Three causes there gained't be considered a 2021 housing industry crash

How To Continue Planning For Your Future Retirement (Safely) Throughout the COVID-19 Recession

If you have found 2021 to be a challenging year, you're not alone. Across the world, the COVID-19 pandemic has not only affected millions of lives but also adversely impacted the global economy.

Singapore has not been spared. According to the Ministry of Manpower, there are only 0.57 job vacancies readily available for every unemployed person. The Straits Times Index (STI), which tracks the performance of the 30 strongest stocks on the Singapore Exchange (SGX), is also down about 16% since the start of this year (as of 11 November 2021). On the personal level, many of us needed to adjust to working-from-home and home-based learning, and it has not been easy.

Given the greater immediate concerns in 2021, it might be convenient to postpone planning for the future. We may reason that thinking about tomorrow's problem isn't helpful when we can't solve today's issues first. While this may apply to some things within our lives, such as putting off the purchase of a new car or property, there are more areas that we should not put on hold even during economic uncertainty.

For example, no one would want to disrupt our kids' education due to a recession. As far as possible, we'd want to ensure continuity within their education even if we are facing some financial constraint, because we understand that any disruption may do more harm than good.

Likewise, we want to continue planning towards our future through both good and bad times. This is because our retirement plan is a long-term goal and we should minimise disruption to it. What we choose to do now will affect our future greatly.

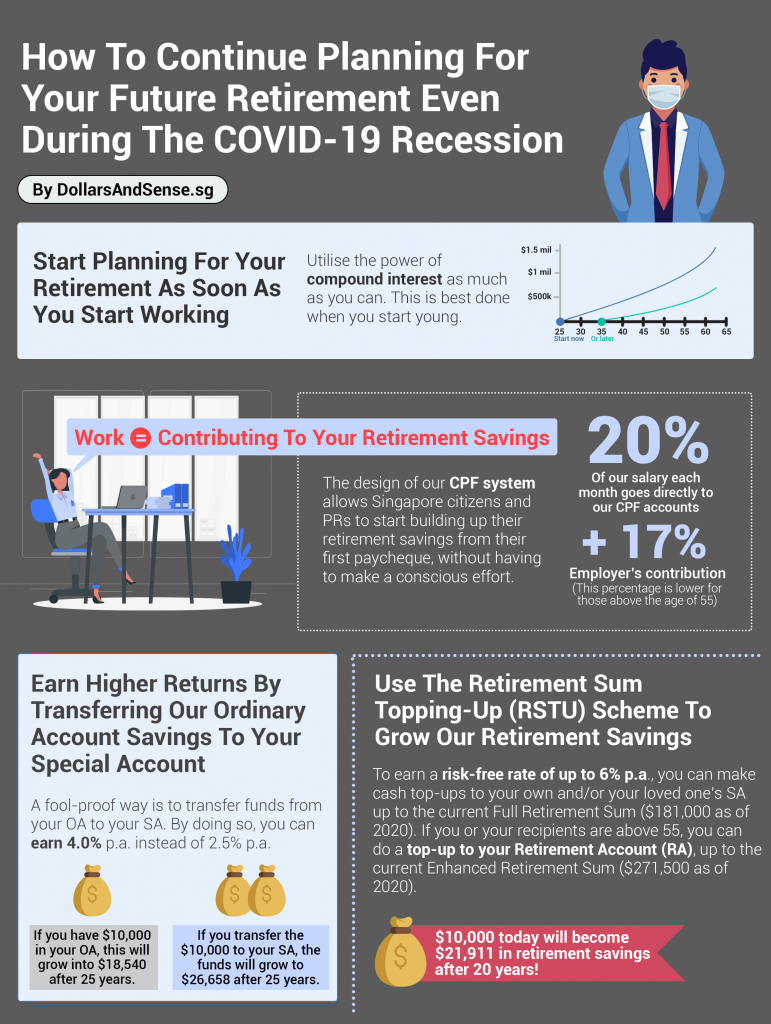

The Ideal time To Start Retirement Planning Happens when We First Start Working

A common misconception that people have is that retirement planning is something that we only need to think about if we are older. However, the trick to some successful retirement plan is to use the power of compound interest around we can. And this is best done when we start young.

For example, if we set aside $10,000 in retirement savings at age 25 and retire at age 65, we will have 40 years to utilise the power of compound interest. At an interest rate of 4.0% p.a., our retirement savings will grow to become $48,010 by age 65!

But if we only start saving towards our retirement at age 55, we will need to set aside $32,434 to achieve the same $48,010 by age 65, assuming the interest rate remains the same at 4.0%.

This also means we need to save three times more to obtain the same retirement amount when we start 30 years later!

In Singapore, We Contribute To Our Retirement Savings Whenever We Work

The good news for Singapore citizens and PRs is the fact that even during a recession, we will still be contributing to our retirement funds when we are working. This is because 20% of our salary each month automatically would go to our CPF accounts. Also, our employers contribute a further 17%. This percentage is lower for those above the age of 55.

In short, the design of the CPF system allows Singaporeans and PRs to start building up their retirement savings using their first paycheque, without having to make a conscious effort.

Our CPF savings also grows in a risk-free base interest rate of between 2.5% [Ordinary Account (OA)] to 4.0% p.a. (Special, MediSave and Retirement Accounts). Additionally, the first $60,000 of our combined CPF balances earns one more 1% p.a. interest, while those above 55 can earn one more 2% p.a. on the first $30,000, and 1% p.a. around the next $30,000.

For example, a 30-year old who contributes $1,000 per month to his CPF Ordinary Account (OA) will earn no less than 2.5% p.a. By age 55 – 25 years later – the $1,000 contribution might have grown into $1,854 based on a return of 2.5% p.a. (though the actual return could be higher due to the extra 1% p.a. interest for that first $60,000 of combined CPF balances). Contributing to our CPF Special Account (SA) will yield better still returns.

Earn Higher Returns By Transferring Our Ordinary Account Savings To the Special Account

If we wish to earn a greater risk-free return, a fool-proof way is to transfer funds from your OA to our SA. By doing so, we are able to earn 4.0% p.a. rather than 2.5% p.a.

For example, when we have $10,000 in our OA today, this can grow to $18,540 after 25 years (based on 2.5% p.a.). However, when we transfer the $10,000 to our SA, the funds will grow to $26,658 (according to 4.0% p.a.) after Twenty five years, earning us an additional $8,118.

You can see the stark difference in the graph below:

To be clear, transferring funds from your OA to your SA isn't without trade-offs. Once the funds are transferred to our SA, the choice is irreversible, and we cannot transfer it to our OA. This also means that we cannot utilise the money for OA-eligible payments for example our home mortgage.

However, if the goal is to plan towards a more comfortable retirement without needing to take on any investment risk, then the SA is the perfect place to grow our retirement savings safely, during both good and bad times.

Use The Retirement Sum Topping-Up Scheme To develop Our Retirement Savings

As a Singaporean, to build up our retirement savings without taking on investment risk, the Retirement Sum Topping-Up Scheme (RSTU) is one of the most powerful tools we can utilise like a CPF member. Doing so automatically allows us to earn a risk-free rate as high as 6% p.a. to put aside for the retirement.

Through RSTU, we can make cash top-ups to the own and/or our loved one's SA as much as the current Full Retirement Sum ($181,000 by 2021). If we or our recipients are above 55, we can do a top-up to our Retirement Account (RA), up to the current Enhanced Retirement Sum ($271,500 by 2021).

To put things into perspective, $10,000 today will become $21,911 in retirement savings after Two decades!

In addition, we can also enjoy tax relief of up to $7,000 per year if we are topping up for ourselves, and an additional $7,000 per year if we are topping up for the loved ones' SA or RA.

For members above age 55, our CPF RA is a great place to park and continue growing our retirement savings. This is particularly true during this volatile period when investors within the financial markets have to face a higher level of uncertainty when they invest in equities, or need to accept low interest rates if they decide to invest in fixed income instruments such as corporate bonds.

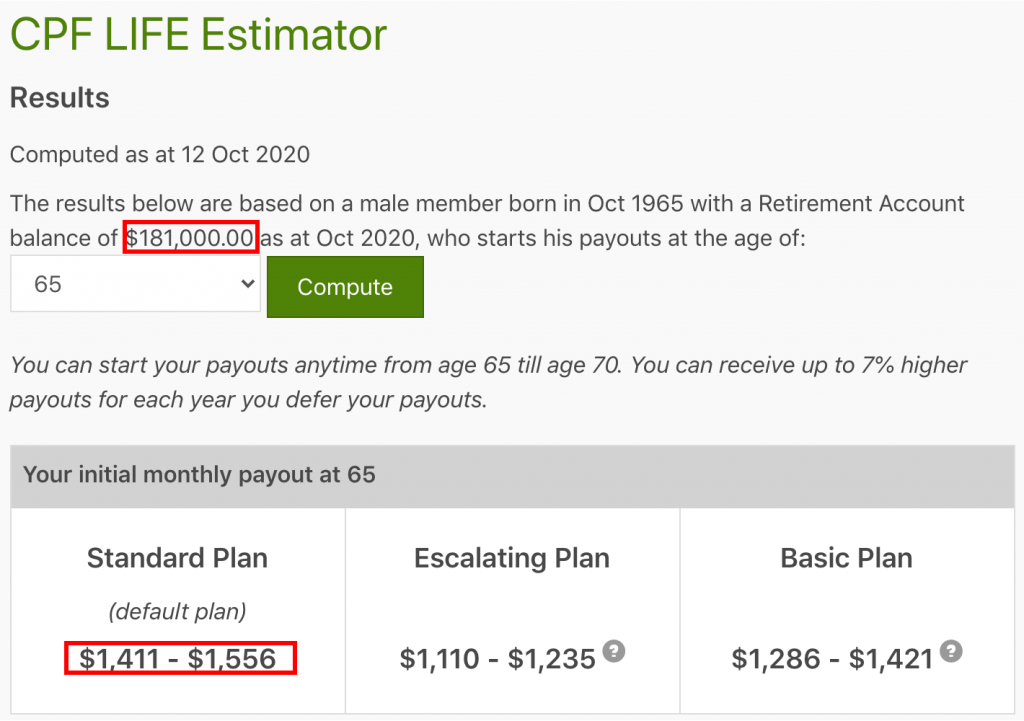

For example, a 55-year-old male (as of 2021) who wishes to retire at age 65 can choose to commence his CPF LIFE payouts in 10 years. If he has the Full Retirement Sum (FRS) of $181,000 (as of 2021) in his RA today, he will receive an estimated payout of between $1,411 to $1,556 each month under the Standard Plan from age 65 onwards.

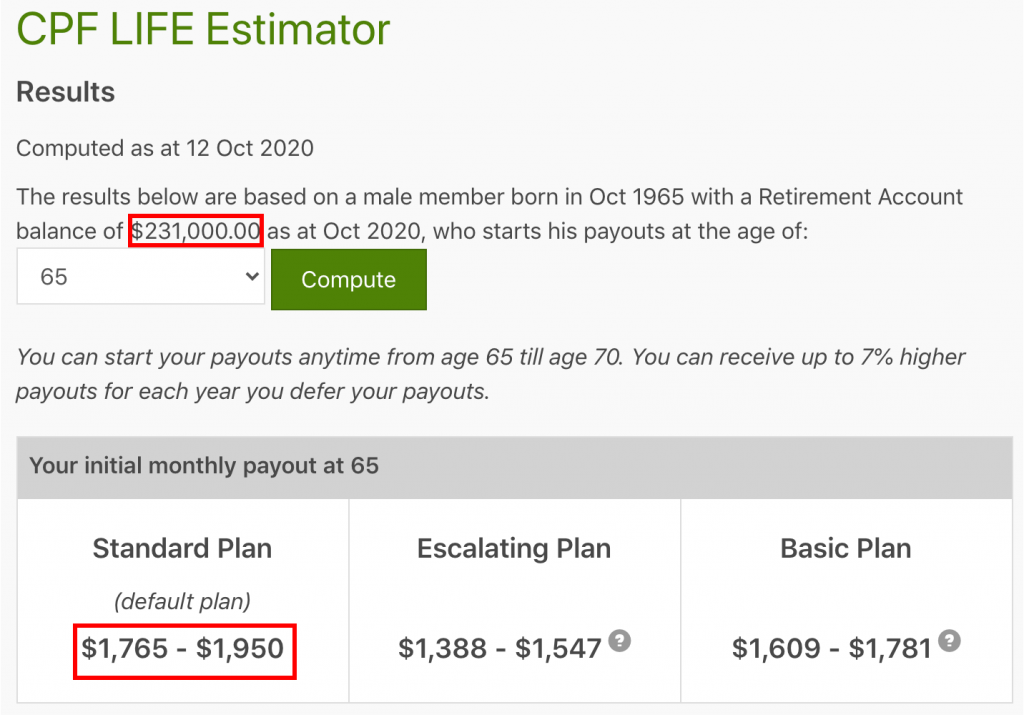

Let's assume he's $50,000 in stocks and bonds that are meant for his retirement. If he is not confident of investing in the financial markets in the next few years but would like to continue growing the money for his retirement, a secure and risk-free way of doing so would be to make a $50,000 top-up to his RA today.

By doing so, he will be able to increase his monthly CPF LIFE payout at age 65 to $1,765 – $1,950 a month instead.

Whether you are a fresh graduate who has just entered the workforce or an older worker who intends to retire in a few years, growing your retirement savings can still be done safely even during a recession. As CPF members, we can be assured that our CPF savings will continue to compound at a safe, reasonable rate even when the financial markets are in distress.

Learn much more about how you can kickstart your retirement plan and maximise your CPF savings here.

Retirement planning even during a recession will be one of the things you are glad you had the foresight to do. Doing so with your CPF savings is better still as it is already set aside for your future needs.