Three causes there gained't be considered a 2021 housing industry crash

Why DBS Multiplier 4.0 Has become The Perfect (High-Interest) Savings Account For college students, NSFs & Retirees

One of the first things we ought to do after we start working is to buy a high-interest checking account. A high-interest checking account not only permits us to start building up our savings, but also gives us the incentive to do so.

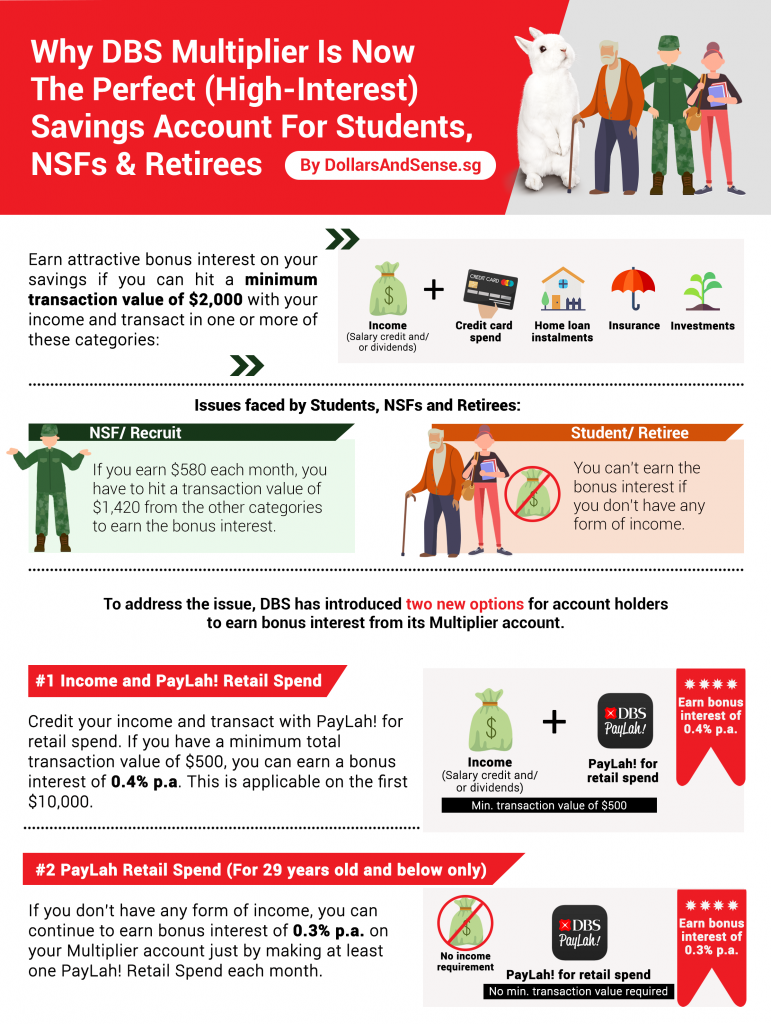

Unfortunately, many high-interest savings accounts require us to fulfill specific conditions – for example needing to credit your monthly salary of a minimum of $2,000 (via GIRO) or having to hit a minimum credit card spend every month.

While that should be simple for most working adults, it also means that there are categories of people – for example tertiary students, NSFs and retirees – who aren't in a position to earn bonus interests from these high-interest savings accounts even if they've significant savings.

One example may be the popular DBS Multiplier Account, which helps you to definitely earn attractive bonus interests in your savings if you can to hit an overall total transaction value of $2,000, according to a minimum of two categories below (for which Income needs to become among the categories).

This is easy if you're already earning a take-home salary of more than $2,000 every month. But even if your take-home salary is below $2,000 each month, you still generate the bonus interests by accumulating sufficient transaction volume in the other categories, since the Multiplier account considers your overall transaction volume across all categories, not just Income.

If you're earning a take-home earnings of $1,900, you can invest $100 via DBS every month to unlock bonus interest.

While this is good for lower-wage workers who are earning a take-home salary of slightly below $2,000, it isn't practical for the kind of National Serviceman (NSF), tertiary students and retirees because these individuals earn a significantly lower income each month, if any at all.

For example, an NSF holding the rank of the Recruit/Private is only going to earn $580 each month. This means he still must hit one more transaction worth of $1,420 in the other categories to offer the minimum $2,000 necessary to earn bonus interest. This may not be sensible for most NSFs because they will not have a home instalment, don't be eligible for a a credit card, and therefore are unlikely so that you can invest or purchase insurance policies to the tune of $1,420 per month.

To address the problem of these groups of people, DBS has introduced two new choices for customers to earn bonus interests from the Multiplier account.

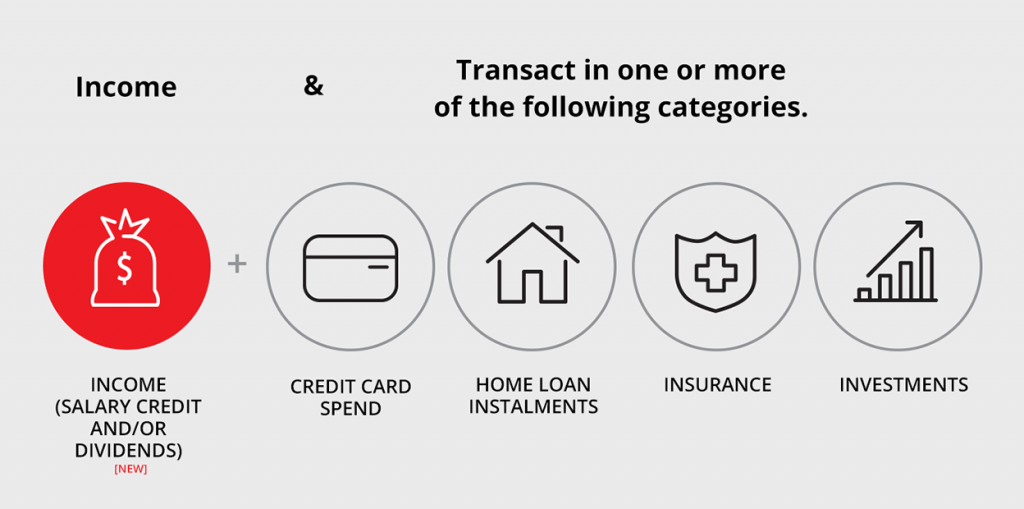

#1 Income and PayLah! Retail Spend

The first way is through crediting our income (salary credit and/or dividends) and transacting with PayLah! for retail spend. If we are able to achieve a minimum total transaction amount of $500, we can earn a bonus interest of 0.4% p.a. This really is applicable around the first $10,000.

For example, an NSF with the rank of Recruit/Private will earn $580 every month. If he credits the salary to his Multiplier account, this is already higher than the $500 total transaction volume required every month. What this means is the NSF account holder only needs to make one PayLah! Retail Spend (any amount) each month to entitled to the 0.4% p.a. interest.

Tertiary students who've part-time jobs could also easily take advantage of this alternate method of earning bonus interest. For example, if their part-time wages are $450 per month, they only need to make PayLah! Retail Spend of $50 every month hitting the $500 total transaction volume to be eligible for the 0.4% p.a. bonus interest.

Let's be clear, we know that 0.4% p.a. is not a lot, especially when compared with what most working adults will be enjoying on their own Multiplier account when they earn bonus curiosity about the usual way.

At the same time, we need to remember that earning this interest is entirely fuss-free. NSFs already have to credit their monthly salary into a checking account anyway – therefore it is just a matter of choosing which bank account to make use of. And making one PayLah! Retail Spend payment each month is definitely doable – if you aren't somehow in opposition to using your smartphone to make cashless payments conveniently.

Besides NSFs and tertiary students who work part-time, retirees will even appreciate this alternate method of earning bonus interests.

Even if they're not currently working, dividends using their investments (credited via GIRO from CDP and/or from DBS Multi-Currency Settlement Account) may also be considered as a form of income. This means that retirees who get consistent dividends can also enjoy this form of bonus interest so long as the total transaction volume from their income and PayLah! retail spend is much more than $500 for that month.

#2 PayLah Retail Spend (29 years old and below only)

The second way is for individuals who do not have any type of income – such as tertiary students who are not working.

For these individuals, they can continue to earn bonus interests of 0.3% p.a. on your Multiplier account just by making one PayLah! Retail Spend each month (any amount).

Yes, that's all.

The DBS Multiplier 4.0 Works A hardship on You, Even Before You begin Working

Previously, the DBS Multiplier Account had been one of the most popular high-interest savings accounts in Singapore. In those days, however, it only makes sense to open a DBS Multiplier Account after you start working.

Now that you can earn bonus interest of 0.4% p.a. even with a low income or bonus interest of 0.3% p.a. with no income, you no longer need to become working prior to applying for the DBS Multiplier account.

The bonus interest is payable for the first $10,000. At an interest rate of 0.4% p.a., this means you can earn $40 a year in interest. While it's absolutely nothing to shout about, it's still higher when compared to $5 (0.05% p.a.) you will earn should you let it rest in a regular account.

Best of, when you finally get a full-time job, you can keep to use your DBS Multiplier Account to enjoy even higher interests without the hassle of having to transfer the money to another checking account.

The current version of the DBS Multiplier Account can also strive for you during retirement. So long as you are able to credit a dividend income (via GIRO from CDP and/or from DBS Multi-Currency Settlement Account) making a retail spend through PayLah! with a total transaction volume of $500 or more, you will benefit from the bonus interest of 0.4% around the first $10,000 in your savings.

With both of these new ways of earning bonus interests, NSFs, tertiary students and retirees no more have an excuse that they are unable earn bonus interests on their own savings. If you're part of these groups but still earning a paltry 0.05% p.a. on your savings, you should think about signing up for a DBS Multiplier Account today.

Furthermore, like a Multiplier Account user, you may enjoy the range of lifestyle services and rewards supplied by DBS, in addition to unlock detailed insights into your spending and saving habits courtesy of DBS NAV Planner.

Here’s an infographic summarising all the together with your DBS Multiplier for you personally: