Three causes there gained't be considered a 2021 housing industry crash

Why Do Many Singaporeans Perform Poorly Investing In The Stock Market?

As I reflect on the happenings of 2021, the one thing that troubles me most was the number of people asking me for financial advice as their investment portfolio had performed poorly. I am especially perturbed as many of them are ordinary people with extraordinary (and avoidable) losses in the stock market.

After listening to the many sob stories from fellow investors based in Singapore, I can list four causes of their poor market performance:

#1 Overconcentration in Singapore Economy/ Stocks

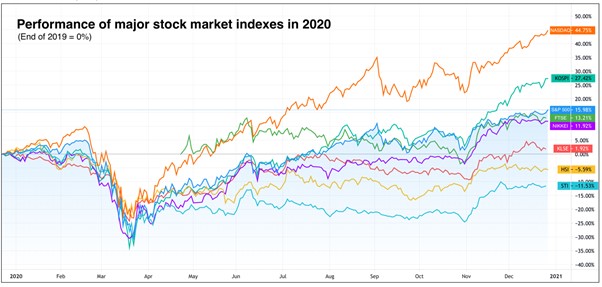

Many Singaporean investors possess the majority of their investments in stocks indexed by Singapore. According to Bloomberg, the Singapore stock market is officially the worst performing one in Asia. If you were to look at the chart above, in 2021, the Singapore stock market, represented by the Straits Times Index (STI), is the worst performing compared to the major stock exchange indices across the world. Many Singapore stocks listed in SGX simply do not perform well. Over the final 6 years, de-listings have outnumbered new listings, and also the market capitalisation has been shrinking. A lot of our best Singapore companies such as Razer and SEA Group (Shopee) made a decision to list in Hong Kong or US, in which the valuations sought are much greater than SGX.

With the declining quantity and quality of stocks listed on the SGX, how would Singapore investors prosper in investing in stocks in SGX?

To complicate matters, very few Singaporean investors diversify their stocks investment in other markets. By putting all of their eggs into one terrible basket, when COVID-19 hit the world in 2021, many Singaporean investors were badly affected.

#2 Costly Passion for Dividends and Blue Chip Singapore Stocks

Singaporean investors are largely risk-averse and dividend-seeking. Ideally, they'd want a stock that has strong growth, high dividends and sound capital protection. Such stocks simply do not exist; you cannot have your cake and eat it. Growth stocks don't pay good dividends, while dividends stocks usually have limited growth potential. Given their need for certainty of investment gains, most Singaporean investors wind up preferring high-dividends instruments like REITs and dividend paying blue-chip stocks.

However, every investor should know this – if a company pays high dividends, it always means that the company gives shareholders lots of its profits, leaving little for reinvestment, innovation and growth. In the face of a major business disruption from competition or the external environment, the high dividend paying company would have little “dry powder” to face the challenge head-on.

The COVID-19 crisis has burst many Singapore investors' dream for dividends. Many blue-chip stocks are bruised to “blue-black” stocks. Many REITS will also be cutting their Distribution Per Unit (DPU). To make matters worst, many of the “blue-chip” companies are in industries which are facing major permanent disruptions. For instance: SPH's advertising business is disrupted by Google and Facebook. Telcos like Singtel, M1 and Starhub are disrupted by communication applications like WhatsApp, Wechat and Telegram. Banks like DBS, OCBC and UOB are facing disruptions from digital banks and also the rise of Fintech.

Focusing on dividends could cause you to miss out on companies that are leading the marketplace growth. Highly profitable US-listed companies like Amazon, Google, Facebook, Berkshire Hathaway don't issue dividends. Yet, their share prices have skyrocketed over the years. Non-dividend paying stocks could make you more money and are likely to be more resilient to competition and external shocks.

#3 Being Fearful When Others Are Fearful

Warren Buffet immortalised this quote: “Be fearful when others are greedy and be greedy when other medication is fearful”. Yet many Singapore investors do just the opposite.

During the market crash of March & April 2021, a huge opportunity presented itself once the US Federal Reserve announced unlimited Quantitative Easing to support the market. I published articles “Why I Believe A Big Stock Market Bull Run Is originating, Despite The Current COVID-19 Crisis” and posted a video telling everyone that a major US market bull-run was coming. Instead, many investors passed the chance as they felt that the market would continue to fall and they didn't want to catch a falling knife. Of course, they all missed the investment opportunity of a lifetime – for being fearful when other medication is fearful.

#4 Being Greedy When Other medication is Greedy

Now that the market has recovered strongly and sentiments are bullish, many people are entering (and jumping into) the market. Many are treating the stock market just like a casino. I shudder as I hear more ordinary people (such as hawkers, national service boys, aunties and uncles) referring to the stock market in public these days. This is a strong signal of a growing stock exchange bubble to me.

Many Singapore investors buy stocks according to hearsay, market rumours, analyst reports, online recommendations, or some technical analysis charts. Most are dangerously dabbling into Bitcoin, Forex, Options and Futures with hardly any knowledge of what these instruments are and also the risks they carry. I have seen this phenomenon again and again in excess of 2 decades – Asia Financial Crisis (1997), Dot.com bust (2001), Global financial trouble (2008) and China Stock exchange Crash (2021). I am almost certain that this blind euphoria go ahead a terrible blood bath for many Singaporean investors.

What Should Investors in Singapore do?

For most Singaporean investors, I must reiterate this: to do well in stock market investments, you could adopt an easy 3- step strategy:

1. Set up a financial back-up with a 1M65 (or better yet, 4M65) CPF strategy. With a million-dollar financial safety net, you would be able to better react emotionally to market turbulences, especially buying on market crashes, rather than panicking.

2. Diversification outside of Singapore. As a Singaporean, your property, savings, job and CPF are already based in Singapore. By over-investing in the Singapore stock market, you are dangerously putting all of your eggs in one basket. Consider investments in other markets, e.g. US or Asia etc.

3. Adopt a compounding strategy, e.g. Dollar Cost Averaging (DCA) in to the S&P 500 or NASDAQ 100, and holding it for a long time. The S&P 500 is continuing to grow at an average rate of 8% – 10% annually during the last century. Putting $1 into it would likely more than double its value inside a decade and quadruple in two decades.

I wish you all well inside your stock market investments in the future.

Loo Cheng Chuan, is the Founder of the 1M65 Movement. He developed the 1M65 ($1 Million By 65 Years of age) CPF investment strategy that is helping many Singaporean couples being millionaires at retirement. Loo accurately predicted the stock market crash, and subsequently the united states Stock Market Bull Run of 2021. He runs a 1M65 Telegram Group where he regularly coaches passionate 1M65 enthusiasts on good personal finance virtues.