Three causes there gained't be considered a 2021 housing industry crash

3 Powerful ETF Investing Techniques for Conservative Investors

One of the key benefits of exchange-traded fund (ETF) investing is allowing investors to possess exposure to multiple asset classes for example stocks, bonds, real estate and commodities. By placing uncorrelated bets across different asset classes, investors are able to reduce risk and boost the risk adjusted returns.

Another benefit of ETF investing is that it is extremely simple to implement. We only have to manage between 2 to 5 ETFs when compared with pure equity investors that typically hold around Twenty to thirty stocks. Because of the convenience of ETF investing, it may be implemented easily on your own using a discount broker such as Interactive Brokers which can save you almost 1% per year on advisory fees.

In this short article, I'm going to discuss 3 powerful ETF investing strategies for conservative investors that can outperform the S&P 500.

Strategy 1: 60/40 Portfolio

The 60/40 portfolio is really a well known investing recommendation where the investor allocates 60% of their portfolio to large cap stocks and 40% to treasuries or investment grade bonds.

This investment technique is often misunderstood by most people. The common impression is that because the portfolio has such a high number of bonds, which are considered safe assets, the overall portfolio returns are going to be significantly worse than a buy and hold strategy on the 100% equity portfolio. Is that actually what goes on?

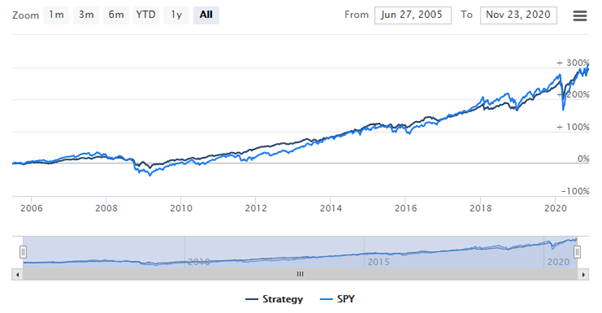

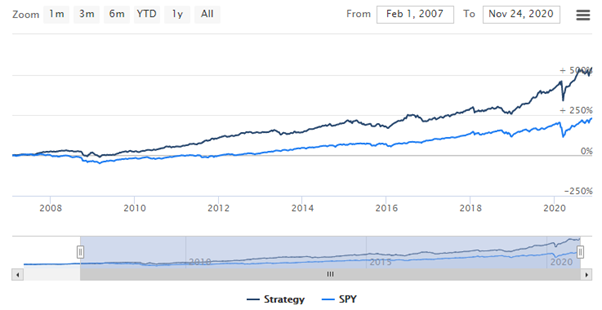

To find out, I ran a strategic allocation backtest where I allocated 60% of the portfolio weight to SPY (S&P 500 ETF) and 40% of the portfolio weight to TLT (Treasuries ETF). I specified a 10% rebalance band where if the actual weights of the portfolio deviated from the 60/40 target allocation by a lot more than 10% due to price movements, the algorithm would rebalance the portfolio back to its original target weights.

The results are surprising. Despite having such a large number of bonds in the portfolio, the 60/40 portfolio's total return is nearly the same as a buy and hold strategy around the S&P 500!

Taking a look at the statistics, as the annualized returns between the 60/40 portfolio and also the S&P 500 are very close at 9.3% vs 9.5%, the 60/40 portfolio includes a much lower risk with a volatility of 10.4% along with a max drawdown of 31.2%.

The key reason the 60/40 portfolio performs well is due to rebalancing. Rebalancing is the process of realigning the weights of stocks and bonds in the portfolio back to their target weights of 60% stocks and 40% bonds. Rebalance needs to be done because over time, the costs of stocks and bonds change, causing their weights to drift away from the 60/40 target allocation.

For example, throughout the 2008 global financial crisis, the value of stocks fell as the value of bonds increased. This was because investors rotated from risky assets such as stocks into safe assets such as bonds to protect their portfolios. If you were holding a 60/40 portfolio previously, the portfolio's stock weightage would fall below 60% while its bond weightage would increase above 40% due to the price movements. To rebalance your portfolio back to the 60/40 target allocation, you should sell some of your bonds that have gone up in value and purchase more stocks which have fallen in value. This method of taking profit on your bonds to buy stocks when they're cheap tends to improve your portfolio's performance over time.

For conservative investors, the 60/40 portfolio done with ETF investing is an attractive option because we can achieve similar expected returns as a buy and hold strategy around the S&P 500 with nearly half the level of risk.

Strategy 2: Bogleheads Three-Fund Portfolio

The Bogleheads three-fund portfolio is a straightforward and diversified portfolio consisting of 3 asset classes:

- Domestic Index Fund

- International Index Fund

- Bond Fund

Also known as a lazy portfolio, the three-fund portfolio is designed to perform well in most market conditions. This portfolio can be implemented with 3 low-cost ETFs and could be rebalanced easily without the hassle of trading numerous instruments.

To implement the three-fund portfolio, I personally use the following ETFs:

- SPDR S&P 500 Index (SPY) because the domestic index fund

- iShares MSCI ACWI ETF (ACWI) as the international index fund

- iShares 20+ Year Treasury Bond ETF (TLT) as the bond fund

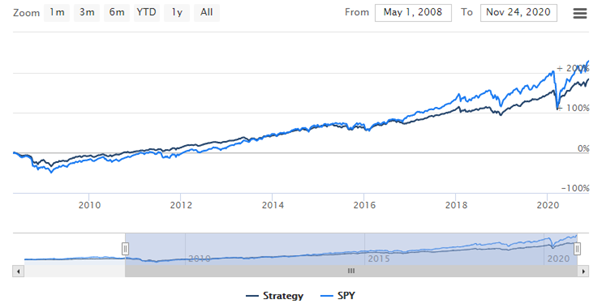

I assigned equal weights to every of these ETFs at 33% each and ran a backtest to compare the strategy's performance against the S&P 500.

At a preliminary glance, the three-fund portfolio seems to perform worse than a buy and hold strategy around the S&P 500.

Looking at the statistics, the three-fund portfolio has a lower annualized return of 8.7% vs the S&P 500 which does 10%. However, the three-fund portfolio's risk is significantly lower with a volatility of 12.3% vs 20.6% along with a max drawdown of -35.7% vs -51.5% for the S&P 500.

To compare the performance between these 2 strategies, we can look at the Sharpe ratio, that is a measure of risk adjusted returns. The three-fund portfolio includes a Sharpe of 0.47 while the S&P 500 has a Sharpe of 0.41. What this means is that adjusting both funds for the same level of risk, the three-fund portfolio has a stronger performance than the S&P 500.

As a good example, we can use leverage which investors can access utilizing a margin account to amplify both the risk and returns of the three-fund portfolio such that both the three-fund portfolio and also the S&P 500 have the same volatility.

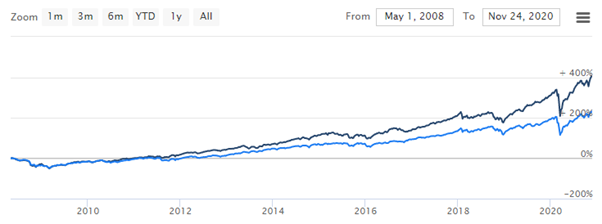

The backtest results reveal that when we leverage the three-fund portfolio 1.66X, the volatility of the three-fund portfolio matches the volatility from the S&P 500 at 20.6%. Having a leverage of 1.66X, the annualized returns from the three-fund portfolio is 13.8%, outperforming the S&P 500 that have an annualized return of 10%.

Strategy 3: Ray Dalio All Weather Portfolio

The Ray Dalio All Weather Portfolio also uses asset class diversification to reduce portfolio volatility and drawdown making an excellent choice for conservative investors. Unlike the 60/40 portfolio and three-fund portfolio, this strategy provides exposure to 5 different asset classes including stocks, bonds and commodities through ETF investing. Fundamental essentials 5 ETFs and their portfolio weights:

- 30% in Vanguard Total Stock Market (VTI)

- 40% in iShares 20+ Year Treasury Bond (TLT)

- 15% in iShares 3-7 Year Treasury Bond (IEI)

- 7.5% in SPDR Gold Trust (GLD)

- 7.5% in iShares S&P GSCI Commodity Indexed Trust (GSG)

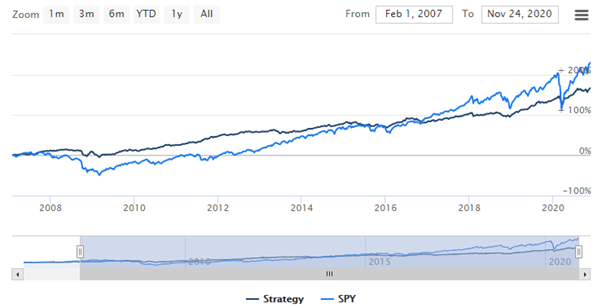

Using the power of rebalancing, during a recession when gold and bonds significantly outperform stocks, the strategy will sell gold and bonds and reinvest the profits into stocks which are cheap. Conversely during a bull market when stocks outperform gold and bonds, the strategy will sell stocks and reinvest profits into gold and bonds at affordable prices. This allows the all weather portfolio to achieve high risk adjusted returns regardless of market conditions.

The backtest results show that even though the all weather portfolio includes a lower total return when compared to S&P 500, the strategy's returns look a lot smoother than the S&P 500 having a significantly lower volatility and drawdown.

Examining the data, over the period from 2007 to 2021, as the all weather strategy has a lower annualized return (7.4% vs 9.1%), its volatility and drawdown is almost one third of the S&P 500. In exchange for having an annualized return that is 1.7% under the S&P 500, we could reduce our risk to one third the risk of the S&P 500. Seems like a pretty good deal!

Consequently, the risk adjusted returns of the all weather portfolio is higher having a Sharpe of 0.56 vs 0.37 for the S&P 500.

One drawback of this tactic though is that since the annualized returns are relatively low at 7.4%, investors having a large risk appetite may not be able to achieve their expected returns even with leverage. Due to Reg T constraints on margin accounts, a retail investor is capped at 2X leverage due to initial margin requirements.

When I re-ran the all weather portfolio with 2X leverage, it achieves an annualized return of 14.4% and a volatility of 14.8%. While this performance is already significantly better compared to S&P 500, for investors having a target volatility above 20%, they'd need to consider the use of futures and choices to gain additional leverage that ETFs don't provide.

Final Thoughts

For conservative investors to rest well at night, using ETF investing to achieve exposure across multiple asset classes is a great way to reduce risk and increase risk adjusted returns. The three ETF investing strategies discussed in the following paragraphs are able to outperform the S&P 500 benchmark with greater risk adjusted returns.

As a follow up exercise, I invite you to definitely clone the Ray Dalio all-weather portfolio and backtest neglect the strategy using PyInvesting's backtesting software. I’ve also attached a tutorial video below to help you on how to create a strategic allocation backtest.

Happy investing and could the odds be in your favour.

Ivan may be the founder of PyInvesting.com. He is passionate about technology and finance and it has worked as a software developer at a hedge fund where he was responsible for building the fund’s trading system. He hopes that PyInvesting can help investors adopt a data driven approach to investing and support them in their journey towards financial freedom.