Three causes there gained't be considered a 2021 housing industry crash

The real Price of Minimum Monthly obligations – Credit Sesame

The allure of credit cards is they allow us to buy things we can not afford right now and pay for them later. We are able to charge what we want and remove the balance at our leisure. But unless you make the most of a temporary offer, you'll pay a price for that privilege of using a bank's money to buy what you need. That price takes the type of interest fees levied on the balance owed. Making minimum monthly payments – versus paying off the total amount entirely at the end of every month – will finish up squandering your greater than you may think.

Check Your Free Credit Score – No Charge card Required!

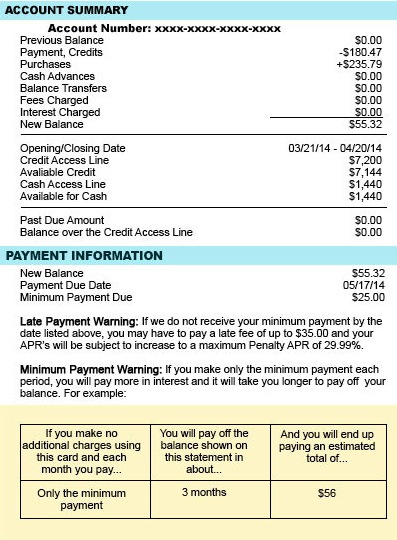

Learn More!The Minimum Payment Warning box is a little box that now appears on all credit card statements. It lets you know in quite simple terms just how long it will take you to pay off your credit card balance by looking into making the minimum payments only. In example #1 below, the the warning box is highlighted in yellow.

Example #1:

In example #1, the total amount is very low. If your financial emergency exists which consumer can't afford to pay off the costs immediately, the cost is minimal to spread it in a couple of months (under one dollar). The bigger problem comes with higher balances. Now take a look at example #2.

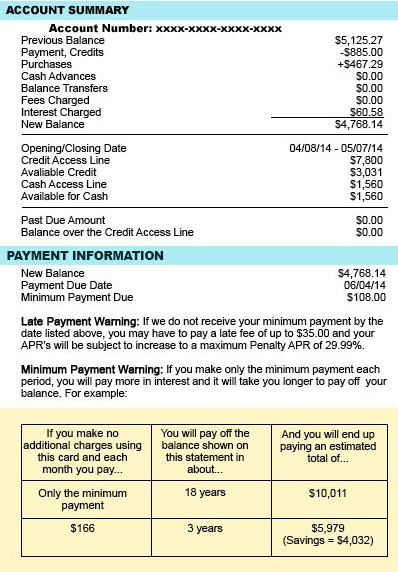

Example #2:

This consumer has a balance of nearly $4,800. The warning box clearly shows that if he makes just the minimum payment each month, he'll pay a lot more than $10,000 over the course of 18 long years. The true cost of minimum payments, therefore, is over $4,000 in interest fees and Fifteen years of monthly payments. Observe that increasing the payment to just $166 and keeping it at that amount before the balance is paid cuts the life span of the debt down to just three years. The main difference is mind-blowing.

Diminishing minimum payments

The forever nature of minimum payments is due to the truth that in addition to being a little percentage of the balance owed, as the balance falls, so too does the required minimum payment. Any consistent increase in the payment amount will noticeably – even drastically – shorten the life span and total price of the debt. For example, when the cardholder can afford that you follow the present payment amount of $108, your debt is going to be paid off within about six years. It's not necessary to do the math in your mind if you wish to alter the numbers. Search on the internet for “credit card repayment calculator” and enter your details. Here's a pleasant one supplied by State Farm.

“Can I afford that?”

If you are thinking about a purchase that you simply can not afford to repay completely right now and you're lured to charge it, look at this true cost calculator first. The credit card accounts illustrated above are at 15.24 percent interest. Itouch new generation ipod 64G costs $399. If this consumer wants one and may only manage to pay $25 monthly toward the balance, he'll spend 18 months paying it off and also the iPod will ultimately cost him about $450. If his minimum payment is just $15, he is able to stretch it to 32 months and pay about $490 for your iPod. Indeed, many charge cards require a minimum payment of just two percent from the balance (not often lower than $10). In that case, our iPod buyer may take a complete 57 months (that's 4.75 years) to pay off his purchase, for a total cost of $564, or 41 percent a lot more than the original cost). Is the item you would like worth that rather more?