Three causes there gained't be considered a 2021 housing industry crash

How Have SGX-Listed Retail Bonds Performed During The 2021 COVID-19 Pandemic

Bonds have always been regarded as the safer cousins of stocks. This is why most asset allocation strategies will recommend that investors hold a combination of stocks and bonds in their investment portfolios. The idea is that when there is a market downturn, stocks will decline in value while bonds are typically more resilient in retaining their value, or perhaps see price appreciation. Through fixed coupon payments, bonds may also provide us a regular fixed income.

The outcome is that through a combination of stocks and bonds, we can construct a portfolio that not only generates us returns during happy times but also provides us with sufficient protection, in addition to a regular fixed income stream even throughout a recession.

Since the 2008 Global financial trouble, we have not witnessed a major recession until captured, when the COVID-19 global pandemic affected markets around the world. This also makes it a good time for us to evaluate just how true it's that quality bonds can retain its value even during periods of heightened volatility.

Rather than choosing bond funds, ETFs or indexes to compare, we decided to look at the performance of some of the major retail bonds listed on the Singapore Exchange (SGX) to see how they have performed in 2021.

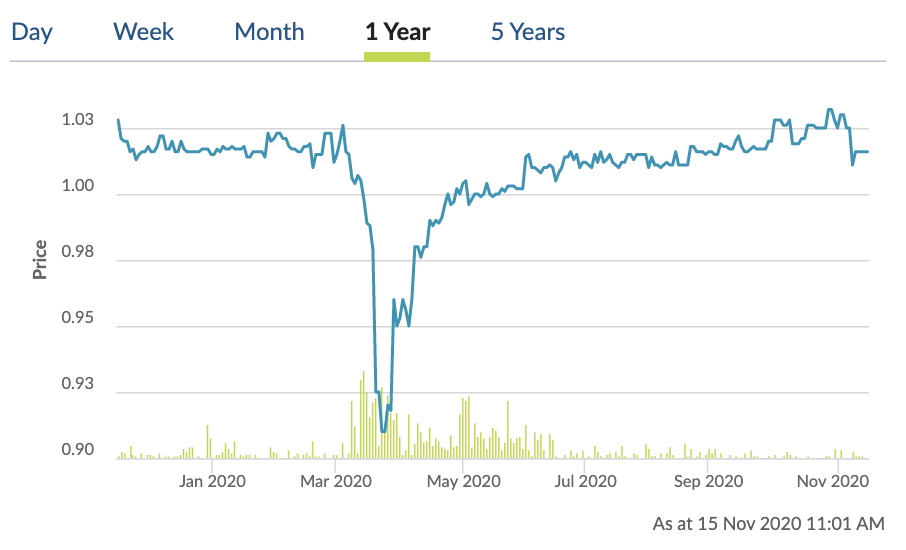

#1 CAPITALDMTR S$350M3.08%B210220 by CapitaMall Trust (SGX: TY6Z)

The CapitaMall Trust bonds may be the first company on our list. The 7-year bond was launched in February 2021 will mature in February 2021.

Given rapid duration it has to its maturity, we are able to see that the bond value remained very stable even during the most volatile 30-day period (24 February 2021 to 23 March 2021) we have experienced in recent times.

| Price on 2 Jan 2021 | Price on 24 Feb 2021 | Price on 23 Mar 2021 (Price difference from 24 Feb to 23 Mar) |

Price By 15 Nov 2021 (Price difference from 23 Mar to fifteen Nov |

|

| CapitaMall Trust Stocks | 2.46 | 2.47 | 1.61 (-34.8%) |

2.00 (+24.2%) |

| CapitaMall Trust Bonds (CAPITALDMTR S$350M3.08%B210220) |

1.017 | 1.009 | 0.979 (-2.9%) |

1.009 (+3.1%) |

| S&P 500 | 3,257.85 | 3,225.89 | 2,237.40 (-30.6%) |

3,585.32 (+60.2%) |

| STI | 3,252.00 | 3,142.20 | 2,233.48 (-28.9%) |

2,711.39 (+21.4%) |

From the table above, we are able to see that even during this volatile period (24 Feb to 23 Mar), CapitaMall Trust bond lost only two.9% of its value. In contrast, CapitaMall Trust stock transpired by almost 35% during the same 30-day period. Both global stock market and the Singapore stock market also performed poorly during this period, as the S&P 500 and STI declined by 30.6% and 28.9% respectively.

Since 23 March 2021, CapitaMall Trust Bond prices have recovered to pre-COVID-19 levels (as of 15 Nov 2021). Both CapitaMall Trust stocks and also the STI have not recovered to their pre-crash level.

As a retail Investment Trust (REIT), it should come as no surprise to anyone that the stock price of CapitaMall Trust has been adversely impacted by COVID-19, and is still struggling to rebound to pre-COVID-19 levels. However, its bonds which mature next year were barely affected during this period.

#2 FP TREA S$500M3.65%B220522 by Frasers Property (SGX: AXXZ)

Frasers Property includes a 7-year bond that was listed on the SGX on May 2021. The text pays out a coupon payment of 3.65% p.a.

| Price on 2 Jan 2021 | Price on 24 Feb 2021 | Price on 23 Mar 2021 (Price difference from 24 Feb to 23 Mar) |

Price on 15 Nov 2021 (Price difference from 23 Mar to fifteen Nov |

|

| Frasers Property Stocks | 1.71 | 1.62 | 1.01 (-37.7%) |

1.18 (+16.8%) |

| Frasers Property Bonds (FP TREA S$500M3.65%B220522) |

1.015 | 1.015 | 0.910 (-10.3%) |

1.016 (+11.6%) |

| S&P 500 | 3,257.85 | 3,225.89 | 2,237.40 (-30.6%) |

3,585.32 (+60.2%) |

| STI | 3,252.00 | 3142.20 | 2,233.48 (-28.9%) |

2,711.39 (+21.4%) |

If you own Frasers Property stocks before the Feb/Mar 2021 crash, you won't be a happy investor, because the stock price of Frasers Property declined by 37.7%, much steeper than the STI (-28.9%).

Its poor performance on the stock market doesn't come as a surprise. Like a real estate and property management company, much of the Frasers Property portfolio could have been badly affected this year.

However, if you have invested in Frasers Property bonds instead, you would be in a much better position. While its bonds did decline by about 10% throughout the 30-day Feb/Mar 2021 crash, it has recovered and is now trading at a similar level since it's pre-COVID-19 price.

This is another example of an established real estate company that has been badly influenced by COVID-19, still seeing its bond value remain strong.

#3 Astrea IV4.35%B280614 By Azalea Asset Management (SGX: RMRB)

We wrote about the Astrea IV private equity bonds if this was first launched in June 2021. Since then, Azalea Asset Management has launched another tranche of bonds known as the Astrea V. Both bonds are traded on the SGX. For this article, we will just consider the performance of the earlier launched Astrea IV.

Azalea Asset Management is a private equity fund that is wholly-owned by Temasek Holdings. It's worth noting that the bonds are not backed by Temasek Holdings. This bond pays a coupon of four.35% p.a.

| Price on 2 Jan 2021 | Price on 24 Feb 2021 | Price on 23 Mar 2021 (Price difference from 24 Feb to 23 Mar) |

Price on 15 Nov 2021 (Price difference from 23 Mar to 15 Nov |

|

| Astrea IV4.35%B280614 | 1.075 | 1.066 | 0.99 (-7.1%) |

1.063 (+7.4%) |

| S&P 500 | 3,257.85 | 3,225.89 | 2,237.40 (-30.6%) |

3,585.32 (+60.2%) |

| STI | 3,252.00 | 3,142.20 | 2,233.48 (-28.9%) |

2,711.39 (+21.4%) |

Unlike the other two companies, Azalea Asset Management is wholly owned by Temasek Holdings and thus is not traded on the SGX. So we can't compare its bond price to its stock price.

However, we can see after an initial drop of 7.1% in Feb/Mar 2021, where it had been trading at just under its par value, the bond has recovered and is now trading in a level similar to its pre-COVID-19 price.

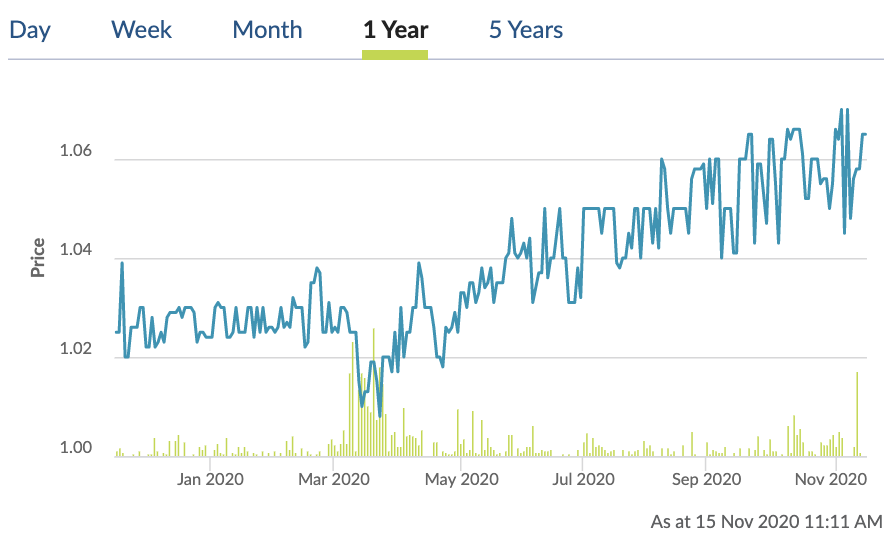

#4 TEMASEK S$500M 2.7% B 231025 (SGX: TEKB)

Besides Singapore Government Securities (SGS), Temasek retail bonds are as risk-free as they come by. These bonds are guaranteed by Temasek Holdings and pay a couple.7% p.a. coupon. This can be a 5-year bond which was listed in October 2021.

| Price on 2 Jan 2021 | Price on 24 Feb 2021 | Price on 23 Mar 2021 (Price difference from 24 Feb to 23 Mar) |

Price on 15 Nov 2021 (Price difference from 23 Mar to 15 Nov |

|

| TEMASEK S$500M 2.7% B 231025 | 1.024 | 1.037 | 1.008 (-2.8%) |

1.065 (+5.6%) |

| S&P 500 | 3257.85 | 3,225.89 | 2,237.40 (-30.6%) |

3,585.32 (+60.2%) |

| STI | 3,252.00 | 3,142.20 | 2,233.48 (-28.9%) |

2,711.39 (+21.4%) |

Like Azalea Asset Management, Temasek isn't traded on the SGX so we cannot compare its bond's performance to its stock.

Not surprisingly, the Temasek bond's value remains relatively stable because it has only declined by 2.8% even during the Feb/Mar 2021 crash. This shows the bond is exceptionally resilient to promote downturns.

Another interesting observation here is the Temasek bonds have not only recovered since but they are also trading at a level that's significantly higher than what it what food was in the start of the year. A likely reason for this is the current low-interest rate environment, along with the economy's uncertainties. This makes the Temasek bond an attractive investment proposition during this period.

#5 NikkoAM SGD Investment Grade Corporate Bond ETF (SGX: MBH)

The NikkoAM SGD Investment Grade Corporate Bond ETF is the first to offer retail investors easy access to investment grade corporate bonds in affordable units. With one investment, investors can diversify their bond portfolio with numerous corporate bonds from high quality issuers, such as sovereigns, banks, investment companies, insurance companies, real estate companies, REITs and others.

| Price on 2 Jan 2021 | Price on 24 Feb 2021 | Price on 23 Mar 2021 (Price difference from 24 Feb to 23 Mar) |

Price on 15 Nov 2021 (Price difference from 23 Mar to 15 Nov |

|

| NikkoAM SGD Investment Grade Corporate Bond ETF | 1.029 | 1.041 | 1.011 (-2.9%) |

1.076 (+6.4%) |

| S&P 500 | 3257.85 | 3,225.89 | 2,237.40 (-30.6%) |

3,585.32 (+60.2%) |

| STI | 3,252.00 | 3,142.20 | 2,233.48 (-28.9%) |

2,711.39 (+21.4%) |

It is hard to make a like-for-like comparison to stock prices, even though the NikkoAM SGD Investment Grade Corporate Bond ETF comprises bonds from some listed companies, including OCBC, DBS, UOB, and others. This is because is it highly diversified.

Broadly, the NikkoAM SGD Investment Grade Corporate Bond ETF experienced a small decline in price throughout the Feb/Mar downturn but has recovered strongly since then – trading at a level that's even higher than at the start of 2021.

Bonds From Established Companies Holds Their Value Well Even During The Worse Recession

As compared to stocks, there are limited retail bonds on the SGX for us to invest in, especially if you exclude the Singapore Government Securities (SGS).

Despite the limitation of choices, it's still important for us as retail investors to decide on the right bonds to invest in carefully. While the pointers above suggest that bonds can hold their value well even if the stock market is in freefall, this doesn't mean that we can just invest in any bonds automatically believing that they will be safe.

We can still invest badly in bonds when we choose the wrong companies. Unfortunate examples in recent years include Hyflux and KrisEnergy. At the end of the day, if a company defaults on its loan obligations, our bond investments is going to be at risk.

As an investor, there are two things we need to remember.

Bonds Can Protect Our Portfolio

The first is that bonds can protect our investment portfolio. As shown above, even while some strong companies (e.g. property companies) are having their earnings adversely influenced by COVID-19, resulting in a weaker share price, their bonds' price remains as strong. In fact, most of the bonds are actually trading at a similar or higher price than their pre-COVID-19 levels. This compares favourably to stock values, even of the same company, which are trading significantly lower than pre-COVID-19 levels.

This is a vital feature of bonds that people shouldn't overlook. Even for the same company, stock prices and bond prices might not be correlated. As long as investors are confident in regards to a company's ability to make their debt repayments, their bond prices will stay stable even during a recession.

While the STI has declined significantly in 2021, investors might be glad to know that the ABF Singapore Bond Index Fund, an index ETF that tracks a gift basket of high-quality bonds issued primarily by the Singapore government and quasi-Singapore, is up 8.2% since the start of the year. The iEdge SFI Corporate Bond Index, which tracks the performance of corporate debt issuances that are denominated in Singapore dollars, is also up about 7.0% since the start of this year. This shows that bonds do have a useful inverse relationship with the equity market.

Choose The Right Bonds

The second aspect to remember is that we need to choose the right bonds. Investing in bonds for the sake of achieving the right asset allocation mix isn't going to be good enough if we choose the wrong bonds.

To help investors in Singapore better understand how bonds can be a part of our portfolio, the Securities Investment Association of Singapore (SIAS) have an annual Fixed Income Conference to help retail investors understand the risks of investing in fixed income instruments and just how they can be used to diversify their investment portfolio.

The inaugural conference which was held in 2021 included speakers such as Christopher Tan (Executive Director, MoneyOwl), Leong Wai Leng (CFO, Temasek) and Margaret Lui (CEO, Azalea). You can follow SIAS event calendar page to stay in touch on announcements on once the next Fixed Income Conference will be.

For a teaser of what to anticipate, watch this video from last year's Fixed Income Conference where our Managing Editor Timothy discusses with Christopher Tan whether bond investing is protected or risky, simple or complex?