Three causes there gained't be considered a 2021 housing industry crash

DBS Multiplier 2021 Guide Regarding how to Maximise Interest Earned About this Savings Account

Regardless of what stage of life you are in, an excellent tool in your personal finance arsenal is really a high-interest savings account, which allows you to earn decent risk-free returns, and keep your cash available for use at short notice when the need arises.

By giving users the opportunity to earn between 0.30% – 3.00% interest per annum, the DBS Multiplier Account is a well-liked choice because the go-to high-interest checking account for many people in Singapore.

We'll explain how the account works so you can decide if it seems sensible for you to start using the DBS Multiplier Account.

Existing users should be conscious of changes towards the DBS Multiplier Account have been made effective from 1 January 2021. In light of these changes, it's worth reading onto see how to maximise the eye you can generate under the new rules.

How The DBS Multiplier Account Works

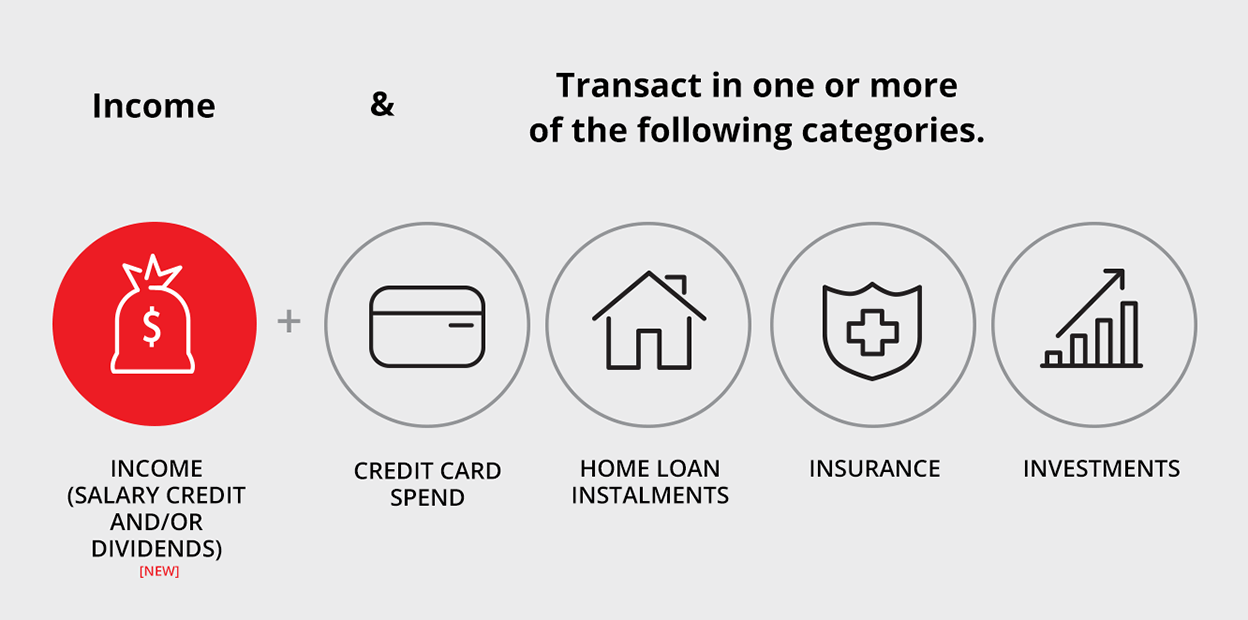

Source: DBS

In essence, to begin earning greater than a trivial (0.05% per year) amount of interest, you'll first have to fulfil the bottom category of Income (Which replaced the prior Salary Credit). To get this done, you may either:

Receive Salary Credit (via GIRO with regard codes of 'SAL' or 'PAY')

OR

Receive Investment Dividends (via GIRO from Central Depository [CDP], DBS Vickers, DBS Online Equity Trading, DBS Unit Trusts, DBS Online Funds Investing, DBS Invest-Saver)

After fulfilling the mandatory Income category, how much interest you earn in a given month depends on:

1) The amount of transaction categories you manage to fulfil;

2) The total value of these transactions; and

3) The Monthly Average Balance in your DBS Multiplier Account.

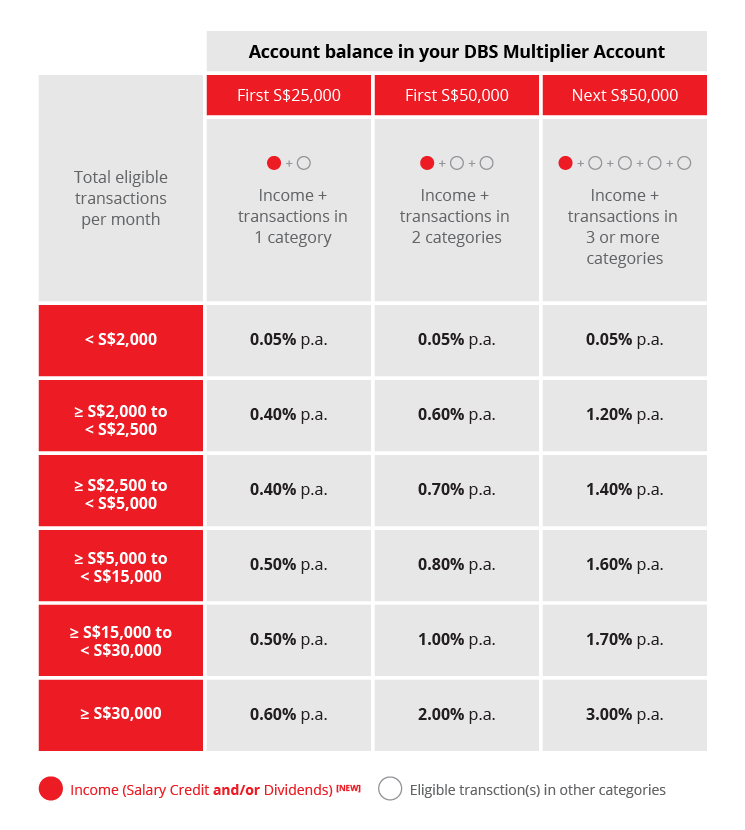

You can refer to this table from DBS to see this represented graphically:

If the awarded interest at higher tiers begins to help make your mouth water, listed here are the criteria for fulfilling each additional category.

Credit Card Spend: This is pretty self-explanatory. You fulfil this category whenever you (or your supplementary cardholder) buy things using any DBS/POSB credit card, such as the popular POSB Everyday Card, DBS Live Fresh Card, DBS Altitude Visa Signature Card, DBS Black American Express Card, and DBS Woman's Card.

Home Loan Instalments: If you're planning to buy a brand new home or qualify to refinance your house mortgage, you can fulfil this criteria by getting a DBS home loan and paying your monthly instalments – company, both cash and CPF components are recognised.

Investments: You can fulfil this category in some ways:

– Create a new Unit Trust Lump sum payment Investment; or

– Make a fully settled 'BUY' trade using DBS Vickers; or

– Initiate a brand new DBS Invest-Saver plan, which is recognised for the first 12 consecutive months.

Insurance: To fulfil this category, you can purchase regular premium insurance policies from DBS' bancassurance partner, Manulife, which is recognised for that first 12 consecutive months.

To assist you to estimate how much interest you can potentially earn while using DBS Multiplier Account, we'll next make use of this handy calculator by DBS and project several common scenarios.

Scenario #1: Just how much Can A Working Adult Earn With DBS Multiplier Account?

According to 2021 data from the Secretary of state for Manpower, fresh graduates in Singapore earned typically $3,500 (public university graduates), $2,501 (Polytechnic graduates) and $2,200 (ITE graduates).

For this illustration, we will make use of a gross monthly earnings of $3,000. Let's also assume the new graduate has a modest $12,000 in savings.

Income: Salary credit of $2,400 (After deducting 20% employee CPF contribution)

Credit Card Spend: $500 (For transport, meals, and other daily expenses)

By leaving your money in a regular checking account (with interest of 0.05% per year), you'll be earning only $0.60 that month (with different 30 day month) in your balance of $12,000.

If i was to make use of the DBS Multiplier Account, we'd have fulfilled the Income and Credit Card Spend categories, in addition to clocking $2,900 in eligible transactions, thus earning us 0.4% in interest per year. On our same balance of $12,000, this calculates to $4 for the month – a lot better than the bottom interest.

Over annually, a DBS Multiplier Account user might have earned at least $51.10 more in interest – all without needing to do anything whatsoever differently. This difference is only going to become even more pronounced once we grow our savings.

Scenario #2: How Much (More) Can A mature Working Adult Earn With DBS Multiplier Account?

Assuming you've been within the workforce for 10 years and are now earning a gross monthly salary of $3,750. You began investing using DBS Invest-Saver, took a DBS home loan, and accumulated a decent $60,000 in cash savings.

Income: Salary credit of $3,000 (After deducting 20% employee CPF contribution)

Credit Card Spend: $800 (For transport, meals, along with other daily expenses)

Home Loan Instalments: Monthly repayment of $1,000 (Utilizing a mix of CPF and funds)

Investments: $200 a month (Using DBS Invest-Saver)

By leaving your hard earned money in a regular checking account (with interest of 0.05% per year), you will be earning a mere $2.40 that month in your balance of $60,000.

If we were to use the DBS Multiplier Account, we'd have fulfilled the Income, Credit Card Spend, Home Loan Instalments and Investments categories, as well as clocking $5,000 in eligible transactions, thus earning us 0.80% in interest per annum on our first $50,000 and 1.60% on the rest of the $10,000 (a drop in the previous 1.8% interest around the first $50,000 and 2.4% on the remaining $10,000).

This calculates to $46 for that month and most $558.45 in risk-free interest more than a year!

Bonus Scenario: Using DBS Multiplier Account Like a Couple

Even if you can't make use of the DBS Multiplier Account as a joint account, if you wish to earn attractive rates of interest, you and your partner can make use of it together to assist one another earn even higher interest on your own DBS Multiplier Accounts.

To do so, both of you have to open DBS Multiplier Accounts individually, then open a joint account with DBS/POSB. Whenever you credit your salary and/or dividends to your joint account, it will likely be recognised as fulfilling the Income criteria for both of the DBS Multiplier Accounts.

If the two of you are working and receive a salary credit of $3,000 each, each of your DBS Multiplier Accounts would have clocked an eligible transaction of $6,000, just by salary credit alone! While Credit Card Spend and the other categories do not stack exactly the same way, you will be inside a great starting position in order to fulfil those categories.

You can read this short article for more details on how you can make utilization of this DBS Multiplier Account together with your partner – or at best someone that you trust enough to spread out a joint account with.

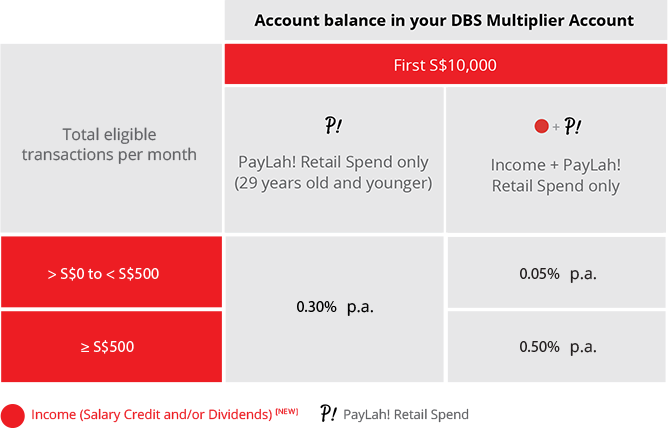

Alternate Track For DBS Multiplier Users: PayLah! Retail Spend

The above outlines the most typical (and advertised) way to earn bonus interest using DBS Multiplier. An alternate track according to PayLah! retail spending continues to be added, presumably for those with no credit card, insurance, home loan or investment with DBS. Here’s how it operates:

Simply clock up retail spend using PayLah! of $500 inside a month, as well as for customers over the chronilogical age of 29, fulfil the Income criteria (Salary Credit/Dividends) to be able to earn bonus interest as high as 0.5% around the first $10,000 in your DBS Multiplier Account. An interesting thing to note for those under 29 is that you can earn 0.3% in interest by virtually not doing anything, which is a clever perk to entice a new generation of consumers.

Source: DBS

DBS Multiplier Account Grows With You

We all require a savings account to get our salary, settle payments, and cash that people want readily accessible – whether with an extensive ATM network, a quick fund transfer or an e-wallet (like PayLah!). The DBS Multiplier Account does all that – and much more.

Even though most users use the DBS Multiplier Account simply because of the high interest they are able to potentially earn, it's also worth noting that the DBS Multiplier Account is also a multi-currency account, which lets you accept and hold deposits in as much as 12 foreign currency, alongside your family SGD balances. This multi-currency feature helps make the DBS Multiplier Account useful for frequent travellers, online shoppers, overseas investors, and exchange students.

One of the notable changes designed to the DBS Multiplier Account imply that even though you may not draw a regular monthly salary – perhaps since you are a freelancer, self-employed individual, retiree, or temporarily out of employment – you can still fulfil the mandatory Income category by means of receiving dividends out of your SGX stocks or Singapore Savings Bonds.

This is definitely an example of the numerous ways you can earn bonus interest out of your DBS Multiplier Account, which means that as you grow inside your career and expand the types of personal finance services you consume, you can keep to savor much more rewards.

Begin your DBS Multiplier Account journey by signing-up in 5 minutes (if you possess the required documents) and exchange tricks and tips with fellow community members as you learn to take advantage out of your DBS Multiplier Account.