Three causes there gained't be considered a 2021 housing industry crash

![4 Stocks This Week (Share Buybacks) [2 October 2021] (Yangzijiang (SGX: BS6); Keppel Corp (SGX: BN4); ST Engineering (SGX: S63); Silverlake Axis (SGX: 5CP)](https://creditoverview.net/wp-content/uploads/2021/07/20210722113659-66-850x560.jpg)

4 Stocks This Week (Share Buybacks) [2 October 2021] (Yangzijiang (SGX: BS6); Keppel Corp (SGX: BN4); ST Engineering (SGX: S63); Silverlake Axis (SGX: 5CP)

A share buyback is a move with a listed company to buy its own shares. This can be done using the free cash flow that the company has. A company may do so if it believes its share costs are undervalued and that it's able to deliver greater value to its shareholders by buying back shares and reducing the outstanding number shares in the market – thus giving each of its current shareholders a larger percentage of equity in the company.

According to a market update report by the Singapore Exchange (SGX) on Thursday (1 October 2021), 24 SGX primary-listed stocks bought back shares for any total consideration of $43 million in September 2021. This really is much higher than the $15 million buyback consideration reported in September 2021. SGX also reported that buyback for August 2021 what food was in $15 million. This could be a sign that many companies find their share prices undervalued and therefore are happy to buy their own shares with the free cash flow they actually have.

Share buyback is a corporate action that requires companies to make a public filing with regulators.

In this week's edition of 4 Stocks This Week, we look at 4 stocks on SGX which have recorded the highest amount of share buyback in September and the possible reasons why.

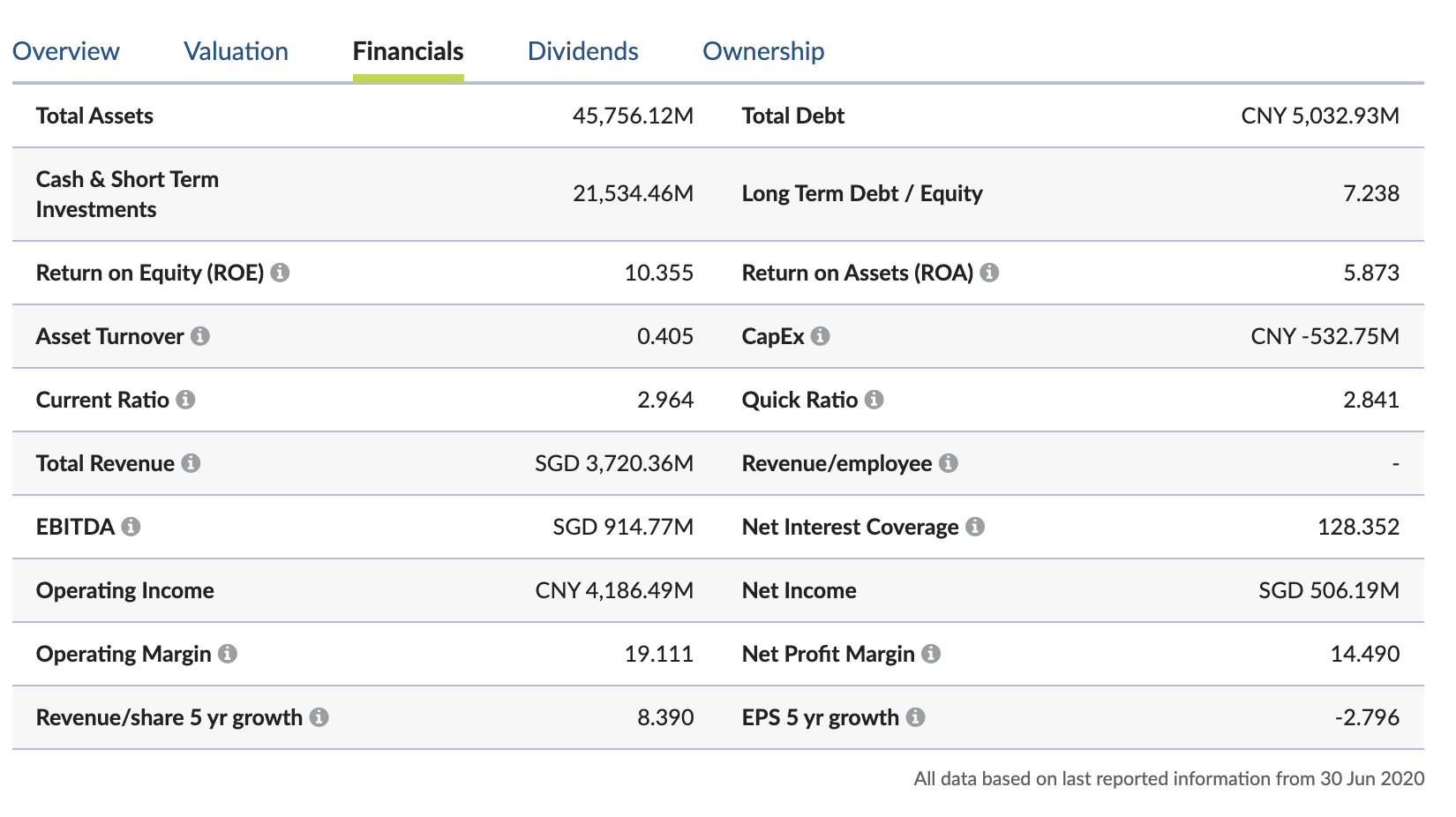

Yangzijiang Shipbuilding (SGX: BS6)

Yangzijiang (SGX: BS6) is a large shipbuilding company that is based in the People's Republic of China. Its main clients are in commercial shipbuilding, producing a range of vessels such as bulk carriers, multi-purpose cargo vessels, containerships, chemical tankers, and offshore supply vessels. With the COVID-19 global pandemic, it comes as no surprise that the markets are not exactly bullish for Yangzijiang financial performance within the next couple of years given that there is likely going to be a reduction of order for new ships given the economic uncertainty. Yangzijiang stock price is down by about 15% since the start of this year.

From a valuation standpoint, the company does look like it could be potentially undervalued. Its price-to-book value is at 0.61 and it's currently trading in a dividend yield of 4.6%. It's price to free cash flow (P/CF) is at 6.2 and its price-to-earnings (PE) ratio is at 7.6. The organization also has cash and short-term investments which are worth about $2.15 billion.

In September 2021, the company bought back shares which are worth about $16.4 million in an average price of $0.95.

Keppel Corporation (SGX: BN4)

Keppel Corporation (SGX: BN4) is one of the largest conglomerates in Singapore, having a business in property, offshore and marine, infrastructure and investments. After talks of a potential offer from Temasek to get the company did not materialise in August, Keppel Corp stock price declined. Share price has gone from $5.40 (7 Aug) to $4.40 (2 Oct). Since the start of the year, Keppel share price went down about 35%.

From a valuation standpoint, Keppel happens to be trading at a price-to-book value of 0.77. That said, it's price to free cash flow (P/CF) is at 33.1. It's cash and short-term investment worth about $1.72 billion with total debt at about $11.7 billion.

In September 2021, the company bought back shares which are worth about $8.4 million in an average price of $4.37

ST Engineering (SGX: S63)

With about 44% of their revenue derived from the Aerospace segment, ST Engineering (SGX: S63) will be heavily impacted by the air travel shut down due to COVID-19.

Since the start of the year, ST Engineering has declined by about 11% from $4.01 to $3.54. Its current price-to-book ratio reaches 4.95 with the price to free cash flow (P/CF) at 11.5. In September 2021, the company bought back shares that are worth about $4.2 million in an average price of $3.41.

Silverlake Axis (SGX: 5CP)

Silverlake Axis (SGX: 5CP) is a market leader in banking and finance software in ASEAN, for major organisations in banking, insurance, payments, retail and logistics industries. 2021 is a poor year for the company as it has seen its share price tumbled bout 31% from $0.415 (2 Jan) to $0.285 (2 Oct). The company is currently trading at a price-to-book worth of 3.0 while its cost to free cash flow (P/CF) reaches 10.6.

In September 2021, the organization bought back shares which are worth about $3.5 million at an average price of $0.31