Three causes there gained't be considered a 2021 housing industry crash

Standard Chartered Bonus$aver Account – Here's The best way to Maximise The Interest Earned About this Deposit Account

Building up savings is a vital financial objective for many working adults.

Whether we are saving to have an end-of-year holiday, our wedding, home rehabilitation or just putting aside money for rainy days, most would agree that having sufficient savings is important for us to live more confidently.

At the same time frame, most of us have a number of banking needs we have to perform. These include the use of a credit card for cashless transactions, crediting our salary and paying our bills online. To simultaneously enjoy convenience and maximise our returns, it seems sensible to have one deposit account where we are able to consolidate all of our banking needs.

The question then arises: how can we make the best utilization of our deposits?

Standard Chartered Bonus$aver: A first deposit Account That Gives You Good Interest Rates

One of the easiest things you can do is to simply employ a deposit account that earns a good rate of interest.

In Singapore, one particular account that you could make the most of may be the Standard Chartered Bonus$aver Account. The Bonus$aver account enables you to earn mortgage loan of up to 2.88% per year (p.a.) on the first S$80,000 kept in the account.

To earn this, account holders need to meet quick and easy criteria.

# 1 Card Spend (up to 0.78% including prevailing rate of interest of 0.03%)

You will earn bonus interest on the first S$80,000 of your deposit balance if you meet the minimum card spend.

If you've S$80,000 and charge no less than S$500 in almost any calendar month on qualifying retail transactions for your Bonus$saver card linked to a Bonus$aver account, you can generate an added bonus interest of 0.25% p.a. This increases as much as 0.75% p.a. if you charge the absolute minimum spend of S$2,000 every month.

# 2 Salary Credit (0.2%)

By crediting a regular monthly collect earnings of S$3,000 to your Bonus$aver account, you will earn a bonus rate of interest of 0.2% p.a.

# 3 Invest & Insure (0.9% each, total of just one.8%)

If you've committed to an eligible unit trust (minimum subscription sum: S$30,000) or purchased an eligible insurance plan (minimum annual premium: S$12,000) through Standard Chartered, you'll earn one more interest rate of 0.9% p.a. each. This means you can potentially earn as much as 1.8% should you invest and insure with Standard Chartered.

# 4 Bill Payment (0.1%)

By paying three eligible bills, with a minimum of S$50 each, from your Bonus$Saver account via GIRO or internet banking, you can generate one more 0.1% p.a.

In total, you can generate Card Spend (up to 0.75%) + Salary Credit (0.2%) + Invest (0.9%) + Insure (0.9%) + Bill Payment (0.1%) + Prevailing Interest Rate (2.88%) = 2.88% p.a. from the Bonus$aver account.

Do observe that the bonus interest above applies to the first S$80,000 deposit balances.

How Much Performs this Equal Every month?

How much you can generate in the Bonus$aver account each month will primarily depend on two factors – 1) the savings that you currently have in the Bonus$aver account and a pair of) the number and type of criteria you meet every month.

To provide a better feeling of just how much you stand to earn every month, here are two scenarios.

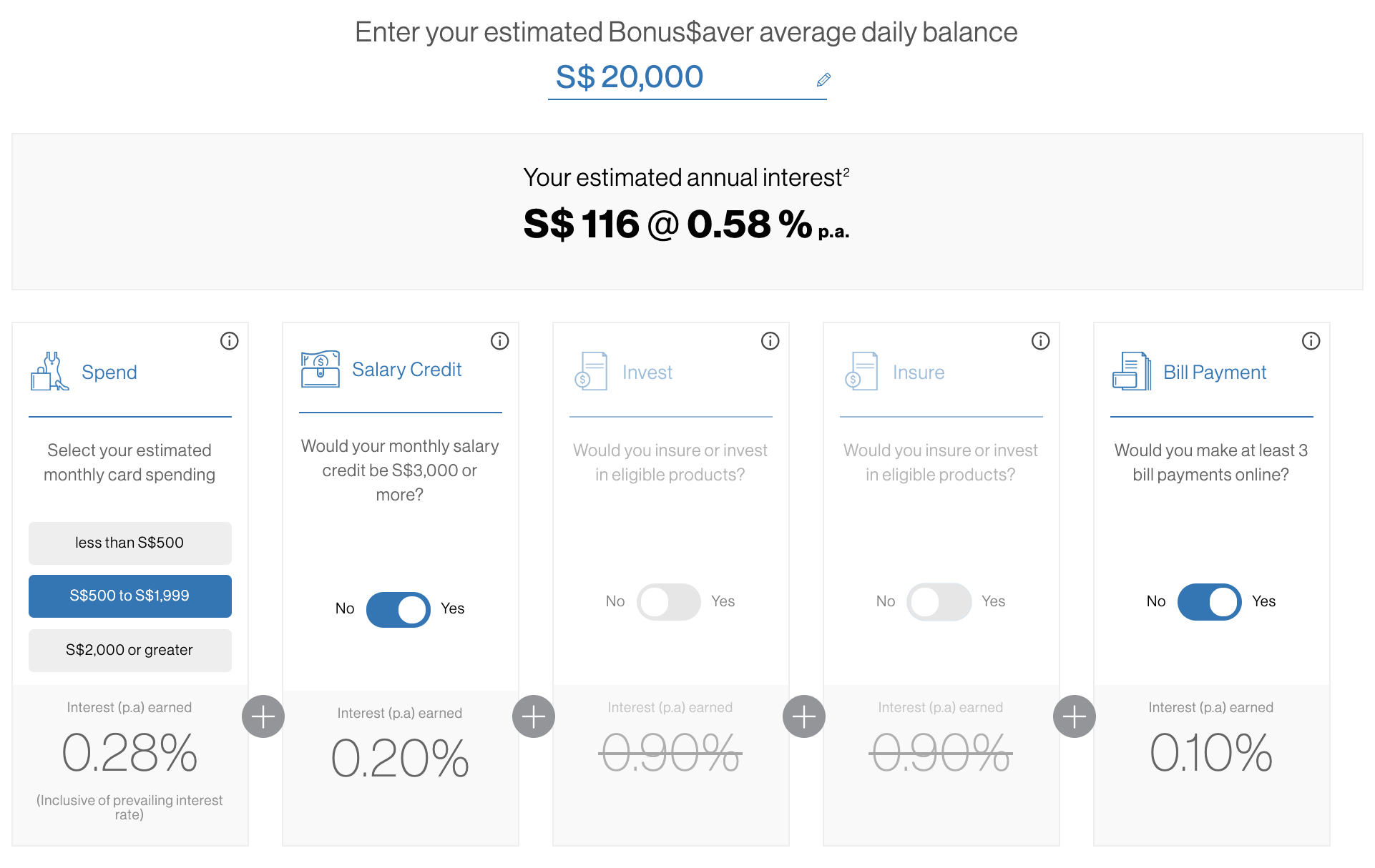

In the very first scenario, we assume Adam, our friend who just started working, gets to be a take home salary of S$3,000. He spends S$500 on his Bonus$saver Card monthly, and also completes three bill payments each month. He currently has S$20,000 in savings.

Based on the widget calculator found on the Standard Chartered website, we can observe that Adam will earn an interest of around S$116 per year or about $9.67 monthly. This is a decent return, especially when you think about that Adam does is basically what most working adults would already be doing anyway.

Advanced Scenario:

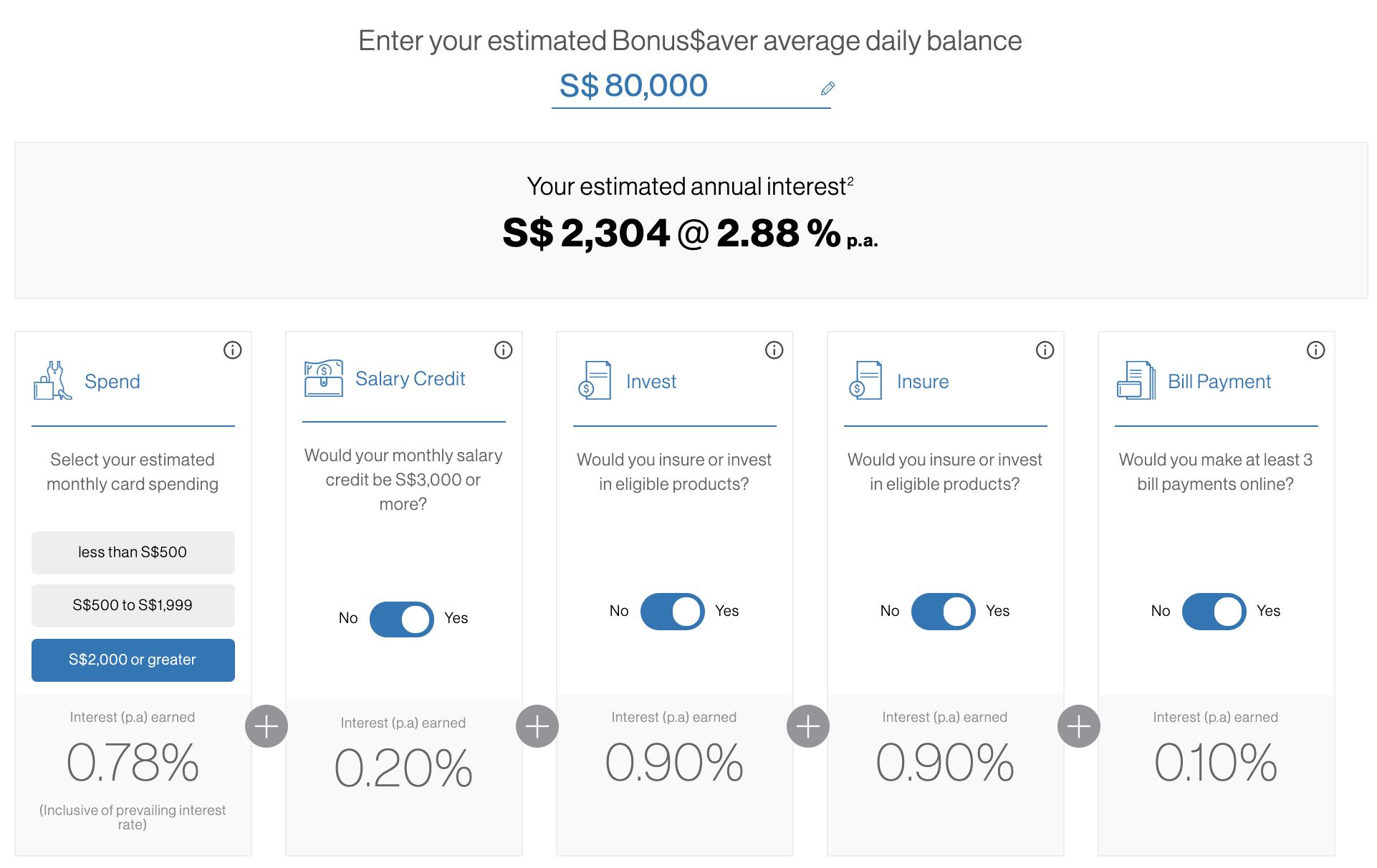

In the second scenario, we assume Ben, a buddy who's older and it has been working longer, receives a collect salary of S$5,000. Because he earns more and also offers to invest more to deal with his family, Ben also spends more on his charge card which pops up to about S$2,000 each month. He also has numerous financial budget, and easily completes three bill payments each month. He recently invested S$30,000 into unit trusts with the Standard Chartered online platform. Also, he buys insurance plans worth up to $12,000 p.a. through Standard Chartered. He currently has S$80,000 in savings.

In this second scenario, Ben has the capacity to earn a pursuit of approximately S$2,304 per annum or about $192 monthly. The effective interest rate of two.88% p.a. he enjoys might even be greater than the returns given by some bonds as well as stocks!

In contrast, if Adam and Ben were to leave their savings inside a regular savings account that pays them 0.05%, they will only earn a pursuit of S$10 and S$40 respectively each year. That's a huge difference.

| Savings Balance | * Annual Interest From Regular Savings Account | Annual Interest From Bonus$aver | Difference | |

| Adam | S$20,000 | S$10 | S$116 | S$106 |

| Ben | S$80,000 | S$40 | S$2,304 | S$2,264 |

*Based on an rate of interest of 0.05% per annum

Maximise The Interest Earned In your Savings Through The Bonus$aver Account

We are not saying that you need to stop investing and turn your focus purely to keeping the profit a high-interest rate deposit account.

Rather, what we should are saying is the fact that while you are investing part of your money, you should not neglect your liquid savings. It's also wise to attempt to maximise the interest rates earned for this money to limit its erosion from inflation.

By giving an interest rate as high as 2.88%, the conventional Chartered Bonus$aver Account can help you just do that, ensuring that you have access to liquid money on demand, while still helping you to earn a good rate of interest each month if you satisfy the relevant criteria.

You can use for the account here and get some attractive perks.