Three causes there gained't be considered a 2021 housing industry crash

Why This Millennial Doesn't Regret Charging a vacation to Egypt on Her Credit Card – Credit Sesame

The word “splurge” accustomed to mean spending like it is going from style at a mall or mall. Today, it's adopted new meaning as charge cards enable consumers, particularly those coveted Millennials who range in age from 18 to 34, to make larger purchases. As well as in the heat from the summer, few large purchases are as attractive like a vacation.

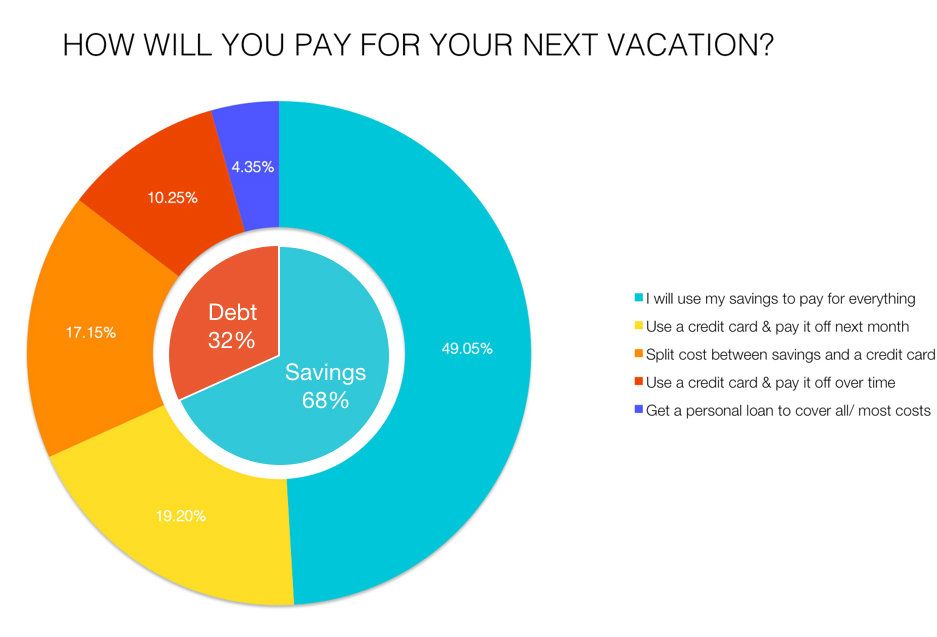

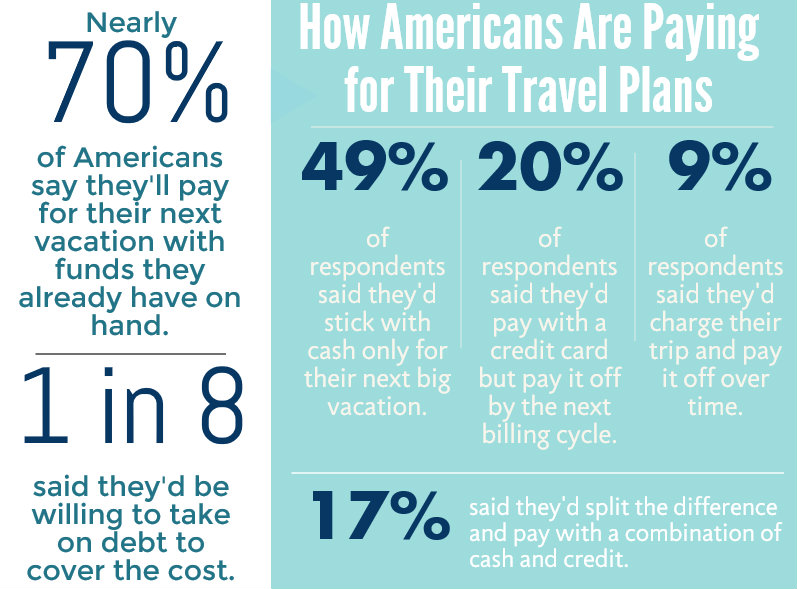

In a current Credit Sesame survey of two,000 people on the internet Consumer Surveys, 10 % of respondents say they plan to cover the cost of their next vacation on the credit card and repay it with time.

Vacations are particularly appealing to Millennials, many of whom have more flexibility to travel in contrast to older generations who've full-time jobs or children in class. This generation is also no stranger to charge cards. Typically, Credit Sesame members aged 25 or much younger possess a charge card balance of $1,778 and a pair of.5 charge cards; members aged 25 to 34 have a balance of $2,735 on 4.1 cards.

10 Simple Tactics I did previously Save $18,000 in my 6-Month Dream Trip

Take 28-year-old Kim Willard and her husband. The couple holds a couple of rewards cards. Two years ago, they booked a vacation to Egypt and Istanbul using one of the reward cards. Their $5,500 visit included $1,200 in airfare and $2,600 for a cruise.

Willard, a Credit Sesame member, subscribed to a free account to check on her credit score and also to review any negative marks that might have appeared on her behalf credit history. She regularly uses Credit Sesame to stay up-to-date on monthly credit rating changes and her debt-to-credit ratio.

Pyramids at Giza

“We made a decision kind of quickly, purchasing airfare first, and debated during the whole first Twenty four hours [when] we're able to still cancel for free whether or not it had been worth it,” Willard recalls. “We ultimately decided that the trip would be worth it and that the best way to begin to see the highlights would be through the Nile Cruise.

After the purchase, i was mostly excited about the trip while also just a little worried about how we would pay it off. Following the trip, we were really grateful for the experiences we'd plus some of those we met along the way.”

The couple repaid their vacation splurge in five months by paying down their credit card in increments of roughly $1,000.

Many prefer cash or quick repayment for travel, survey finds

Although credit is a popular option for vacation financing, it isn't in the majority, according to the Credit Sesame survey. For example:

- 49 percent will pay for their newest vacation only with savings

- 19 percent will pay for the trip entirely within the next month with a credit card

That means near to 70 % of respondents will pay for travel with money they have on hand-or may have available within weeks.

Conversely, 17 percent say they'll split the price between savings and credit cards, and 4 percent will require an unsecured loan.

Nubian village

If you plan to use a credit card for vacation, Willard shares the following tips:

Make sure you're earning points. She opened credit cards that offer rewards programs geared for travel and that also included bonus offers. Check to make sure you entitled to the bonus offer and when you do you'll be required to meet certain conditions to generate the bonus offer – generally you will need to spend a specified amount on purchases using the new card within a few months.

Shop around. Be flexible with your dates, and look for the very best deals, Willard advises. You'll regret purchases a lot less should you realize you have a great deal for them.

Fly for free. Take advantage of this along with other perks for signing up for new cards.

Demographic data reveal distinct travel preferences by age, income, gender

A introduction to the Credit Sesame survey data reveals several noteworthy trends about vacation spending.

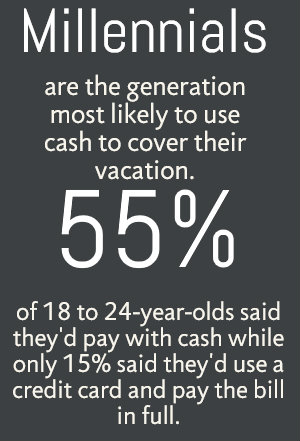

Takeaway #1: Young people are likely to lean on savings first. The survey finds 55 percent of Millennials 18 to 24 uses exclusively savings, whereas just 14.9 percent uses credit cards and pay off the balance in full within a month. Compare that figure towards the 25.6 percent of consumers 65 and older who'll opt for the one-time charge card payment or the 27.1 percent of young seniors in the same category.

This could underscore the very fact young people have fewer credit cards and lower limits, creating a pricey vacation untenable from the start. It is also entirely possible that younger people are reluctant to exploit charge card points-earning strategies and risk falling into debt.

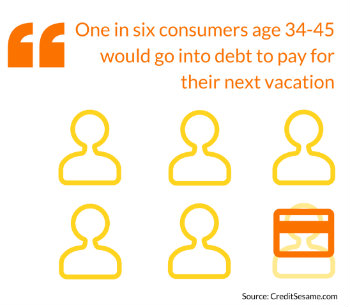

Takeaway #2: The sandwich generation is less worried about lengthier repayment. Nearly 13 percent of individuals 35 to 44 are prepared to repay vacation-related credit card debt with time, compared with under 10 % of those 45 to 54.

As a generation, younger consumers might not fully understand the importance of of balancing discretionary debt with student education loans, automotive loans, mortgages, care for aging parents and other expenses that come to mid-career professionals.

About one in 10 Midwesterners will use a credit card and repay it with time.

Takeaway #3: For those within the South, cash is critical. Roughly 54 percent of shoppers in southern states is only going to pay for vacations with savings. That's over 3 points higher than people in the Midwest (50.2 percent), a lot more than 7 points above those in the Northeast (46.8 percent) and most 10 points a lot more than our consumers out West (43.8 percent).

Chalk it up to conservative fiscal views, lower average income and credit limits, perhaps? In an interesting twist, southern individuals are a bit more likely to say they'd take out an unsecured loan for vacation (5.Five percent) compared to those in the West (3.6 %), Midwest (3.4 percent) and Northeast (2.2 percent).

Takeaway #4: Consumers in the western world choose to pay in full-next month. Nearly A quarter of consumers in western states say they'll put vacation expenses on the credit card and outlay cash entirely the following month, when compared with just 15.7 percent of southern consumers.

Takeaway #5: Suburbanites OK with delaying payment, rural residents prefer to use savings. It's an account of two philosophies when it comes to the suburban-versus-rural divide. Nearly 22 percent of shoppers within the suburbs say they normally use charge cards for a vacation and pay off the balance the following month, compared with 18.4 % in cities and merely under 16 percent in rural ones.

Meanwhile, 53.2 percent of rural residents say they'll pay with savings in contrast to 48.9 % of urban residents and 48.3 percent of these in the suburbs. Yet those in the suburbs won't let the debt last: Under 8 percent will invest costs on a card and pay with time, compared with 10.7 percent in cities and 8.Five percent in rural areas.

Takeaway #6: Lower incomes depend on savings; higher incomes rely on one-time credit card debt. Consumers earning $150,000 may take on a one-time charge card expense for vacations (47.6 %) when compared with just 12.4 % of those within the lowest-earning category of up to $24,000.

Meanwhile, those in the middle who bring home between $50,000 and $99,999 are likely to invest on the credit card for vacation and gradually repay over time.

Takeaway #7: Poorer consumers use unsecured loans. Nine percent of these earning $24,999 or less say they will use an unsecured loan for vacation when compared with just 3.Five percent of these earning between $25,000 and $74,999; 3.4 percent for those earning $75,000 to $99,999 and 3 percent of those earning $100,000 to $149,000.

This happens to be an indicator of less use of charge cards with high spending limits, or simply a measure of available discretionary income. For a lot of consumers, it’s simpler to pay a bill rather than stash away monthly savings.

Travel on a credit card can be memorable

For Willard and her husband, the Egypt trip turned out to be well worth the expense despite their initial second-guessing.

“In our experience, it's better to splurge on experiences instead of material items,” Willard says. “Memories can last an eternity, and traveling when you are young is something you will never regret. You'll be able to travel cheap and do the whole backpacker experience and spend hardly any money.”

Highlights included taking a sunrise heat balloon over the Valley of the Kings, traveling with an overnight train to Cairo, smoking hookah in an open-air café and riding camels and ATVs in the desert.

The visit to Egypt turned out to be one of several international adventures for Willard and her husband, who hadn't traveled outside of the U.S. before they started dating.

“We happen to be together six years (married for three) and have traveled to 13 countries outside of the U.S. since that time,” Willard says. “Earlier this year, we backpacked in Cartagena, and we just got back from the week in Mexico. – We mostly travel for fairly cheap, staying in hostels and backpacking around, and that we purchase flights with points. This was one of our biggest splurges in luxury travel, but was a fantastic experience that we won’t regret.”