credit assessment before giving you loan options with varying loan terms, fees and rates of interest.

From that time, you choose the loan that work well for your needs and complete an in depth application before Prosper puts the loan on its website for investors to finance. When you watch for investors to fund your loan proposal, Prosper verifies your income information, identity and other information. Investors must fund a minimum of 70% from the loan that you should be eligible to borrow the total amount. The process can take as much as five business days.

Personal Loans: Compare Rates & Lenders At a Glance

| Lender/Platform | Rise | Avant | LightStream | Discover | Prosper |

| APR | 36% to 365% | 9.95% to 35.99% | 1.74% to 14.49% | 6.99% to 24.99% | 5.99% to 36% |

| Origination fees | Varies by state | Up to 4.75% of the loan amount | None | None | 1% to 5% of the loan amount |

| Prepayment fees | None | None | None | None | None |

| Late payment fee | Varies by State | $25 | None | $39 | $15 or 5% of the payment amount, whichever is more |

| Loan amounts | $500 to $5,000 | $2,000 to $35,000 | $5,000 to $100,000 | $2,500 to $35,000 | $2,000 to $35,000 |

| Loan Duration | Up to 26 months | 2 to 5 years | 2 to 7 years | 3 to 7 years | 3- or 5-year |

| Average time that it takes to receive funds | Within 24 hours | As soon because the 24 hour or inside a week | As soon as 24 hour or within Thirty days of approval | Next day or as much as one week | 3 to five business days |

| Minimum credit score | Unspecified | 580 | 680 | 660 | 640 |

| Applicants? average income | Unspecified | $40,000+ | Unspecified | Minimum of $25,000 | $83,000 |

Before applying for a high-interest loan, research all your options. For consumers in dire situations who have poor credit, Rise may be a wise decision. Many purchasers consider Rise to become a great small loan company because of the company's transparency, credit rating policies and rewards program that lowers the eye rate on future loans. These unsecured loans have a high cost; component that into your decision prior to signing the contract.