Three causes there gained't be considered a 2021 housing industry crash

Credit Bureau Asia IPO: 8 Stuff you Should Know Before Investing

Earlier this week, Credit Bureau Asia announced it had lodged its prospectus to have an initial public offering (IPO) of 30,000,000 ordinary shares in an offering price of S$0.93. The offering period will close at 12 pm on 1 December 2021, and also the company will be listed on the Singapore Exchange (SGX) on 3 December 2021.

Whether you decide to purchase the offering shares or invest via the secondary market once the clients are listed on SGX, here are 8 stuff you should know about Credit Bureau Asia first.

#1 Who is Credit Bureau Asia & How Are They Related To Credit Bureau Singapore?

For most of us in Singapore, it's the subsidiary company – Credit Bureau Singapore – that we would likely recognise and may have purchased something from (our own credit report) in the past.

Some of us may mistakenly believe that Credit Bureau Singapore is a government-led initiative and could be surprised to hear that the clients are privately owned. Let us explain.

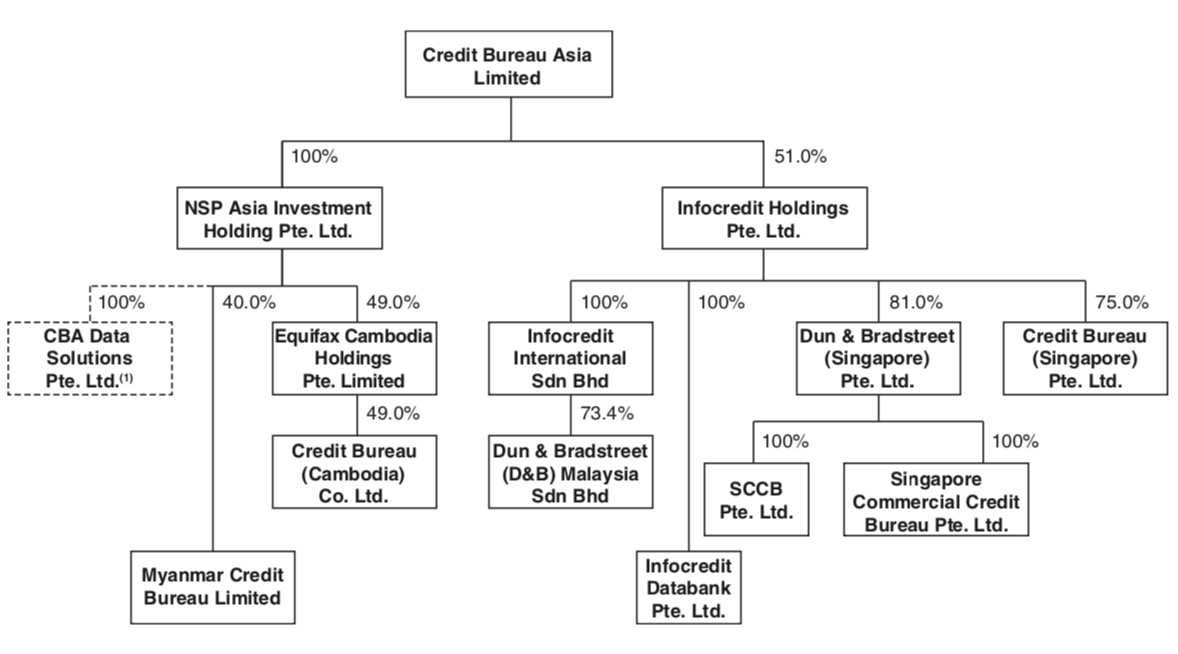

Credit Bureau Singapore Pte Ltd (CBS) is a joint venture between the Association of Banks in Singapore (ABS) and an information management firm – Infocredit Holdings Pte Ltd. This has always been known on the CBS website. Because it has lodged its prospectus, now that we know the shareholding structure.

Infocredit Holdings Pte Ltd owns 75% of Credit agency (Singapore) Pte.Ltd. In turn, Infocredit Holdings Pte Ltd is 51% of Credit Bureau Asia Limited, the company that will be listed and you may invest in. Besides Singapore, Credit Bureau Asia Limited also offers a presence in Cambodia and Myanmar.

#2 Who're Credit Bureau Asia Shareholders Today?

As explained in point 1, Credit agency Asia is a private company and its link to the Association Bank of Singapore (ABS) is it owns a joint venture company – Credit Bureau Singapore – with ABS.

According to its prospectus, Kevin Koo, the chief Chairman and CEO of Credit agency Asia owns 90% of Credit Bureau Asia total share capital while William Lim, the chief Director owns the remaining 10%. This is prior to the IPO.

After the IPO, Kevin Koo will own 67.3% from the company's total share capital.

#3 How Profitable Is Credit agency Asia?

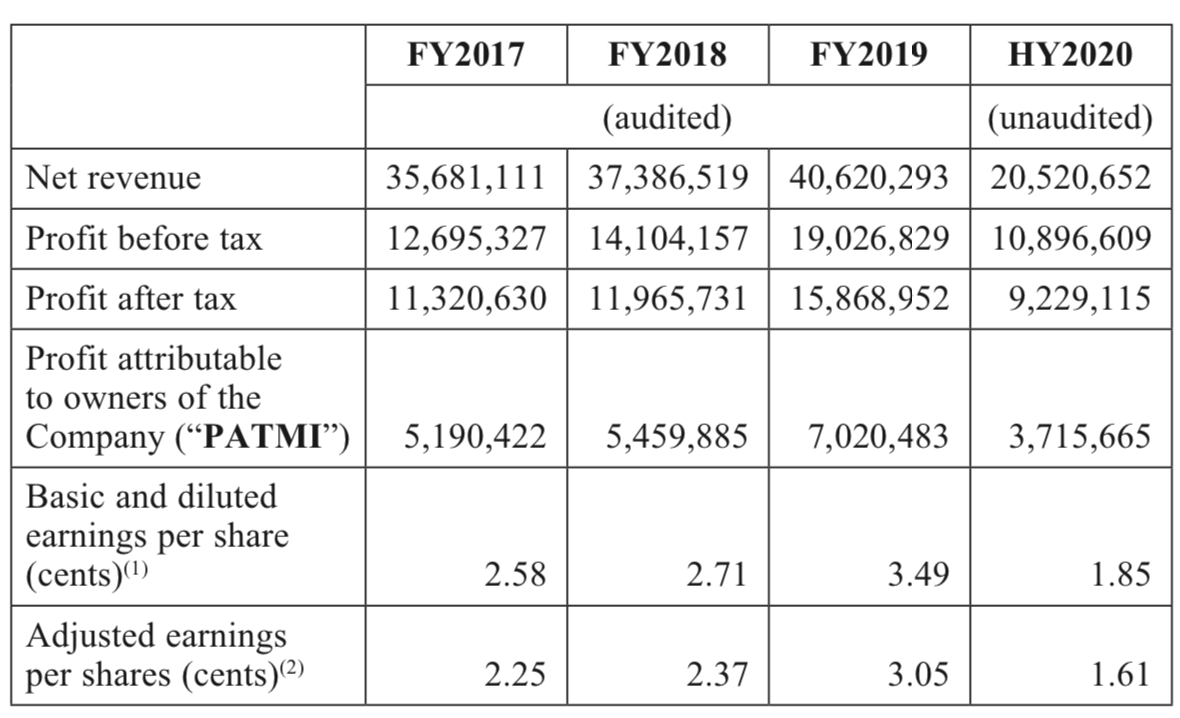

Credit Bureau Asia is really a stable and profitable company. Its net gain margin before tax in FY2021 is all about 46%. For HY2021, it's more than 50%.

As you can observe from the table above, the net income attributed to owners of the company is significantly lower than its profit after tax. This really is likely because Credit Bureau Asia operates a number of its business via joint ventures along with other entities. This, in turn, cuts down on the profit that can be attributed to the company.

It's also worth noting that more than 96% from the group's revenue in FY2021, FY2021, and FY2021 was derived in Singapore. So this is pretty much a Singapore-based company that you are purchasing – at least for the time being.

From Credit Bureau Asia's prospectus:

CBS is really a key and material subsidiary coupled with contributed to 44.1%, 42.4%, 41.7% and 41.6% in our Group's total revenue in FY2021, FY2021, FY2021 and HY2021 as well as 46.8%, 43.8%, 40.4% and 40.2% in our Group's profit before tax in FY2021, FY2021, FY2021 and HY2021, respectively.

#4 Risk For The Company

Since it's in the business of providing credit and risk information, Credit agency Asia business model is highly susceptible to national laws and regulatory oversights specific towards the credit reporting industry, particularly in Singapore, where it derives the majority of its revenue.

According to its prospectus:

In the big event that the Credit Bureau Act anytime in the future is updated, revised or enhanced before it comes down into force, we may need to alter our existing business or adopt alternative structures to be able to comply with such enhanced regulatory requirements. Potential negative effects include an increase in our operating costs due to enhanced regulatory compliance requirements, reduced or limited interest in our products and services, restrictions within our ability to provide certain services and products to our customers, granting more licences that may introduce more competitors, any of which could materially and adversely affect our business operations, reputation, revenue and/or financial results.

Also, most importantly the regulatory license to function in the first place – particularly in Singapore, is always subject to government approval.

While we have not had any issues in maintaining our regulatory licences and approvals for the existing operations to date, and to the best of our knowledge and belief, we're not aware of any facts or circumstances which would cause such licences and approvals to become suspended, revoked or cancelled because the case may be, or for any applications for, or renewal of, any of these licences and approvals to become rejected by the relevant authorities, there isn't any assurance that we will be able to obtain licences and approvals as are usually necesary in the future. There is also no assurance that we will be able to obtain such licenses, permits or approvals which may be required for our expansion plans. Our inability to obtain such licences, permits or approvals which may be required may affect our capability to continue to carry on our credit agency business and materially and adversely affect our business, prospects, results of operations and financial performance.

#5 Just how much Will It Be Raising During The IPO?

The company will be offering 30,000,000 shares in an offering price of S$0.93. What this means is it hopes to raise S$27.9 million from the IPO. Similar to most IPOs, the majority of the offering shares (28.5 million) will be by way of placement while only 1.5 million shares will be made available by way of the public offer.

At the same time frame but separate from the Offering, Aberdeen Standard Investments (Asia) Limited, Affin Hwang Asset Management Berhad, Eastspring Investments (Singapore) Limited and Tokyo Shoko Research, Ltd. (collectively, the “Cornerstone Investors”), have signed agreements a subscription for an aggregate of 28,000,000 new shares (the “Cornerstone Shares”) in the Offering Price. The Cornerstone Shares will in aggregate constitute approximately 12.2% of the total number of 230,390,000 issued shares as at the date of listing.

#6 How Will The Money Be Used?

Of the S$23.Six million that will be due to the company from the IPO, the company has mentioned that

- 26% will go towards organic growth initiatives,

- 44% going towards strategic investments, regional expansion and acquisition,

- 18% will go towards general working capital and

- 12% for payment of underwriting and site commission and offering expenses.

# 7 How Much Will Credit Bureau Asia Be Worth Post-IPO?

Based on the Offering Price, the estimated post-IPO market capitalisation of CBA is expected to be approximately S$214.3 million. From a price-to-earning ratio, this puts it at about 30 times.

# 8 Credit agency Asia Is Likely A Dividend Play For Singapore Investors

For dividend-seeking investors in Singapore that are looking to invest beyond REITs and telecommunication companies, Credit Bureau Asia will be an interesting company to think about investing in.

Management has indicated that it intends to recommend dividends of at least 90.0% of net profit after tax attributable to our Shareholders for FY2021 and FY2022. According to its FY2021 earnings of 3.05 cents per share, this would be a dividend payout of 2.745, which translates to a dividend yield of approximately 3%.