Three causes there gained't be considered a 2021 housing industry crash

Funding Societies Is Offering Property-Backed Secured Investment: 4 Things To Understand Before Investing

Mortgage-backed securities (MBS) and collateralised debt obligations (CDO) possess a bad reputation among some investors in the financial world.

This can be traced to the 2007-08 Global Financial Crisis, when the excessive creation of MBS and CDO led to property prices being driven up, just for U.S. housing prices to crash, resulting in major defaults on homes and subsequently, huge financial losses for many banks and retail investors who've invested in these MBS and CDO that were backed by the cash flow from all of these mortgage investments.

Regrettably, this has caused some investors to avoid collateralised debt investments even though they are technically safer than unsecured loans. The idea behind collateralised debt investments is it is safer to lend someone money when you have claim over their assets in the event of a default.

Given the uncertainty over the economy today, Funding Societies, Southeast Asia's largest P2P lending platform, has introduced a product called Property-backed Secured Investment. According to Funding Societies, there has been no defaults within this product since it was launched 2 years when.

How Property-Backed Secured Investment Works?

To know how Property-backed Secured Investment works, we first have to know how Funding Societies operates.

As a P2P lending platform, Funding Societies helps match borrowers (i.e. SMEs who need to borrow money) to lenders (investors who are willing to lend in exchange for high rates of interest).

An interest rate is set by Funding Societies with respect to investors. This interest rate relies upon the credit quality of the SME borrowers who are assessed internally by a team of credit officers associated with their proprietary credit scoring algorithm. Naturally, SMEs which are deemed as more creditworthy will be charged a lesser interest. Investors can expect coming back of between 3% to 18% p.a. across a variety of guaranteed returns, secured and unsecured investments. Funding Societies charges a charge of 18% of the interest earned by investors.

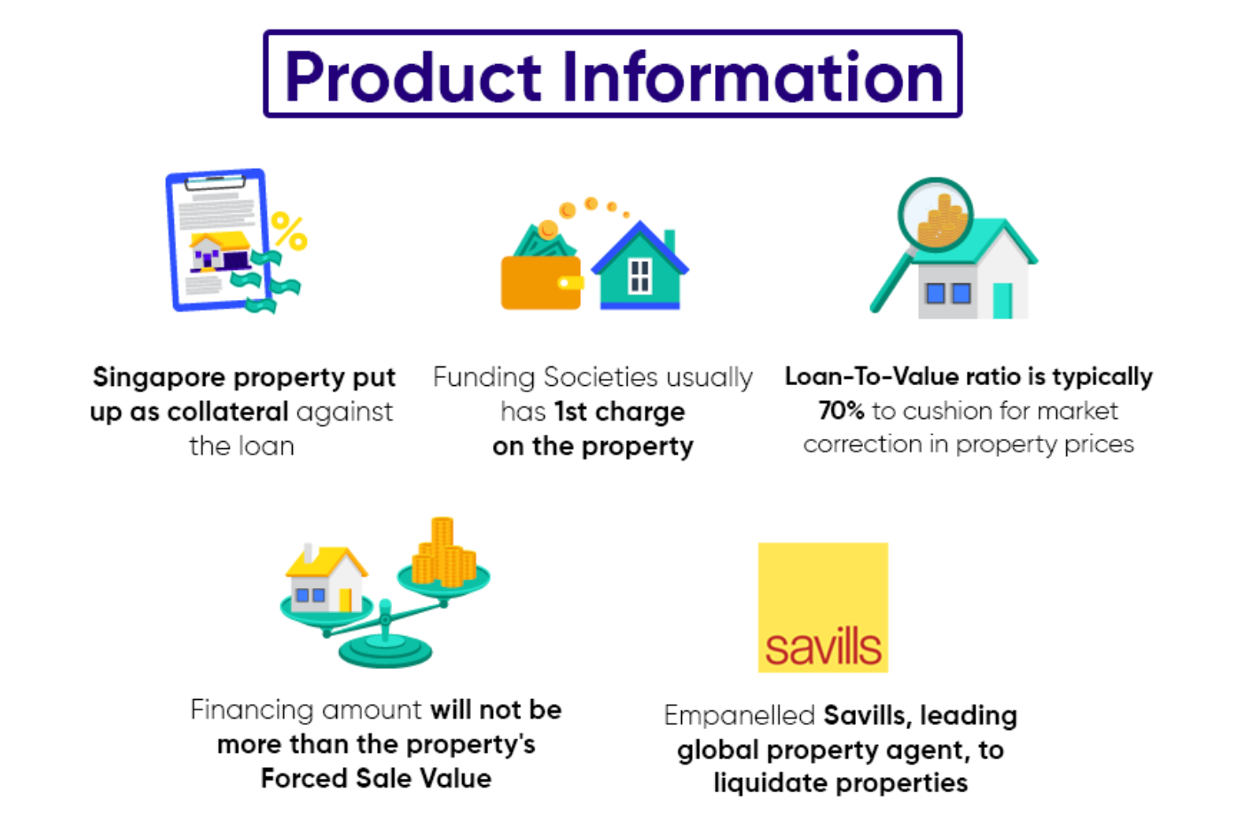

To lower the eye cost to borrowers, as well as reduce the risk for investors at the same time, Funding Societies introduced the Property-backed secured Investment, where SMEs can pledge their properties to secure the loans and therefore enjoy lower interest rates.

Here are 4 items to know about how its Property-backed Secured Investment works before investing in it.

#1 Your Loan Is Secured With a Property Owned By The SMEs Or Its Directors

Funding Societies only provide short-term loans of a maximum of 12 months. Also, all of its SME clients are required to pledge a personal guarantee when trying to get a loan with Funding Societies. Quite simply, if the company fails to make the promised repayments, the directors who guarantee the loan are personally responsible for the repayments.

Of course, this doesn't suggest the loan is 100% secured. If your company goes bust, pursuing the directors may also be a futile effort if he/she declares for bankruptcy.

To mitigate this risk, the Property-backed Secured Investment takes collateral in the form of properties. In the event of a default, Funding Societies has got the legal right to auction off the properties, thus providing one more recourse for investors.

#2 Residential, Industrial Or Commercial Properties Can Be Pledged

Investors who provide the loans aren't purchasing or investing in the home that is being pledged. Instead, the property is already owned by the company or the director, who is pledging it as being collateral as part of the loan arrangement. This would usually be a residential or commercial unit. As the borrower still owns the home, Funding Societies has the legal right to sell the property if there is financing default to recoup its loan.

#3 Maximum Loan To Property Value (LTV) Is 80%

If the valuation of a property (e.g. a condominium) is $1 million, Funding Societies will only approve a loan of up to $800,000. This is a Loan To Property Value (LTV) of 80%. Based on Funding Societies, the majority of business loans are approved at 70% of the LTV or below. This gives a buffer of at least 20% for price adjustments based on market conditions in property value. The majority of the properties accepted as collateral are unencumbered, reely of charge or mortgage. The forced sale property's value is always greater than the amount loaned; this provides assurance for the lenders.

#4 Expected Returns Which is between 4% To 8% P.A.

As compared to its unsecured business loans, expected returns for that Property-backed Secured Investment is significantly lower at about 4% to 8% p.a. This may come as no surprise, given that these property-backed loans are incredibly safe because of the collateral that is being held in the event of the default.

The returns are lower, however this is also because the risks tend to be lower – in line with the risk-return trade-off concept.

Fees charged by Funding Societies is the same as other products it offers, at 18% of great interest. If the interests earned by investors is $1,000, $180 is payable to Funding Societies.

If you have an interest to know how a Property-backed Secured financing fact sheet looks like, check out a sample below from Funding Societies.

You may also check out the Funding Societies FAQ page about this product.

If you are new to Funding Societies and would like to start investing with them, you can sign up using the DollarsAndSense Promo code <DNS20> to obtain $20 cashback.

Find out more about this promotion and sign up today here.