Three causes there gained't be considered a 2021 housing industry crash

CPF Investing Using FSMOne: How You Can Maximise The Returns On Your CPF Monies

In our previous article, we wrote about a few of the pros and cons of investing our CPF monies for our retirement. The idea is that as CPF members, we have the option to take a more active role in growing our CPF savings, or simply leave it untouched and earn the risk-free interest rate of 2.5% (Ordinary Account) and 4.0% (Special Account) respectively.

If you intend to invest your CPF savings, one platform that you could consider is FSMOne.

FSMOne is not a new comer to Singapore investors. Previously known as Fundsupermart, FSMOne is among the pioneering Financial Technology (FinTech) companies in Singapore and it has been operating since 2000, before the term FinTech was widely understood.

Recently, FSMOne launched a CPF microsite – Looking for CPF – which aims to make CPF investing easier and much more accessible to CPF members through an extensive range of tools, products and insights.

Outperform The Risk-Free Rate, Not The Market

When you invest your CPF savings, the objective is to outperform the risk-free rate of interest (of 2.5% and 4%) or to be merely quite happy with some positive investment returns instead of outperform the market.

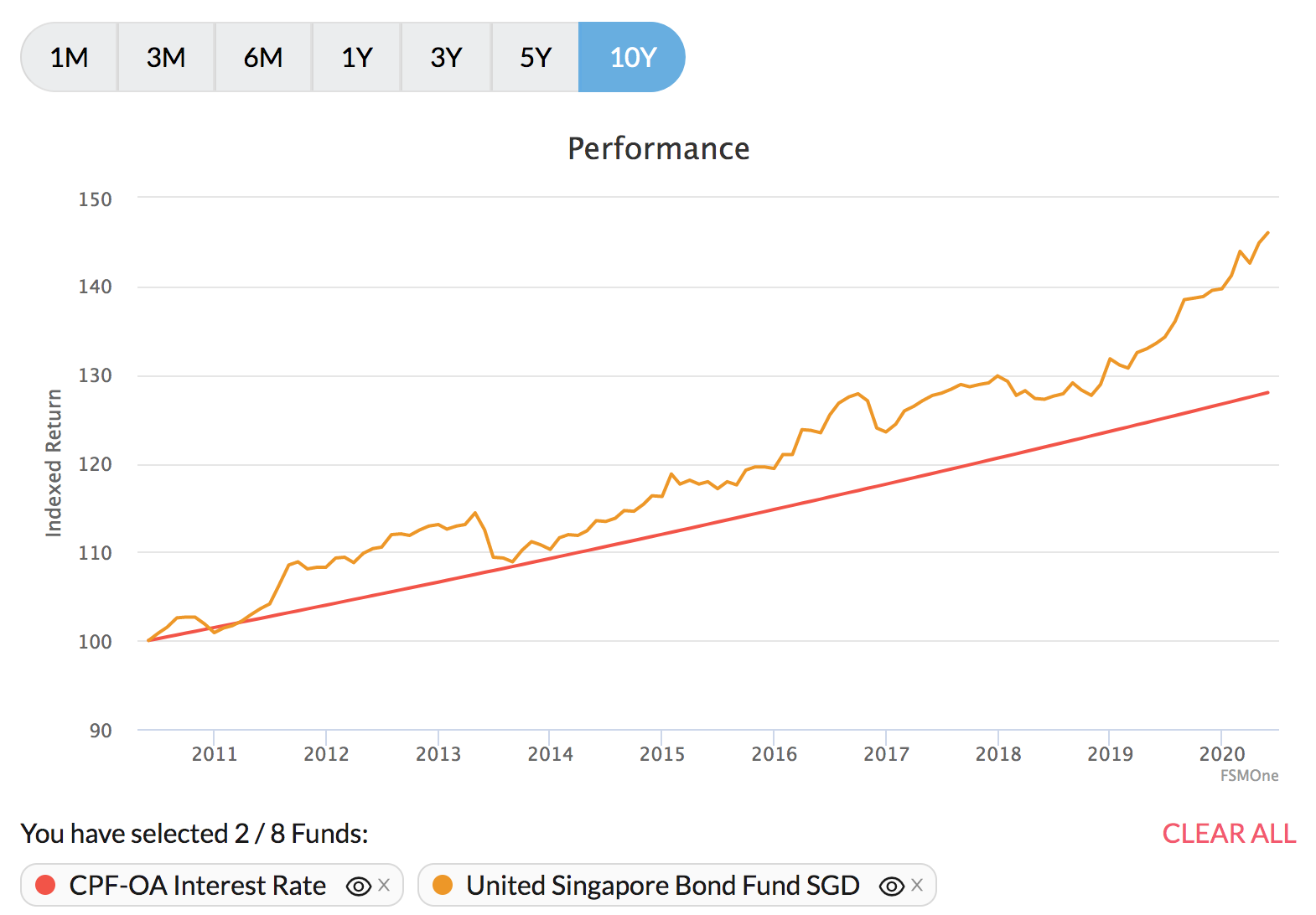

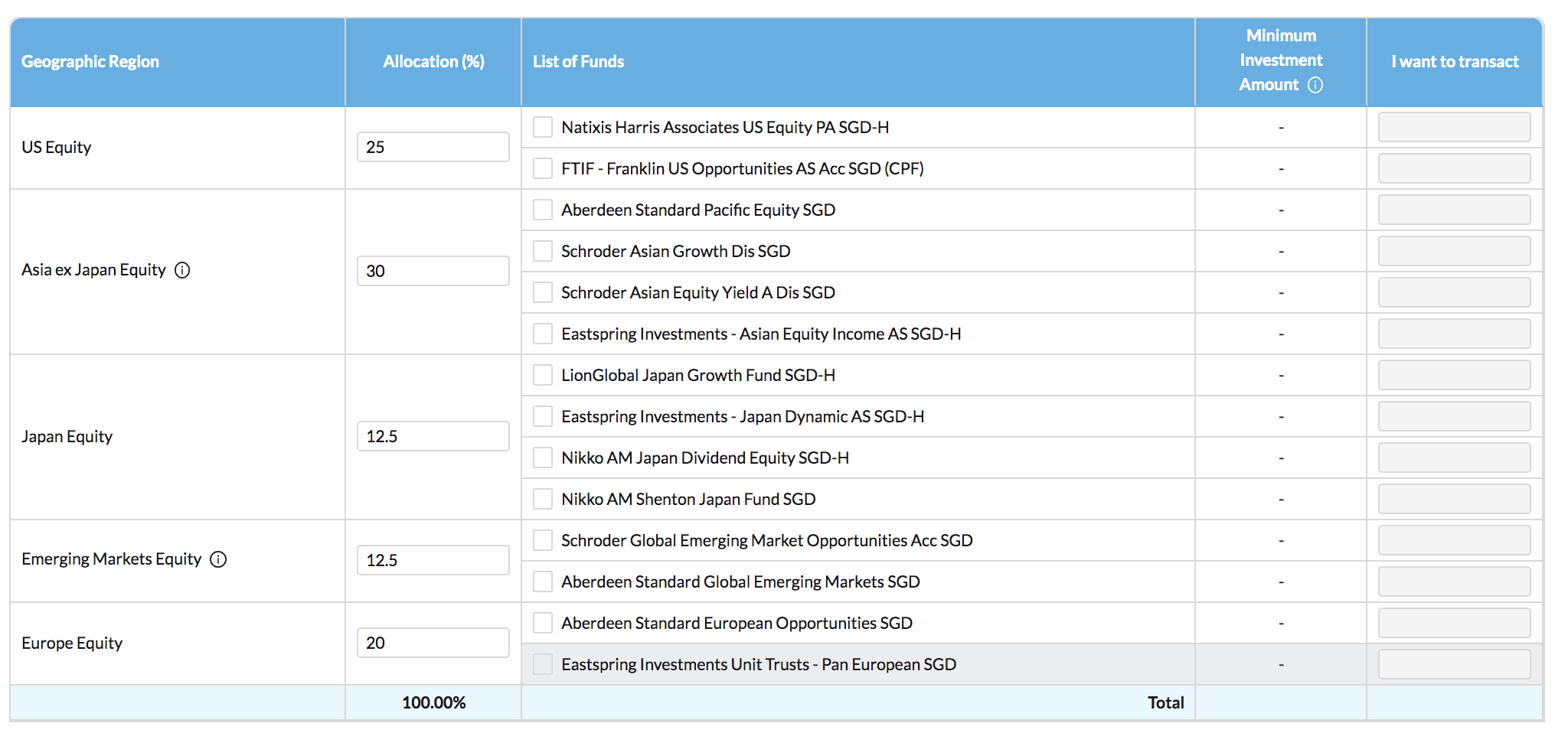

For example, when we compare the United Singapore Bond Fund, a fund that has been incepted since 2004 and invests mainly in bonds denominated in Singapore Dollars, we can see that it has outperformed the 2.5% risk-free returns that we would have earned from our CPF Ordinary Account (OA).

It's worth mentioning that as a relatively safe fund that invests mainly in bonds, investors shouldn't expect returns to be high. That said, a return of 3.7% p.a. is still higher than the 2.5% p.a. we obtain from our CPF OA. Over the long-term, this can add up to be a significant difference for the retirement nest egg.

The FSMOne performance chart likewise helps us compare the performance of selected funds to assist us make investment decisions. Despite the fact that past results cannot be accustomed to predict future returns, it's useful in helping us understand the kind of volatility that we can expect when we invest our CPF savings within the financial markets.

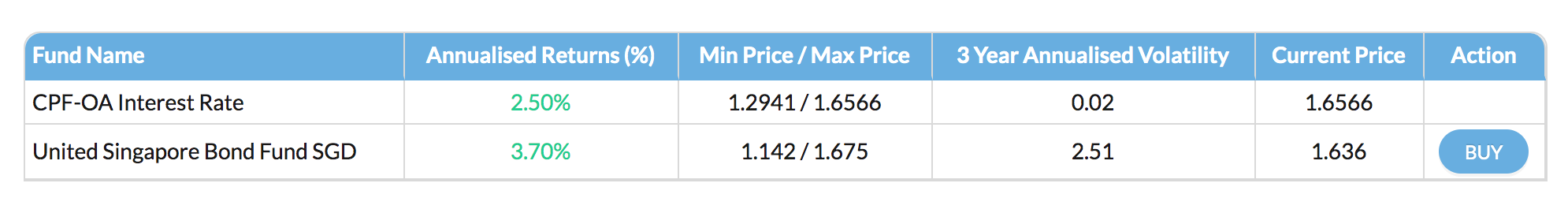

As an example, if we look at the chart above, we can see that equity funds (invested in Singapore, Asian and Japan) tend to be more volatile than bond funds and also the returns given by CPF OA. This is actually the risk that investors should be willing to bear when investing, since financial markets do not just go up in a straight line.

Using the Chart Centre, it's easy for investors to identify how each CPF-approved funds have performed in the past.

Invest Your CPF Monies In A Wide Range Of Unit Trusts

As an investor, we have to know what our risk appetite is and select our portfolio's risk level appropriately.

Low-risk funds will expose us to lower volatility, but our returns could be lower. On the other hand, higher-risk funds may potentially give us a much higher performance, however it might also decline in value during major recessions. As CPF members, we need to be mindful of the risk-return trade-offs that we face.

Our investment time horizon plays a component as well. If you are 50 and also liquidate some of your investments by age 55, it isn't ideal for you to invest in higher-risk funds since surprise recession (like what is happening in 2021) can certainly wipe out your gains and even part of your capital. If you're only 30 and have an investment time horizon of at least Twenty five years, you could consider taking on a higher risk level to savor greater long-term returns.

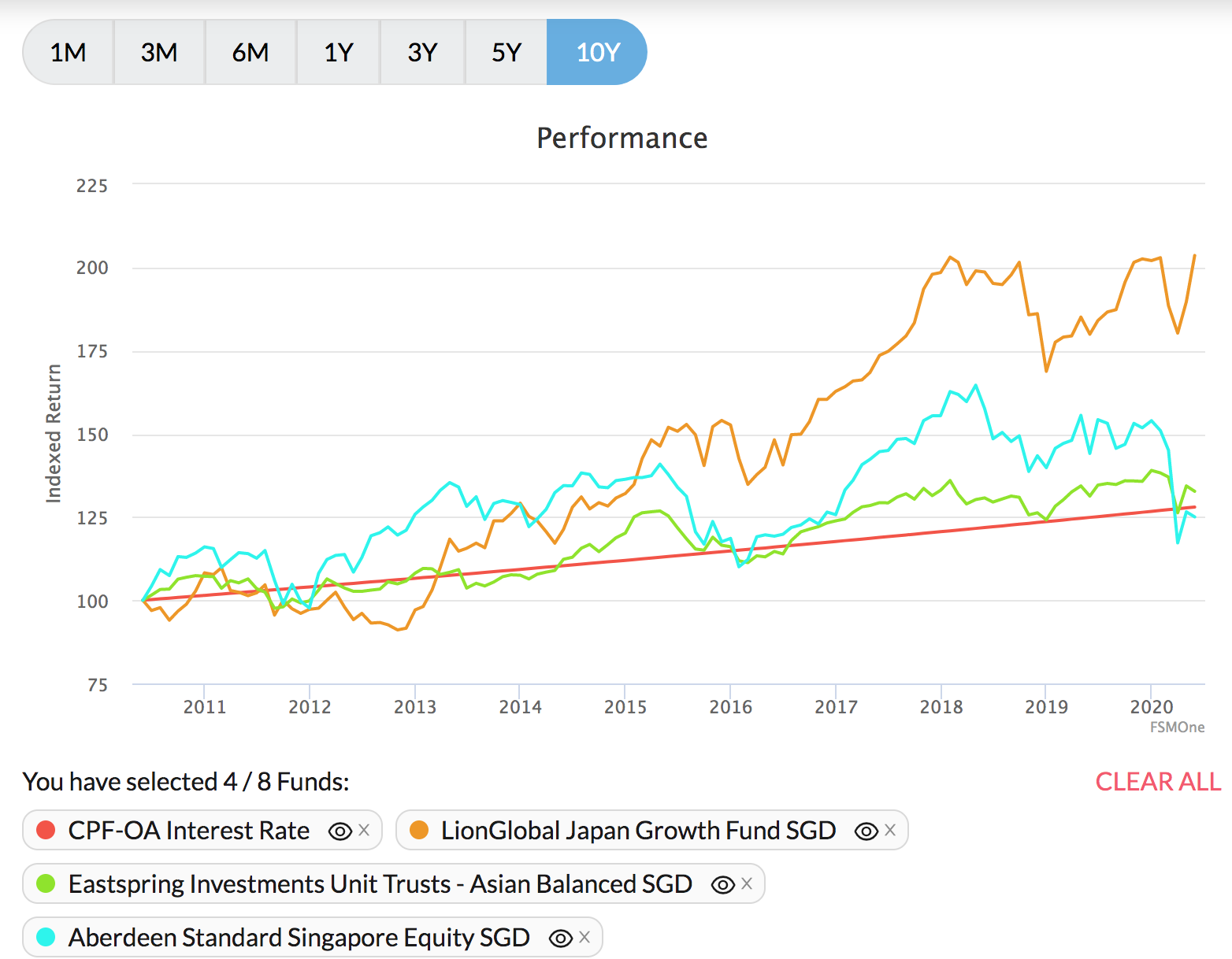

FSMOne offers a number of unit trusts, also known as mutual funds, which are approved for CPF investments. These unit trusts really are a basket of assets that invests inside a combination of stocks, bonds and other assets. You can select which geographic region you wish to invest in, including the US, Europe, Asia (excluding Japan), Japan and Emerging Markets.

FSMOne offers you access to all these unit trusts at 0% sales charges or platform fees. The only fees you pay are CPF agent bank charges and fund-related expenses charged through the respective unit trusts.

How New Investors Could possibly get Started Investing Your CPF Monies

If you're unsure of how to get started on investing your CPF savings in unit trusts, there's a starter kit that can guide you regarding how to construct your unit trust portfolio.

FSMOne advocates creating a GDP-weighted allocation.

For example, you could have 25% of the portfolio in US, 30% in Asia (excluding Japan), 12.5% in Japan, 20% in Europe and the remaining 12.5% of your portfolio in Emerging Market equity. FSMOne also highlights a few of the unit trusts that you can invest in to gain the exposure to the regions you are looking for.

The idea here is that if any specific region doesn't succeed, your entire portfolio will remain resilient as long as global market continues to grow within the long-term. This provides an important diversification for the investments.

Do note that these are only suggestions and doesn't constitute a recommendation or financial advice from FSMOne. Investors have the freedom (and responsibility) to choose their preferred portfolio allocation and unit trusts to invest in. You can even ignore the suggestions provided within the starter kit.

As a value-added service, FSMOne offers Investment Insights for investors to stay updated with important market news that may be important for your investment decisions. Even if you are not investing your CPF savings, it's good to keep yourself abreast of what's happening in the financial markets.

Investing Your CPF Or Leaving It Untouched Isn't a Mutually Exclusive Decision

If you wish to get started on investing your CPF, do note that you need to meet the following criteria first.

- Be a minimum of 18 years old;

- Have more than $20,000 in your OA; and/or

- Have more than $40,000 inside your SA.

- Have an agent bank account with DBS, OCBC or UOB if you are investing your CPF OA monies

- Not be an undischarged bankrupt

We need to stress that investing your CPF savings, or leaving it untouched, isn't an all-or-nothing decision. Even if you were to choose to invest your CPF savings, you don't need to invest every dollar you can.

Rather, investing just part of it allows you to earn higher returns when the market performs well, while still making certain part of your CPF savings are earning you a guaranteed compounded return of two.5% p.a.

To learn more and begin using FSMOne to invest your CPF, you are able to open an account today.