Three causes there gained't be considered a 2021 housing industry crash

Pros And Cons Of Investing In Singapore Savings Bonds (SSB) During This COVID-19 Crisis

The Singapore Savings Bonds (SSBs) are a special kind of Singapore Government Securities (SGS), which also includes SGS bonds and treasury bills (T-bills). Unlike the SGS bonds and T-bills, SSBs provides investors the flexibleness to withdraw their investments at any point and without any penalties.

Due to its superior benefits (or potentially lower “risks”), SSBs provide an interest rates that are typically less than regular 10-year SGS bonds. Moreover, there's a special step-up interest rate feature around the SSB, paying us a higher interest return the more we hold on to the SSB. The maximum tenure of the SSB is 10 years.

During a market downturn, such as the one brought upon through the COVID-19 pandemic, holding bond investments can be handy as the principal and charges are guaranteed. In this article, we glance at some pros and cons of investing in the SSB this year.

Pro # 1 One Of The Safest Investments

While bonds may be perceived as being safer investments than stocks, properties or alternative investments, especially throughout a market crash, they are not completely safe from risks.

The current COVID-19 pandemic has affected almost every company's operations in one way or any other. Even if the company hasn't been financially impacted, it does not mean that it will continue to remain safe from the imminent recession we face this season, which could be the worst because the Great Depression in 1930s.

This makes bonds issued by any company riskier, regardless of their current financial standing. While this may apply to the SSB, it is backed by the Singapore government, which supports the strongest “triple-A” rating from international credit score agencies.

If we are looking for a liquid investment or want the bulk of your emergency funds to continue earning a pursuit return, the SSB offers superior rates than our bank accounts and without any volatility.

Pro # 2 Greater Cash Flow Concerns

As we grapple with an economy in recession and grow uncertain of its full impacts on our finances and job prospects, ploughing funds in to the stock market can be daunting.

This is particularly so if we run into unpredictable financial hardships and have to cash out our investments in a few months. If we do so, we might not be able to ride out the short-term volatility and may suffer losing a significant slice of our investments.

By investing in the SSB, we do not risk the principal and even if we cash out early, we are assured to receive the interest returns on a pro-rated basis.

Once you're more confident or have built other financial buffers, you can always redeem your SSB and invest the funds elsewhere.

Pro # 3 Make Your Money Work Harder By Investing Through the Supplementary Retirement Scheme (SRS)

During a market crash, we want to be able to stretch our dollars so far as we can. By investing in the SSB through our Supplementary Retirement Scheme, we are able to earn dollar-for-dollar tax relief on up to $15,300 each year, on top of enjoying other benefits provided by the SSB investment.

The impacts of COVID-19 may last for longer than we think, and being able to reduce our income tax, while continuing to put away money for our retirement in our SRS accounts is a good idea.

Cons Of Investing In SSB: It Pays A Low Interest Return

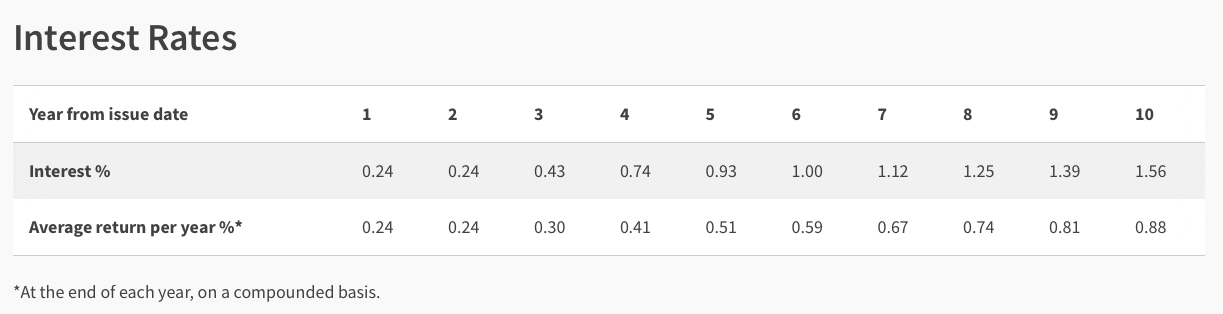

In return for enjoying such a safe investment option, we get a return that some may deem low. The present SSB issue for August 2021 is paying a pursuit return of just 0.24% in the first and second year, and even if we held the SSB to the full 10-year period, we would have earned 0.88% per year on average.

The Latest SSB (August 2021):

If there's an investment horizon of 10 years or more, think that the global economy will recover within the longer term and have the stomach for higher risks in the short-term, investing in stocks and other investments can potentially provide significantly higher returns.

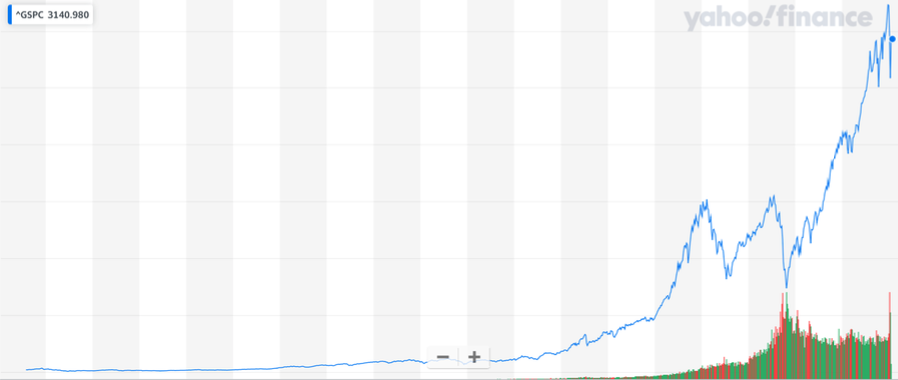

The evidence behind this is that, given enough time, the markets always recover from recessions and crashes. In the chart below, we can see that the S&P 500, comprising close to 500 of the largest and most liquid companies in the US has been on an upward trend over near to 100 years.

Consider Your Risk Appetite And Ability To Take On Risk Before Investing

The SSB has many other pros and cons that may not be specific to the current COVID-19 situation, and you can read these SSB-related articles on DollarsAndSense.

However, when selecting to invest your money in the current market environment, you need to understand the risks associated with your decisions as well as your possible requirement to use your investments in case you become impacted by the recession headed our way.