Three causes there gained't be considered a 2021 housing industry crash

Poor credit Score Guide: Credit Cards, Loans

What is really a poor credit score?

Based on the information present in your credit report, the loan reporting bureaus typically generate a score between 300 and 850. The larger your credit rating, the greater your chances should be approved for credit and also to get the most generous terms, like lower interest rates or longer repayment periods. Conversely, a low credit score is one that could result in a lender to reject the application for credit or charge higher interest rates on loans which are approved. It is also worth noting that lenders, credit cad issuers, look at different scoring models and also have different criteria they use to determine if you are approved for any credit card and the terms they will extend to you, so, using a credit score in a particular range is not a guarantee that you'll be approved for that card or the terms you applied for.

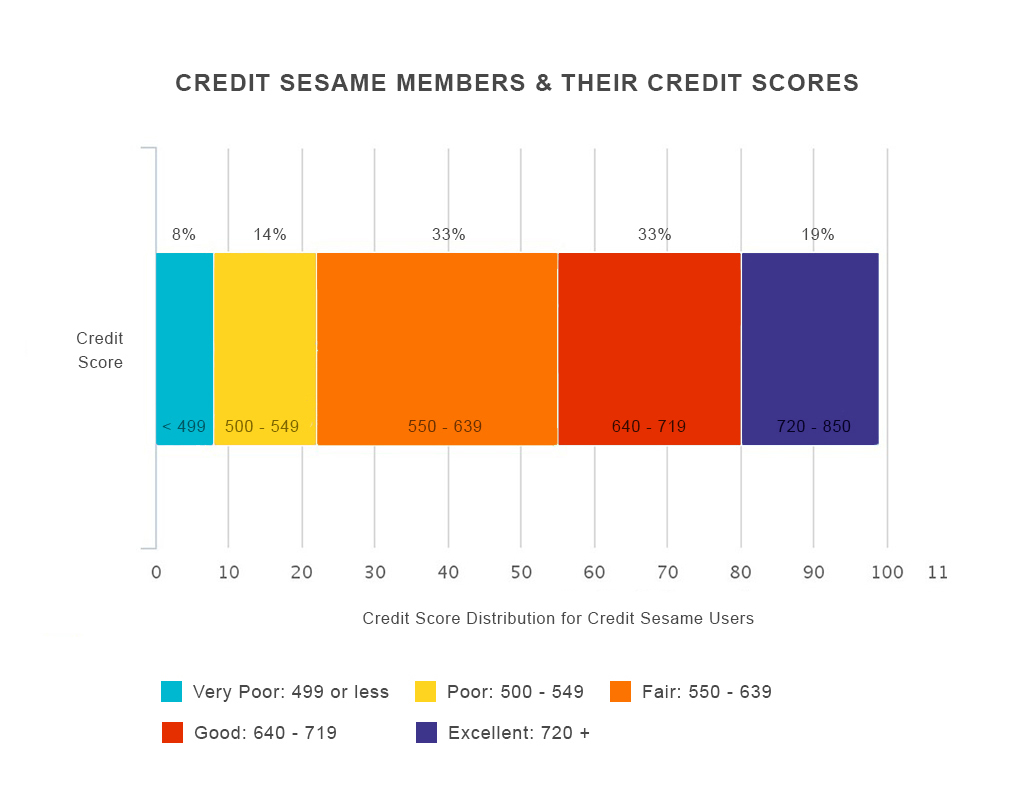

Here's a general credit score chart that shows the course and credit ranges. Bear in mind each credit bureau has their very own scoring model, therefore the ranges will differ.

[Offer: Free Credit Score]

Many lenders think about a credit rating between 500 and 549 “poor,” and a credit score below 500 “very poor.” If your credit score falls for the reason that credit range, you'll have difficulty being approved for brand new credit, and may even have job or rental applications rejected if an employer or landlord asks to run a credit assessment on you.

[Related: Rental History Reports]

For people in that range, the very first questions asked are often concerning how to improve your credit score.

That said, each lender sets its very own cutoff points. Some consider anything over 550 to become fair or better. A minimum of 75% of Credit Sesame members are in the fair, good or excellent category. Take a look (data collected October 2021):

If your score is in the 500-549 range, approval for any credit product will be a challenge. If you are in the 550-599 range, the lender may consider your score to be unacceptable, or they may provide you with a shot. If you are at or below 649, you need to focus on reaching the following higher credit tier.

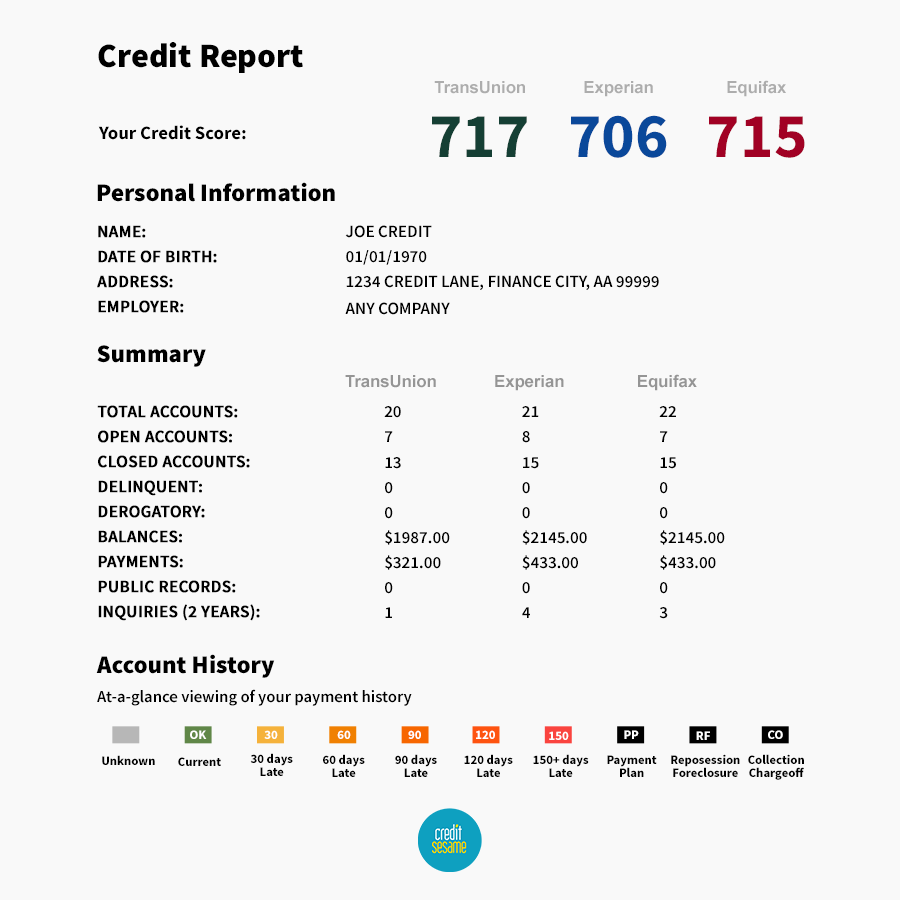

The most important initial step would be to examine your credit report closely for accuracy. Be sure you recognize every entry on your credit report, and if there are any discrepancies, move quickly to repair them. If you have been targeted by identity thieves or had a credit card compromised, you may have unpaid balances on cards you never opened – and aren't responsible for. The sooner you have those accounts closed and removed from your credit report, the earlier your score will begin to recover.

Here is what you will probably see when you pull your report.

If your poor credit score is a result of late payments or high balances, then while you reduce your balances and built a record of on-time payments, your score will gradually increase with time. Most late and missed payments are kept on your credit score for seven years, so you need to focus on building up that record of on-time payments.

Credit repair is straightforward, but that doesn't allow it to be easy: generate a system which works for you to make all of your payments promptly and pay a lot more than the minimum due on charge cards if possible. Ultimately, people who have the best credit ratings have perfect payment histories and low or zero balances.

[Related: Repair Credit]

Best credit cards for bad credit

Even if your credit rating is below 549, you might find you can still be approved for charge cards, although charge cards for “bad credit” generally offer low limits and interest rates. On the other hand, should you pay off your charge cards entirely as well as on time, those payments is going to be reported to the credit agencies and will help to increase your credit rating over time.

With that in your mind, here's a number of what you need to learn about applying for credit cards for poor credit.

Unsecured charge cards for bad credit

Unsecured charge cards are “regular” charge cards that don't need you to deposit any cash with the bank as collateral against unpaid debt: you're permitted to buy things up to your borrowing limit, and can invest in your purchases with time – although you'll typically pay high interest rates on any purchases you don't lead to full every month.

Unsecured credit cards targeted at those with truly bad credit tend to charge, in addition to high rates of interest, high annual fees as well as fees only for applying for example processing fees.

It's better to stay away from those cards and either obtain a secured credit card or reach just a little and obtain a charge card which has no annual fee and you can work at building up a history of on-time payments – a vital component of your credit rating.

[Related: How to Build Credit]

Instant approval charge cards for bad credit

Credit card providers don't offer “instant approval” anymore, and many card providers don't offer instant decisions either, but for those that do, they offer an immediate decision or perhaps a decision “within A minute.” That simply means there is a link with the credit bureau they use to evaluate applicants, and a computer algorithm that decides what credit rating applicants need to be approved (they may also evaluate on-time payment history and the other aspects of your credit rating). Some charge cards with internet applications, or perhaps those are applying for in a bank branch, could give you a decision in your application within moments, however remember that the decision they provide for you may also be that they'll require additional information or that they'll require more time to access your application and credit information.

For credit underwriting reasons, even charge cards that promote an “instant decision” may need an evaluation by a person of all time finally approved or declined, so know that the application might not be immediately processed.

Secured credit cards for bad credit

One way to rebuild your credit would be to subscribe to a secured charge card and also to utilize it responsibly. With a secured charge card, you can open credit cards with a spending limit typically comparable to the amount of cash you deposit using the bank issuing the charge card. The safety deposit is not put on purchases that you make on the card. It is held by the bank in case you fail to pay the bill. With responsible use on your part a secured card can provide you the opportunity to demonstrate what you can do to manage a revolving line of credit, improve your credit score, and eventually graduate to an unsecured credit card.

Opening a secured charge card does need you to connect cash in the type of security deposits, secured credit rebuilding charge cards are for those individuals who are a new comer to credit and have no credit/limited history or for those who are attempting to rebuild their credit. Their offers can be used something that will help you, nevertheless the final point here is it's your decision to manage your account responsibly and also to work on repairing or developing a positive credit history.

[Related: Improve Your Credit Score]

Store credit cards for bad credit

Besides secured charge cards, another option to consider are store credit cards. These are lines of credit that you could just use to create purchases in the issuing store. When you are making a lot of purchases from one merchant, it might be worth checking out if you're eligible for an outlet card.

Your balances and payments will be reported towards the credit bureaus, and you'll also earn rebates or discounts in your in-store purchases made in the issuing store. However, remember that the interest rate, annual percentage rate (APR) for purchases, is commonly higher for store charge cards so it might be best to maintain your spending so that you are able to pay off your balance entirely and on-time each billing period.

Even Amazon.com offers an Amazon Store Card you can use to buy things on Amazon.com, however that is not to suggest that you'd qualify for this card if you are a new comer to credit or you are rebuilding your credit.

There are no guarantees that you'll be approved for any store charge card.

Question: What’s the best way to obtain a charge card with poor credit?

Answer: The easiest method to get a charge card with poor credit is to raise your credit score. For those who have a low credit score due to missed or late payments, then getting back on the right track together with your payments will gradually rebuild your payment history and improve your credit score. Each late or missed payment disappears off your credit score after seven years, therefore the sooner you get back on track the sooner your credit rating will recover.

If you have not opted from pre-screened credit offers, you may also be targeted through the mail with credit card offers for poor credit.

Question: Are there credit cards for those who have no credit?

Answer: Although you may get a credit line of just $100, consider a store charge card or, as already mentioned, a secured charge card (in which you make a security deposit that's typically comparable to the credit limit you'll be extended by the card issuer) these choices are the best opportunity to get a credit card for people who have no credit. They provide you with the opportunity to begin to build past on-time payments and responsible control over your credit, both of which eventually open the door to unsecured credit cards, mortgages, auto loans, along with other types of personal credit.

Bad credit car loans: what you need to know

Some lenders offer car and motorcycle loans for those who have bad credit, but you need a strategy before you start looking around. You will most likely pay more in interest with this kind of financing. For example, some car lots offer “buy here, pay here” financing without any credit assessment required however the rates might be 15% to 30% or higher.

If you're trying to get a car loan with poor credit, look at your free credit score card from Credit Sesame first to see what shape your credit is in. Pay down your existing debt balances and make sure you have to pay all of your bills promptly. Doing those two simple things can add points to your score that will assist you be eligible for a a better deal on a auto loan.

Question: Can poor credit auto loans assist in improving my credit score?

Answer: It depends. If you are purchasing a car through a dealer that offers on-the-lot financing, the loan may not be reported towards the credit agencies. Prior to signing on the dotted line, make sure that your payments will show up on your credit score so your score benefits from your responsible credit management.

Bad credit personal loans

Personal loans for people who have bad credit may take a variety of forms-peer-to-peer loans, loans issued by online banks and car title loans are just a few. These are all examples of quick installment loans for bad credit, which means you borrow a specific amount of money and also you must pay it back over a collection period of time.

If you'll need a personal loan and you've got bad credit, a web-based lender might be the best choice. Online lenders frequently offer better rates than traditional banks and they are usually a little more flexible with regards to approving borrowers who've sub-standard scores. Take a look at the list of lenders mentioned earlier to obtain a feel for what your options might be.

Home loans for bad credit

Editor’s Note January 7, 2021: The U.S. Department of Housing and concrete Development (HUD) websites have not been updated due to the lapse in Congressional Appropriations for Fiscal Year 2021, as a result the information for FHA loans might not be the most current

If you want a mortgage and you have poor credit, prepare for a constant battle. Typically, most lenders require a minimum credit rating of 620 for any conventional loan. For any USDA loan without any down payment, the score requirement climbs to 640.

Technically, it's possible to have an FHA loan with a score as little as 580. But each individual lender who works together with the FHA decides what score it will or won't allow. The benefit of an FHA loan over conventional financing is that you can make a down payment of less than 3.5% from the purchase price. To find the best terms on a conventional loan, a 20% deposit may be the industry standard.

A few lenders will underwrite an FHA loan for a consumer with a score below 580, but the loan comes at a price. Instead of 3.5%, you will need to pony up a 10% deposit instead. If you prefer a $200,000 loan, you'll need $20,000 to obtain a foot in the door. This may be a good option for somebody who has received a cash windfall, but for anyone who has to save, within the time that it takes to save that sort of money, you can easily as quickly (or even more easily) improve your credit and be eligible for a a better loan.

Tapping your home equity with bad credit

If you already own a home and also you want to consolidate your high-interest charge cards, you may want to think about a home equity loan. When you have a home equity loan, you're borrowing a lump sum and repaying it according to a predetermined schedule. A house equity line of credit is different – it is a credit line that you can draw on over and over until you've borrowed the limit.

One aspect to remember if you are trying to get an equity loan and you've got bad credit is that you may be limited as to the amount of your home's value you can draw against. You may even have to pay a bigger origination fee along with a higher interest rate than someone with better credit.

Bad credit pay day loans: Are they a good borrowing option?

In-store an internet-based payday loans for those who have poor credit provide fast cash when you really need money in a pinch but you should approach them with extreme caution. The premise is straightforward: a payday lender enables you to borrow a certain amount of money using your next paycheck as your collateral. When you are getting paid, the lending company takes the money electronically from your bank account, together with any interest and costs the lending company charges.

It sounds fairly easy but there's a catch. Lenders who issue payday loans for those who have bad credit appear to operate on the idea that other borrowing avenues may be closed to you from your credit rating. They charge reasonably limited for lending you cash in the form of an astronomically high APR, invariably in triple digits and sometimes topping 1,000%.

If you can't remove the loan whenever your paycheck comes in, they provide you with a choice of allowing this to continue your original loan into a brand new one and also the interest and fees just keeps mounting up. Before very long, you're held in a vicious cycle that you simply can't dig your way from and your debt balance keeps growing daily. The bottom line? Pay day loans are best avoided if you do not wish to accomplish even more harm to your finances and credit.

If you need to do consider a payday loan, remember that their interest rates are usually expressed in monthly terms. Multiply the amount by 12 to find the APR. An online payday loan with a 36% monthly rate may seem fair but it actually has a 432% APR.

Finally, know that the typical payday loan customer rolls the loan over eight times. That means registering for a new loan because you can not afford to pay off the loan punctually. Each time you roll the loan over you have to pay another set of fees. It's not uncommon for payday borrowers to pay for fees and charges which are more than the original loan amount.

Finding debt consolidation reduction loans for bad credit

Consolidating charge cards, loans or other lines of credit can help your credit rating as long as you do it the right way. Unsecured unsecured loans for people who have poor credit allow you to roll all your payments into one without offering any personal assets as collateral.

When you take out financing for debt consolidation reduction you use the money to repay other debts. You then make one monthly payment towards the consolidation loan lender. The goal would be to streamline your instalments minimizing your interest rate so you can spend the money for debt off faster.

If you have poor credit, spend time comparing loan options to see who have the very best rate and just what the fees are.

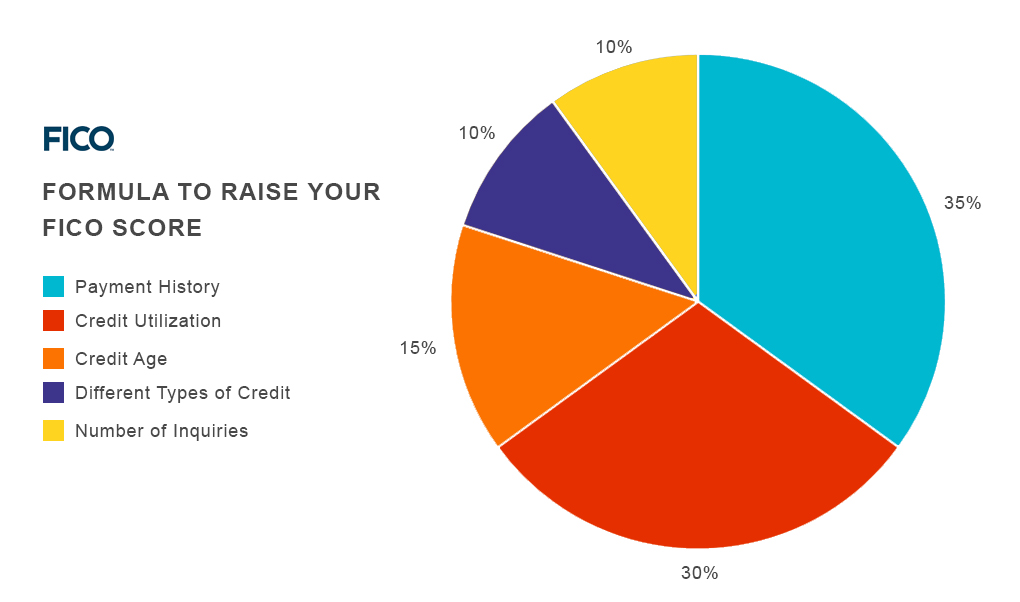

Otherwise you will end up in much deeper trouble than you started in. If you know you can preserve the accounts open without adding more debt, achieve this since 10% of your FICO credit score is based on the typical period of your credit history.

Bad credit student loans

When are applying for federally guaranteed student loans, your credit history doesn't come up. The government assumes that most college students haven't had the chance to establish a strong credit rating yet.

It's a different story, however, if you apply for private loans.

Private student loan lenders consider your credit report included in the application. If you've got low credit score because of a past credit mistake or else you haven't used credit long enough to work the right path to some higher score, you will possibly not qualify. A co-signer may be the only option if you really want the borrowed funds.

First, determine if you can steer clear of the loan. Regardless of what the rep says, no school program can guarantee you a healthy – or even a minimal – income after graduation. If you can't qualify on your own and you don't qualify for federally-guaranteed loans, think about a less costly program or spend a couple of years saving money first. Also, many large companies and employers offer tuition assistance. See if you can land a job for an organization that will give you free money for college.

When you may well ask a parent or other people to co-sign for the loan, the lender will appear at that person's credit history and score in addition to yours. As long as she or he been responsible with credit, a co-signer can mean loan approval. Just know that when someone else signs their name to your loan, they're assuming full liability for that debt. Should you default, the lending company can and will pursue your co-signer to collect what's owed.

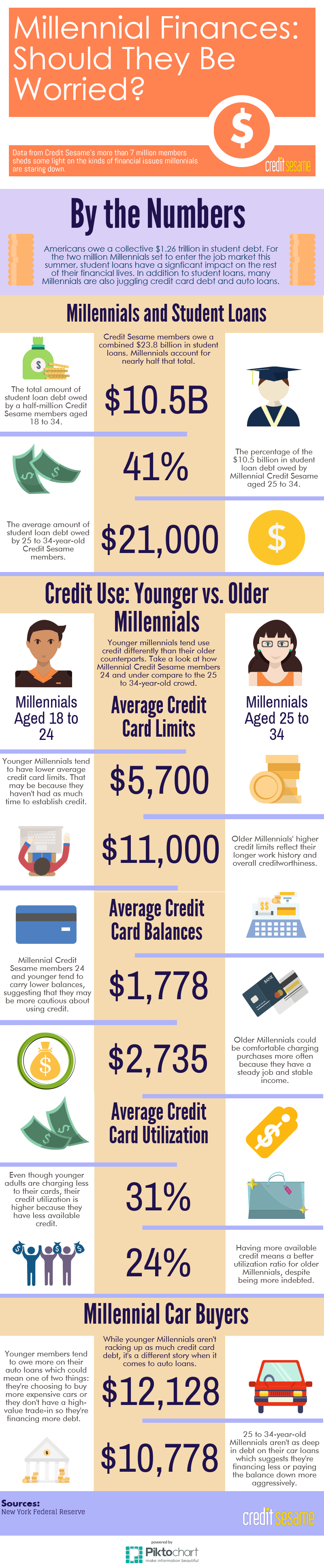

Approximately 70% of all graduates leave school with education loan debt. We looked at Credit Sesame members — Millennials particularly, and stopped working some scary numbers, including student loan debt.

Business loans for bad credit

If you're looking to get a company off the floor or maintain positive cash flow for an existing venture, financing is an excellent method to cover the space. While bank loans when you have poor credit are not as easy to come by, other options exist to gain access to money for business-related expenses.

Merchant cash advance lenders, for example, make large and small loans for businesses who cannot qualify for loans from banks or any other loan/credit products, without having to put your credit report under the microscope. Instead, a merchant cash loan depends upon your company revenue and just how much revenue you've coming in from sales every week.

Invoice financing is another option if you have unpaid invoices that you simply reasonably be prepared to collect on soon. Invoice lenders loan funds against amounts invoiced. It's possible to borrow as much as $500,000 by doing this, even if you possess a credit rating that's in the 500 to 550 range.

The most significant caveat to bear in mind with loans for all those with bad credit, is the price for that convenience. For several kinds of financing, the annual percentage rate hovers around the 100% mark. Know how the interest will affect your business's bottom line over time, and for a far more in-depth picture of small loans for those with bad credit, take a look at Fundera.com.

Bad credit mortgage lenders

In a nutshell, obtaining a mortgage when you have poor credit means you'll pay a significantly higher interest rate than your good credit peers. While bad credit doesn't always equal a denied application, it's likely to make the road to homeownership harder.

[Related: What is a A good credit score Score]

Lenders search for borrowers having a stable income, great credit, and also the willingness to pay interest on a loan. Because the housing crisis of 2007-2008, mortgage lenders have tightened requirements for home loans.

Improving the chance isn't impossible. Some banks and mortgage companies even specialize in obtaining home loans for those who have a less-than-perfect credit rating.

The initial step to getting a home loan is discovering wherever you stand. The lending company will use a 3 bureau credit history to judge your creditworthiness. This tri-merged report includes data all three major credit agencies (Equifax, Experian and TransUnion). You will get an advance take a look at what the lender will see by requesting a duplicate of your credit history from each of the credit reporting agencies by going to AnnualCreditReport.com. They are free once every 12 months. If you want additional copies sooner, you will need to pay a charge. You can also look at your credit and score now and every month, free of charge, on Credit Sesame.

Look at your credit history before you decide to approach a home loan lender. Certain kinds of data provide a warning sign to lenders:

- Bankruptcy in the past 10 years

- Collections

- Judgments

- Tax liens and overdue taxes

- Loan default

- Revolving accounts which are within the credit limit

- Accounts that demonstrate late payments

A decent FICO credit score could get you right into a car or apartment, but mortgage lenders pay attention to your whole credit rating. While your FICO credit rating still matters, the items in your credit history and also the credit scores generated by TransUnion, Experian, and Equifax may ultimately do or die your mortgage application.

If you see errors in your credit history like accounts that should have aged off your report (7 to 10 years), accounts that do not belong to you, or errors inside your name or address, it's important to dispute them immediately using the credit agency reporting the error(s). Millions of credit rating errors are serious enough to affect your score.

Other tactics to wash your credit include bringing your credit card balances down to below 30% of the credit limit on each account. Two cards with low balances are superior to one card maxed out. Pay your bills promptly. Payment history weighs most heavily in your credit rating, so one option is put your bills on auto-pay to ensure the payments arrive on time, however, you still need to keep watch as occasionally your creditors may change their payment deadline. Avoid closing any accounts until after you have secured your mortgage.

Here is the formula FICO uses to calculate your score. You can use this as a help guide to bring up your score, if you are searching to enhance it soon.

How to locate poor credit mortgage lenders

Many banks, lending institutions, and mortgage companies cater to the wants and needs of people that can't provide an excellent FICO credit score (an excellent credit rating range is usually considered to be 720 and better). Subprime credit scores mean higher interest rates, and more than half of Americans have credit scores that fall under a less-than-desirable range. Scores below 649 are considered “poor” based on the mortgage industry.

[Related: Highest Credit Score]

For prospective homeowners with a military background, a VA loan is a good option to explore. VA loans don't have any required down payment. Additionally they do not require traditional private mortgage insurance (PMI), making the entire mortgage payment lower. The minimum credit rating for many VA loans is 620.

The Federal Housing Administration (FHA) provides an option for borrowers having a minimum credit rating of 580 and a 3.5% cash down payment. You can qualify for an FHA loan having a score less than 580 if you're able to swing a greater deposit; a score as low as 500 might be enough if you in addition have a 10% deposit and other favorable factors such as stable history of employment and verifiable income. The FHA also accepts an inheritance or a gift as a deposit, making this type of loan one of the best choices for many borrowers with poor credit and limited financial means who want to get a home loan.

Borrowers with credit scores above 620 should try to qualify for a conventional loan backed by Freddie Mac or Fannie Mae. Using this type of loan, you have to pay 20% from the cost to prevent paying a regular monthly PMI premium. If you cannot make any type of a down payment, but your credit rating is better than 620 and you'd like to reside in a province, a USDA loan may be worth pursuing.

Subprime mortgages are harder to obtain compared to what they were just a couple years back, but they are still available. Just be mindful of the eye rates and fees. A one percentage point difference in your interest rate could add thousands of dollars towards the price of your house over the course of a 30-year mortgage.

How to get mortgages for those with bad credit

If you've been denied for a home loan due to having poor credit, ask the lending company for that exact reasons. In some instances, a larger down payment, correcting an error, or providing additional information may improve your chances of getting approved the next time around.

Some lenders, especially the ones that deal specifically with subprime borrowers, are willing to take a look at extenuating circumstances. For example, if you can prove that you've paid your rent promptly each month within the last year and you're simply requesting a loan amount that produces a loan payment about the same as the rent payment, you might have a case.

A large financial company that is familiar with a variety of subprime lenders will help you find a loan to suit your needs. Your chances of obtaining a mortgage for people who have poor credit may increase if you seek the advice of a skilled broker. Certain lenders focus on borrowers with low income, while others focus on creating mortgages for people who have limited documentation, high debt-to-income ratio, or perhaps a short credit history.

Getting a mortgage if you have poor credit is definitely an option for some people. Failure or success depends upon how much money you've for a down payment, whether you are able to improve your credit score within the short-term, and how willing you are to search for the right lender.

Also remember that creditors and all lenders take a look at more then just your credit rating when looking for you for any credit line or perhaps a loan.