Three causes there gained't be considered a 2021 housing industry crash

Credit Sesame Survey: 2 Big Explanations why Millennials Still Won't Want credit Cards – Credit Sesame

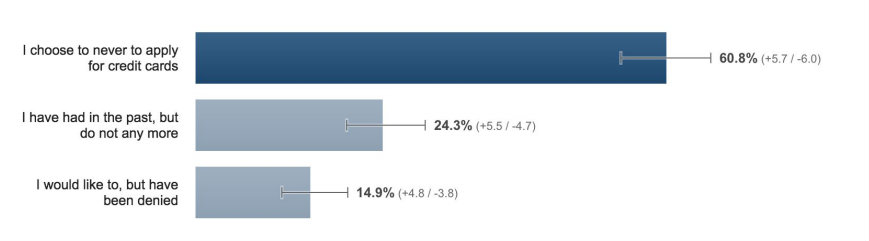

Credit Sesame recently asked 1,000 consumers ages 18-34, also known as Millennials or Gen Y, about their charge card usage and found that about 60 % do not have credit cards by choice and don't think it is a problem either.

That jives with a few 2021 research from First Data about young adults' banking habits, which found that 71 percent individuals prefer to go to the dentist compared to bank and 33 percent felt they would not even require a bank in five years. First Data also found 63 percent of this age group doesn't actually have a charge card, that are also often from banks.

Credit Sesame also discovered that 70 percent of those who will have credit cards don't trust credit card issuers and most 50 % asserted banks are simply not friendly. Another reason why this group remains strongly against credit cards is because they are concerned about accumulating debt.

Twenty-four percent also said they’ve were built with a credit card previously, however for some reason, choose not to utilize it anymore.

But, utilizing a charge card along with a bank goes hand-in-hand for finding out how to use financial tools, and in the near future, saving money on life’s large purchases, like a house or a car.

Although the mistrust Millennials feel toward banks is obvious, avoiding credit cards isn't the answer. If you’re in this age bracket and also shunning credit cards, consider the following points:

Responsible credit card usage can actually save you money

Truth is, if you have any desire to have a reputable car loan or mortgage at the best rates in your future, you need to learn how to use a banking account along with a credit card.

Using credit cards responsibly might help construct your credit rating and show lenders you have paid your debts promptly. Lenders want to see that you are not a liability, so seeing your solid credit history will help you secure a lower type of loan, or car loan rate, for instance.

Having a lesser interest rate for such big loans will save you 1000s of dollars, within the lifetime of the borrowed funds.

Once you utilize a credit card, you'll learn much more about how credit is scored

When you receive a new charge card, you learn what your borrowing limit is, what your payments are, when they are due and how to handle charge cards responsibly. Actually, those respondents to the Credit Sesame survey who already have a credit card may trust credit cards company and see them as consumer friendly.

How you utilize your charge card and pay your bill would be the largest factors of the credit score but gone will be the credit rating on apply for you if you have never had a credit account opened inside your name for at least six months.

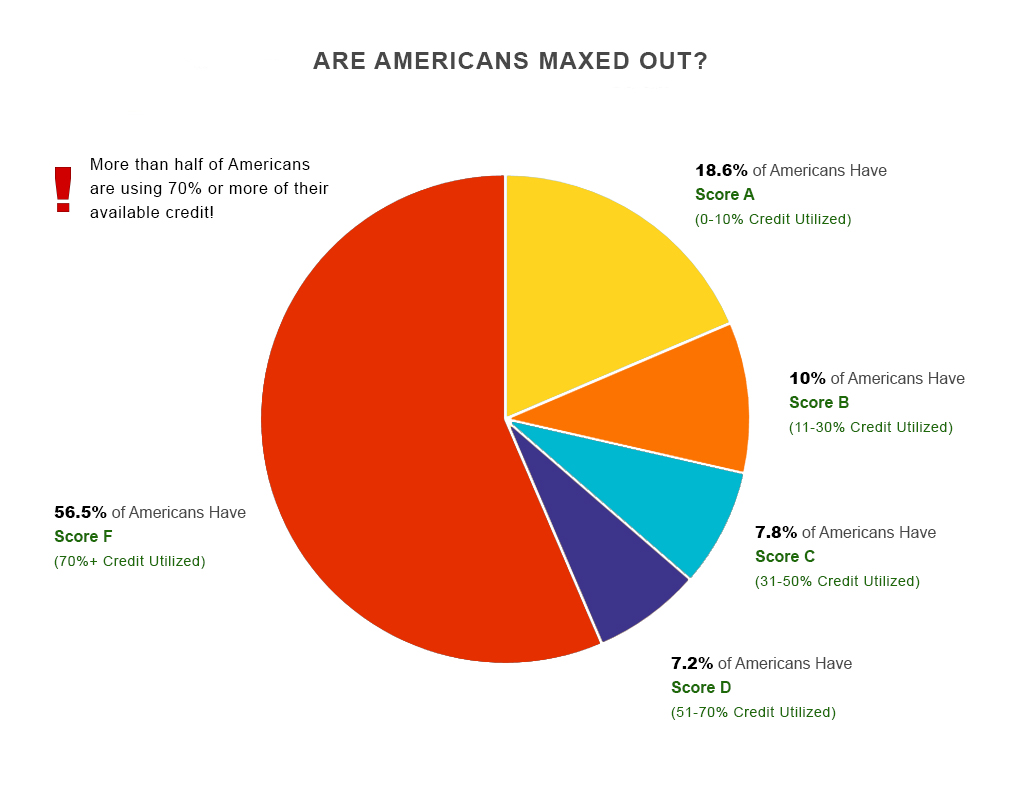

Keeping the money you owe low means your credit utilization will be lower, which will help improve your credit score. Credit utilization means how much overall credit you use, when compared with how much credit you have. For example, if you have a borrowing limit of $1,000 and have consumed $500 of it, which means your utilization is 50 %, which is considered high in the eyes of lenders. Keep the dpi below 10 percent.

According to Credit Sesame data from the report that was published captured, over fifty percent of Americans are using 70 % of their available credit.

But, use a charge card responsibly to build good credit quickly for future loan needs and protect yourself from debt at the same time by requesting a low credit limit, making small charges you will pay off before the deadline rather than carrying debt monthly.

Debt is caused by poor spending habits

Credit cards themselves don't cause the debt. The way in which you utilize a credit card causes debt and you have control over that.

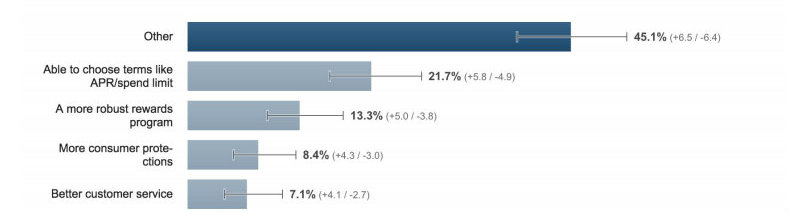

Twenty-one percent of respondents to our survey said they would consider getting a credit card if they could create a spending limit on their own cards, meaning they're worried about accumulating debt.

Thirteen percent said they'd obtain a card if it had a better quality rewards program. Forty-five percent answered “other,” and also the most typical responses included:

- Don’t have to have one — meaning, nothing would change their brains about obtaining a card

- I’m too young — meaning, many respondents aged 20 believed they were too young for any credit card

- Don’t want to pay it off

If you are young and just starting out with credit and have a job, obtain a secured charge card or ask a relative with good credit to add you to the account being an authorized user that will help you construct your credit. Just pick one and don't apply for a whole couple of cards previously because which will hurt your credit.

Without a bank, you almost certainly have no savings

If you are not utilizing a bank and you've got not been stashing your cash in a secret place in your home, then you definitely have in all probability no emergency fund. This really is saved cash to make use of when things go wrong such as a flat tire, a dead battery, a damaged appliance as well as other necessary unforeseen expense. If you have money in a bank checking account available for car and residential repairs or medical expenses, these little “emergencies” can't hurt you.

Having no bank account with no credit means you might have no idea how the economic climate really works because you have not used it. Until you do, you won't be eligible to gain access to money in the best rates for stuff you want to do later on and may fall under debt traps such as payday loans much easier than someone who understands how credit and accounts work.

If you’re prepared to learn more about which charge card is the best for you, visit Credit Sesame’s charge card page to find out more about the best charge cards.