Three causes there gained't be considered a 2021 housing industry crash

![[2021 Edition] Best Savings Accounts for Working Adults in Singapore](https://creditoverview.net/wp-content/uploads/2021/07/20210722095603-65-850x560.jpg)

[2021 Edition] Best Savings Accounts for Working Adults in Singapore

When you start working, choosing the best checking account is one of the first financial decisions that you ought to make. A good checking account should help you earn high interest with minimal inconvenience.

Wait… Why Do I Need To Choose A Best Savings Accounts? Don't We All Already Have One?

Chances are that you simply curently have a minumum of one checking account under your name. How come you need another one?

For probably the most part, those who have yet to begin work could be utilizing a basic account that doesn't provide many benefits. Like a working adult, you have the opportunity to choose a far better checking account that provides you higher rates of interest. But which would be the greatest savings makes up about you like a working adult?

Do observe that a few of these accounts mentioned below possess a higher minimum average balance required, then, a regular monthly fall-below fee ($2 or even more) may be charged.

Let's compare some of the best savings accounts in Singapore that you ought to be thinking.

Read More:

- OCBC 360, OCBC

- One Account, UOB

- BOC SmartSaver, Bank Of China

- Bonus$aver Account, Standard Chartered

- DBS Multiplier Account, DBS

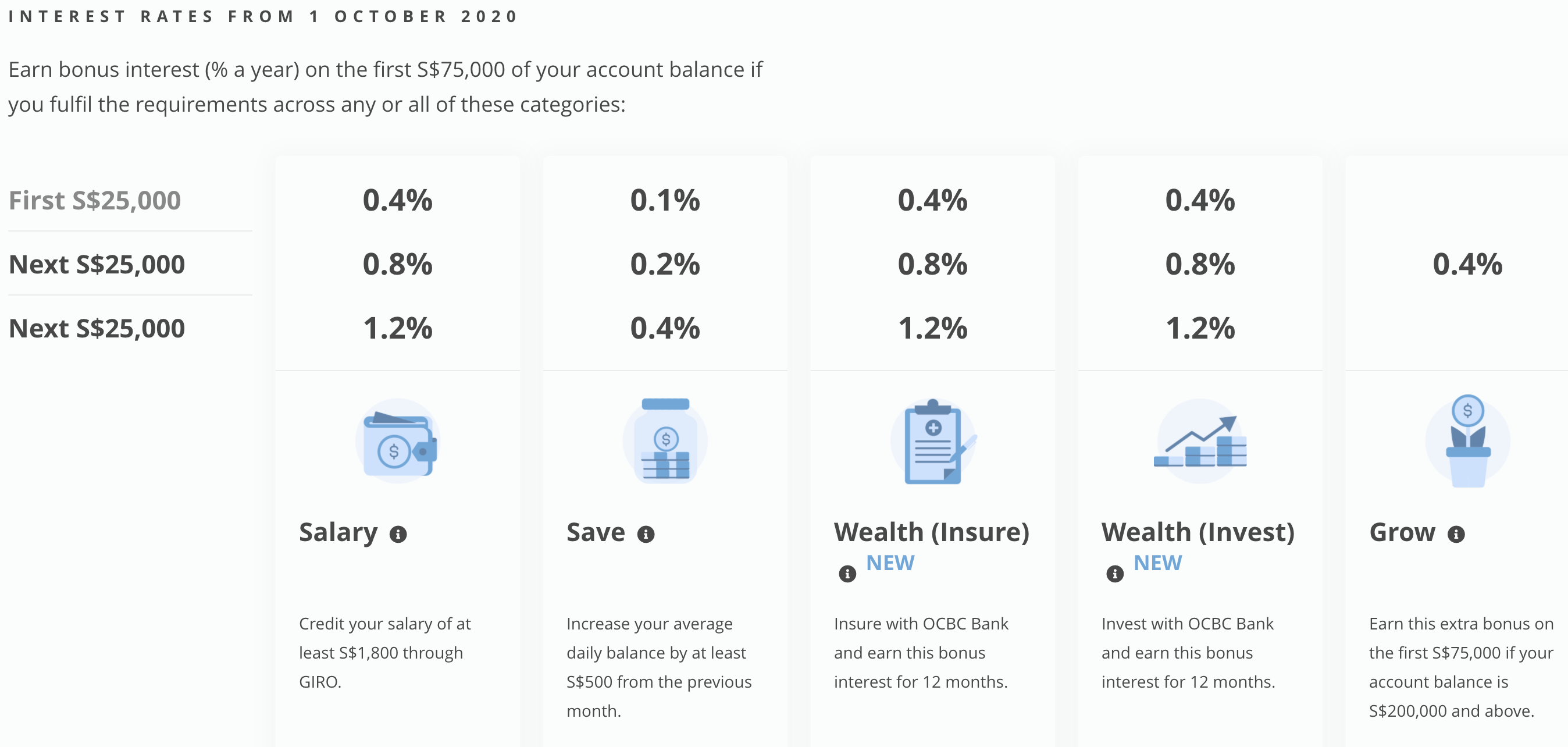

OCBC 360, OCBC

The OCBC 360 is among the best savings accounts in Singapore among working adults. That's because it's been around for a long time and provides a good rate of interest to the customers.

However, the past couple of years have seen OCBC revised the eye rates of their widely popular OCBC 360 checking account many times. However, you may still earn decent interest as much as the first $75,000. Here's the way it currently works.

- Monthly crediting of salary (min $2,000) through GIRO – 0.4% p.a (first $25,000), 0.8% p.a (next $25,000), 1.2% p.a (next $25,000)

- Increase your account balance by at least $500 compared to previous month – 0.1% p.a (first $25,000), 0.2% p.a (next $25,000), 0.4% p.a. (next $25,000)

- Insure with OCBC – 0.4% p.a (first $25,000), 0.8% p.a (next $25,000, 1.2% p.a (next $25,000)

- Invest with OCBC – 0.4% p.a (first $25,000), 0.8% p.a (next $25,000, 1.2% p.a (next $25,000)

- Grow: Maintain at least $200,000 of the average daily balance in your account and produce 0.4% p.a. in your first $75,000.

Put simply, for those who have savings as high as $25,000, the effective interest rate that you simply earn could be lesser as compared to for those who have $50,000. You will have higher interest rates if you have savings of up to $75,000.

Realistic Interest Rate ($25,000 or less): 0.5% (Maximum Interest Rate: 1.30%)

Realistic Rate of interest ($75,000): 1.03% (Maximum Interest Rate: 2.63%)

We put the realistic rate of interest at 0.5% when you have savings of up to $25,000 (along with a realistic interest rate of just one.03% when you have savings of $75,000) because we don't think it seems sensible for a person to buy an insurance or investment product, just to earn an extra 0.4% to at least one.2% interest for 12 months.

If you've $75,000, the effective interest rate for the OCBC 360 is decent at 1.03%, even if you do not invest or insure through OCBC.

One thing that people like about the OCBC 360 Account is that bonus interest in each area could be earned independently. Which means you don't need to complete any particular area in order to be eligible for the power interests in other areas.

Who Should Apply: Young working adults who got their first paycheque can consider getting an OCBC 360 account and to credit their salary into it. By doing so, they immediately have a 0.4% p.a. interest on their savings.

If you've savings of between $35,000 to $70,000, the OCBC 360 account provides you with a greater effective interest rate.

Editor’s Note: With effect from 1 February 2021, OCBC will be reducing the rate of interest because of its 360 Account. What this means is the present figures previously stated will be reduced soon.

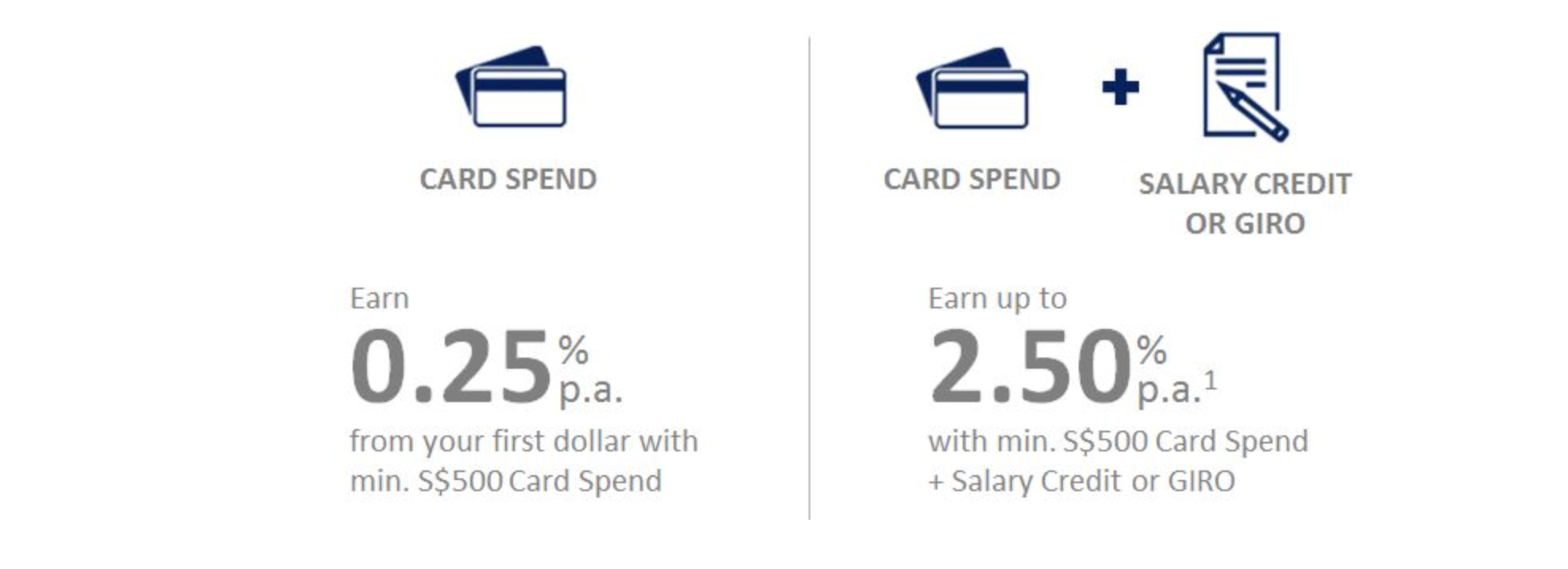

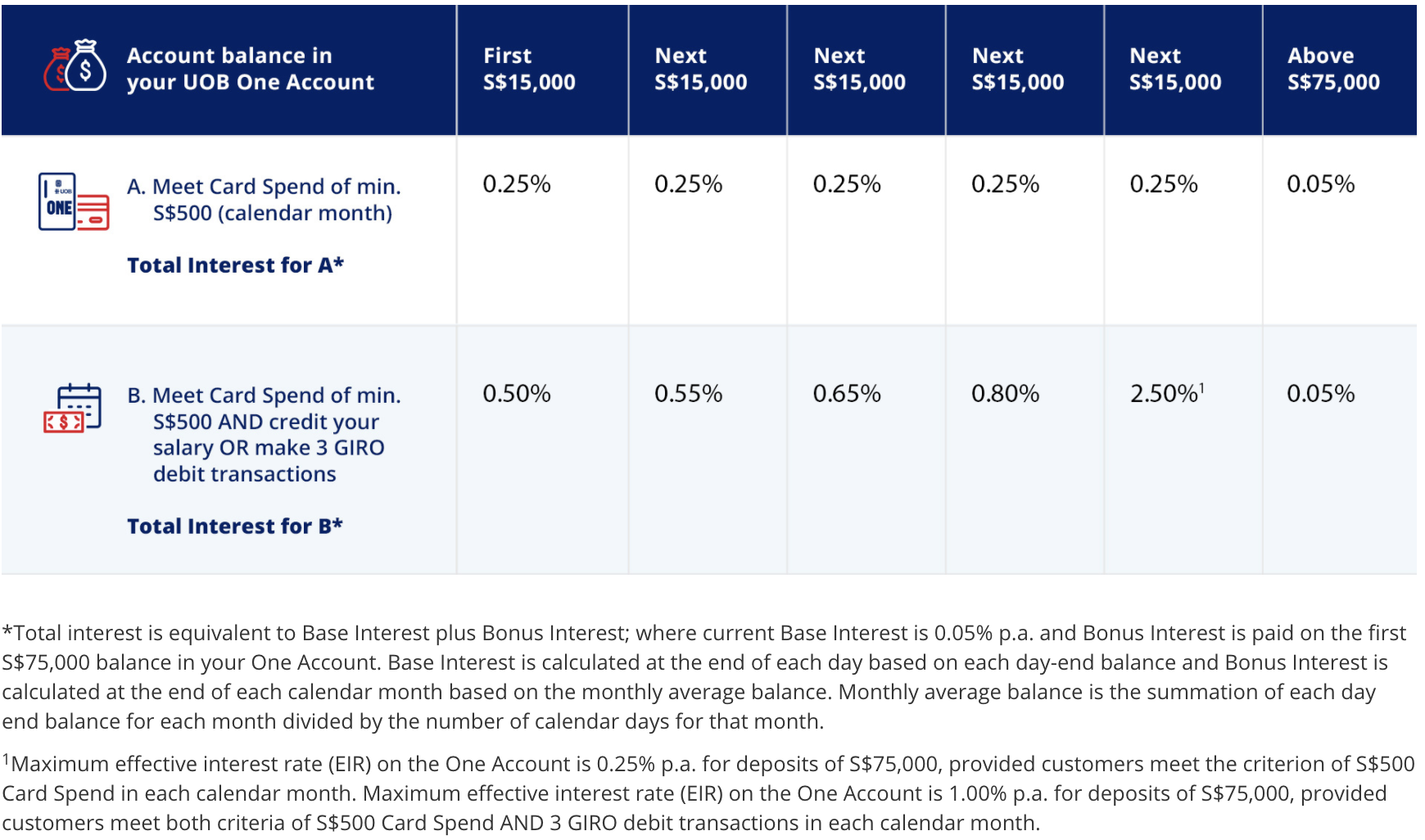

One Account, UOB

For recent times, the UOB One Account has been the primary competitor to the OCBC 360 among the best savings accounts in Singapore. The interest minute rates are somewhat similar although the UOB One Account works inside a slightly different way. We will let the table below do the explaining.

An individual with savings of $75,000, and that can meet both criteria (minimum spending of $500 plus three GIRO payments or crediting of salary), stands to earn an effective rate of interest (EIR) of 1.00%.

Firstly, to be eligible for a bonus interest, you have to acquire a minimum spend of at least $500 in your UOB One Card (which by itself, is a great card to possess anyway in line with the reviews from your readers) and/or other selected UOB cards. After you have done that, you'd have met the very first criteria for bonus interest.

In order to generate the second tranche of bonus interest, you've two options.

Option A: Pay three bills monthly via GIRO

or

Option B: Credit your salary (minimum $2,000) via GIRO

Realistic Interest Rate: 1.00% (according to $75,000 savings)

It's worth noting that though UOB advertises that you will get up to 2.50% p.a. interest from the account, this isn't truly the case.

That's since the 2.50% rate of interest only pertains to savings which are from $60,000 to $75,000. Quite simply, to get this 2.50%, you initially have to accept the low rates of interest the account gives you in your first $60,000.

This step-up rate of interest structure implies that the effective interest rates that the UOB One Account gives differ, depending on the balance in your checking account.

Who Should Apply: Assuming you've $75,000, the UOB One account gives an effective interest rate of just one.00%.

In return, you simply need to spend $500 on the UOB One card and either credit your salary or pay three bills online. This is fewer actions required when compared to OCBC 360 but you earn a greater interest.

The catch here's that you simply MUST spend $500 on the UOB One Card that you should qualify for any bonus interest. Otherwise, you don't get any interest even if you fulfill the other requirements. Also, you need to have about $75,000 in savings. For example, should you have only $15,000 in savings, then you would only be earning an effective interest rate of 0.50%.

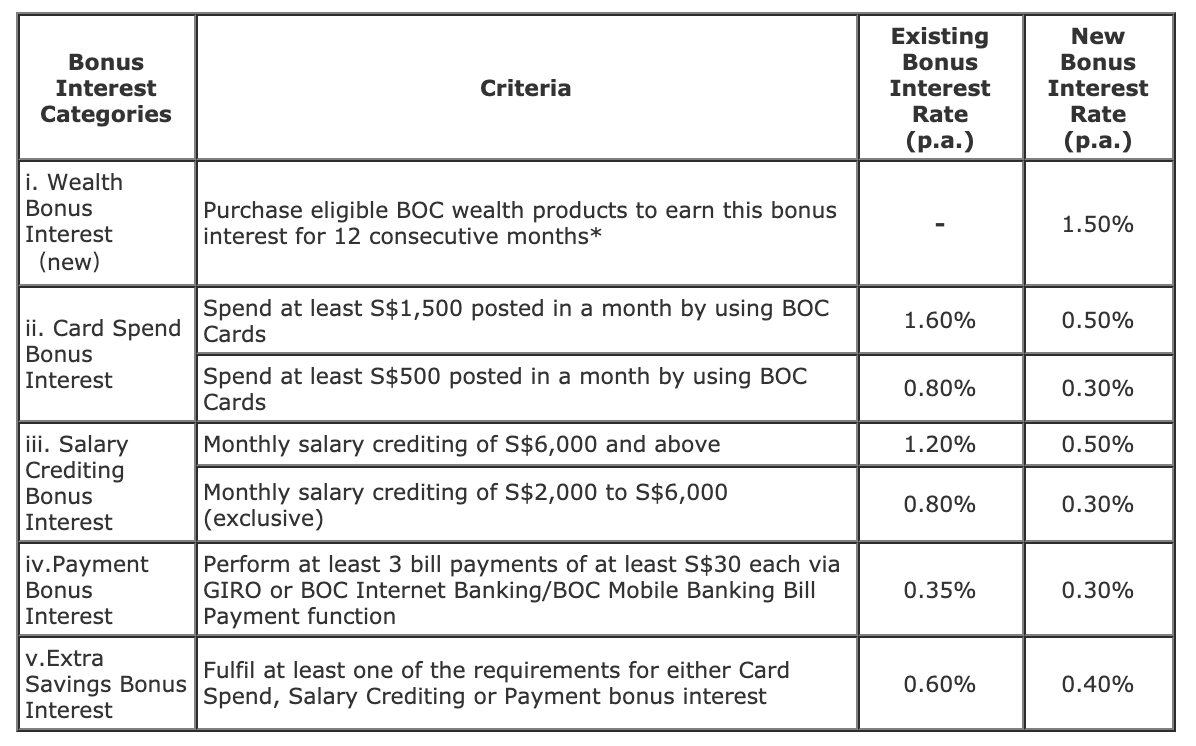

BOC SmartSaver, Bank Of China

We once said the BOC SmartSaver had the very best checking account in Singapore and got punk'd by them on the very same week when their criteria were changed. How do they fare now? Here are some of their perks. Here is the bonus appeal to you can earn around the first $80,000 of the savings.

- Crediting of salary (min: $2,000) – 0.3 % p.a. If salary credited is $6,000 or more, interest rate is 0.5% p.a.

- Credit card spend (min: $500) – 0.3% p.a. If credit card spend is $1,500 or even more, rate of interest is 0.5%

- Pay 3 bill payment (min $30 each) – 0.30%

- Bonus Interest – Should you fulfilled at least one from the requirements above, you'll receive 0.4% p.a. on funds above $80,000, subject to a maximum of $1,000,000.

Realistic Rate of interest: 0.9% is what most people can expect in line with the usual criteria being met (e.g. crediting of salary, spending $500 on credit cards, GIRO bill payments). For higher earners with a take-home salary of $6,000 or even more, and who are able to spend at least $1,500 on their own BOC charge cards, an interest rate of 1.30% is achievable.

Who Should Apply: If you're a young working adult starting at an average salary, the BOC SmartSaver will work out to be rather similar to the OCBC 360 (BOC: 0.90%, OCBC: 0.5-1.03%). However, if you're a high-income earner having a take-home earnings of $6,000 or even more plus spent $1,500 per month on your credit card, then your BOC SmartSaver is an attractive checking account to think about.

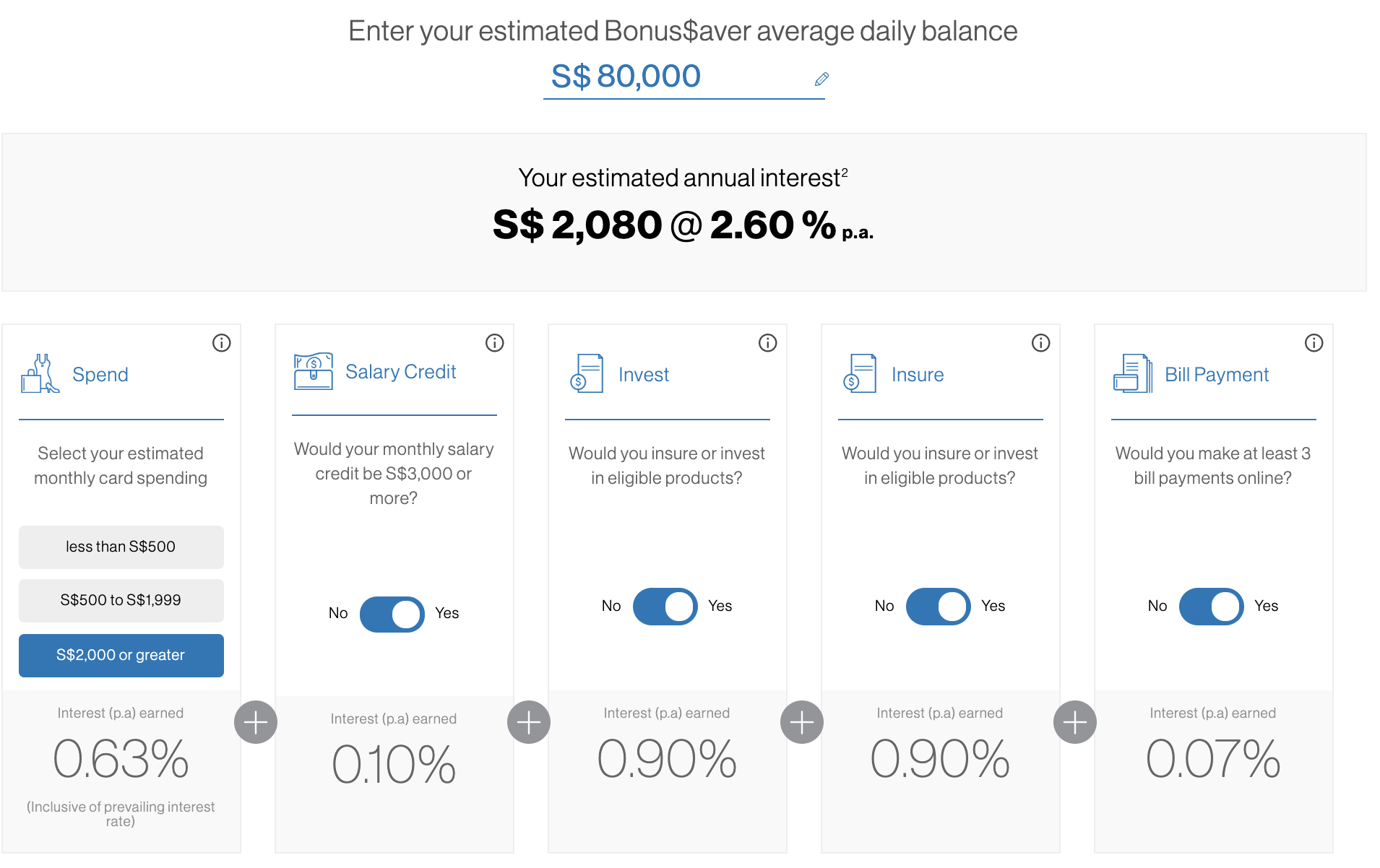

Bonus$aver Account, Standard Chartered

Another savings account that cannot be ignored when discussing the best savings makes up about working adults in Singapore may be the Standard Chartered Bonus$aver Account. On paper, the Standard Chartered Bonus$aver Account provides the highest effective interest rate in Singapore at a very impressive 2.60% p.a. This really is currently unmatched.

# 1 Card Spend (up to 0.63% – including prevailing interest)

You will earn bonus interest on the first $80,000 of the deposit balance if you meet the minimum card spend.

If you've $80,000 and charge a minimum of $500 every month on your Bonus$saver card linked to a Bonus$saver account on qualifying retail transactions, you can earn a pursuit of 0.25% p.a. This increases as much as 0.60% p.a. if you charge a minimum spend of S$2,000 every month.

# 2 Salary Credit (0.1%)

By crediting a monthly take-home salary of S$3,000 to your Bonus$aver account, you will earn a bonus interest rate of 0.1% p.a.

# 3 Invest & Insure (0.9% each, total of just one.8%)

If you have invested in an eligible unit trust (minimum subscription sum: S$30,000) or purchased an eligible insurance plan (minimum annual premium: S$12,000) through Standard Chartered, you will earn an additional rate of interest of 0.9% p.a. each. Which means you could possibly earn as much as 1.8% should you invest and insure with Standard Chartered.

# 4 Bill Payment (0.07%)

By paying three eligible bills, with a minimum of S$50 each, out of your Bonus$Saver account via GIRO or internet banking, you can generate an additional 0.07% p.a.

In total, you can generate Card Spend (as much as 0.60%) + Salary Credit (0.1%) + Invest (0.9%) + Insure (0.9%) + Bill Payment (0.07%) + Prevailing Interest Rate (0.03%) = 2.60% p.a. from the Bonus$aver account.

Do note that the bonus interest above applies to the first S$80,000 deposit balances.

Realistic Rate of interest: Should you spend no less than $500 in your Bonus$aver card, credit your monthly salary (minimum $3,000), making three eligible bill payments every month, you will earn a fundamental interest of 0.45%, which is obviously not so impressive when compared to other high-interest savings accounts above. However, if you can to spend $2,000 monthly on your Bonus$saver card, your rate of interest increases to 0.80 % p.a.

We don't believe it makes sense to take a position or insure inside a product simply to earn the additional 1.8% per annum.

Who Should Apply: What is important for the Bonus$Saver account is your salary credit needs to be a minimum of $3,000 monthly. You can apply here if you wish to enjoy attractive perks.

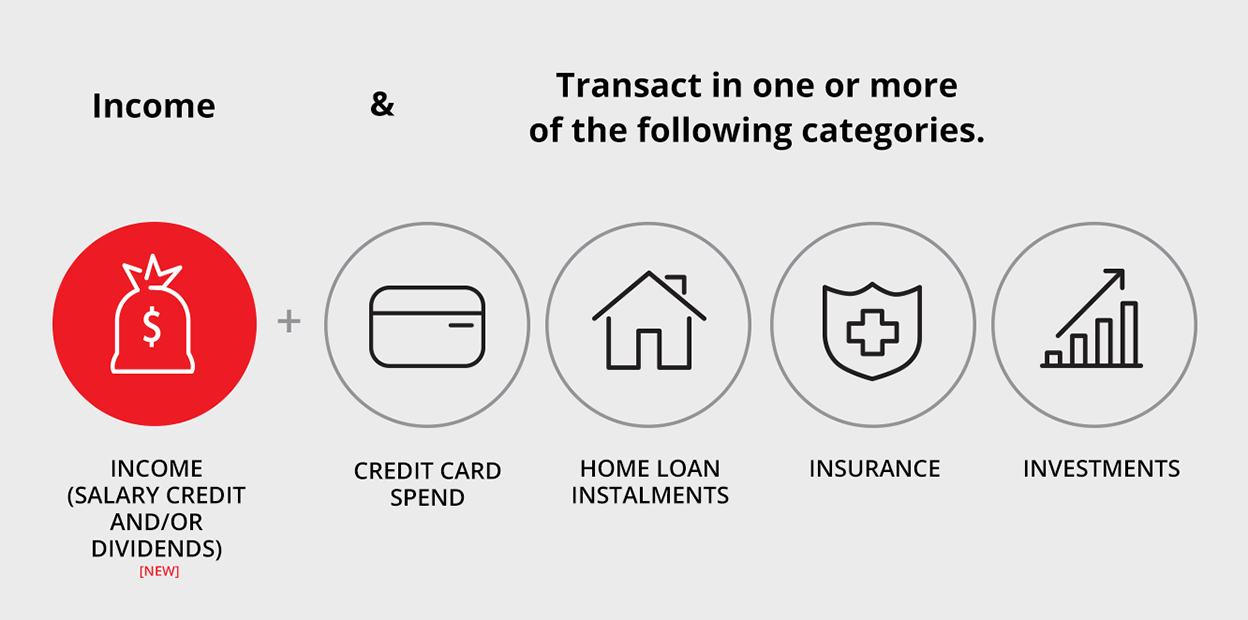

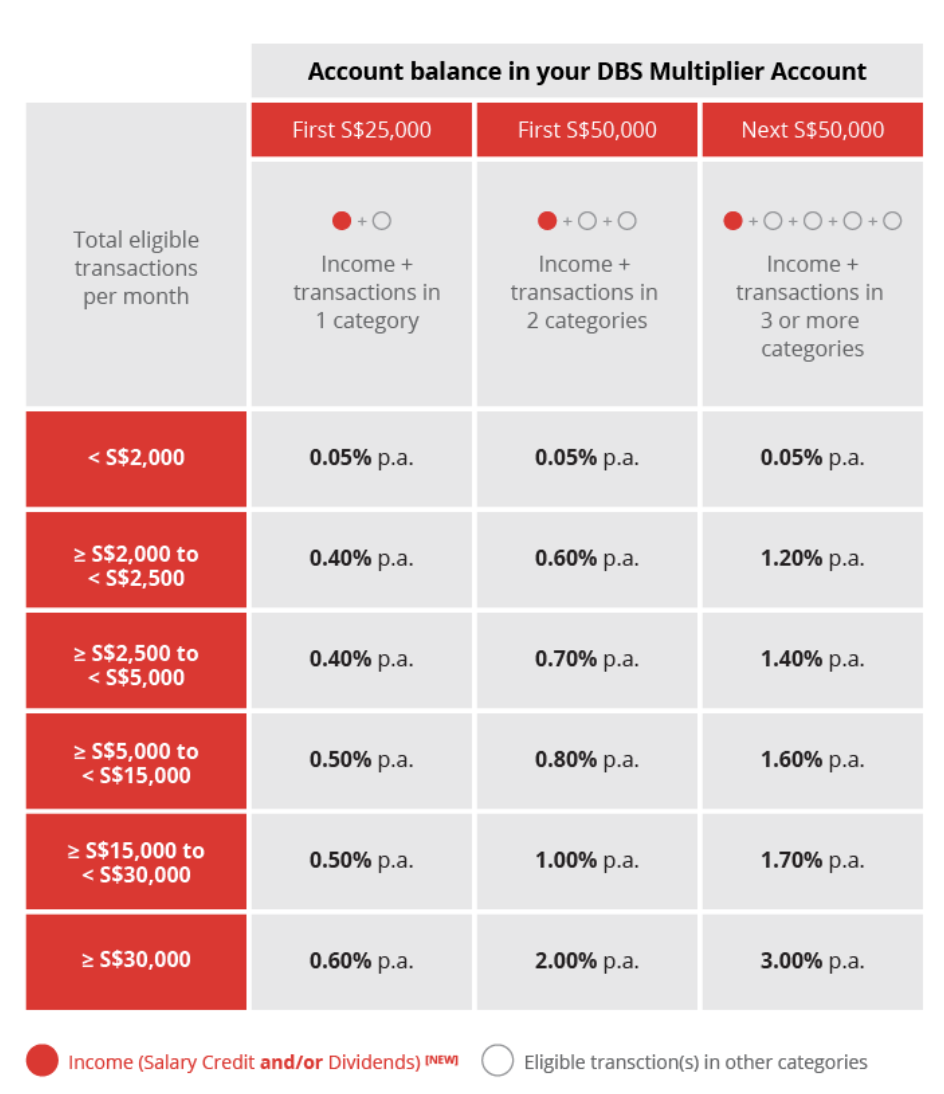

DBS Multiplier Account, DBS

The DBS Multiplier account could be considered as one of the best savings accounts however it works in a different way when compared to other savings accounts that have been mentioned in the following paragraphs.

Rather than give customers bonus interest according to each of the requirements they meet, bonus interest is given based on the total eligible transactions completed each month. Bonus interests can be earned on the first $100,000 of savings.

However, unlike the other savings account, you must make a salary credit and finish at least one other requirement first. Otherwise, you do not get any bonus interest.

In short, you need to use the Multiplier account for monthly crediting of salary (no minimum amount required) and at least one of the following:

– Charge card devote to DBS/POSB

– Mortgage loan instalment with DBS/POSB

– Insurance with DBS/POSB

– Investments with DBS/POSB

There aren't any minimums for each category, but to receive bonus interest, your total monthly eligible transactions have to equal to $2,000 or more.

The DBS Multiplier account gives you mortgage loan according to two factors. 1) The volume of your total eligible transactions each month and 2) the number of categories in which you make an eligible transaction each month

For example, an individual with a take-home earnings of $2,000 who spends $400 on his DBS/POSB credit card will earn a highly effective interest of 0.40% per annum. However, if the person adds in an investment or insurance at $100 per month, his/her interest increases to 0.60%.

Who Should Apply: Those who can't meet the minimum salary or charge card spending requirement of other savings accounts can consider using the DBS Multiplier account because it does not impose any minimum requirement in every of those areas.

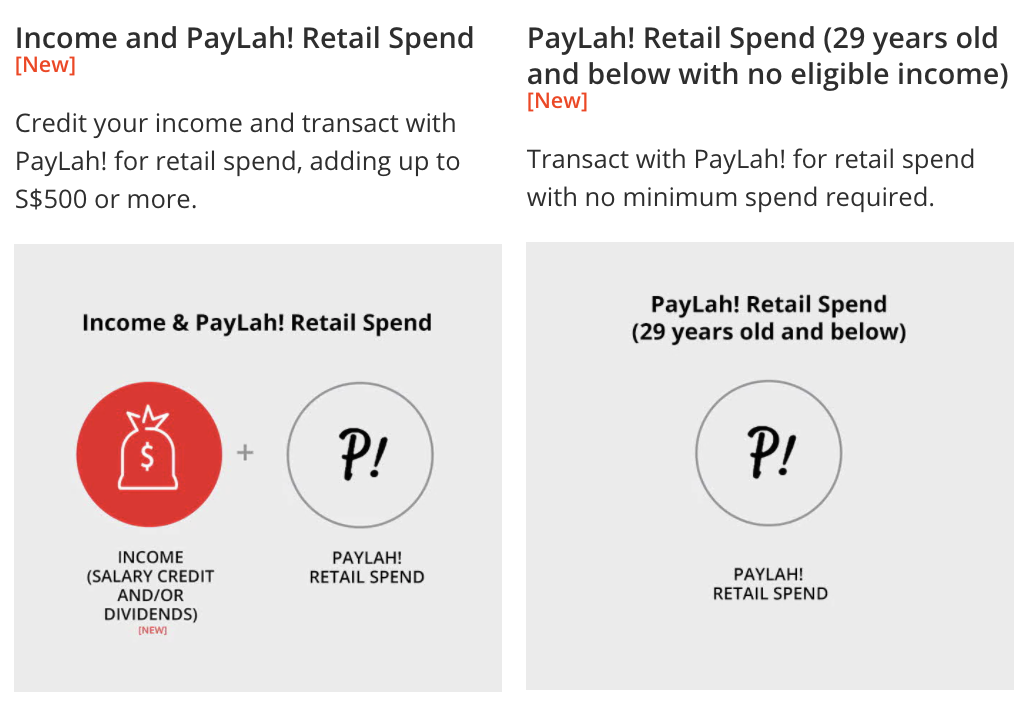

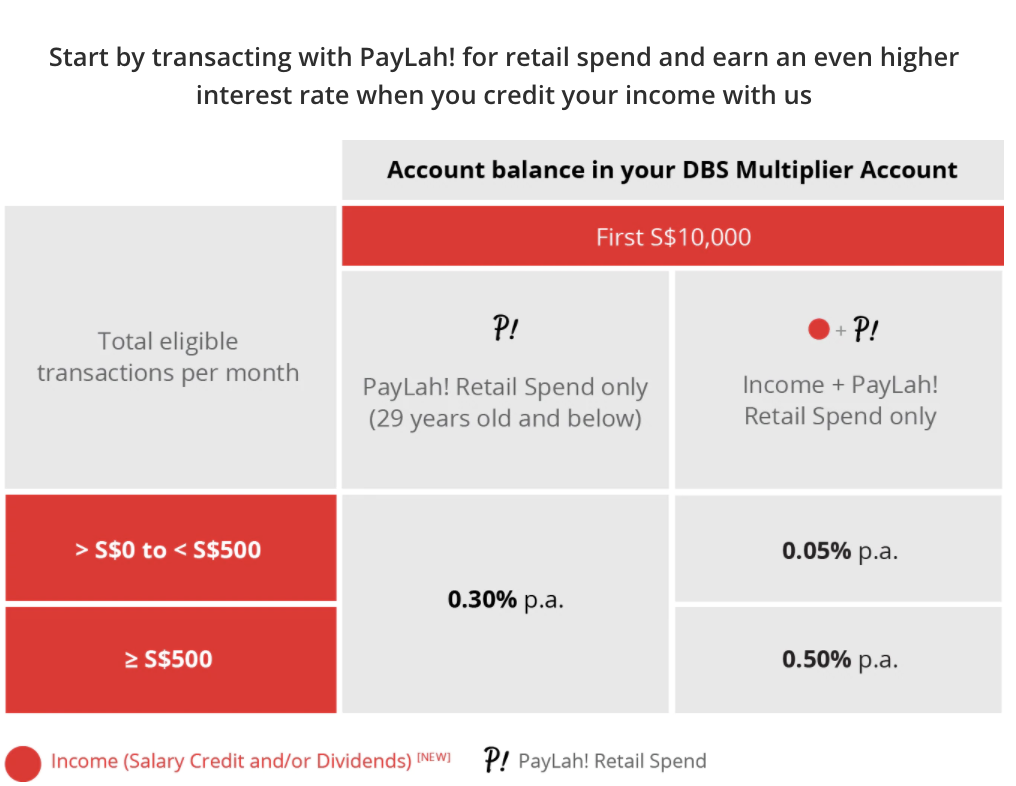

Alternate Track For DBS Multiplier Users: PayLah! Retail Spend

The above outlines the most typical (and advertised) method to earn bonus interest using DBS Multiplier. Another track according to PayLah! retail spending continues to be added, presumably for those without a credit card, insurance, mortgage loan, or investment with DBS. Here's how it operates:

Simply clock up retail spend using PayLah! of $500 in a month, as well as for customers over the age of 29, fulfill the Income criteria (Salary Credit/Dividends) in order to earn bonus interest as high as 0.5% on the first $10,000 inside your DBS Multiplier Account. An interesting thing to note for those under 29 is that you can earn 0.3% in interest by virtually doing nothing, which is a clever perk to entice a new generation of customers.