Three causes there gained't be considered a 2021 housing industry crash

Want To Invest For Your Retirement But they are Afraid To Lose Money? Here's How A Variable Annuity Plan Might help

With the highest global average life span at 84.8 years, it ought to come as no surprise that having the ability to retire comfortably is an important financial goal for many Singaporeans.

At the same time, retirement planning can be daunting for many, particularly if you are not good in managing neglect the. For example, if you had the bulk of your retirement portfolio invested into equities at the beginning of 2021, you would have suffered what can be considered as an emotional roller coaster ride thus far in 2021.

Using the S&P 500 index as a reference point, a $1 million investment portfolio at the beginning of the year would now be worth about $690,000 by 23 March 2021.

And with interest rates dropping to historic low, purchasing safe, government bonds for yield would not give you a good return either.

While the decline in the financial markets in 2021 due to COVID-19 was a celebration that nobody could had anticipated, this isn't the first recession that we have experienced. Past recessions such as the 2000 dot-com bubble, the 2003 SARS Outbreak and also the 2008 Global Financial Crisis have also caused stock exchange crashes in the past. If you were invested during these times, you would have seen your investment portfolio lose a sizeable chunk of its value.

This leads to another question. While we know that it's important to invest, and that we cannot avoid the volatile nature from the stock markets, how can we make sure that we continue to grow our retirement nest egg while not having to feel like we are constantly in a 360-degree roller coaster ride?

#1 CPF LIFE Scheme

In Singapore, our CPF savings make up the foundation of our retirement income.

As soon once we start work, we begin making CPF contributions, which earn guaranteed, risk-free interest which is between 2.5% to 6%. Part of these funds are channeled into our Retirement Account, which is often used to provide us with monthly CPF LIFE payouts during our retirement.

The various CPF accounts allow us to to grow our retirement nest egg in a predictable, risk-free manner, without needing to worry about the volatility within the stock market. At age 65, we start receiving monthly lifelong payouts from CPF LIFE.

#2 Investment Properties

Another retirement planning instrument for Singaporeans is investment properties, which can be rented out for retirement income.

Compared towards the stock market, property prices tend to be less volatile in the short run. However, the value of your property can go down during poor market conditions which unlike our CPF LIFE payouts, rental income is never guaranteed and may decline or perhaps fall to zero when the rental market is weak. Property owners also incur additional costs for his or her investment properties such as property tax, monthly maintenance fees and agent fees.

# 3 Variable Annuity Plan

While utilising our CPF savings and buying an investment property are common ways many Singaporeans will consider included in retirement planning, neither options allow us to have exposure to the equity markets.

If we want to participate in the growth of the equity markets to help build our retirement portfolio, while not having to be worried about the roller coaster rides the equity markets will give us, we are able to consider purpose-built retirement planning products like a variable annuity plan.

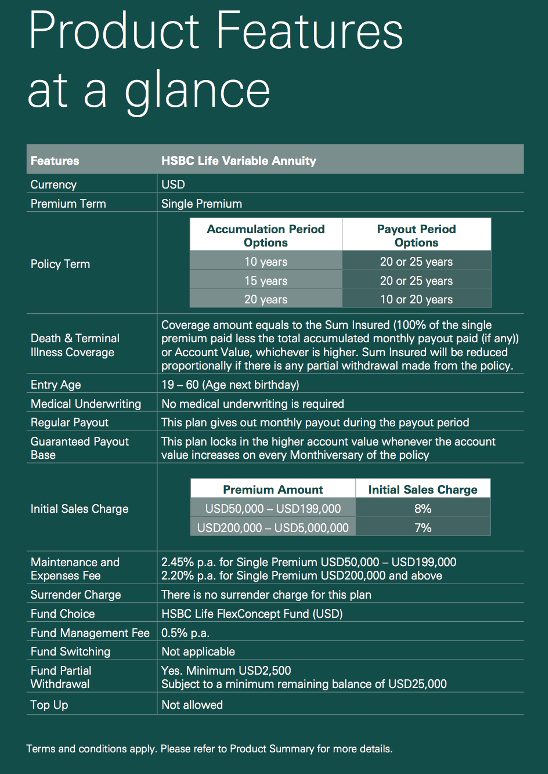

HSBC Life Variable Annuity is definitely an example of one such retirement instrument. It is a single-premium monthly income plan that invests your money into the financial markets while guaranteeing your initial investment upon the end of the policy term.

Investing While Protecting Their Downside Having a Unique “Ratchet” Feature

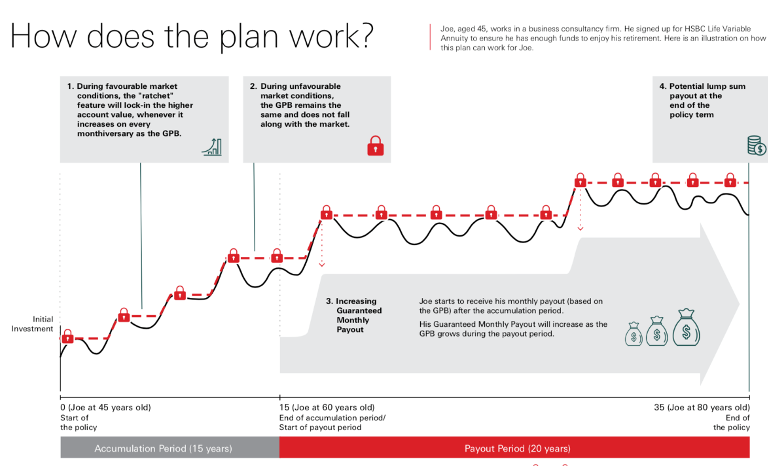

The HSBC Life Variable Annuity has a novel “ratchet” feature that helps policyholders secure any gains earned during favourable market conditions monthly.

How the “ratchet” feature works is that it locks-in the higher account value every month and becomes the Guaranteed Payout Base (GPB)*. This GPB doesn't adjust downwards even if markets would fall subsequently. When the market goes up and the account value increases past the previous locked-in value, the “ratchet” feature will start working again to lock-in the new (and better) locked-in value.

As seen in the diagram above, the payout* are only able to go up and never go down as supplied by the “ratchet” feature under this product.

* You will get back at least 100% of the single premium paid by means of the monthly payouts throughout the payout period selected provided there is no partial withdrawals made throughout the policy term and the policy is held until maturity.

Choose Your personal Accumulation & Payout Period

As a variable annuity plan, you choose both your accumulation and payout periods. For example, after a one-time single premium investment (in $ $ $ $ only), you can choose your preferred accumulation period of 10 years, 15 years or 20 years. You can also decide how long your monthly payout period is going to be: 10, 20 or Twenty five years.

For example, a 40-year old who chooses a 20-year accumulation period look forward to receiving monthly payouts from age 60 onwards for a period of 10 or 20 years.

It's worth pointing out also that the “ratchet” feature remains in effect not just during your accumulation period, but also your payout period. Which means that even after you start receiving your payouts, your payout can continue to increase if the market continues to perform well. However, it will never drop.

The “Ratchet” Protects Your Investment While The Market Is constantly on the Deliver You Returns

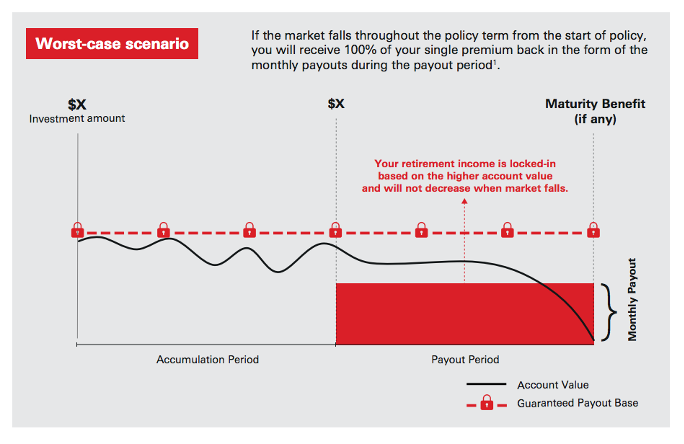

The “ratchet” feature within the plan is incredibly important because it helps lock-in your gains and protect against downside risk. So, while investors reach participate in the upside of the equity markets, they are also protected from wild downward swings if this does happen, similar to what we should are currently experiencing today due to the COVID-19 pandemic.

| Capital Guaranteed | Potential Upside If Market Performs Well | Fixed Guaranteed Regular Payout | Liquidity | |

| CPF Savings | Yes | No | Yes | Low |

| Investment Properties | No | Yes | No | Low |

| Variable Annuity Plan | Yes^ | Yes | Yes* | High (anytime without any surrender charge) |

^ Your capital is guaranteed only when you hold the policy to the end of the policy term and provided you haven't made any partial withdrawals.

In the unlikely event the market falls throughout the policy term rather than recovers from the day policyholder first invests, the insurance policy will guarantee the capital invested and the policyholder will receive their initial capital back.

With HSBC Life Variable Annuity, there are no surrender fees and you can make partial withdrawals if you want your funds earlier. Ideally though, you would want to leave your investment monies untouched to reap the full benefits from the plan. If you surrender your policy before maturity or make any partial withdrawal throughout the policy term, you will get the prevailing account value, and never the Guaranteed Payout Base (GPB) amount.

That said, investors should always invest in a product with a suitable investment time horizon, and to build their retirement nest egg steadily.

The key advantage for HSBC Life Variable Annuity is it allows you to participate in the growth of the financial markets, while still protecting your investments against inevitable market downturns. This may be a complementary solution to add into the retirement portfolio that you have carefully constructed particularly if you have a long enough investment horizon.

The HSBC Life Variable Annuity is also an Awarded Winner of the Insurance Asia Award 2021 – New Insurance Product of the season. To better understand this product better, do visit HSBC Life website for the product brochure and explanatory video. You may even find out more from a licensed representative.

Disclaimer

HSBC Life Variable Annuity is underwritten by HSBC Insurance (Singapore) Pte. Limited (Ref.No.195400150N).

Information is true as at 21 July 2021.

This advertisement has not been reviewed by the Monetary Authority of Singapore. Protected up to specified limits by SDIC.